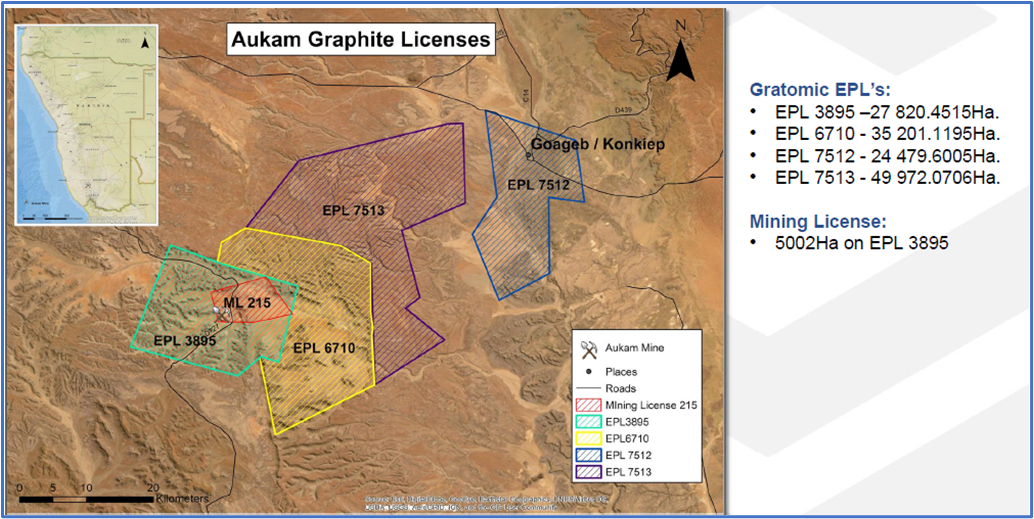

November 19, 2020 / Gratomic Inc. (“GRAT” or the “Company”) (TSXV:GRAT)(OTC PINK:CBULF)(FSE:CB81)(WKN:A143MR) is pleased to report that it has entered into a definitive agreement (the “Agreement”) with Next Graphite, Inc. (“NextG”), for the acquisition of NextG’s 37% interest (the “Interest”) in Gazania 242 Pty Ltd. (the “Acquisition”), the Namibian company which holds the licenses on the Aukam property (“Aukam”). The Agreement was dated November 12, 2020 and executed on November 16, 2020. The parties negotiated an amendment to the Agreement dated November 16, 2020 which was executed on November 19, 2020. Upon completion of the acquisition, Gratomic will hold 100% of the rights and interests in the Aukam Mining License (ML215) and exploration License (EPL 3895).

Arno Brand, President and CEO commented, “It has been a pleasure working with Cliff Bream and his team at Next Graphite over the years and I look forward to continuing a strategic business relationship and building a strong future for Aukam together.”

In consideration for the Interest, Gratomic will, upon closing of the Acquisition (the “Closing“), issue 18,986,188 common shares (the “Escrowed Shares“), valued at $0.14 per share, and 2,272,727 common shares (the “Additional Shares” and collectively with the Escrowed Shares, the “Consideration Shares“)) in the capital of Gratomic (the “Common Shares“). Additionally, Gratomic has agreed to honour its previous contractual condition to provide NextG with US$500,000 from the first US$1,000,000 of net revenue generated from sales of graphite from the Aukam property pursuant to the issuance of the Additional Shares and the agreement to pay US$250,000 (the “Revenue Amount“). In the event the Revenue Amount is not paid in full by the 12-month anniversary of the Closing (the “Due Date“), then any outstanding Revenue Amount will be settled by the issuance to NextG of that number of common shares (the “Settlement Shares“) as is arrived at by dividing the then outstanding Revenue Amount by the closing price of the Common Shares on the first trading day following the Due Date, less the maximum discount allowed by the rules of the TSX Venture Exchange (“TSXV“).

The Consideration Shares will be issued to third parties and NextG shareholders (the “NG Recipients“), as directed by NextG, upon condition that no such issuance will result in any such recipient holding more than 9.9% of the Common Shares of Gratomic post issuance. The Escrowed Shares will be subject to an 18-month escrow subject to a release of 1/3 of the original balance every 6 months, pro rata, and the Additional Shares will be subject to an 12-month escrow and shall be released from escrow, pro rata, on the Due Date.

Gratomic has also granted the NG Recipients a right to participate in any future financings of Gratomic at the same price as any other participants on a pro rata basis to its percentage holding in Gratomic (calculated on the basis of the number of Consideration Shares remaining in Escrow) at the time of any such fundraise (calculated on a non-dilutive basis).

The Acquisition (including the issuance of the Consideration Shares and Additional Shares, if any) is subject to the fulfillment of certain conditions precedent as are customary for transactions of this size including the approval of the TSXV.

Cliff Bream, President and CEO of Next Graphite said, “we feel that combining the interests in Aukam will optimize the potential of Aukam and allow the shareholders of NextG to participate in the success of Gratomic. Many of us in the two companies have worked together for years, and we have great confidence that Gratomic will be successful with the Aukam project”.

About Gratomic Inc.

Established in 2014, Gratomic is an advanced materials company focused on low-cost mine to market commercialization of carbon-neutral, Eco-friendly, high purity vein graphite and is set to become a key player in EV and Renewable Resource supply chains. Gratomic Inc. is a leader among peers, anticipating full operational capabilities in late 2020 and aiming to transition to an open pit operation as early as the end of 2021.

Gratomic is in the process of solidifying its development plans for micronization and spheronization of its clean Aukam graphite. This significant milestone is a small, additional step in the Company’s existing Eco-friendly processing cycle and will allow its naturally high purity graphite to meet ideal North American battery grade standards for use in Li-ion battery anodes.

The Company promises to deliver mine-to-market traceability and guaranteed quality control. This will be accomplished by providing documented tracking on all graphite generated at its flagship Aukam Graphite Project. The tracking will begin at Aukam and will be verified at every stage during transport.

Two off-take purchase agreements are currently held for lump-vein graphite sourced from Gratomic’s Aukam Graphite Project in Namibia, Africa. Fulfillment of the contracts is slated to begin in 2021. The agreements exist with TODAQ and Phu Sumika.

TODAQ is an innovative tech company and will partner with Gratomic on its mine-to-market commodity tracking.

Phu Sumika is a large global graphite supplier to battery and lubrication companies. Gratomic Inc. is listed on the TSX Venture Exchange under the symbol GRAT.

For more information: visit the website at www.gratomic.ca or contact:

Arno Brand at [email protected] or 416 561-4095

Subscribe to the link below to receive news and updates

https://gratomic.ca/contact/