- First of two monthly graphite purchase orders to the

value of US$ 6 Million as part of an aggregate US$25,000,000 deal

spanning over 39 months payable in Toda Notes (“TDN”)

- The deal between TODAQ and Gratomic Inc. is powered by the TDN digital asset

- Graphite to sit in TDN reserve backstop to underpin the true value of the digital asset

Gratomic Inc. (“Gratomic” or the “Company”) (TSX-V:GRAT)(FRANKFURT:CB81)

a vertically integrated graphite to graphenes, advanced materials

development company announces it has received its first two purchase

orders for a total of USD 6 Million following a previously announced

supply agreement on October 17, 2019 (https://gratomic.ca/gratomic-signs-deal-to-supply-graphite-to-todaq/)

for an aggregate of USD $25,000,000 of graphite in an all-digital-asset

deal from TODAQ STAR Program Phase 1 Corp, a subsidiary of TODAQ

Holdings. The purchase orders are each for 600 tonnes of graphite valued

at USD $6,000,000 solely payable in TDN at a price of USD$0.10 per TDN

for an aggregate of TDN 60,000,000 that is to be delivered within 90

days.

Subsequent to the success of the initial delivery, TODAQ will place

one additional order of 600 tonnes of graphite with 30 day intervals

bringing the total to 1800 tonnes of graphite for USD $9,000,000 in

consideration for the issuance of an aggregate of 90 million TDN.

Thereafter, TODAQ will place orders on a monthly basis with the value of

USD $484,848.49 based on both the purchase price for graphite and the

exchange between USD and TDN applicable at the time over a period of 39

months.

The agreement marks the first steps towards a significant journey for

Sovereignty Tech pioneer TODAQ, with a strategic intention towards both

building its TDN rewards program and allowing cryptographic ownership

of commodities so that all business, people and markets can transact

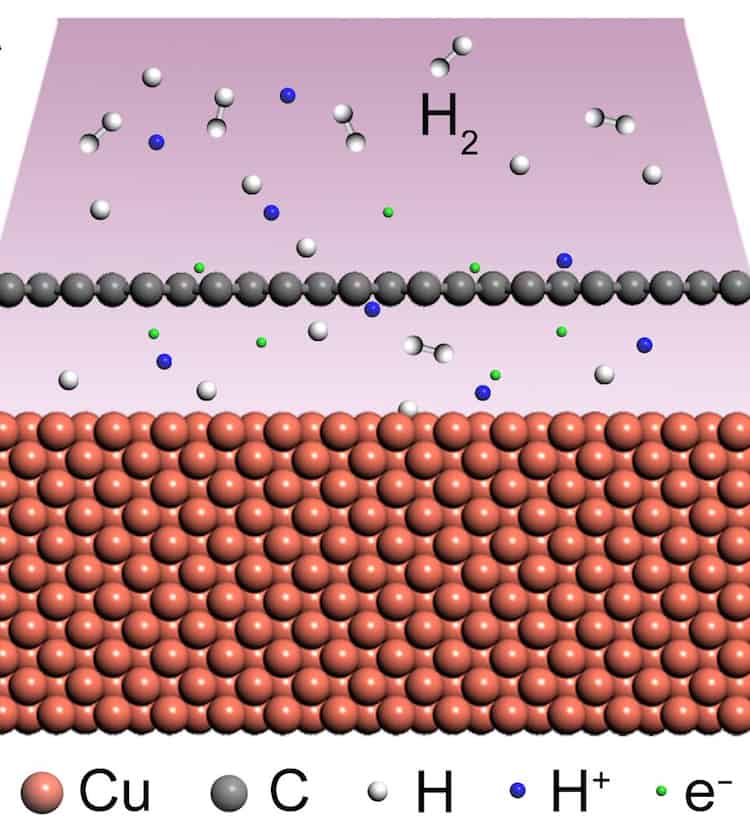

quickly with security and long-term stability. Furthermore, the graphite

will sit in the TDN reserve backstop as part of a diverse set of

commodities to underpin the true value of deployed TDN with physical

substance and utility.

No mineral resources, let alone mineral reserves demonstrating

economic viability and technical feasibility, have been delineated on

the Aukam Property. The Company is not in a position to demonstrate or

disclose any capital and/or operating costs that may be associated with

satisfying the terms of the Todaq Supply Agreement.

Gratomic wishes to emphasize that Supply Agreement is conditional on

Gratomic being able to bring the Aukam project into a production phase,

and for any graphite being produced to meet certain technical and

mineralization requirements.

Gratomic continues to move its business towards production and as part of its business plan, expects to obtain a National Instrument 43-101 Standards of Disclosure for Mineral Projects technical

report to help it ascertain the economics of Aukam. Presently the

Company uses its existing pilot processing facility to produce certain

amounts of graphite concentrate from accumulated surface graphite.

Risk Factors

The Company advises that it has not based its production decision on

even the existence of mineral resources let alone on a feasibility study

of mineral reserves, demonstrating economic and technical viability,

and, as a result, there may be an increased uncertainty of achieving any

particular level of recovery of minerals or the cost of such recovery,

including increased risks associated with developing a commercially

mineable deposit.

The Supply Agreement provides that if Gratomic is unable to deliver

graphite in accordance with the orders from Todaq, Todaq has the right

to refuse to take any subsequent attempt to fulfil the order, terminate

the agreement immediately, obtain substitute product from another

supplier and recover from the Company any costs and expenses incurred in

obtaining such substitute product or suing for damages under the

contract.

Historically, such projects have a much higher risk of economic and

technical failure. There is no guarantee that production will begin as

anticipated or at all or that anticipated production costs will be

achieved.

Failure to commence production would have a material adverse impact

on the Company’s ability to generate revenue and cash flow to fund

operations. Failure to achieve the anticipated production costs would

have a material adverse impact on the Company’s cash flow and future

profitability.

Steve Gray, P.Geo. has reviewed, prepared and approved the scientific

and technical information in this press release and is Gratomic Inc’s

“Qualified Person” as defined by National Instrument 43-101 – Standards

of Disclosure for Mineral Projects.

About TODAQ

TODAQ serves businesses, financial institutions and governments,

offering a true digital asset ownership management platform for secure

and efficient settlement. Leveraging the TODA protocol, each asset

maintains an immutable, sovereign record of ownership. TODAQ aims to

enhance the right of ownership over digital assets through the use of

cryptographic and legal techniques to replace intermediaries. In 2019,

TODAQ officially launched the TODA Note (TDN) as a fungible digital

payment and loyalty asset. To learn more about TODAQ and TDN, please

visit https://todaq.net and https://tdn.network, questions should be directed to [email protected].

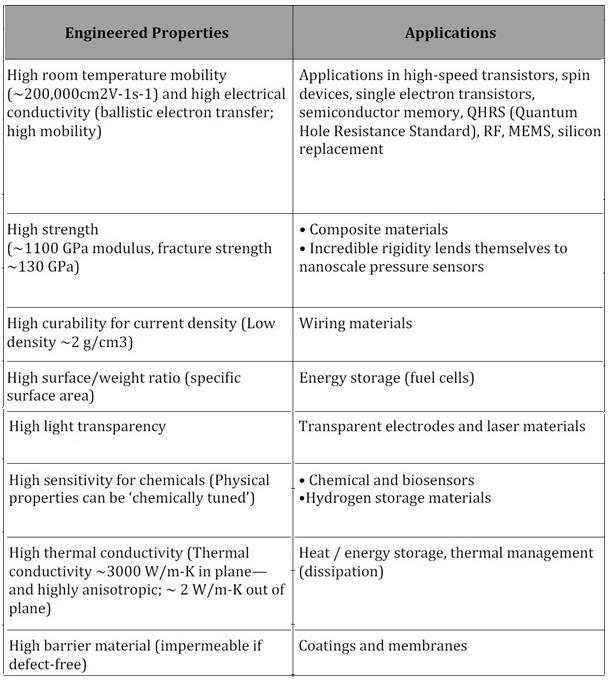

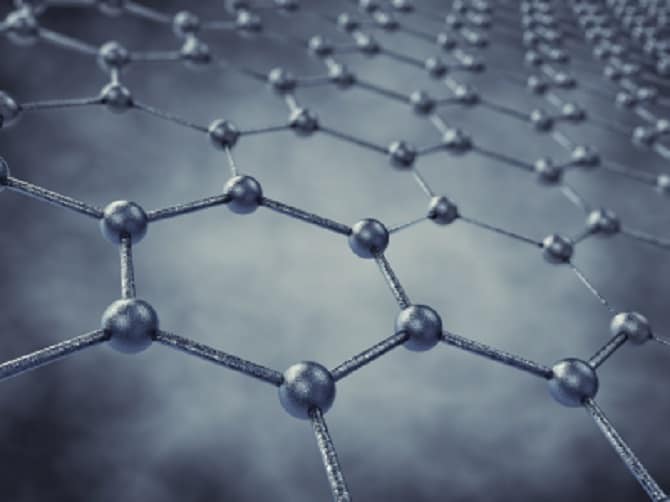

About Gratomic Inc.

Gratomic is an advanced materials company focused on mine to market

commercialization of graphite products most notably high value graphene

based components for a range of mass market products. Gratomic is

collaborating with a leading European manufacturer of graphenes to use

Aukam graphite to manufacture graphene products for commercialization on

an industrial scale. The company is listed on the TSX Venture Exchange

under the symbol GRAT.

For more information: visit the website at www.gratomic.ca or contact:

Arno Brand, Co-CEO, +1 416-561-4095

E-mail inquiries: [email protected]