MONTREAL, Jan. 24, 2019 — HPQ Silicon Resources Inc. (HPQ) (TSX-V “HPQâ€) is pleased to provide investors this corporate overview of the milestones attained since our 2014 entry in the Quartz exploration business and our 2015 decision to become a vertically integrated producer of Solar Grade Silicon Metal through the development of the PUREVAP™ Quartz Reduction Reactor (QRR). Shareholders and prospective investors are encouraged to review the following information in its entirety to understand the progress made and plans being implemented to transform HPQ into the lowest cost and greenest producer of Solar Grade Silicon Metal, as we commence 2019 with the final assembly of the PUREVAP™ Pilot Plant, “Gen 3†and it’s mid 2019 start-up.

Mr. Bernard J. Tourillon, President and CEO of HPQ-Silicon provides his responses in the following Q&A format. The questions, for the most part, are derived from inquiries received from investors, investment professionals and industry participants. A table summarizing the Purevap™ milestones appears on page 2 of this summary:

Q. To start, could you please briefly describe the focus and objectives of HPQ going forward?

A. Most certainly. Following the successful closing of our $ 5,250,000 Financing in August 2018 and the December 2018 completion of our Beauce Gold Field assets spinout, HPQ is now entirely focused on becoming a vertically integrated producer of solar grade silicon metal. In 2019, we intend to:

- Use our 50 tpa (tonnes per year) Pilot Plant, developed by our partners PyroGenesis Canada Inc. (“PyroGenesis†or “PYRâ€), to demonstrate the commercial potential of the PUREVAPTM “Quartz Reduction Reactors†(QRR) process (patent pending), and its ability to convert Quartz (Silicon Dioxide or SiO2) into High Purity Silicon Metal of 99.9% to 99.99% Si, (referred to as 3N and 4N, respectively) in just one step;

- Use the material produced by the Pilot Plant to finalize the best metallurgical pathway (UMG) to upgrade “HPQ PUREVAP™ Si†(Silicon Metal) to Solar Grade Silicon Metal (SoG Si), through collaboration with PYR and Apollon Solar (“Apollonâ€), and in doing so becoming the world’s leading Low Cost, Low Carbon Footprint producer of SoG Si;

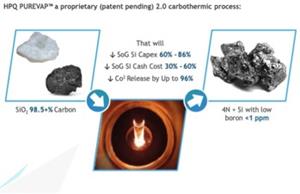

HPQ expects to confirm that PUREVAPTM and UMG processes will:

- Reduce CAPEX to transform Quartz to SoG Si by between 60% (China) and 86% (“Rest of the World†or “ROWâ€) 1;

- Reduce OPEX to transform Quartz to SoG Si by between 30% (China) and 60% (ROW)1;

- Reduce the Carbon Footprint to transform Quartz to SoG Si by up to 96%2;

- Investigate new opportunities for high value niche applications that need the High Purity Silicon Metal that our PUREVAPTM QRR produces in one step.

Q. Could you please briefly describe what started HPQ interest in becoming a vertically Integrated Producer of Solar Grade Silicon metal?

A. Well, the short answer is: “Necessity is the Mother of Inventionâ€. The long answer is that in 2014 HPQ had a number of gold properties that contained extensive quartz veins with which gold is typically associated. Quartz (Silicon Dioxide or SiO2) is the key ingredient required for making Silicon Metal (Si).

Silicon Metal (Si), is one of today’s key strategic metals, like Lithium and Cobalt, that is needed to fulfil the renewable energy revolution presently under way.

By early 2015, HPQ management came to the realization that in order for HPQ to succeed in the Quartz business, HPQ needed to transform its low value quartz resources into a higher value material, Silicon Metal, and ultimately Solar Grade Silicon Metal (SoG Si), which is a higher purity form of Silicon Metal that allows the transformation of the sun’s energy into electricity in photovoltaic (PV) modules.

In short, we needed to find a pathway to become a vertically integrated producer of Si, and preferably SoG Si. That is when we discovered PyroGenesis.

Q. Ok, its one thing to say “HPQ wants to become a vertically integrated producer of Solar Grade Silicon metal†but implementing is another. Could you please describe what makes the HPQ plan unique?

A. Certainly. From the start we knew that HPQ could not afford the time or money required to assemble a world-class technical team with Silicon Metal (Si) or Solar Grade Silicon Metal (SoG Si) expertise. To reach our goal, our choices were either a) collaborate with a university, knowing that it would take years just to pass the proof of concept phase, or b) outsource our R&D with a technological partner that possesses proven expertise with high temperatures processes, and a track record of successfully taking new concepts, from the lab to commercialization phase.

During 2015, HPQ concluded that to convert our Quartz into Si, and possibly SoG Si, we needed to convince PyroGenesis Canada Inc (“PyroGenesisâ€), with their vast expertise on high temperature plasma base processes, to partner with us.

PyroGenesis has an impressive track record of successfully taking new concepts from the lab to commercialization, including but not limited to, the following:

- The US Navy, developing the PAWDS™ technology from lab scale to finally being specified in the design of the new US Aircraft Carriers,

- Plasma atomization for 3D printing;

- More recently with the deployment of their DROSRITE™ technology.

PyroGenesis expertise is of such high level that:

- In addition to the US Navy, during the last 2 months, PyroGenesis has concluded exclusive partnerships with two multi-billion conglomerates to commercialize specific applications they have developed, from lab to commercial scale, on a global basis.

In 2015, HPQ’s Board of Directors accepted a testing proposal from PyroGenesis regarding laboratory scale, proof of concept, metallurgical testing of the PUREVAPTM QRR. The proposed program was to validate its capacity to produce high purity silicon metal from HPQ quartz in just one step (September 30, 2015 release).

In June 2016, the first successful lab scale tests were completed and by test #6, results confirmed the game changing potential of the PUREVAPTM QRR process.

HPQ immediately approached PyroGenesis regarding additional testing and the development of a pathway to building a pilot plant that could validate the commercial scalability of the process as quickly as possible. As they say, the rest is history.

Q. What motivated HPQ to move so fast to validate the commercial scalability of the PUREVAPTM QRR process?

A. The decision was simple; the first bench test showed all equipment and data analyzers worked. By test #6, not only did the system operate as designed, but also the PUREVAPTM QRR process was already reaching its first major milestones, the ability to transform quartz into high purity Silicon Metal (Si) exceeding 99.9+% Si “3N†(June 29, 2016 release).

HPQ and PyroGenesis came to an agreement whereby HPQ would invest 100% of project costs for 90% of the revenues to be generated by PUREVAPTM QRR and, with that, HPQ obtained the participation of a world class technical team to work on our project of becoming a vertically Integrated producer of Solar Grade Silicon Metal (SoG Si). Fundamentally, the agreement allows both Parties to reap the rewards of the new process to make High Purity Silicon Metal (Si) and eventually SoG Si using HPQ Quartz and the PyroGenesis PUREVAPTM QRR.

On August 2, 2016, PyroGenesis and HPQ announced the terms under which HPQ would invest the funds and own the PUREVAPTM QRR’s Intellectual Property3 (August 2, 2016 release), with PyroGenesis taking responsibility for the bench testing, process design, fabrication, assembly, and cold commissioning of the Pilot Plant.

Q. In your press releases you refer to Gen 1 and Gen 2 can you please describe Gen 1 and the testing milestones?

A. As we outlined above, the project started in 2015 with PyroGenesis’ technical team designing and building a laboratory scale proof of concept PUREVAPTM QRR, the Gen1 reactor.

The Gen1 PUREVAPTM QRR laboratory scale equipment completed 15 tests between March 29th and July 22th 2016 under the scope of the “Phase 1 – Proof of Concept Metallurgical Tests Programâ€. These tests confirmed that the PUREVAP™ QRR concept of combining different known steps into a one step process works at lab scale. With this milestone achieved, we then agreed to expand our collaboration to go all the way to Pilot Plant.

In September 2016, while initial Pilot Plant design was underway, HPQ also ordered a new series of lab scale R&D tests using the Gen1 PUREVAPTM QRR to provide invaluable input toward the design of the pilot plant, as well as, determine the most efficient way of scaling up the PUREVAPTM QRR process to commercial scale production.

In November 2016, another key milestones was reached as Gen1 testing results demonstrated that the PUREVAP™ QRR was capable of using SiO2 feed material below minimum industry specifications to produce Silicon Metal (Si) of greater purity than what could be achieved by traditional, status quo processes used to make Metallurgical Grade (98.5% to 99.5% Si) Silicon Metal4 today.

By the end of January 2017, in tests using a modified and expanded Gen1 PUREVAP™ QRR reactor, the yield increased from less than 0.1 g to 8.8 g (test #32), an increase of approximately 9,000% (roughly one hundred-fold), thereby confirming the potential scalability of the process.

Ongoing work to the end of Q2 2017 validated our systematic and methodical approach to the project and allowed PyroGenesis to advance the detailed engineering and design of the pilot plant.

By the end of Q2 2017, it was clear that the Gen1 PUREVAP™ QRR had reached its maximum usefulness so the decision was made to build a Gen2 PUREVAP™ QRR, pushing the design envelope of the lab scale system to a point that will allow it to be operated in a semi-batch mode to increase Silicon Metal (Si) yields. This would provide further insight into process improvements needed for the Pilot Plant, thereby saving millions of dollars in future development work.

Q. Now during 2017 you announced an agreement with Apollon Solar, can you diverge a bit and tell us how that came about, and the impact?

A. In 2017, we attracted the attention of Apollon Solar SAS, (“Apollonâ€). This is significant because Apollon is a private French company with longstanding expertise in Silicon Purification and Crystallisation, Solar Silicon, Photovoltaic Cells and Photovoltaic Modules. The team at Apollon has become one of the world leaders in the development of processes to refine Solar Grade Silicon Metal “SoG Si UMGâ€. They achieved, an independently confirmed, world record conversion efficiency of 21.1% with a monocrystalline ingot, for a solar cell made with 100% “SoG Si UMGâ€.

Apollon first completed a technological audit of the Gen1 PUREVAP™ QRR results to evaluate the potential of the innovative PUREVAP™ QRR process. They concluded that successful commercial scaling-up of the PUREVAP™ process could lead to the production of solar quality silicon at a significantly lower cost compared to those of competing process technologies (examples include Siemens chemical process, Elkem Solar, Silicor Materials, etc.).

As a result, in December 2017, HPQ and Apollon announced the signing of a consultancy agreement whereby Apollon agreed to transfer knowledge it has acquired in solar silicon over the last 20 years for the benefit of HPQ and PyroGenesis.

Q. That’s all very exciting, now can you discuss Gen 2 and the commercial scalability of the PUREVAPTM QRR process?

A. The Gen2 PUREVAP™ QRR incorporates important process modifications identified during Gen1 testing and is designed to be a scale replica of the planned larger pilot plant (Gen3 PUREVAP™ QRR). In Q2 of 2017 we set about constructing the newly redesigned reactor while awaiting the final report from the Gen1 work. In Q4, as Gen2 was being finalized, HPQ received a final report on the Gen1 PUREVAP™ QRR testing and we learned that:

- The highest silicon tested for bulk purity was produced in test #75 and measured 99.92% Silicon Metal (Si)5.

- Si yield could be increased by increasing production yield, which had been constrained around an average of about 3% in Gen1.

- Theoretical calculations indicated that purity of the Si produced under various conditions could range from 3N (99.984 % Si) to 4N (99.996 % Si) with the addition of volatilization agents for low purity feedstock, to over 4N (99.998 % Si) when using high purity feedstock5.

These results were incorporated into Gen2 and, by November 2017, the Gen2 PUREVAP™ QRR was operational, allowing the de-facto start of the pilot plant testing and commissioning, thereby reducing the risk profile of the project and allowing additional process modifications and further proof of commercial scalability work to be done in parallel with major plant fabrication, to keep advancing work.

JANUARY 2018

PyroGenesis confirmed that the Gen2 PUREVAP™ QRR was operating as designed and yielding results that were in line with expectations. By this time, we had also arranged monthly meetings with Apollon and PyroGenesis to benefit from the backend expertise of Apollon in our ongoing test work as we continued to plan for the Gen3 Pilot Plant design.

Gen2 PUREVAP™ demonstrated it could be operate and perform under the conditions demanded for optimum operational parameters to produce the purities required in one step. Again, this was another major milestone because, to our knowledge, there is no other process that does this in the world.

With the main design and equipment performance characteristics reached, significantly increasing the Yield6 and the Production Yield7 of the Gen2 PUREVAP™ became the next key objectives in contributing to final purity.

FEBRUARY 2018

By mid February 2018, the Gen2 PUREVAP™ was proving to be an invaluable bench test platform and the results were used to scale back on the size of the planned Pilot Plant from 200 tonnes per year to 50 tonnes per year. This had a massive benefit on our planned costs, timing, and on locating the Pilot Plant test site – right inside the PyroGenesis testing facility, another huge cost saver.

By the end of February 2018, the Gen2 reactor was operating within the 90th percentile of its achievable production yield. By mid April 2018, as a direct result of continuous process improvements done by PyroGenesis, Gen2 PUREVAP™ test #14 attained Yield and Production Yield numbers that surpassed theoretical expectations. The total mass of Silicon Metal (Si) produced (yield) during test 14 was 101.45 gr; and conversion of material, referred to as Production Yield, of 34.3%, the highest to date.

APRIL 2018

PyroGenesis completed a scheduled audit of the Gen2 PUREVAP™ equipment for wear and tear following test#14. The audit was needed to help identify critical operational parameters for the PUREVAP™ Pilot Plant and allowed the evaluation of additional design modifications that could be implemented for further tests using the Gen2 PUREVAP™.

JULY 2018

By the end of July 2018, the Gen2 PUREVAP™ equipment had been refurbished, re-assembled and modified to incorporate the latest design modifications and was ready to start a new series of at least 8 additional tests focused on:

- Continuing to optimize conditions for the Gen2 PUREVAP™ and the planned Gen3 PUREVAP™ Pilot Plant operation;

- Increasing the Yield and the Production Yield;

- Testing the Purity range of the Silicon Metal (Si) from low purity feed stock (98.84% SiO2) and ultra high purity feed stock (> 99.9% SiO2), analyzed using ICP-OES8;

Q. It sounds like Gen2 is giving great results and contributing to the Pilot Plant final parameters. You mentioned CO2 (“Greenhouse Gas†or “GHGâ€) reductions as another positive feature of the PUREVAP™ process can you elaborate on that?

A. Yes we are very excited about this aspect of the project. First, readers must understand that: “It’s not because photovoltaic solar panels do not emit CO2 (GHG) while producing electricity that solar energy is not a significant source of GHGâ€.9 In fact solar power has its greenhouse gas issues that lurk behind the scenes. Seventy percent (70%) of the GHG generated when building a new solar farm10 comes from the production of the Solar Grade Silicon Metal (SoG Si) needed for the fabrication of the solar panels.

Manufacturing SoG Si in China, the world’s largest producer, generates an astounding 141 kg of CO2 per kg of SoG Si produced. In Germany that ratio is reduced to 87.7 kg CO2 per kg of SoG Si produced. What we see is that solar power is not that panacea of low carbon if one looks at the entire process from start to finish.

96% REDUCTION IN CARBON FOOTPRINT – OPPORTUNITY TO RESOLVE SOLAR PARADOX

In August 2018, PyroGenesis prepared a report11 that found that the PUREVAPtm QRR process operated in Quebec should only produce 5.4 kg CO2 per kg of SoG Si produced, a 96% reduction in the carbon footprint compared to existing processes. This is why we are so excited about this “green†opportunity revolutionizing the solar energy industry.

Q. Technically it sounds like great progress is being made, how is HPQ set financially today?

A. On August 21, 2018, HPQ announced the closing of a $5,200,000 financing that included the participation of the Quebec government, via its “Créativité Québec†program, and PyroGenesis. Closing these financings, at more than a 40% premium to market price in August 2018 was a tangible demonstration that both the Quebec Government and PyroGenesis believe in the innovative potential of our PUREVAPtm QRR process (August 13 and 21, 2018 releases). Since August 2016, HPQ has invested $3,988,400 for the pilot equipment, representing 90% of the $4,430,000 design, fabrication and assembly budget.

Thanks to these new financings HPQ, in collaboration with its technical partners, will now be able to dedicate its efforts and energies toward the fulfilment of the ambitious commercial validation of the PUREVAPtm QRR process and the production of Solar Grade Silicon Metal (SoG Si) at the Pilot Plant level.

Q. Sounds like you have the financing under control. You mentioned at the onset that HPQ and partners are targeting a Pilot Plant, with bench test work well in hand and financing complete, can you give a status update of the Pilot Plant that you are now referring to as Gen3?

A. In mid September 2018, PyroGenesis took delivery of the 6 tonne furnace, the key component of the 50 tonne per year Gen3 PUREVAPTM QRR pilot plant. Delivery of the furnace marks the start of the assembly phase of the Pilot Plant, which is in an HPQ dedicated area at PyroGenesis’ production facility in Montréal. The Pilot Plant assembly will be completed during Q1 2019, commissioned during Q2 2019 and operational mid – 2019, just 3 years after the original concept was validated.

As of the date of this corporate update, the Gen2 PUREVAP™ equipment is still being used by PyroGenesis to test different operational conditions in order to gain more information about future Gen3 PUREVAP™ operation and testing is also ongoing to find new ways of increasing the Yield and the Production Yield of the Gen2 PUREVAP™.

Finally, a new progress report on the test results completed in 2018 with the Gen2 Purevap should be ready soon.

Q. How transferable are the results obtained from Gen2 to the pilot plant?

A. We believe they are very transferable. In fact, we expect the results to be even better at larger scale. By increasing the scale, we are increasing the production rate. As you can imagine, we are already extremely excited about the results we have had with Gen2, and at a larger scale, the production rate is automatically higher which, as we have already proven with Gen1, should lead to a higher conversion yield and better purity.

Q. HPQ has started talking about using a metallurgical process to transform the Si produced via the PUREVAPTM QRR to produce SoG Si. Is this just a semantic change or is HPQ changing its objectives?

A. It is more semantic than anything else; the project is advancing towards meeting our stated objectives when we started it in 2015:

“The “PUREVAP ™ Quartz Reduction Reactor is a proprietary process that uses a plasma arc within a vacuum furnace. This unique technology should allow HPQ (Uragold then) to convert its (…) Quartz Projects into the highest purity, lowest cost supplier of Solar Grade Silicon Metal (…) to the solar industry.

But this may be a good opportunity to explain in detail what makes the PUREVAPtm QRR such a game changing technology and why we have started to refer to it as a “Second Generation (2.0) Carbothermic processâ€.

Presently, using the status quo to produce Solar Grade Silicon Metal (SoG Si), you first need to transform Quartz (Silicon Dioxide or SiO2) into Metallurgical Grade Silicon Metal (MG Si) and then the MG Si needs to be further purified produce SoG Si.

PRESENT LEGACY CARBOTHERMIC PROCESS

The first step in making SoG Si involves mixing Pure Quartz (99.5%+ SiO2), Low Ash Carbon and Wood Chips and heating the mixture to very high temperatures in an electric arc furnace to create the Carbothermic process required to reduce the SiO2 to Metallurgical Grade Silicon Metal (MG Si).

The traditional smelter process to make MG Si requires six (6) tonnes of raw material to produce one (1) Tonne of Silicon Metal (Si).

To view Figure 1, please visit the following link: http://www.globenewswire.com/NewsRoom/AttachmentNg/2209e304-a764-4575-b120-e7c3fc010574

By its design, the impurities contained in the raw material end up being concentrated in the final product, that is why traditional smelters need (99.5%+ SiO2) to produce 98.0% Si.

The maximum purity that can be attained in traditional smelters is around the 99.5% Si threshold, but that requires additional post treatments. On average these postproduction processes can increase the purity of the MG Si by a factor ranging from ½ N to 1 N.

For Silicon Metal (Si) to be used in the Solar and High Tech Industries, higher purity levels than what can be attained by standard carbothermic reduction are required. Presently, less then twenty percent (20%) of MG SI produced by smelter meets the demanding feedstock purity specs required for the different additional purifications steps.

CHEMICAL DISTILLATIONS PROCESS (Siemens)

Chemical distillations process (Siemens process) to purify MG Si to purity required for Solar Grade applications or electronic applications has become the gold standard, with over 95% of the world SoG Si produced through chemical distillations, even with it negative environmental footprint.

Producing SoG Si (Polysilicon) via chemical distillations requires between 72,000 KWh/T up to 120,000 kWh/t and as the term clearly indicates chemical distillation implies that further refinement involves the use of harsh chemicals like hydrochloric acid, and the final products include liquid silicon tetrachloride and polysilicon. Each ton of polysilicon is manufactured at the cost of three to four tons of these hazardous by-products. When silicon tetrachloride is exposed to water it releases hydrochloric acid, which causes acidification of soil as well as the emission of toxic fumes.12

To view Figure 2, please visit the following link: http://www.globenewswire.com/NewsRoom/AttachmentNg/cf2fb91b-4738-4b69-9770-ee2bfd81a628

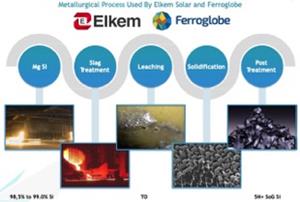

METALLURGICAL PROCESS

For many years, companies have been searching and investing funds looking for a metallurgical alternative to Chemical distillations process to transform MG Si into SoG Si.

Two groups, Elkem and Ferroglobe have been able to demonstrate, at commercial scale, the technical viability of using metallurgical process to further purify what is essentially 2N MG Si (99.0% Si) into a 5N+ SoG Si (UMG) that can be used to produce solar cells that deliver efficiencies and yield ratios which compare very favourably with photovoltaic industry benchmarks.13

To view Figure 3, please visit the following link: http://www.globenewswire.com/NewsRoom/AttachmentNg/7f4b1ae1-c535-4b98-8345-a43ac34cc8e3

The main advantage of a metallurgical process is the low operational cost, (for each individual step and total) combined with lower energy consumption for producing the UMG SoG Si (35,000 kWh/t versus a minimum of 72,000 KWh/t).

The biggest drawback of this process and the reason why, until now, it has not become the industry standard is that the CAPEX cost associated with every operational step (Slag Treatment, Leaching, Solidification and Post Treatment) are high, due to size and capacity needed to purify what is essentially 2N MG Si (99.0% Si) into a 5N+ SoG Si (UMG).

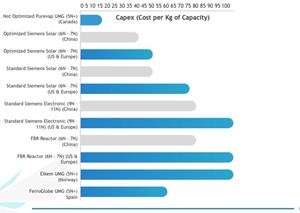

The fact that the operational cost saving are marginal on relative term while the CAPEX (Cost per kg of annual capacity matrix) associated with a complete metallurgical process to make UMG SoG Si is equivalent to the CAPEX (Cost per kg of annual capacity matrix) of building a chemical distillation process (Siemens) plant, is the only reason why metallurgical processes to make UMG SoG Si have not become mainstream in the industry.

Q. Now that is all very interesting, but if big companies like Elkem and Ferroglobe have not been able to make metallurgical processes work, why should we believe that HPQ with it’s PUREVAPTM QRR can?

A. It really comes down to big corporate culture. Our approach to the problem is disruptive; we are not looking at tweaking existing process to transform Quartz (Silicon Dioxide or SiO2) to Metallurgical Grade Silicon Metal (MG Si) or developing a new process that will be more efficient at removing the impurities from MG Si to produce Solar Grade Silicon Metal (SoG Si). We are looking for a new pathway of reducing Quartz (Silicon Dioxide or SiO2) to Solar Grade Silicon Metal (SoG Si) by developing the PUREVAP™ QRR a “Second Generation (2.0) Carbothermic processâ€.

Imagine a young engineer walking into a meeting and telling his bosses that the billions of dollars invested in the technology assets of the company should be scrapped for a brand new concept. Those bosses grew up, as it were, on the existing technology. There is no way that is going to happen, so big corporations spend all their effort tweaking the existing process.

It takes an upstart that is unencumbered with this corporate culture to bring about change. Examples include Microsoft with IBM, Tesla and GM, as simple examples of this concept.

This is what we are working on accomplishing and we believe that the PUREVAPtm QRR is that game changing disruptive technology for Solar Grade Silicon Metal.

To view Figure 4, please visit the following link: http://www.globenewswire.com/NewsRoom/AttachmentNg/0bcb69d4-f20a-43ca-a609-a0a654773359

Q. Ok, its one thing to say: the PUREVAPTM QRR is a game changing disruptive technology, but why and more important when will HPQ be in a position to demonstrate that the project is truly advancing toward that tipping point?

A. We, HPQ and technical partners PyroGenesis and Apollon Solar, have identified the following reasons why the PUREVAPtm QRR process will become the game-changing technology that could revolutionize the solar energy industry:

- Using metallurgical process to purify 2N MG Si (99.0% Si) into a 5N+ SoG Si (UMG) is technically feasible;

- The costs (CAPEX and OPEX) of removing, with metallurgical processes, multiple N of impurities from MG Si to produce 5N+ SoG Si (UMG) are prohibitive and make these process not financially feasible at present;

- Increasing by one (1) or better yet two (2) N the purity of the Silicon Metal (Si) produced during the carbothermic phase of converting Quartz (Silicon Dioxide or SiO2) to Si, for the same (CAPEX and OPEX) costs as traditional smelters incur to produce 2N MG Si (99.0% Si), should generate significant reductions of (CAPEX and OPEX) costs to make UMG SoG Si;

- This is what our Gen1 PUREVAPtm QRR results indicated should happen at commercial scale, and that is what the Gen3 PUREVAPtm QRR was built to demonstrate at commercial scale.

So, during 2019, as the Gen3 PUREVAPtm QRR pilot plant confirms the key working hypothesis of the November 2017 Gen1 based theoretical calculations is working at commercial scale, is when we expect to start receiving inquires from players in Silicon Metal and Solar Grade Silicon Metal industries.

If we can demonstrate a capacity to produce, in one step, a Silicon Metal (Si) with a purity that range from 3N+ to 4N+ from low purity Quartz (Silicon Dioxide or SiO2) feedstock, interest may also come from Solar players, since we would be starting to validate our claim that our PUREVAPtm QRR and UMG process will be the cheapest and greenest way to produce SoG SI in the world.

This does not mean that they are not looking at what we are doing, “au contraireâ€â€¦ But presently, we are attracting mostly interest from industry participants that have invested significant funds developing Quartz resources looking for ways of increasing the economic model of their projects.

Finally, shareholders and prospective investors would be wrong to assume that nothing will happen until then. As stated above, the Gen2 PUREVAP™ equipment is still being used to test different operational conditions in order to gain more information about future Gen3 PUREVAP™ operations and testing, to find new ways of increasing the Yield and the Production Yield of the Gen2 PUREVAP™.

A new progress report on the test results completed in 2018 with the Gen2 Purevap should be ready soon.

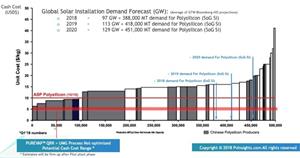

Q. With Solar Energy Prices now at Parity with Natural Gas and Coal, is there still a need for a new process like the PUREVAPTM (QRR)?

A. Yes, actually more than ever, as the size and speed of future investment in renewables energy is dependent on an ever-declining cost per watt model going forward, while the GHG concerns are becoming more challenging to governments and industry.

Over the last 40 years, solar energy innovations, financed mostly by government incentives, have allowed solar energy prices to reach parity with most fossil fuels today14. While this type of approach has generated phenomenal success regarding the cost per watt matrix, this approach is also responsible for phenomenal long term and short term market dislocation.

One of the most important dislocations is related to the costs (CAPEX and OPEX) of making Solar Grade Silicon Metal (SoG Si). Process improvements for making SoG Si have plateaued while returns for producing SoG Si are vanishing for investors, making financing of new high purity silicon capacity using old processes to turn MG Si into SoG Si difficult. HPQ solves this problem.

As figures 5 and 6 demonstrates, without new processes (like the PUREVAPTM QRR) that can bring about a new leg down in the cost (CAPEX and OPEX) of making SoG Si, this situation will either lead to production bottlenecks and potential shortage of SoG Si to meet demand. As with all commodities, this will result in a surge in the price of silicon, causing an unexpected increase in the price of solar energy.

CAPEX reduction as it pertains to the cost of making SoG Si have plateaued around the US $35 Cost per Kg of annual Capacity in China and US$ 50 Cost per Kg of annual Capacity in the Rest of the World.

Figure 5 clearly demonstrates the disruptive Capex potential (US$) of the PUREVAPTM QRR process.

To view Figure 5, please visit the following link: http://www.globenewswire.com/NewsRoom/AttachmentNg/516c785a-8302-4817-b315-7654cc35fcd9

Figure 6 for its part demonstrates that, even in 2018, the cost curve for SoG SI suggests that reductions in the OPEX costs had now plateaued and that a longâ€term SoG Si price below USD 14/Kg is simply not feasible. It is clear that to break this plateau, new processes like the PUREVAPTM QRR will need to reach commercial viability.

To view Figure 6, please visit the following link: http://www.globenewswire.com/NewsRoom/AttachmentNg/8506f76f-63fb-430e-9529-9c91a8b6e611

Q. According to a specialized publication15, Solar Grade Silicon Metal (SoG Si) consumption should decline to 3g/W by 2022, from 4g/W in 2018, how will this new reality affect HPQ Business Model?

A. My answer may sound counter intuitive, but HPQ sees this as a positive factor for our PUREVAPTM QRR + UMG project going forward. The effect of the decline will negatively impact mainly the highest cost producer, but a new process that can cut CAPEX and OPEX costs as much as our PUREVAPTM QRR + UMG project appears to be on the threshold of doing, will definitively benefit the entire industry and future consumers, possibly leading to the breakout needed to catapult solar energy ahead of carbon based energy for future generations.

What is important to realize is that demand for SoG Si is a combination of demand for each new GW of solar energy for the consumer and the SoG Si consumption needed to produce that new GW.

What is also shown in Figure 6 is the demand need for increased amounts of SoG Si required to meet the demand growth for solar energy:

- 2018 was projected at 97 GW @ 4.0 g per W; ≈ 388,000 MT of SoG Si demand;

- 2019 was projected at 113 GW @ 3.7 g per W; ≈ 418,000 MT of SoG Si demand;

- 2020 was projected at 129 GW @ 3.5 g per W; ≈ 451,000 MT of SoG Si demand.

Future demand projections for solar energy is such that even at 3.5 g thresholds, demand for SoG Si in 2020 should exceed the 451,000 MT mark, and that can be directly related to the fact that Solar Energy demand grows from its present two percent (2%) market share of the global electricity generation capacity to the ten percent (10%) threshold anticipated by 203016.

This translates into a demand in US$ for SoG Si that will grow from US$ 7.1 B in 2018 to over the US$ 11.8 B mark by 202817.

Q. An often-asked question is, how comfortable are you with the patent application?

A. The short answer is: very comfortable. PyroGenesis is leading the patent application, which is progressing as expected. Given PyroGenesis vast experience in obtaining patents and their $1,950,000 investment in HPQ at a premium in August, this question should be put to rest once and for all.

Q. Some investors/shareholders are skeptical about the whole process. Do you have any comments?

A. Well, they should meet the engineers! Now there is a skeptical bunch and that is natural with any new process as groundbreaking as this. Every step of the way has brought its share of challenges but has also brought about many more positive surprises and developments. This is the immense competitive advantage HPQ has as a result of bringing together the engineering brainpower of PyroGenesis and Apollon Solar. Seriously, we are talking about a process that potentially could be game changing by several magnitudes. Who wouldn’t be skeptical? You would have to be a fool not to be. Adding to this is the fact that the results to date are beyond our expectations, which, in a weird way, fuels the “too good to be true†skepticism, no? On the other hand, how many chances do you get to invest into such potential, at 6 cents a share and market cap of CAD$13 million, when our strategic partner and the Government have invested CAD$5,250,00 at a Company valuation of CAD$26 million? Food for thought!

Q. What about the quartz properties? The last we heard about quartz exploration was in Q4 2017 when you announced a drilling campaign on the Ronceveaux?

A. We are still fully invested in our 100% owned Martinville and Ronceveaux quartz properties. However we decided to hold off on quartz exploration to allocate exploration funds for geophysics and geology work on the Beauce Gold property.

Now that the spin-off of Beauce Gold Fields is done, we intend to go back to Martinville and Ronceveaux properties to bulk sample quartz as test feed for the Gen3 PUREVAP reactor. For the next twelve (12) to twenty-four (24) mounts our need in Quartz as feedstock is limited to about 150 MT for 2019-2020.

Q. Ok so you have talk a lot about your plans for the solar market but in your first answer you mentioned silicon for batteries, what is that about?

A. From phones to electric cars, batteries play important role for just about everyone on earth, and Si usage in the batteries space is increasing. The most promising new type of battery being developed presently is Lithium Silicon Anode Batteries (Li-Si Batteries). Researchers have found that by replacing the graphite with silicon in a standard lithium battery, your drastically improve performance. Anyone who owns a mobile phone or for that matter, an electric car, wishes that the battery would charge faster and last longer.

For everybody involved in this project it has given an appreciation of silicon metal, and some surprises have included opportunities that may have an impact on the lithium ion battery industry. We will not retire the Gen2 reactor as we did Gen1 but we will use it to pursue some of the interesting ‘accidental outcomes’ from our efforts to develop a new pathway to make clean energy cleaner and more cost efficient.

Q. Conclusion?

A. There is no other way to say it, our belief that PUREVAP™ process is going to become a game-changing event that has the potential to revolutionize the solar energy industry has not waned one bit since we made our first bold statements in 2015. The project is advancing, the success we have attained in less than 3 years is spectacular and the de-risking that has occurred with every successful phase is significant.

In short, all three partners are happy with the progress to date and stand firmly behind the project. We are more convinced than ever that we will be successful in having a commercially viable process at the end of the 2019. Investors need to remember that we are just at the start of this process and that we have more exciting developments moving forward then what we have already accomplished to this point. The future of HPQ is very bright – no pun intended.

This News Release is available on the company’s CEO Verified Discussion Forum, a moderated social media platform that enables civilized discussion and Q&A between Management and Shareholders.

About HPQ Silicon

HPQ Silicon Resources Inc. is a TSX-V listed resource company planning to become a vertically integrated and diversified High Purity, Solar Grade Silicon Metal (SoG Si) producer and a manufacturer of multi and monocrystalline solar cells of the P and N types, required for production of high performance photovoltaic conversion.

HPQ’s goal is to develop, in collaboration with industry leaders, PyroGenesis (TSX-V: PYR) and Apollon Solar, that are experts in their fields of interest, the innovative PUREVAPTM “Quartz Reduction Reactors (QRR)â€, a truly 2.0 Carbothermic process (patent pending), which will permit the transformation and purification of quartz (SiO2) into high purity silicon metal (Si) in one step and reduce by a factor of at least two-thirds (2/3) the costs associated with the transformation of quartz (SiO2) into SoG Si. The pilot plant equipment that will validate the commercial potential of the process is on schedule to start mid-2019.

Disclaimers:

This press release contains certain forward-looking statements, including, without limitation, statements containing the words “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “in the process” and other similar expressions which constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking statements reflect the Company’s current expectation and assumptions, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Company with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Company’s on-going filings with the securities regulatory authorities, which filings can be found at www.sedar.com. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact

Bernard J. Tourillon, Chairman and CEO Tel (514) 907-1011

Patrick Levasseur, President and COO Tel: (514) 262-9239

www.HPQSilicon.com

Shares outstanding: 222,284,053

1 PyroGenesis Budgetary cost number for a 2,5K TPA Purevap, Apollon Rough Order of Magnitude Costing for a 2,5K UMG process

2 PyroGenesis Canada Inc. Technical Memo: “TM-2016-707 REV 01, (July 2018),- Purevap system – Carbon Footprint study

3

PyroGenesis retains a royalty-free, exclusive, irrevocable worldwide

license to use the process for purposes other than the production of

silicon metal from quartz. Should PyroGenesis develop any other such

application, HPQ Silicon shall have a right of first refusal in the

event of any sale or otherwise disposal.

4 http://pyrometallurgy.co.za/Pyro2011/Papers/083-Xakalashe.pdf5 PyroGenesis Canada Inc. Technical Memo: “TM-2017-830 REV 00, – Final Report-Silicon Metal Purity Enhancement

6 Total mass of Si produced during one test

7 Production Yield is the conversion efficiency of Quartz into Silicon Metal of the process

8 Inductive coupled plasma optical emission spectrometry

9 https://www.economist.com/news/science-and-technology/21711301-new-paper-may-have-answer-how-clean-solar-power10 Assessing the lifecycle greenhouse gas emissions from solar PV and wind energy: A critical meta-survey, Energy Policy , February 2014, Pages 229-244

11 PyroGenesis report – Silicon SoG Carbon Footprint TM-2016-708, revision #2

12 https://www.azocleantech.com/article.aspx?ArticleID=831

13 Ferroglobe PLC, Aug. 14, 2018 release.

14 http://news.mit.edu/2018/explaining-dropping-solar-cost-1120

15 https://www.pv-tech.org/editors-blog/china-531-to-accelerate-demise-of-multi-polysilicon-consumption-decline-to

16 (Canadian Solar latest investor presentation)

17

(Deutsche Bank, Future Market Insights report titled, “Polysilicon

Market: Global Industry Analysis 2013-2017 and Opportunity Assessment

2018-2028”)

Figure 1 – Quartz to MG Si process

Figure 1 – Quartz to MG Si process

Figure 2 – Chemical Process (Mg SI to SoG)

Figure 2 – Chemical Process (Mg SI to SoG)

Figure 3 Metallurgical Process (MG si to SoG Si)

Figure 3 Metallurgical Process (MG si to SoG Si)

Figure 4 PUREVAP

Figure 4 PUREVAP

Figure 5 CAPEX analysis (US$ Cost per Kg of annual Capacity)

Figure 5 CAPEX analysis (US$ Cost per Kg of annual Capacity)

Figure 6 Cost Curve for SoG Si