Vancouver BC – LOMIKO METALS INC. (TSX-V:LMR, OTC: LMRMF, FSE: DH8B) (the “Companyâ€)

is pleased to announce that Mr. Kumara Rachamalla, M.B.A,M.Eng., P.Eng. has been appointed to the Board of Advisors. Mr. Rachamalla has extensive experience with various aspects of business including Strategic Planning, Resource Financing and Mining.

“Mr. Rachamalla was a Director of Holmer Gold Mines, taken over by Lake Shore Gold Corp., Kumara was also an Advisory Board member of Augun Gold Mines, acquired by Trelawney Mining & Exploration and of Augen Capital, a merchant bank. He has comprehensive knowledge of the process of financing, planning and building mines throughout Canada. He has a broad network across Canada in government bodies, institutions and companies within the mining industryâ€, stated A.Paul Gill, CEO of Lomiko Metals Inc., “He knows the milestones required for building a viable mining entity.â€

Key Highlights

-Developed and implemented innovative incentive policies for the Government of Ontario,

-Advised public and private sector clients on technical, environmental, natural resource,financial and taxation issues.

-Designed economic, financial and taxation models to develop and assess a broad range of fiscal options and their impact on private sector investments and made recommendations for incorporation into tax statutes.

-Advised institutional investors in Canada, U.S., Europe and the Far East to invest in attractive investment opportunities in the natural resource sector by providing in-depth commodity analysis, combining financial, technical and industry expertise.

-Provided expert opinion in Canadian and U.S. tax courts.

-Raised both equity and debt capital for corporations and advised corporate clients on financing, joint ventures, acquisitions and mergers.

-Developed strategic plans and reviewed project evaluation of the multi-billion dollar Syncrude oil-sands project.

-Evaluated and conducted feasibility studies and ore reserve estimates in Quebec and Yukon Territories as Assistant Chief Mine Engineer.

-Conducted cost-benefit analyses, environmental studies and health and safety surveys for the National Coal Board in the United Kingdom.

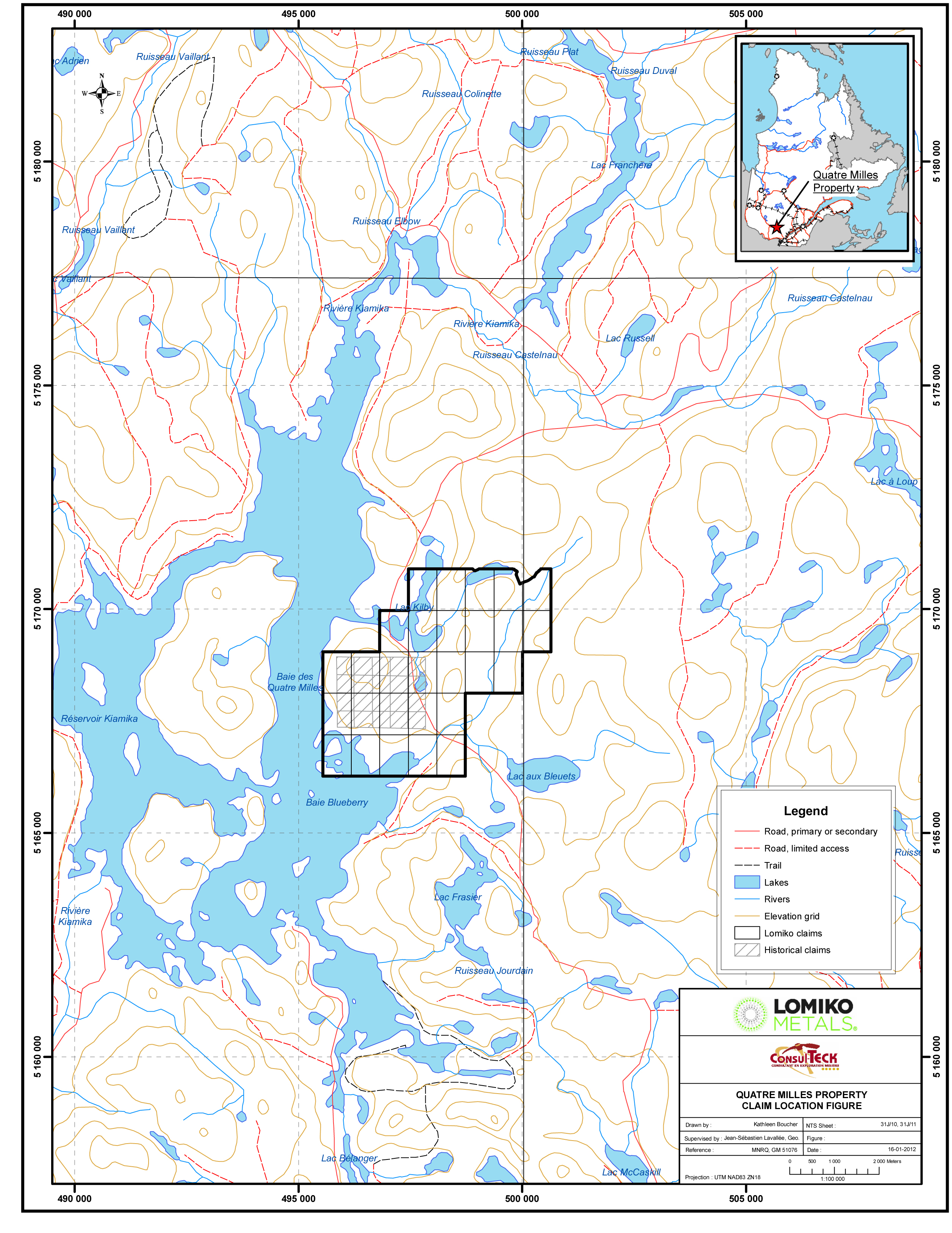

Lomiko’s Quatre Milles Graphite Property

The Quatre Milles Property is road accessible and is located approximately 175 km northwest of Montreal and 17 km due north of the village of Sainte-Veronique, Quebec. The property consists of 28 contiguous claims totaling approximately 1,600 hectares.

The property was originally staked and explored by Graphicor Resources Inc. (“Graphicorâ€) in the summer of 1989 based on the results of a regional helicopter-borne EM survey. The underlying geology consists of intercalated biotite gneiss, biotite feldspar gneiss, marble, quartzite and calc-silicate lithologies of the Central Metasedimentary Belt of the Grenville Province.

Near-Term Strategy

Lomiko plans to mount an aggressive exploration campaign on the Quatre Milles Graphite Property commencing with a complete compilation of historic geologic work followed by surface mapping, prospecting and follow-up diamond drilling.

Historical Highlights

- 1Graphicor completed reconnaissance mapping and prospecting as well as ground geophysics and a 26 hole diamond drill program totaling 1,625 metres.

- 2

- 3The work identified several conductive trends in the central portion of the property and at least three, relatively flat lying graphitic beds.

- 4

- 5Three surface samples were collected and analyzed returning results of 14.16% Cgf, 18.06% Cgf and 20.35% Cgf.

- 6

- 723 of the initial 26 drill holes intersected graphite concentrations with graphite concentration in range of 4.69% in hole Q90-1 to a highlight of 8.07% Cgf over 28.60 metres in hole Q90-7. The highest individual assay was reported in hole Q90-10 reporting 15.48% Cgf over 0.50 metres. A table of results from the 43-101 indicates:

- 8

------------------------------------------

|HOLE NO.|FROM(M)|TO(M)|WIDTH (M)|GRADE |

| | | | |(% CGP)|

|----------------------------------------|

|Q90-1 |8.94 |10.46|1.52 |7.33 |

|----------------------------------------|

|Q90-2 |28.68 |30.13|1.45 |10.38 |

|----------------------------------------|

|Q90-3 |16.23 |17.84|1.61 |4.09 |

|----------------------------------------|

|Q90-4 |9.4 |14.1 |4.7 |3.95 |

|----------------------------------------|

|Q90-5 |2 |3.90 |1.90 |2.07 |

|----------------------------------------|

|Q90-5 |22.13 |23.25|1.12 |10.52 |

|----------------------------------------|

|Q90-6 |32.54 |41.19|8.65 |8.07 |

|----------------------------------------|

|Q90-6 |43.47 |44.05|0.98 |3.87 |

|----------------------------------------|

|Q90-7 |3.94 |32.54|28.60 |8.07 |

|----------------------------------------|

|Q90-8 |1.54 |2.16 |0.62 |14.89 |

|----------------------------------------|

|Q90-8 |5.23 |8.05 |2.82 |7.45 |

|----------------------------------------|

|Q90-9 |2.05 |3.10 |1.05 |8.47 |

|----------------------------------------|

|Q90-9 |5.76 |6.8 |1.04 |10.86 |

|----------------------------------------|

|Q90-10 |2.14 |5.54 |3.40 |8.02 |

|----------------------------------------|

|Q90-10 |7.03 |7.61 |0.58 |10.59 |

|----------------------------------------|

|Q90-10 |8.53 |9.03 |0.50 |15.48 |

|----------------------------------------|

|Q90-10 |9.27 |11.24|1.97 |12.37 |

|----------------------------------------|

|Q90-10 |14.16 |15.46|1.30 |4.26 |

|----------------------------------------|

|Q90-11 |26.82 |34.02|7.20 |4.63 |

|----------------------------------------|

|Q90-12 |0.94 |8.53 |7.59 |8.60 |

|----------------------------------------|

|Q90-12 |38.16 |43.61|5.45 |3.79 |

|----------------------------------------|

|Q90-13 |0.69 |10.28|9.59 |4.64 |

|----------------------------------------|

|Q90-13 |40.95 |43.14|2.19 |3.82 |

|----------------------------------------|

|Q90-14 |5.56 |7.22 |1.66 |8.12 |

|----------------------------------------|

|Q90-15 |2.21 |5.59 |3.38 |9.76 |

|----------------------------------------|

|Q90-16 | | | |NSV |

|----------------------------------------|

|Q90-17 |15.48 |18.63|3.15 |8.11 |

|----------------------------------------|

|Q90-17 |21.43 |23.67|2.24 |13.29 |

|----------------------------------------|

|Q90-17 |36.77 |47.97|11.20 |5.88 |

|----------------------------------------|

|Q90-17 |57.15 |58.21|1.06 |9.53 |

|----------------------------------------|

|Q90-17 |59.54 |69.82|10.28 |5.99 |

|----------------------------------------|

|Q90-18 |10.68 |12.90|2.22 |8.12 |

|----------------------------------------|

|Q90-19 |47.80 |49.25|1.45 |9.16 |

|----------------------------------------|

|Q90-19 |50.42 |58.49|8.07 |5.72 |

|----------------------------------------|

|Q90-20 |13.51 |16.98|3.47 |5.81 |

|----------------------------------------|

|Q90-21 |2.80 |4.98 |2.18 |5.56 |

|----------------------------------------|

|Q90-22 |17.37 |20.04|2.67 |2.58 |

|----------------------------------------|

|Q90-23 | | | |NSV |

|----------------------------------------|

|Q90-24 |1.78 |4.14 |2.36 |3.77 |

|----------------------------------------|

|Q90-24 |12.32 |13.09|0.77 |4.20 |

|----------------------------------------|

|Q90-24 |16.86 |18.66|1.80 |4.96 |

|----------------------------------------|

|Q90-25 |19.69 |21.24|1.55 |3.67 |

|----------------------------------------|

|Q90-25 |25.27 |26.65|1.38 |9.66 |

|----------------------------------------|

|Q90-26 | | | |NSV |

------------------------------------------

The Company cautions that it has not had the chance to verify the quality and accuracy of the historic sampling and drilling results reported in this news release which predate the introduction of NI 43-101 and cautions readers not to rely upon them. The historic figures were generated from sources believed to be reliable, however, they have not been confirmed. Although the sampling and drilling results are relevant, they have not been verified.

Graphite Market

-The price for flake graphite is $ 2000-$4000 per tonne depending on flake size and grade.

-Graphite prices have been increasing in recent months and over the last couple of years prices for large flake, high purity graphite (+80 mesh, 94-97%C) have more than doubled.

-Graphite prices have almost tripled since 2005 due to the ongoing industrialization of China, India and other emerging economies and resultant strong demand from traditional steel and automotive markets.

-Demand for graphite is expected to rise as electric vehicles and lithium battery technology are adopted, nuclear reactors are built in China, and if fuel cells and graphene patents become products.

-China, which produces about 70 per cent of the world’s graphite, is seeing production and export growth leveling, and export taxes and a licensing system have been instituted.

-Europe and the USA have both indicated graphite is of economic importance and has a supply risk (Critical Raw Materials for the EU, July 2010).

Graphite Facts

-Natural graphite comes in several forms: flake, vein, amorphous and lump.

-Southwestern Quebec is host to some of the most favorable geological terrain for graphite exploration in Canada and is known to host graphite resources, including the nearby Lac Des Iles mine operated by Timcal.

-Graphite has many important new applications such as lithium-ion batteries, fuel cells, and nuclear and solar power that have the potential to create significant incremental demand growth.

-There is roughly 20-30 times more graphite by weight needed to produce a lithium-ion battery than there is lithium.

-Of the 1.2 million tonnes of graphite produced annually, approximately 40 per cent is of the most desirable flake type.

-High-growth, high-value graphite applications require large-flake and high-purity graphite which is the prime exploration and development target at the Quatre Milles Property.

Jean-Sebastien Lavallee (OGQ #773), geologist, a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical content of this release.

For more information, review the website at www.lomiko.com, contact A. Paul Gill at 604-729-5312 or email: [email protected]

On Behalf of the Board

“A. Paul Gillâ€

Chief Executive Officer

We seek safe harbor. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.