Last week at Inside the Market, we invited you to submit questions for Eric Sprott. We received over 100 questions.

We posed a selection of these to Mr. Sprott this week and present the questions and answers below. As you’ll read, the CEO of Sprott Asset Management is only becoming more entrenched in his bullish views, calling for a $2,400 (U.S.) gold price within a year. And he sees nothing short of “explosive†gains in junior mining stocks. Thanks to all for participating.

Are we near the bottom of the decline in gold and what timeframe do you see for its appreciation to reach the old highs and possibly push through to new highs? Craig

Craig, I firmly believe that we reached the bottom on June 28th and that gold should double from that bottom within the next 12 months. So by next summer, I think that the price of gold will have made new highs and stand around $2,400 per ounce.

What is your view on the junior mining and exploration space? What has to occur in the mining sector to see a turn-around in the junior space? Anonymous

Given my outlook on gold prices, this sector will be explosive. The continuation of the gold bull market will lead the junior gold mining stocks higher by many hundreds of per cents, just like it did during the 2008 recovery. By the way, since hitting the bottom on June 28, gold has rebounded by 12 per cent while gold miners have gone up by about 25 per cent.

Hello Mr. Sprott, I think your analysis of what is happening with fiat currency is bang on. I am wondering how do you think the U.S. Government can ever get out of this catch-22 they are in with their debt? If they let the interest rate rise by stopping QE (quantitative easing) then they will pay more interest on their debt. If the pay more interest on their debt, they will have a bigger deficit. Will they print money until the reset button is pressed? When? What will that mean for the average Joe? Kyle Brown

Mr. Brown, you are exactly right, and this is why I think that the Fed will remain accommodative for a very long period of time. However, the official debt is only the tip of the iceberg and, as we discussed in the most recent Markets at a Glance, longer-term benefits such as social security and medical care will have to be cut as well. The promises made by governments are too generous and cannot be kept. Not just for the average Joe but for everyone, I think we should expect less from the government and prepare to fend more for ourselves. Money printing can hide financial problems for a while, but it can’t provide tangible services to citizens.

Why do you think the bullion banks have so consistently shorted the gold market? Were one or more, in your view, acting as agents for the Fed to prevent gold from being seen as a secure store of value and a preferred alternative to the U.S. dollar? Do you have conclusive evidence to back your opinion? Derek White

Mr. White, there is strong evidence that Central Banks have surreptitiously colluded with bullion banks (see our Sprott Thoughts article on the topic here) and sold their gold in the market. This is further evidenced by recent comments at the Bank of England and the ridiculously long delays to repatriate German gold from the U.S. Furthermore, I would refer you to the Gold Anti-trust Action Committee website, which discusses those issues at length, and our Markets at a Glance article series “Do Western Central Banks Have Any Gold Left???â€. (Part 3 can be seen here.)

Some prominent analysts claim that the Commitment of Traders reports from the U.S. CFTC are giving very bullish signals concerning the future direction of gold and silver prices. Do you agree– and why or why not? Andrew

Yes, I agree with this analysis and further details can be found in my recent article here. Basically, we have seen a complete reversal of the situation in the futures market: commercial dealers covering their shorts, speculators selling (going short), and most importantly, COMEX inventories declining. The most important part of the equation is the covering of shorts by commercial dealers. That means they are no longer supplying (paper) gold to the market, which was depressing the price.

The price of gold appears to be set by the enormous volume of transactions in the paper gold market, which dwarf the physical. This price mechanism seems to have survived various significant events of almost physical default this year – Dutch bank settlements, German gold recovery from the US, and India’s domestic restrictions on gold investments. What therefore could possibly change this equation and cause (and allow) the real physical supply-demand reality to start driving price as classical economics dictates it must? Simon Lester

Mr. Lester, I think that you are absolutely correct in your analysis; daily paper volumes are many times larger than annual mine production. I believe that the return to fundamentals driving gold prices will be triggered by a shortage of physical gold and ultimately, a failure to deliver. We already see signs of physical gold shortages, as evidenced by the negative Gold Forward Offered Rates (GOFO) rates, record low physical inventories and backwardation in the futures market. A full discussion can be read in the articles linked to above.

Why have your funds performed so poorly and why may you think that will change? Andrew

I have always believed that I am right and that markets are wrong, but throughout the years, I have had to endure situations like this. It happened in 1998 and 2008, but my funds have always rebounded. In due course, the markets will realize their failure. After this short pause, the gold bull market will continue and those that have been patient will be rewarded.

Whenever the Fed hints at tapering, gold takes a hit (as does the stock market in general). At some point, the Fed will have to taper as this bond purchasing cannot go on forever. Won’t gold get crushed at that point in time? Anonymous

The Fed may or may not taper; I am in the disbeliever camp. As for gold, I happen to believe that the Western central banks, which have suppressed the price of gold, won’t be able to do so for long.

How do you see the selling of paper gold and silver in the West and the aggressive purchasing of physical precious metals by the East resolving itself and what time frame would you give for some kind of resolution of this contradictory behaviour to occur? Dave

We have already seen some manifestations of this (see our article here). Recently, the China Gold Association announced that gold consumption increased 54 per cent in the first half of 2013 (to 706.36 tonnes). As mentioned in previous answers, a shortage of physical gold will ultimately correct this discrepancy.

What if you are wrong in your case for gold to go up dramatically? What if gold falls below $1,000 dollars this year and 800 next? Would you change your investment strategy? Richard Wiklo

Then I would need to admit that the timing was wrong, but we stand by our in-house analysis. We believe that the price is suppressed and, based on our work, I am not changing my investment strategy.

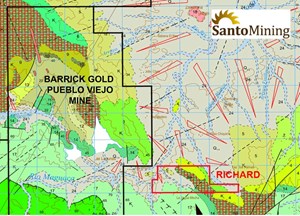

Gold producers are once again hedging their production. Does that mean that we are about to see a replay of a long period of depressed prices similar to what we saw when Barrick had massive hedging programs in the 1990’s? Chuck

I sure hope not, as you would imagine. Barrick paid a huge price for hedging. I can’t predict what producers will do but those that hedge will be penalized in the market. I hope that they won’t.

The Western central bankers allegedly have 18,000 tonnes of gold. [10,000 Europe, $8,000 USA], the Bank of England sold off 1,300 tonnes of gold in recent months [7 per cent of Western civilization’s gold]. What’s to stop them from using the rest of their gold to keep the price down for years to come? Jeff Spakowsky

Mr. Spakowsky, I believe that this is unlikely since I doubt that Western Central Banks have any gold left.

Good day sir. Do you believe there will be a major shake-up and consolidation among the junior gold producers who are “borderline price-point producers†and will not survive the current prolonged downturn in the gold market? Jamie Dillon

Mr. Dillon, it is an opportune time for intermediate and senior producers to be buyers of precious metals companies at those depressed valuations. With my expectations of a short-term turnaround in gold prices, there will be a high survival rate.