|

August 29th 2018 / Rockport, Canada – New Age Metals Inc. (NAM) (TSX.V: NAM; OTCQB: NMTLF; FSE: P7J.F) The company is very pleased to announce that the first technical report on NAM’s 100% owned Genesis PGM/Polymetallic Project is complete.

NAM Seeking Option/Joint-Venture Partner

NAM management is actively seeking an option/joint-venture partner for this road accessible PGM/Multiple Element Project using the Prospector Generator business model. For a copy of the Avalon report please contact Cody Hunt, Business Development ([email protected]) or by phone at 613-659-2773. A standard confidentiality agreement will be forwarded to the interested party and the report will be made available.

Avalon Development Corporation (Avalon) provided geologic consulting, including field sampling, mapping and data compilation on this project in the past and was retained to compile this NI 43-101 compliant report.

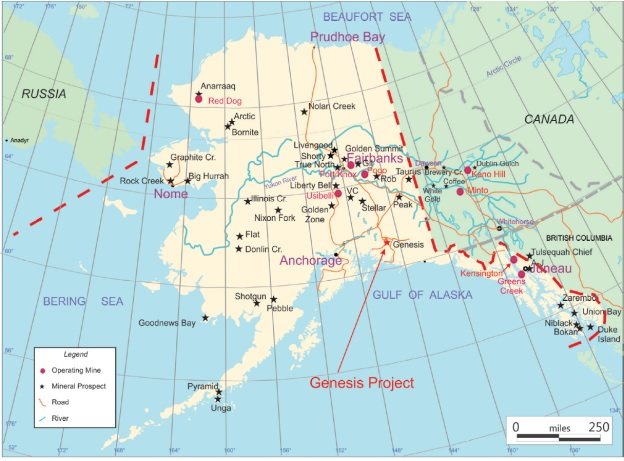

The Genesis project is a Ni-Cu-PGM property located in the northeastern Chugach Mountains, 75 road miles north of the city of Valdez, Alaska. The project is within 3 km of the all-season paved Richardson Highway and a high capacity electric power line. The project is covered by 4,144 hectares (10,240 acres) of State of Alaska mining claims owned 100% by New Age Metals. Past exploration has revealed the presence of chromite-associated platinum and palladium mineralization and stratabound Ni-Cu-PGM mineralization within steeply dipping magmatic layers of the Sheep Hill portion of the Tonsina Ultramafic Complex. The mineralized horizon has been identified in outcrop sampling for 850 m along strike and a 40 m true thickness.

Figure 1: Location of the Genesis Project, Nelchina Mining District, Alaska.

PGM values at Genesis are strongly correlated with the chromite rich portions of the mineralized horizon, while Ni and Cu are strongly correlated with sulfide rich portions of the mineralized horizon. Metal grades are regular over multiple meter intervals, including 6 meters grading 804 ppb platinum and 1,018 ppb palladium, and 12 meters grading 5,938 ppm nickel. There has been no drilling on this district-scale project and the strike and depth extent of Ni-Cu-PGM mineralization remains untested. Additionally, two areas of banded chromite hosted in dunite and harzburgite on the Bernard Mountain portion of the Tonsina Ultramafic Complex host multiple ppm PGM and a sample of chromite hosted in the olivine websterite unit contains the high values for both Platinum (Pt) and Palladium (Pd) for a combined 5,340 ppb PGM. Outcrop sampling has returned values of 16-9,660 ppm Ni, 0.5-5,800 ppm Cu, 0-2,800 ppb Pt, 0-2,540 ppb Pd. Limited geochemical sampling and geologic mapping has been conducted over these two mafic-ultramafic massifs.

The identification of two different styles of PGM mineralization at Sheep Hill suggests that multiple mineralizing events have occurred. The parental magma for the Tonsina Ultramafic Complex contained highly anomalous concentrations of PGM and Ni. More exploration is required to define if a reef event has formed the stratabound magmatic sulfide mineralization and if the geochemical patterns caused by reef formation hosts economically significant Ni-Cu-PGM mineralization in the Tonsina Ultramafic Complex.

The different Cr/Fe ratios for chromite ores studied by the USBM during the 1980’s (Foley et al, 1985, Foley and others, 1987) fits with observations from layered intrusions with multiple chromite horizons (Maier and Barnes, 2005) where the Cr/Fe ratio decreases in successive chromite layer formation. The decrease in Cr/Fe ratios between Bernard Mountain, thought to be a basal sequence, and Sheep Hill, interpreted to be a stratigraphically higher portion of the intrusive complex (Foley and others, 1987), could indicate that multiple chromite formation events have occurred in the ultramafic magma chamber, and that other PGM-enriched horizons remain undiscovered. PGM profiles of Genesis project outcrop samples show a Ruthenium trough, which is postulated to have formed during partial melting of the mantle in a subduction environment, and are more similar to PGM profiles from Ni-Cu-PGM ores from layered intrusions such as Stillwater, the Great Dyke, and Penikat, than PGM profiles from ophiolite associated ores.

Figure 2: Projects Location Map: The road accessible Genesis PGM Project adjacent to Richardson Highway and 138 kv electric lines. The project is 460 road kilometers to Fairbanks, Alaska and 120 road kilometers to the all-weather port city of Valdez.

Merits of the Genesis PGM Project

The Genesis PGM Project is an under explored, highly prospective multi-prospect drill ready Pd-Pt-Ni-Cu property that warrants follow-up drilling, additional surface mapping, sampling to expand the known footprint of mineralization and to determine the ultimate size and grade of the layered mineralization outlined to date. The stable land status, ease of access and superb infrastructure make this project prospective for year-around exploration, development and production.

Significant aspects of the Genesis PGM Project include:

- – Drill ready PGM-Ni-Cu reef style target with 2.4 grams/ton Palladium (Pd), 2.4 grams/ton Platinum (Pt), 0.96% Nickel (Ni), and 0.58% Copper (Cu).

- – Reef mineralization is open to the west, east, north, and at depth.

- – Mineralized reef identified in outcrop for 850 m along strike and a 40 m true thickness.

- – Separate style of chromite mineralization contains Platinum Group Metals (PGM) up to 2.5 g/t Pd and 2.8 g/t Pt.

- – Known PGM mineralization covers a distance of 9 km across the prospect.

- – No historic drilling has been done on the project.

- – Project is within 3 km of a paved highway and electric transmission line.

- – Project is on stable State of Alaska claims.

- – Fraser Institute’s 2017 survey of mining companies has Alaska ranked as the 10th best jurisdiction in the world for mining.

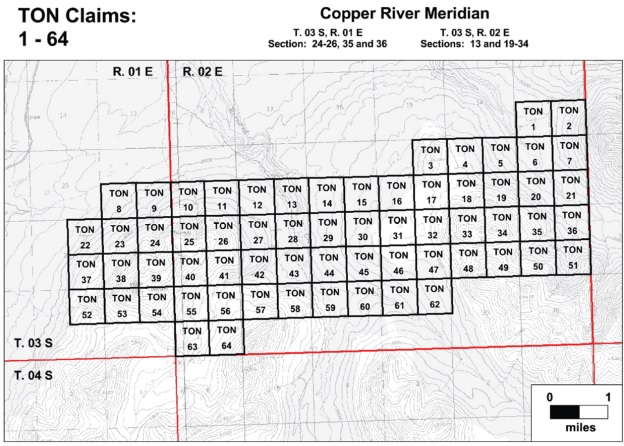

The agreement with Anglo Alaska is for an aggregate of 64 contiguous one hundred and sixty-acre claims (10,240 acres) in the Valdez and Chitina Recording District, Alaska.

Figure 3: Claim location map for the Genesis Project.

Future Recommended Work on the Genesis Project by Avalon Development’s August 2018 Report

Year 1: Initial efforts at Genesis should focus on detailed geologic mapping (1:1,000 or better), grid-based lithogeochemical sampling, 2D and 3D reinterpretation of previously completed airborne and ground geophysical surveys, and acquisition, interpretation and ground-truthing of hyperspectral imagery over the Tonsina Ultramafic complex and vicinity. This effort will require some pre-season desk-top work (geophysical reinterpretation and hyperspectral analysis) followed by field work centered on 6 to 8 person tent camps that are emplaced by helicopter but which do not have daily helicopter support. The focus of field efforts will be detailed geologic mapping and lithogeochemical sampling designed to locate and define both bedded and chromite-related Cu-Ni-PGM mineralization to a degree sufficient to target drilling in year 2. All analytical work will include Pt+Pd+Au by fire assay and multi-element IPC-AES analysis with 4-acid digestion. Total estimated cost of this program is approximately $500,000.

Year 2: Exploration recommended for year 2 will be focused on initial scout drilling of one or more targets as refined by year one efforts. Approximately 2,500m of drilling is included in this program. Hole coordinates, inclinations and azimuths will be refined using results from year 1 field efforts. Drilling will be helicopter supported using an LF70 or CS1000 or equivalent drilling rig supplied with water derived from local streams or ponds. Drill support will be from a contract tent camp capable of supporting 10-12 persons. All drill core will be logged, photographed, and sawed with one-half of the core remaining in archive, the other half being shipped for geochemical analysis. All analytical work will include Pt+Pd+Au by fire assay and multi-element IPC-AES analysis with 4-acid digestion. Total estimated cost of this program is approximately $1,000,000.

Year 3: Exploration recommended for year 3 will be focused on definition drilling of the most promising target drilled in year 2. The goal of year 3 efforts will be to advance at least one target to the inferred resource stage. Approximately 5,000 metres of drilling is included in this program. Hole coordinates, inclinations and azimuths will be refined using results from year 2 drilling efforts. Drilling will be helicopter supported using an LF70 or CS1000 or equivalent drilling rig supplied with water derived from local streams or ponds. Drill support will be from a contract tent camp capable of supporting 10-12 persons. All drill core will be logged, photographed, and sawed with one-half of the core remaining in archive, the other half being shipped for geochemical analysis. All analytical work will include Pt+Pd+Au by fire assay and multi-element IPC-AES analysis with 4-acid digestion. Total estimated cost of this program is approximately $1,500,000. NAM’s management are actively seeking an Option/Joint-Venture partner for Genesis.

ABOUT NAM’S LITHIUM DIVISION

The summer exploration plan has begun for the company’s Lithium Division (June 14th, 2018). NAM has 100% ownership of eight pegmatite hosted Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba, with focus on Lithium-bearing pegmatites. Three of the projects are drill ready. This Pegmatite Field hosts the world class Tanco Pegmatite that has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium minerals) in varying capacities, since 1969. NAM’s Lithium Projects are strategically situated in this prolific Pegmatite Field. Presently, NAM is the largest mineral claim holder for Lithium and Rare Metal projects in the Winnipeg River Pegmatite Field.

Lithium Canada Development is a 100% owned subsidiary of New Age Metals (NAM) who presently has an agreement with Azincourt Energy Corporation (AAZ) whereby AAZ will now expend a minimum of $600,000 in 2018. In its initial earn in AAZ may earn up to 50%, of the eight Lithium projects that are 100% owned by NAM. AAZ’s 50% exploration expenditure earn in is $2.950 million and should they continue with their option they must issue up to 1.75 million shares of AAZ to NAM. NAM has a 2% royalty on each of eight Lithium Projects in this large underexplored pegmatite field. On July 11th,2018, NAM announced that they had exercised their option to search for Lithium and Rare Metals on the CAT4 claim. For additional information on the NAM/AAZ option/joint-venture and recent acquisitions (see the news releases dated Jan 15, 2018, May 2, 2018, May 10, 2018, June 6, 2018, June 13, 2018, July 11, 2018) or go to the investors presentation on www.newagemetals.com

ABOUT NAM’S PGM DIVISION

NAM’s flagship project is its 100% owned River Valley PGM Project (NAM Website – River Valley Project) in the Sudbury Mining District of Northern Ontario (100 km east of Sudbury, Ontario). Presently the River Valley Project is North America’s largest undeveloped primary PGM deposit with Measured + Indicated Mineral Resources of 160 million tonnes @ 0.44 g/t Palladium, 0.17 g/t Platinum, 0.03 g/t Gold, with a PdEq metal grade of 0.90 g/t at a cut-off grade of 0.4 g/t PdEq equating to 3,297,000 ounces PGM plus Gold and 4,626,000 PdEq Ounces (Table 1). This equates to 4,626,000 PdEq ounces M+I and 2,714,000 PdEq ounces in Inferred classification (see May 8th, 2018 press release). NAM is currently conducting Phase 4 of their proposed 2018 exploration and development program. The current program is based on recommendations of previous geophysical studies and reviews by the company’s consultants, recent drilling, ongoing advanced metallurgical and minerology studies and selective pit design drill programs. The results of Phase 4 will assist in early PEA work being conducted by P&E Mining Consultants Inc and DRA Americas Inc and is meant to contribute towards the River Valley PEA. Mr. Michael Neumann, P.Eng., a veteran mining engineer and one of NAM’s directors, will oversee the completion of the PEA.

On April 4th, 2018, NAM signed an agreement with one of Alaska’s top geological consulting companies. The companies stated objective is to acquire additional PGM and Rare Metal projects in Alaska. On April 18th, 2018, NAM announced the right to purchase 100% of the Genesis PGM Project, NAM’s first Alaskan PGM acquisition related to the April 4th agreement. The Genesis PGM Project is a road accessible, under explored, highly prospective, multi-prospect drill ready Palladium (Pd)- Platinum (Pt)- Nickel (Ni)- Copper (Cu) property. A comprehensive report on previous exploration and future phases of work was completed in August 2018 on Genesis. This report was completed by Avalon Development of Fairbanks Alaska.

On August 29 the Avalon report was submitted to NAM, management is actively seeking an option/joint-venture partner for this road accessible PGM and Multiple Element Project using the Prospector Generator business model. For a copy of the Avalon report please contact Cody Hunt, Business Development ([email protected]) or by phone at 613-659-2773. A standard confidentiality agreement will be forwarded to the interested party and the report will be made available.

The results of the new Mineral Resource Estimate for NAM’s flagship River Valley PGM Project are tabulated in Table 1 below (0.4 g/t PdEq cut-off).

| Class | Tonnes

‘,000 |

Pd (g/t) | Pt (g/t) | Rh (g/t) | Au (g/t) | Cu (%) | Ni (%) | Co (%) | PdEq (g/t) |

| Measured | 62,877.5 | 0.49 | 0.19 | 0.02 | 0.03 | 0.05 | 0.01 | 0.002 | 0.99 |

| Indicated | 97,855.2 | 0.40 | 0.16 | 0.02 | 0.03 | 0.05 | 0.01 | 0.002 | 0.83 |

| Meas +Ind | 160,732.7 | 0.44 | 0.17 | 0.02 | 0.03 | 0.05 | 0.01 | 0.002 | 0.90 |

| Inferred | 127,662.0 | 0.27 | 0.12 | 0.01 | 0.02 | 0.05 | 0.02 | 0.002 | 0.66 |

| Class | PGM + Au (oz) | PdEq (oz) | PtEq (oz) | AuEq (oz) |

| Measured | 1,440,200 | 1,999,600 | 1,999,600 | 1,136,900 |

| Indicated | 1,856,900 | 2,626,700 | 2,626,700 | 1,463,800 |

| Meas +Ind | 3,297,200 | 4,626,300 | 4,626,300 | 2,600,700 |

| Inferred | 1,578,400 | 2,713,900 | 2,713,900 | 1,323,800 |

Notes:

- A.CIM definition standards were followed for the resource estimation.

- B.The 2018 Mineral Resource models used Ordinary Kriging grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids.

- C.A base cut-off grade of 0.4 g/t PdEq was used for reporting Mineral Resources.

- D.Palladium Equivalent (PdEq) calculated using (US$): $1,000/oz Pd, $1,000/oz Pt, $1,350/oz Au, $1750/oz Rh, $3.20/lb Cu, $5.50/lb Ni, $36/lb Co.

- E.Numbers may not add exactly due to rounding.

- F.Mineral Resources that are not Mineral Reserves do not have economic viability

- G. The Inferred Mineral Resource in this estimate has a lower level of confidence that that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

QUALIFIED PERSON

The contents contained herein that relate to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Curt Freeman, P.Geo., of Avalon Development Corp, a consulting geoscientist for New Age Metals. Mr. Freeman is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

ADDITIONAL INFORMATION

Should you have additional inquiries, please contact Anthony Ghitter, Business Development, Tel: 1-613-659-2773, email: [email protected] and/or Cody Hunt Business Development, email: [email protected] .

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.