Posts Tagged ‘#mining’

INTERVIEW: HPQ Silicon Resources $HPQ.ca Discusses Final Gen 1 PUREVAP Purity Enhancement Test, Findings Validate Concept

Monarques Gold $MQR.ca files a technical report for its Wasamac #Gold project

HPQ Silicon Resources $HPQ.ca Final Gen 1 PUREVAP(TM) Purity Enhancement Test Identifies Pathways To Producing Solar Grade Silicon Metal with the Gen 2

FEATURE: American Creek $AMK.ca JV Drill Program is Well on Its Way to Defining a #Gold Resource #Tudor Gold $TUD.ca #SeabridgeGold $SA $SEA.ca

RECENT HIGHLIGHTS

- Encountered numerous high grade gold/silver intercepts in preliminary drilling at the new HC zone at the Treaty Creek Project Read More

- Additional gold discovery of 5.1m of 9.57 g/t gold from 249.35m to 254.45m Read More

- Discovered a New Gold Zone at Treaty Creek: 110 M of 0.909 g/t Gold, Upper 316 M of Hole Yet to Be Assayed

- Specimens from the Electrum property average 27,092 gm/tonne silver and 248 gm/tonne gold. Read More

- Completed the previously announced Magnetotelluric survey and has commenced drilling Read More

- Hole CB-16-03 returned 0.526 g/t gold over 629.7 meters

- Included within this wide 629.7 meter interval is 338 meters of 0.70 g/t gold

- Also included 54 meters (from 88 to 142 meters) of 1.117 g/t gold and 122 meters of 0.965 g/t gold

- Reports that drill program is well on its way to defining a Gold Resource

View Presentation

T3 Becomes 2nd New Footwall #Discovery and Drilling Continues to Intersect #PGM from the Pine Zone at the River Valley Platinum Group Metals Project $NAM.ca #Platinum #Palladium

- Drilling continues to encounter PGM mineralization in the Pine Zone of the River Valley PGM Deposit

- Borehole PL-17-06 intersects 22m of 1.51.g/t Pd+Pt+Au, including 10m at 2.58 g/t, and 3m of 3.95 g/t.

- T3 becomes 2nd footwall discovery with T4 to T9 earmarked for future footwall exploration (Figure 2)

- Updated NI 43-101 to commence upon the announcement of final assays

- River Valley is the Largest Undeveloped Primary PGM resource in Canada, with 3.9Moz PdEq in Measured Plus Indicated including an additional 1.2Moz PdEq in Inferred.

October 31st, 2017 Vancouver, Canada – New Age Metals Inc. (TSX.V: NAM; OTCQB: PAWEF; FSE: P7J.F) is pleased to announce the second batch of drill hole results from the 2017 drilling campaign. Drilling was focused on the T3 Zone and Pine Zone as a follow up of the 2015 and 2016 drilling at the River Valley PGM Deposit. The drill program is now complete and the company is waiting for the last batch of assays.

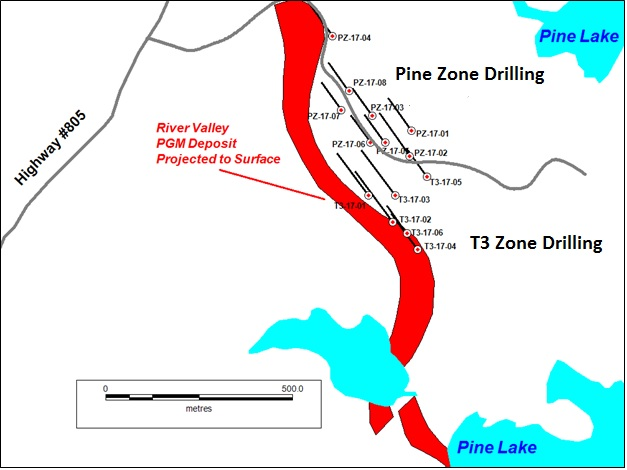

Harry Barry, Chairman/CEO states. “The purpose of the 2017 summer/fall exploration program was to focus on the footwall mineralization and recent IP geophysical targets from the Pine Zone to T3 (figure 1). The footwall mineralization is a new model as opposed to the historical contact mineralization model where the bulk of the resource had been identified, giving us further confidence that the project can be developed into an open pit mining operation”.

T3 Target Becomes 2nd Footwall Discovery

To date, 4 holes have been drilled in the T3 area which is approximately 1000m South from the top of the Pine Zone discovery. All 4 holes in the T3 area hit significant mineralization with borehole T3-17-04 (News Release September 20th, 2017) resulted in 28m of 2.45 g/t Pd+Pt+Au at 4m below surface, including 3m of 7.12 g/t. Within the same hole, mineralization was also intersected at 24m below surface with an additional 6m of 4.06 g/t Pd+Pt+Au, and at 37m below surface with another zone of 4m at 3.30 g/t.

Upon completion of this program, further holes will be delineated for additional drilling on the T3 discovery as the results are reviewed. The new exploration model of footwall mineralization has yet to be tested further south of T3, between T3 and T9 (figure 1), and these targets equate to a small portion of the 16km of strike length of the main zone. Drilling of the T3 continues to show PGM (Pd+Pt+Au) mineralization in the footwall of the main River Valley PGM Deposit and therefore increasing the amount of known PGM mineralization in this new area.

Pine Zone

The Pine Zone was the first of numerous newly discovered PGM zones within the district-scale River Valley PGM Project. The Pine Zone is located east of the main River Valley Deposit in an area previously not known for mineralization. The 2016 drill program (figure 2) confirmed the higher-grade, near-surface PGM discovery made in the 2015 drill program (figure 2) and highlighted the continuity of the PGM mineralization into the footwall. The Pine Zone remains open along strike and at depth.

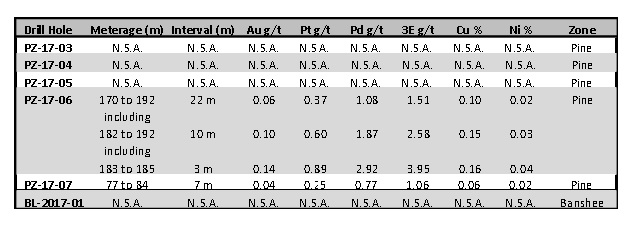

Figure 1: Drill Hole Distribution Map

Table 1: Drill Results from Banshee and Pine Zone

(3E = Au+Pt+Pd, N.S.A. = no significant assays)

Figure 2: T3 Zone and Pine Zone Drill Map

Assay Procedures and QAQC

The drilling was undertaken by Jacob & Samuel Drilling Ltd. of Sudbury, Ontario under the supervision of a NAM geologist. The drill core samples were sent to the SGS Canada Inc. Laboratory in Lakefield, Ontario for sample preparation and assay analyses. The preparation involved crushing of 3kg of each sample to 90% passing 2mm, and then pulverizing 0.5kg to 85% passing 75um. Palladium, Platinum and Gold were assayed by fire assay with ICP-AES finish (GE-FAI313). Copper, Nickel and 32 additional metals were assayed by two acid digestion and ICP-OES finish (GE-ICP14B). Blanks and blind certified standard samples were submitted at regular intervals for assay with the core samples as part of NAM’s quality control program.

Future Activity

WSP Canada (News Release: Sept 7th, 2017) will be conducting the updated resource calculation and model for the River Valley PGM Deposit. This will incorporate the new findings and interpretations. The company plans to initialize a Preliminary Economic Assessment (PEA) Report in the future with WSP Canada. In-house recommendations will be compiled to delineate future work upon completion of the 2017 field program with future work on Pine Zone, T3, and new un-explored footwall targets.

To date an approximate 140,659m (461,480ft) in 628 holes have been conducted by the company and its past major joint venture partners to test the PGM mineralization of the River Valley PGM Deposit. Several 43-101 compliant resource estimates have previously been generated for the deposit through the development phases. The River Valley Deposit present resource, with approximately 3.9 PdEq ounces in Measured Plus Indicated mineral resources and near-surface mineralization covers over 16km of continuous strike length.

The Company will continue to update investors as the drill results are received.

ABOUT NAM’S PGM DIVISION

NAM’s flagship project is its 100% owned River Valley PGM Project (NAM Website – River Valley Project) in the Sudbury Mining District of Northern Ontario (100 km east of Sudbury, Ontario). Presently the River Valley Project is Canada’s largest primary undeveloped PGM deposit with Measured + Indicated resources of 91 million tonnes @ 0.58 g/t Palladium, 0.22 g/t Platinum, 0.04 g/t Gold, at a cut-off grade of 0.8 g/t PdEq for 2,463,000 ounces PGM plus Gold. This equates to 3,942,910 PdEq ounces. The River Valley PGM-Copper-Nickel Sulphide mineralized zones remains open to expansion. The company has recently completed a drill program on the Pine and T3 Zones.

In 2016, the Company acquired the River Valley extension property from Mustang Minerals which added approximately 4 kilometres to the project’s mineralized strike length to the southern portion of the intrusion.

ABOUT NAM’S LITHIUM DIVISION

The Company has five pegmatite hosted Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba. Three of the projects are drill ready. This Pegmatite Field hosts the world class Tanco Pegmatite that has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium ore minerals) in varying capacities, since 1969. NAM’s Lithium Projects are strategically situated in this prolific Pegmatite Field. Presently, NAM is the largest mineral claim holder in the Winnipeg River Pegmatite Field and is seeking JV partners to further develop the company’s Li division.

QUALIFIED PERSON

The contents contained herein that relate to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Carey Galeschuk, a consulting geoscientist for New Age Metals. Mr. Galeschuk is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

INTERVIEW: Sheldon Inwentash. ThreeD Capital $IDK.ca Puts Focus on #Blockchain Themed Technologies $HIVE.ca $BLOC.ca $CODE.ca

Monarques Gold $MQR.ca reports 2.6 million ounces in measured and indicated resources on the Wasamac #Gold project

- An updated mineral resource estimate on the Wasamac gold project indicates a Measured and Indicated resource of 2,587,900 ounces and an Inferred resource of 293,900 ounces, as the bulk of the previous Inferred resource has been upgraded to the Indicated category.

- Drilling to date shows that the Main Zone is open to the east and at depth. Zones 2 and 3 are also open at depth.

- Monarques Gold will plan an exploration program aimed at increasing the Wasamac resource.

MONTREAL, Oct. 26, 2017 – MONARQUES GOLD CORPORATION (“Monarques” or the “Corporation”) (TSX.V: MQR) (FRANKFURT: MR7) is pleased to report the results of an updated mineral resource estimate for its wholly-owned Wasamac gold project located 15 km west-southwest of Rouyn-Noranda, Québec. The estimate was prepared by Tudorel Ciuculescu, M.Sc., P. Geo., Senior Geologist for Roscoe Postle Associates Inc. (RPA) and a qualified person as defined by NI 43-101. The effective date of the estimate is October 20, 2017.

“The outcome of the estimate is great news for Monarques, as the bulk of the previous Inferred resource has been upgraded to the Indicated category based on infill drilling,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarques. “This is also an important step towards our goal of advancing the development of our Wasamac gold project. With our latest acquisition, which includes the Beaufor mine and the Camflo mill, we have become a fully integrated gold producer and now have the team and the resources to reach this goal. The Wasamac gold project is an important part of the future of Monarques and we intend to bring it to its full potential.”

Based on a cut-off grade of 1.0 g/t Au, RPA estimated a resource of 3.99 million tonnes at an average grade of 2.52 g/t Au for 323,300 ounces in the Measured category, and 25.87 million tonnes at an average grade of 2.72 g/t Au for 2,264,500 ounces in the Indicated category. An additional 4.16 million tonnes grading an average grade of 2.20 g/t Au for 293,900 ounces were estimated in the Inferred category. The cut-off grade is based on a gold price of US $1,500 per ounce and assumed operation costs.

The database includes 3,317 holes drilled for various purposes on the property and surrounding area from the 1940s to 2012. Of these, 2,016 holes were used for the resource estimate. The resource holes consist of 288 surface holes with a total length of 122,781 m and 24,613 samples (24,401 m sampled) and 1,728 underground holes with a total length of 36,842 m and 24,018 samples (32,148 m sampled).

Notes:

- CIM definitions for mineral resources were used.

- Mineral resources were estimated at a cut-off grade of 1.0 g/t Au.

- Mineral resources were estimated using a gold price of US$ 1,500 per ounce and an exchange rate of US $0.80 = C $1.00.

- A minimum mining width of four metres was used.

- A bulk density of 2.8 g/cm³ was used.

- Numbers may not add due to rounding.

Gold mineralization is hosted in a number of zones located along the Wasa Shear Zone (WSZ), namely, from west to east, the Main Zone, Zone 1, Zone 2, Zone 3, the MacWin Zone and Zone 4 (see map). The Wildcat Zone occurs off the WSZ to the south of the Main Zone. Historical production from 1965 to 1971 was predominantly from the Main Zone and the upper portion of Zone 1, with a limited tonnage extracted from the Wildcat Zone. Zone 2 was partially developed but was not mined. A total of 252,923 ounces of gold were produced at Wasamac.

The estimate was supported by a block model and was constrained with mineralized wireframes capturing mineralized intercepts with a nominal grade of 1.0 g/t Au over a minimum thickness of four metres. Erratic higher-grade samples were capped at 35 g/t Au prior to compositing to two metre intervals. Block gold grade was estimated using an inverse-distance-to-the-power-three (ID3) interpolation method.

The new mineral resource estimate reflects a number of changes, including additional drilling, the exclusion of mineralization previously considered as resources, the addition of new resources, a lower cut-off grade, and the upgrading of Inferred mineral resources to the Indicated category.

The Wasamac property is near a major mining centre in a mining-friendly jurisdiction and benefits from significant infrastructure, including underground openings that could be redeveloped, road access, access to the provincial power grid, and a restored tailings disposal area.

RPA is of the opinion that the Wasamac property hosts a significant gold deposit and that the project has good exploration potential that warrants additional exploration and technical studies.

The 43-101 technical report will be delivered and filed on SEDAR within the next 45 days.

Recommended work program

Phase I:

- Exploration potential study to determine the minimum grade, thickness, and tonnage for new targets

- Drill hole targeting exercise to optimize future drilling programs, with the objective of upgrading areas of Inferred resource to the Indicated category and extending the mineral resource to areas that remain open

- Investigation into the Horne Creek Fault and its potential control on the Wasamac deposit

- Testing of advanced 3D modelling techniques based on the current database

- GIS database compilation of all available and relevant data

Phase II:

- Contingent on the results of Phase I: 20,000-metre diamond drilling program focused on bringing the mineral resource estimate to the point where it could support the preparation of a preliminary economic assessment.

The technical and scientific content of this press release has been reviewed and approved by Marc-André Lavergne, Eng., the Corporation’s qualified person under National Instrument 43‑101, and by Tudorel Ciuculescu, M.Sc., P. Geo., Senior Geologist for Roscoe Postle Associates Inc. (RPA) and a qualified person as defined by NI 43-101.

ABOUT MONARQUES GOLD CORPORATION

Monarques Gold Corp (TSX-V: MQR) is an emerging gold producer focused on pursuing growth through its large portfolio of high-quality projects in the Abitibi mining camp in Quebec, Canada. The Corporation currently owns more than 240 km² of gold properties (see map), including the Beaufor Mine, the Croinor Gold (see video) and Wasamac advanced projects, and the Camflo and Beacon mills, as well as six promising exploration projects. It also offers custom milling services out of its 1,200 tonne-per-day Camflo mill. Monarques enjoys a strong financial position and has more than 150 skilled employees who oversee its operating, development and exploration activities.

Forward-Looking Statements

The forward-looking statements in this press release involve known and unknown risks, uncertainties and other factors that may cause Monarques’ actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.