- Company has completed nine holes

- Testing the major structure, below the historical underground workingsÂ

- Can play host to high-grade silver mineralization

Toronto, Ontario–(August 1, 2017) – Northern Sphere Mining Corp. (CSE: NSM)Â (“Northern Sphere” or the “Company”) is pleased to provide an update on it’s ongoing diamond drill program at it’s patented Buckeye Property, located adjacent to Freeport McMoran-BHP’s open pit copper project in Miami, Arizona.

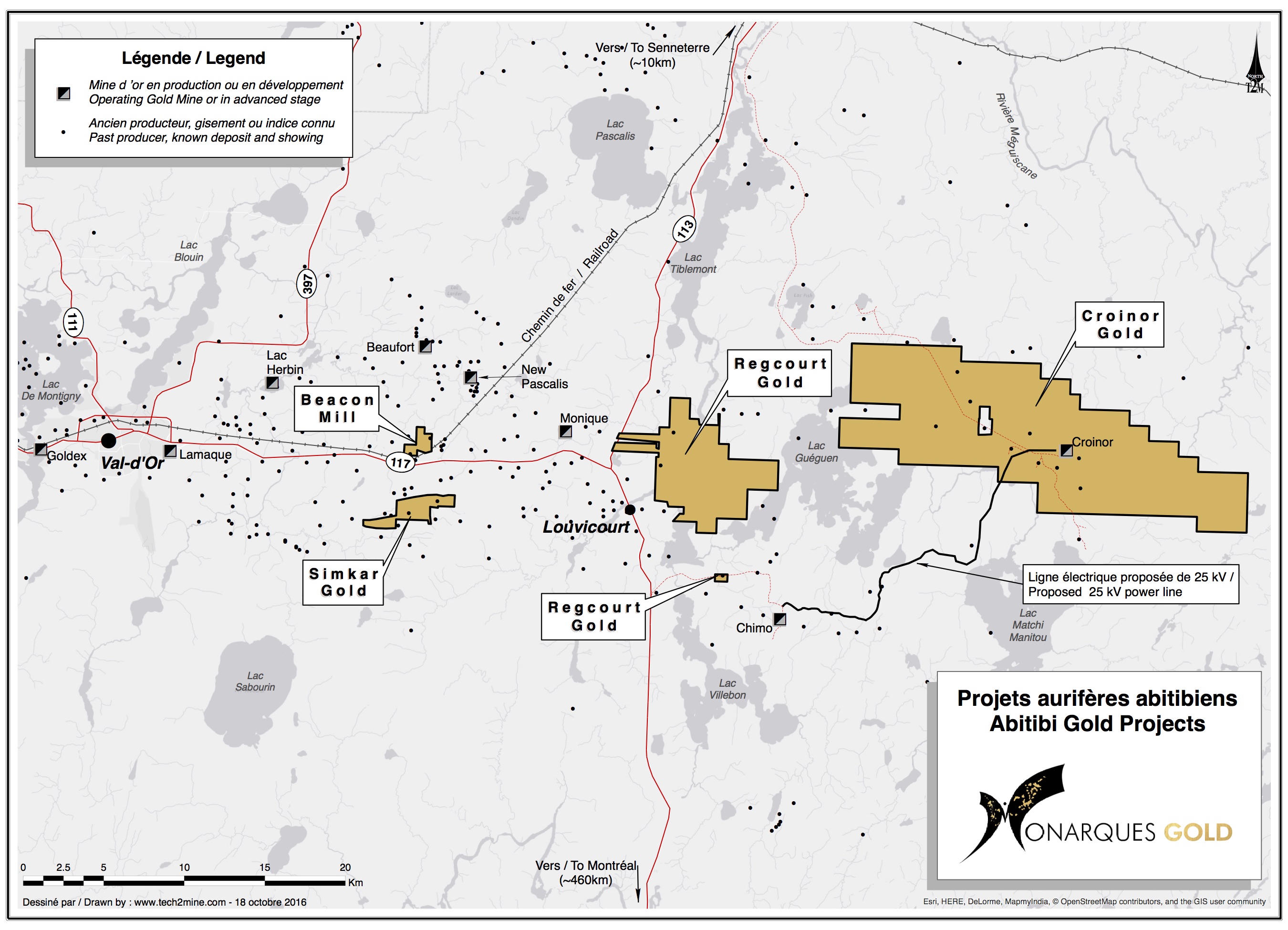

Cannot view this image? Please visit http://orders.newsfilecorp.com/files/2104/28245_a1501585782894_51.jpg to view this image

Satellite Image of Northern Sphere Mining’s Arizona Option Claims

The Company has completed nine (9) holes, testing the major structure, below the historical underground workings that can play host to high-grade silver mineralization.

The drilling intersected the host structure on all 9 holes, all exhibiting pervasive alteration and mineralization. The Company has moved forward and is expanding the program. Additional holes will target areas below the surface sampling completed in February 2017 where systematic rock-chip channel samples taken perpendicular to the strike of the mineralized structure, yielded silver grades of 38.2 ounces per tonne (opt) over 0.8 ft, 12.2 opt over 3.0 ft, and 4.0 opt over 5.0 ft. The mineralization is on strike with the historic Buckeye Structure, which had grab samples selectively taken within the mineralized structure (and may not be representative of the entire mineralization), yielding assays of 227.4 opt, 22.7 opt and 88.7 opt. These samples were collected where the central portal re-accessed the historical working at the bottom of the decline. Laboratory analysis for the first (9) nine holes are expected to be completed during the month of August.

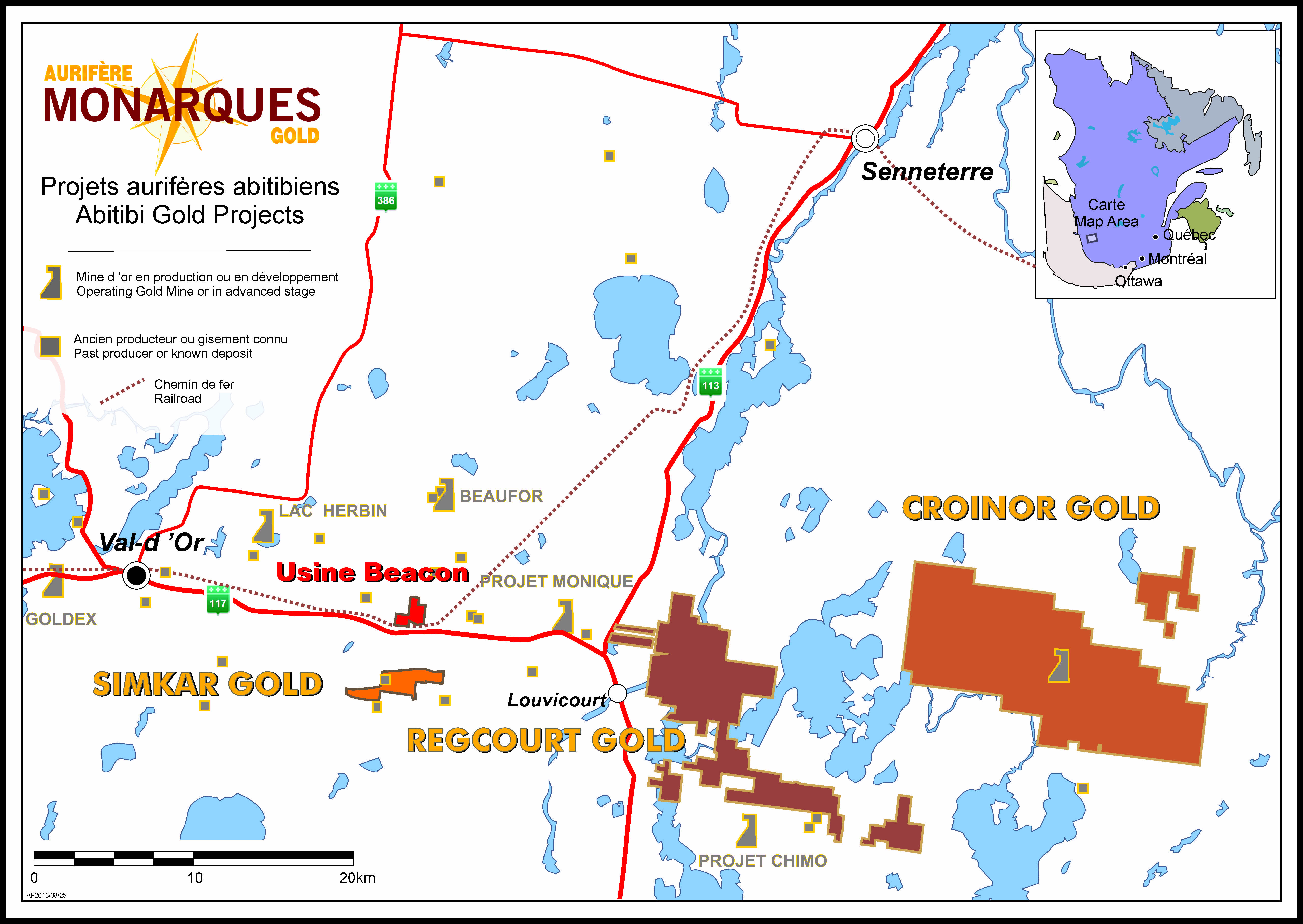

Cannot view this image? Please visit http://orders.newsfilecorp.com/files/2104/28245_a1501585783003_49.jpg to view this image

Godbe Drilling LLC at Buckeye Property

It is important to note the Buckeye Patent covers less than 1% of Northern Sphere’s Arizona land package. NSM’s Black Diamond Property, contiguous with the Buckeye Property, has multiple prospects, including historic underground silver mines such as the McMorris-La Plata Mine, Jumbo Mine and Silver Sevens Mine. In addition to the historic underground silver mines, large scale, near surface, silver-gold prospects exist in the vicinity and are part of an ongoing large scale geochemical sampling program which began in June 2017.

Northern Sphere is currently reviewing a prospective surficial copper-iron-gold prospect known as the Iron Nugget. The prospect, located on the Black Diamond Claims was mapped and sampled last in 2011 by Trueclaim Resources, when chip samples taken from surficial exposures returned copper values between 2.3% and 7.4% copper.

Quality Control

Northern Sphere’s quality control and assurance program includes the use of an independent certified lab, ALS Laboratories (“ALS”) of Tucson, Arizona. All ALS geochemical hub laboratories are accredited to ISO/IEC 17025:2005 for specific analytical procedures. The ALS quality program includes quality control steps through sample preparation and analysis, inter-laboratory test programs, and regular internal audits. It is an integral part of day-to-day activities, involves all levels of ALS staff and is monitored at seniro management levels.

Qualified Persons

Steve Gray, P.Geo., Vice President of Northern Sphere has reviewed and approved the scientific and technical information in this press release and is Northern Sphere’s “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Northern Sphere Mining Corp.

Northern Sphere Mining is dedicated to growth through the acquisition and development of mining assets, with an emphasis on near term production opportunities. Headquartered in Toronto, Ontario, Northern Sphere Mining has a strong project pipeline of properties with a focus on gold, silver and other metal production in pro-mining jurisdictions.

Cautionary Statements

This press release contains forward-looking statements which reflect Northern Sphere’s current expectations regarding future events. The forward-looking statements involve risks and uncertainties. Actual results could differ materially from those projected herein. Northern Sphere disclaims any obligation to update these forward-looking statements other than as required by applicable securities laws.

For further information, please contact:

A. John Carter

Chief Executive Officer

Northern Sphere Mining Corp.

Tel: 905-302-3843