- Hole CR-17-532 intersected 6.96 g/t Au over 15 metres

- including 17.1 g/t Au over 5.9 metres

- Drilling confirms that the shear corridor is mineralized over a width of 15 metres, to a vertical depth of at least 115 metres

MONTREAL, April 4, 2017

Drilling confirms that the shear corridor is mineralized over a width of 15 metres, to a vertical depth of at least 115 metres

MONTREAL, April 4, 2017 – MONARQUES GOLD CORPORATION (“Monarques” or the “Corporation”) (TSX-V: MQR) (FRANKFURT: MR7) is pleased to announce the results of drilling in the Gold Bug area, which lies less than 500 metres from the Croinor Gold deposit.

The 2017 drilling program on Gold Bug was aimed at testing the gold-bearing potential of the zone discovered by the Corporation in January, when Hole CR-16-521 returned an intersection of 8.41 g/t Au over 25 metres (see press release dated January 24, 2017).

Drilling has confirmed that the shear corridor contains anomalous to economic gold grades over a width of about 15 metres, to a vertical depth of at least 115 metres. Hole CR-17-532 intersected 6.96 g/t Au over 15 metres (see plan view), including 17.1 g/t Au over 5.9 metres. That intersection, as well as those from Holes CR-17-526 and CR-17-533, confirms that the shear corridor intersected near surface in Hole CR-16-521 is about 15 metres wide. In addition, Holes CR-17-527 and CR-17-528 returned 0.27 g/t Au over 8.6 metres (from 101.1 to 109.7 metres) and 0.97 g/t Au over 6.7 metres (from 158.1 to 164.8 metres), respectively, demonstrating that the shear corridor extends to a vertical depth of approximately 115 metres. The shear corridor remains open along strike and at depth.

“The results for Gold Bug show increasingly attractive economic gold potential due to the width and depth of the gold-bearing structure discovered in January,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarques. “We believe that this area could eventually add to the resource for the Croinor Gold project. A key advantage at Gold Bug is that the structure lies close to surface, and could therefore be mined more easily, at a lower cost. This area will remain a high-priority drill target, with further testing of the structure along strike and at depth.”

The following table shows the results for the 2017 drilling program on Gold Bug:

|

Hole |

From (m) |

To (m) |

Length (m) |

Au (g/t) |

|

CR-17-526 Â Â Including |

35.8 41.0 |

51.2 44.2 |

15.4 3.2 |

0.69 2.49 |

|

CR-17-527 Â Â Including |

101.1 101.1 |

109.7 104.8 |

8.6 3.7 |

0.27 0.45 |

|

CR-17-528 Â Â Including |

158.1 159.5 |

164.8 161.9 |

6.7 2.4 |

0.97 1.73 |

|

CR-17-529 |

166.3 |

168.3 |

2.0 |

0.10 |

|

CR-17-530 |

106.7 |

107.7 |

1.0 |

0.37 |

|

CR-17-531 Â Â Including |

43.9 49.3 |

49.8 49.8 |

5.9 0.5 |

0.29 2.22 |

|

CR-17-532 Â Â Including |

21.0 21.0 |

36.0 26.9 |

15.0 5.9 |

6.96 17.07 |

|

CR-17-533 Â Â Including |

43.3 46.3 |

61.9 49.5 |

18.6 3.2 |

0.63 2.04 |

The widths shown are core lengths; true width cannot be estimated. High grades were cut to 70 g/t, which is the cutoff grade used to calculate the resource estimate for the Croinor Gold deposit.

The technical and scientific content of this press release has been reviewed and approved by Donald Trudel, P.Geo., B.Sc., the Corporation’s Qualified Person under National Instrument 43-101.

Sampling normally consisted of sawing the core into two equal halves along its main axis and shipping one of the halves to the ALS Minerals laboratory in Val-d’Or for assaying. The samples are crushed, pulverized and assayed by fire assay with atomic absorption finish. Results exceeding 3.0 g/t are re-assayed using the gravity method, and samples containing gold grains are assayed using the metallic sieve method. Monarques has established a full QA/QC protocol, including the insertion of standards, blanks and duplicates.

ABOUT MONARQUES GOLD CORPORATION

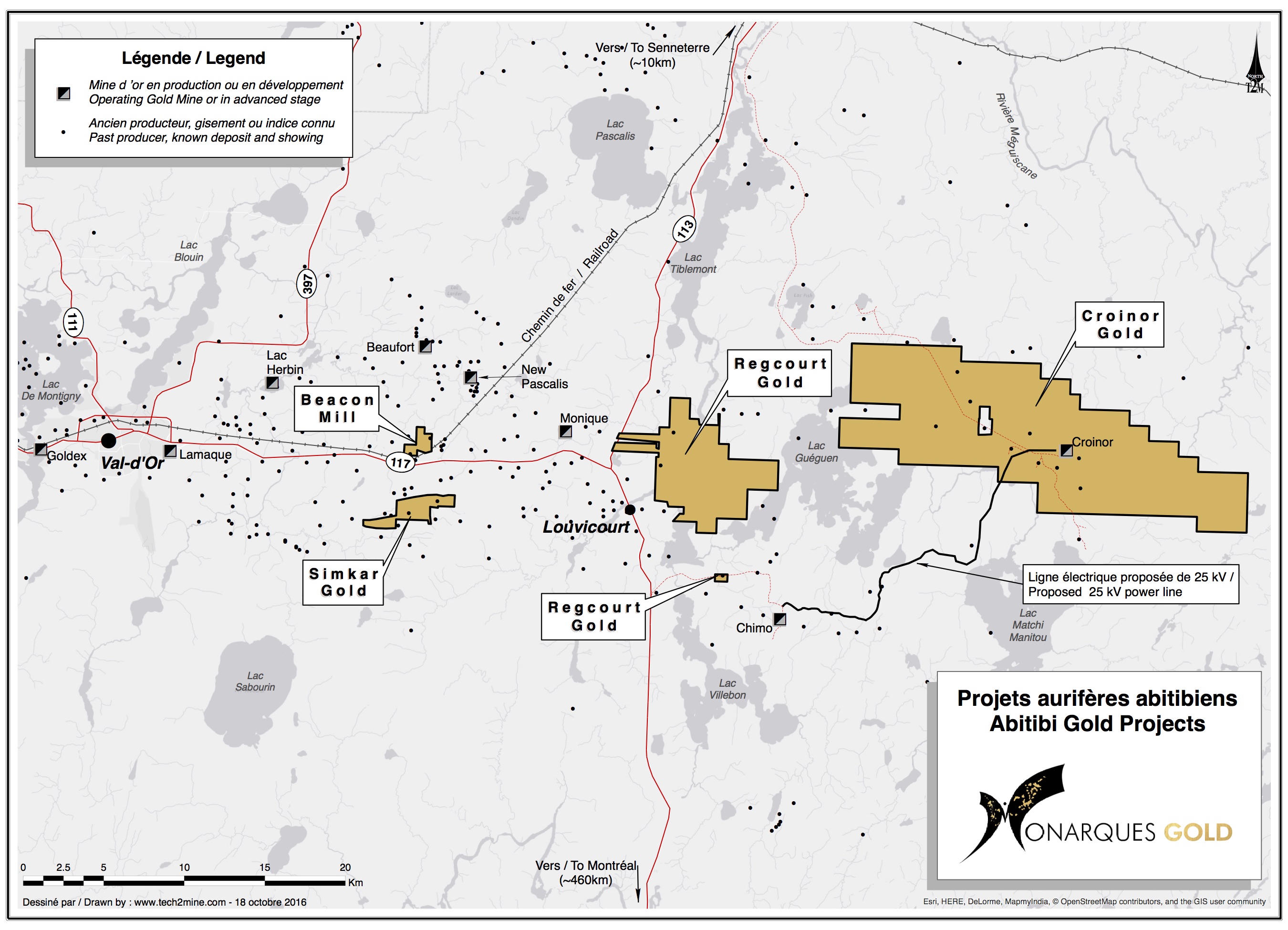

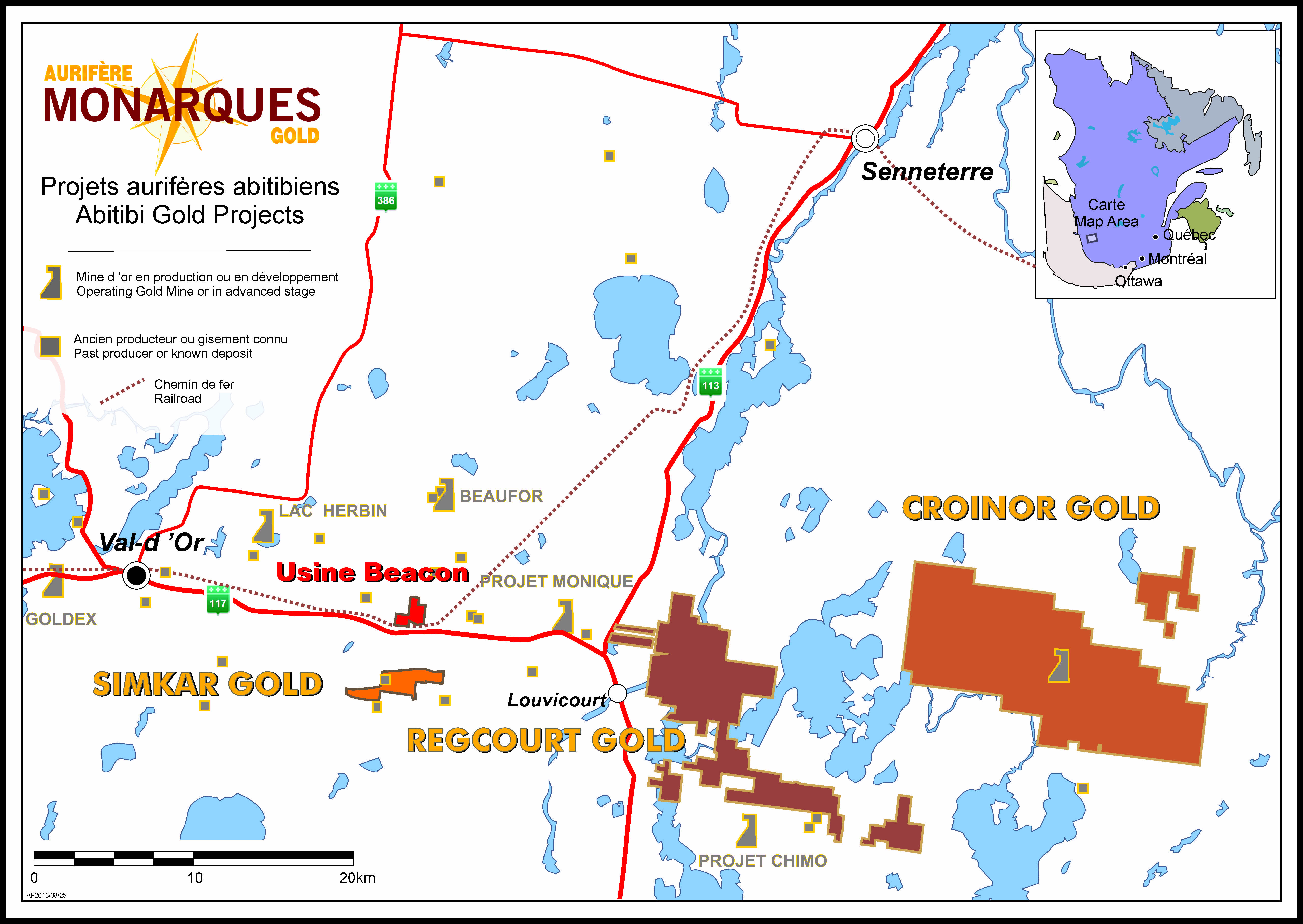

Monarques Gold is a growing junior gold company focused on becoming the leading explorer and developer of gold properties in the Val-d’Or/Abitibi gold camp in Quebec, Canada. The Corporation currently has approximately 200 km² of gold exploration properties (see map) along the Cadillac Break, as well as its main asset, the Croinor Gold mine, which has great potential to become a producing mine. Monarques Gold is well financed and has close to $9 million in credits from Quebec’s Ministry of Energy and Natural Resources.

(Watch our latest Corporate Video)

Forward-Looking Statements

The forward-looking statements in this press release involve known and unknown risks, uncertainties and other factors that may cause Monarques’ actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Neither TSX Venture Exchange nor its Regulation Services. Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

SOURCE Monarques Gold Corporation

To view the original version on PR Newswire, visit: http://www.newswire.ca/en/releases/archive/April2017/04/c5950.html

Jean-Marc Lacoste, President and CEO, 1-888-994-4465 x 201, [email protected], www.monarquesgold.comCopyright CNW Group 2017