SPONSOR: Tartisan Nickel (TN:CSE)

Kenbridge Property has a measured and indicated resource of 7.14

million tonnes at 0.62% nickel, 0.33% copper. Tartisan also has

interests in Peru, including a 20 percent equity stake in Eloro

Resources and 2 percent NSR in their La Victoria property. Click her for more information

Demand for electric vehicles bodes well for nickel

- The reason many are bullish on prices long-term is the expected demand for nickel for EVs, a key component in electric batteries.

- Right now, two-thirds of the world’s nickel is used for stainless steel production, and three per cent for batteries.

By: Darren MacDonald

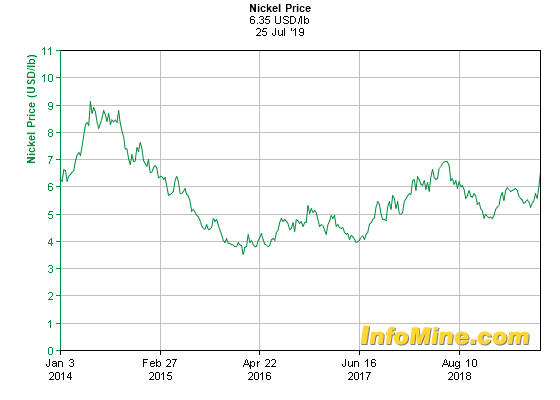

While nickel analysts expect the price of nickel to dip again despite

the impressive gains it has made in recent weeks, demand for the metal

is bright thanks to the increasing demand for electric vehicles.

Nickel was trading at US $6.40 on Monday afternoon on the London

Metals Exchange (LME), down from last week’s high of US $6.85, but still

up more than 20 per cent in the last two weeks.

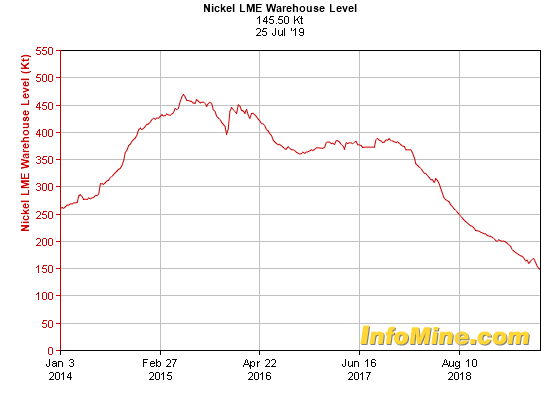

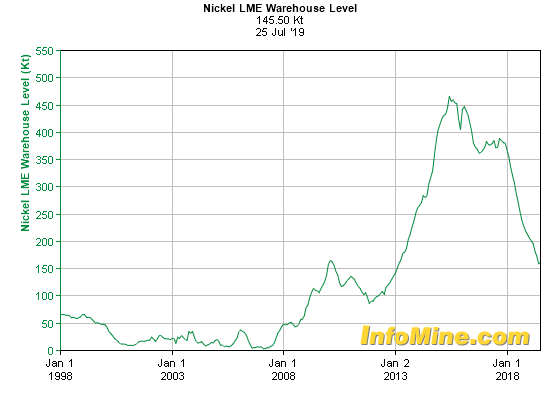

Commonwealth Bank commodities analyst Vivek Dhar told the Financial Review that

the reasons some have given for the recent surge – falling LME

stockpiles and an impending export ban in Indonesia – are not new

revelations, and are factors traders have known for a long time.

“That’s what’s got all of us scratching our heads,” Dhar

said in the article. “It’s not like LME stockpiles have just fallen in

July. They’ve been heading down for a while, so why would you see an

acceleration in price like just now?

“In terms of how sustainable is it, we’re very bullish over the long

run but in terms of the rise since the beginning of July, it’s come out

of nowhere.â€

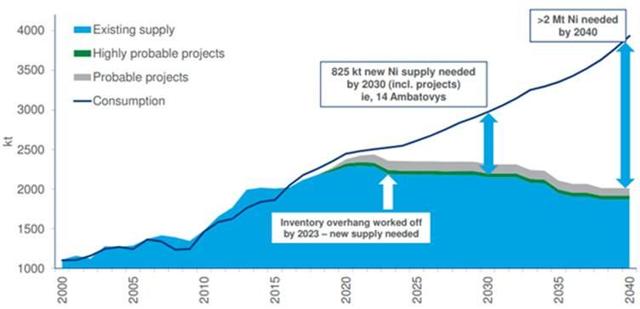

The reason many are bullish on prices long-term is the expected

demand for nickel for EVs, a key component in electric batteries. Right

now, two-thirds of the world’s nickel is used for stainless steel

production, and three per cent for batteries.

“Changes in battery technology that improve the longevity and cost

profile of batteries are likely to lift the proportion of nickel used in

batteries, which combined with significantly higher battery production,

is expected to open new opportunities for nickel producers from the 2020s onward,†says a June analysis by the Australian government.

“World consumption is forecast to increase from 2.3 million tonnes in 2018 to 2.7 million tonnes in 2021, growing at an average rate of 4.7 per cent a year.â€

Devin Arthur, president of the Electric Vehicle Society’s Greater Sudbury chapter, says car makers such as Ford and Volkswagen and Toyota are ramping up their capacity to build electric batteries, joining Tesla in the race to build fully electric cars.

“All that means is people are going to need more nickel,†Arthur said. “We have a lot of it, so it’s good for us.â€

Up until now, car makers have usually contracted out production of

batteries from companies with limited production capacity. Tesla decided

it would make its own batteries, and other car makers are following

suit.

“Volkswagen, for example, have kind of said ‘OK, we need make our own

battery factories,’†Arthur said. “We’re going to do it all in-house.

So right now we’re in this really large kind of transition period where

all these companies are investing billions of dollars in battery plants.

“Once these plants are up and running, I think you’re going to see nickel prices just shoot through the roof.”

It’s not just Arthur saying that – according to the Australian government’s analysis, there is a chance it could “boom.

“There is potential for nickel consumption to boom, as electric

vehicle battery manufacturing picks up and technological advances are

married with market developments, supportive policy and changing

consumer preferences,†the analysis said.

The evolution of the batteries is important too, Arthur said. His

Chevy Bolt can go as far as 400 kilometres between charges, depending on

the temperature and other conditions. With improvements to battery and

charging technology, longer and longer trips with shorter and shorter

recharging times are on the way.

Porsche says a high-voltage charger it has developed can recharge a EV battery in eight minutes, Arthur said.

“So a typical charge stop would probably take as long as pumping gas – if not shorter,†he said.

And software can tell a driver how much they need to charge their

car, depending on the length of the trip and the location of the next

charging station.

“A lot of the newer vehicles, you’re looking at the 500-600 kilometre

ranges on a full charge,†he said. “The technology is evolving so fast

that you’re going to see is just massive updates every time they come up

with new models. I think once Volkswagen and other major manufacturers

start actually releasing their models, I think you’ll this ‘range

anxiety’ isn’t going to be much of a problem anymore.â€

With production ramping up, and EV production expected to take off

beginning in 2021 and beyond, Arthur said groups like the Electric

Vehicle Association – which has chapters across the province – is

working to not only spread the EV message, but advocate for the charging

infrastructure to be in place to meet the demand for new EV owners. In

Sudbury, the number of EV owners has grown to about 170, up from 95 last

year, with the growth rate expected to increase as more products hit

the marketplace.

In addition to new companies developing charging stations, traditional companies such as Petro Canada have plans to build a national charging network from coast-to-coast.

“I guess even (fossil fuel companies) know that this is the future

and if they don’t get get in now, you know, they’re kind of going to be

left behind,†Arthur said. “So the future will see charging stations

everywhere the way we see gas stations today.â€

Source: https://www.sudbury.com/local-news/demand-for-electric-vehicles-bodes-well-for-nickel-and-for-greater-sudbury-1599309