- Drilling commenced on T2 Target at the north end of the River Valley PGM deposit

- Follow-up to Discovery of High-Grade, Near-Surface Mineralization at T2 in 2015

- Other similar targets Under Evaluation for Drilling in 2017

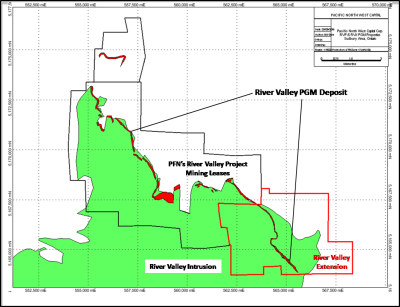

- PFN’s River Valley Project consists of a Primary Platinum Metal Deposit

- 2.5 Moz Platinum Metals in Near-Surface Measured and Indicated Resources

- Within 100 road-kms of Sudbury, with Strong Infrastructure and Community Support

- Strategic Partner sought for River Valley

- 100%-owned Lithium Division, with Exploration Projects in Manitoba and Nevada

- Summer/Fall Surface Exploration Programs in Progress

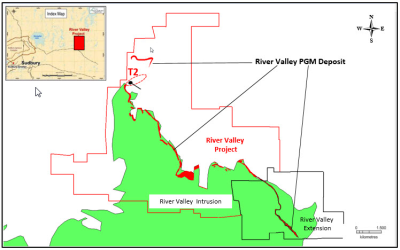

Vancouver, British Columbia / October 11, 2016 – Pacific North West Capital Corp. (“PFN” the “Company”) (TSXV: PFN OTCQB: PAWEF FSE: P7J) is very pleased to announce; Drilling Has Commenced, at their 100% owned River Valley Platinum Metals Group (PGM) Project, near Sudbury Ontario. In the next few weeks, PFN plans to complete up to 1100 metres of Diamond Drilling, on their High Grade T2 Target, in the north part of the 16 km long River Valley PGM Deposit.

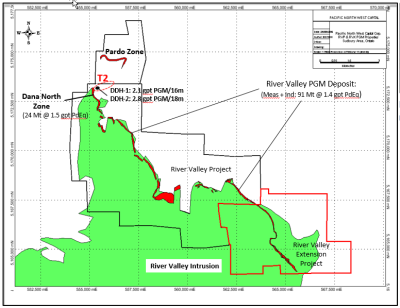

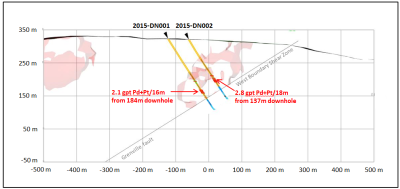

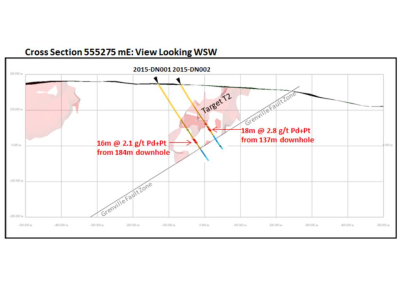

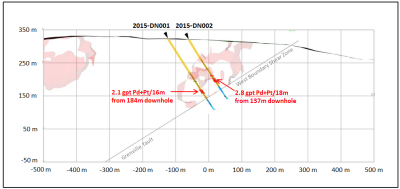

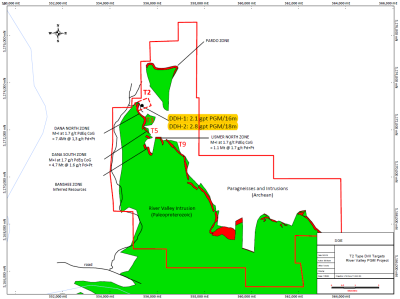

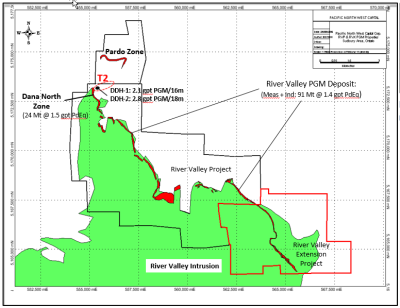

The Drilling is planned to Test Extensions of the High-Grade Mineralization, intersected in Previous Drilling, between the Dana North Zone, to the west and the Pardo Zone to the east (Figure 1). Previous Drilling intersected Thick Intervals of High-Grade Mineralization (see PFN press release: March 11, 2015) Immediately Adjacent to the Dana North Zone. The Mineralization appears to be Open to Expansion, by Drilling along the strike, for up to 2 km, between Dana North and Pardo, and the up-dip and down-dip of the previous intersections.

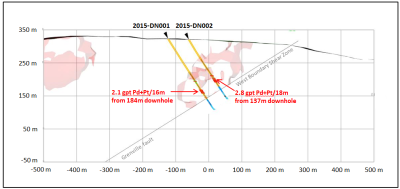

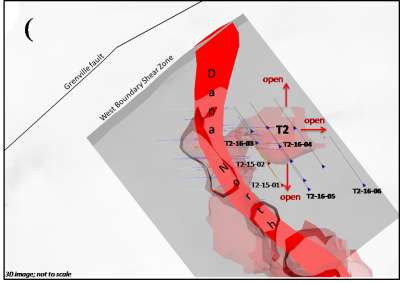

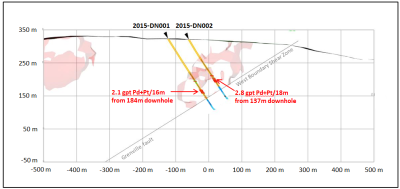

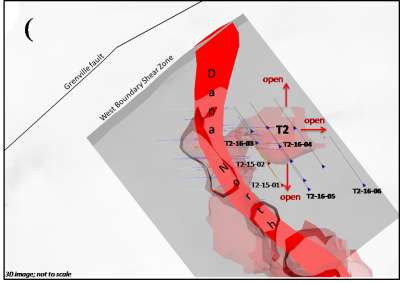

The Current Plan is to Drill 4 Holes (Figure 2). The 1st Hole will be Drilled on the same section as the previous two holes, to Expand the Mineralization up-dip, toward the surface. The 2nd and 3rd Holes will be drilled on the next section, to the east, to Expand the Mineralization, 50 metres along the strike. The 4th Hole will be drilled 200 metres along the strike, to test for the presence of Favourable Geology and High-Grade Mineralization. Pending successful Drill Results, 6 Additional Holes are planned for Drilling, at T2, in early 2017. Numerous additional T2-like targets at River Valley are also under evaluation for Drill Testing in 2017.

PFN contracted Jacob Samuel Drilling Ltd., of Sudbury, to provide a Diamond Core Drill Rig. The Drill Program is being carried out with financial support from the Junior Exploration Assistance Program (JEAP Project 16011) (see PFN press release: June 6, 2016).

“We are extremely pleased to commence our T2 Target Drill Program for 2016” said Mr. Harry Barr, Chairman & CEO of PFN. “We have been looking forward to Drilling these follow-up holes, since the Discovery of T2, in early 2015. The Presence of a New High-Grade, Near-Surface, Mineralized Zone, adjacent to the access road, could significantly impact the Development Potential of our 100% owned River Valley PGM Project”.

Click Image To View Full Size

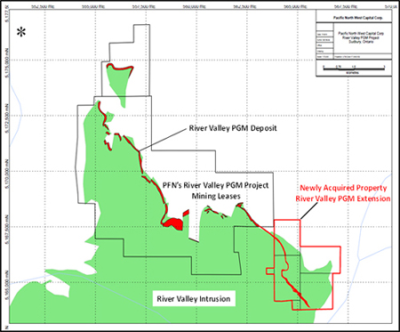

(Figure 1). Geological Map, showing the Location of the T2 Target, on PFN’s 100% owned River Valley PGM Project. The T2 Target is situated between the Dana North Zone to the west and the Pardon Zone to the east, at the north end of the River Valley Project. Note that the distance between Dana North and Pardo is approximately 2 km and vastly underexplored.

Click Image To View Full Size

(Figure 2). Plan View of 3D models of the T2 Target Feature, which is situated about 100 metres below surface, to the east of the Dana North Zone. Holes T2-16-03 to T2-16-06 will be Drilled in the Current Program. Holes T2-15-01 and T2-15-02, the Discovery Holes, were Previously Drilled in 2015.

About PFN’s Platinum Group Metals Division

River Valley is Canada’s Largest Undeveloped Primary PGM Deposit.

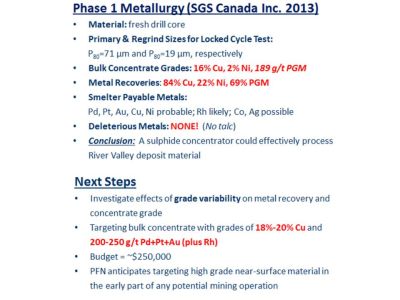

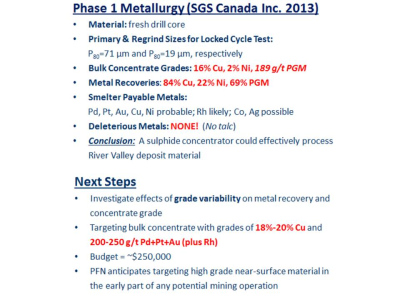

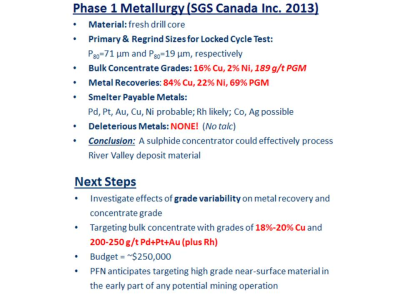

Achievements to date and Future Plans for River Valley are outlined below as follows:

-

- –PFN currently has 100% ownership in the River Valley Project, subject to a 3% NSR, with Options to Buy Down

- –Completed Exploration and Development Programs, on the River Valley Property:

- –Include more than 600 Holes Drilled, since year 2000, and several Mineral Resource Estimates and Metallurgical Studies

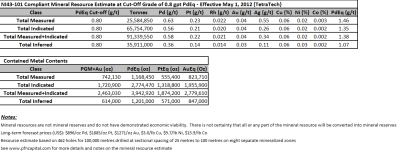

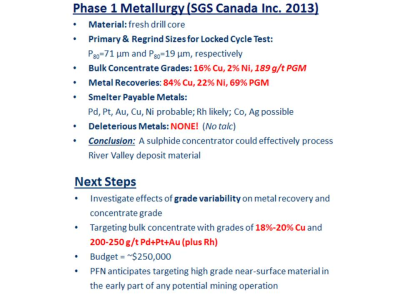

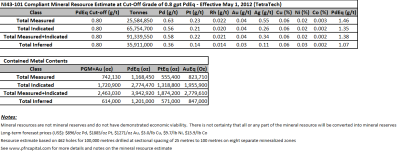

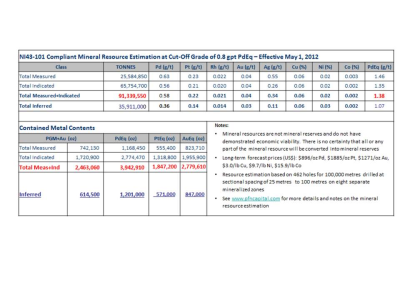

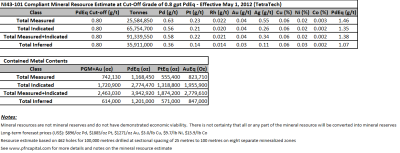

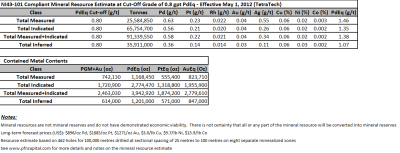

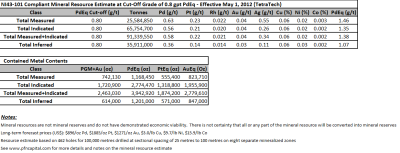

- –Results for the Current (2012) Mineral Resource Estimate are below

- –2015 Drill Program Confirms New High Grade T2 Discovery

- –Exploration and Development Plans outlined for 2016

- –Ongoing Strategic Partner Search for River Valley Project

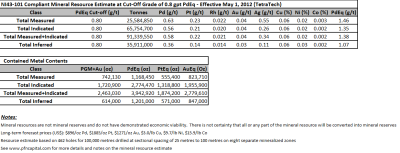

- –Results for the current Mineral Resource Estimate are summarized below:

-Prepared by Tetra Tech (Wardrop)

-High Confidence: Measured plus Indicated = 72% of total

-Reported on PdEq basis: Pd=40% & Pt=20% of the Payable Metals

-Pd to Pt Ratio = 2.5:1; Cu to Ni Ratio = 3:1

-High Grade Potential: particularly in the north part of the River Valley Deposit

-Resources under Evaluation for Development Potential as Open Pit Mining Operation

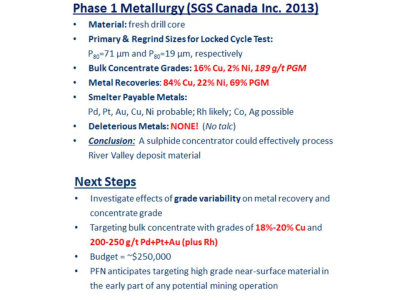

Click Image To View Full Size

Click Image To View Full Size

-

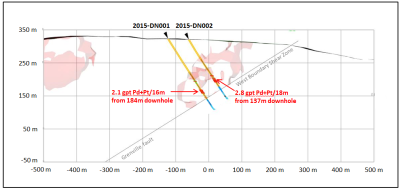

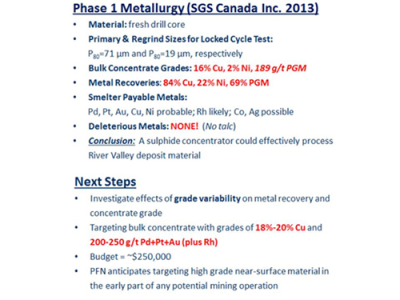

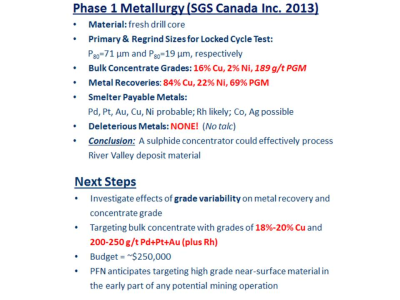

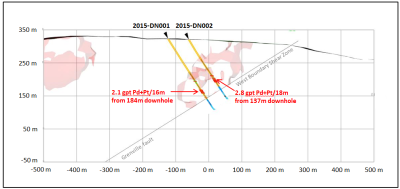

- –Results for the 2015 Discovery Drill Program on the T2 Target are as follows:

-Drill Hole intercepts Much Higher than the average grade, of the Current Mineral Resource Estimate

-Possible New Mineralized Zone at the north end of the River Valley Deposit

-Shows Potential to take the River Valley PGM Project in a New Direction

-More Drilling Planned

Click Image To View Full Size

-

- –Exploration and Development Plans for 2016

-Mineral Prospecting and Geological Mapping on Surface: In Progress

-Drill Programs targeted to add More, Higher Grade: Drilling Underway; October, 2016

-Geological Interpretation and 2D/3D Modelling of all Drill and Surface Results

-Ongoing Strategic Partner Search for River Valley

Map showing the location of River Valley PGM Project relative to the City of Sudbury.

About PFN’s Lithium Division

The Company’s Lithium Division will focus on the Discovery, Acquisition, Exploration and Development of Lithium Projects in Canada. In the United States, the Company will use its wholly owned U.S.A subsidiary to Acquire and Develop Projects, in Active Mining Camps, in Nevada, Arizona and California.

Management believes that these New Age Metals, Lithium, PGMs and Rare Earths, have robust macro trends with surging demands and limited supply. Going forward, this New Division Will Explore, for the Minerals needed to Fuel the Demand for Energy Storage and other Core 21st Century Technologies.

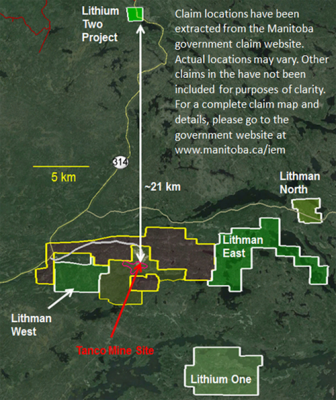

The Company has a Growing Portfolio of Lithium Projects: The Clayton Valley Forks Li Project, in Nevada, is a recent Lithium Brine Project acquired by the Company (see PFN News Releases: April 25th, 2016 and May 9th, 2016). The Company also has several Hard Rock Lithium Projects in Canada: To date the Company has Acquired 5 Hard Rock Lithium Projects, in the Winnipeg River Pegmatite Field, in SE Manitoba (see PFN News Releases: April 21st, 2016; May24th, 2016; June 15th, 2016; July 5th, 2016 and July 21st, 2016). This Pegmatite Field hosts the Giant Tanco Pegmatite Mine, which has been mined for Tantalum, Cesium and Spodumene (one of the Primary Lithium Ore Minerals) in varying capacities, since 1969. Today, the Tanco Mine is Focused on the Mining and Production of Cesium Formate, a drilling fluid for the petroleum industry. PFN’s Li Projects are strategically situated, to further Explore this Pegmatite Field. Presently, the Company is the Largest Claim Holder in the Winnipeg River Pegmatite Field.

Lithium and Platinum Group Metal Prices have improved drastically, in recent months. Lithium Supplies Remain in Deficit, Relative to their Demand. Both Metals Groups are used for the expanding worldwide automobile industry (conventional and electric). In the case of PGMs, demand is increasing for Autocatalysts, a key component for reducing toxic emissions, for automotive, gasoline and diesel engines. Regarding Lithium, there is an ever increasing demand for batteries, in cellphones, laptops, electric cars, solar storage, wireless charging and renewable energy products.

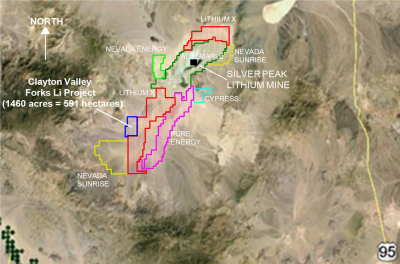

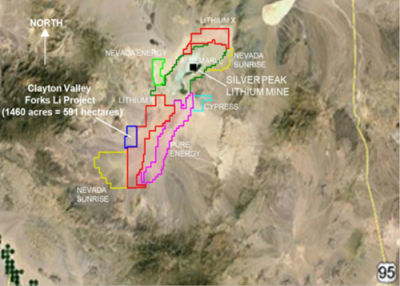

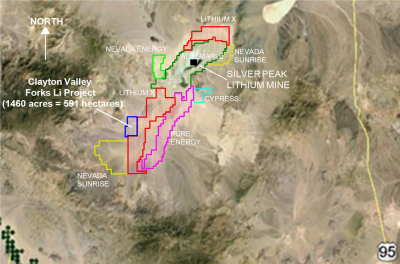

Click Image To View Full Size

PFN’s 5 New Lithium Projects in Manitoba, Surrounding Tanco Mine

Click Image To View Full Size

Figure 1: Company Claim Blocks, in the Clayton Valley Area of Nevada

(Figure 1 is a Company-made composite and not intended for redistribution. The Company accepts no responsibility for the accuracy of these claim blocks, other than the claim block associated with the Clayton Valley Forks Li Project).

Clayton Valley is located in Esmeralda County, Nevada, host to the Albemarle Corporation’s Silver Peak Lithium Mine and Brine Processing Operations. The mine has been in operation since 1967 and remains the only Brine-Based Lithium Producer in North America. The New Project Acquisition in Nevada provides the Company a Project, in an area that is well known for its Lithium Carbonate Production. Clayton Valley is a centralized location in Nevada, with Highway Access, Power Infrastructure, Water and Local Labour.

The Company’s New Lithium Brine Project will be approximately 3.5 hours away from Tesla’s Gigafactory, which has a planned annual Lithium-Ion battery production capacity of 35 gigawatt-hours per year, by 2020. The CV West Li Project is located approximately 3 hours north of the Faraday Electric Car Factory, to be operated in Las Vegas, Nevada.

Clayton Valley is one of the few locations globally, known to contain Commercial-Grade Lithium-Enriched Brines.

QUALIFIED PERSON

The contents contained herein that relates to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Dr. Bill Stone, Principal Consulting Geoscientist for Pacific Northwest Capital. Dr. Stone is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

TSXV: PFN OTCQB: PAWEF FSE: P7J

www.PFNCapital.com [email protected]

Tel: +1-604-685-1870 Toll Free: 1-800-667-1870

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.