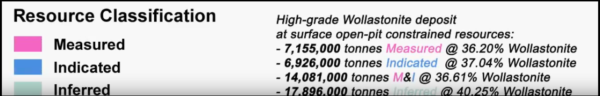

SPONSOR: Vertical Exploration is developing its St. Onge Wollastonite as a soil additive for optimizing marijuana growth. Recently engaged AGRINOVA’s Phase 1 Reseach program also demonstrated Wollastonite can potentially become BNQ certified for agricultural use in Quebec. Recently signed distribution agreement with AREV Brands International to Supply St-Onge Wollastonite to the Cannabis and Hemp Industries. Click Here for More Info.

The Imerys ore processing operation in Willsboro is closed until further notice for cleaning of asbestos that has contaminated its wollastonite products.

A representative of union workers at the plant said the plant shutdown is temporary, and a plant spokesman preferred to call it a suspension of work.

The France-based Imerys, which acquired the former NYCO Minerals mining and processing operations in 2016, learned of the problem this summer from a customer. The closure brings the latest round of job uncertainties for a mine that New York voters in 2013 agreed to support by amending the state constitution to allow an Adirondack land swap that has yet to happen.

“A third party told them about asbestos. It’s in the ore,†said Ray Bettis, a representative of the United Auto Workers, the union for about 40 workers at the processing operation in Willsboro.

He said the entire workforce was called into a meeting on Wednesday afternoon. Many were relieved that the announcement was not that the plant was closing altogether, Bettis said.

Ryan Toohey, a spokesman for the company, confirmed the contamination problem and said the company intends to reopen for business. He emphasized the plant’s difficulties are not related to the bankruptcy protection sought on Wednesday by Imerys Talc America.

The Chapter 11 bankruptcy announcement was related to lawsuits alleging that the Imerys Talc subsidiaries are liable for products that have caused ovarian cancer and asbestos-related mesothelioma.

Wollastonite is a mineral used in ceramics, paints, plastics and auto-body parts.

In Essex County, the plant closure also worried workers because of repeated statements by company officials that sales of wollastonite at Willsboro, mined by Imerys in nearby Lewis, have been weak.

The plant has been closed since its third shift on Tuesday. The workers are being paid during the closure, Bettis said, and many will return on Monday to clean the premises. They will wear masks, he said.

Tests revealed trace levels of asbestos, and only in some products, the company said, and no contamination in the plant’s air. Toohey issued a statement that said Imerys has no reason to believe the wollastonite or the products sold are unsafe for handling and use.

“Out of an abundance of caution, we are temporarily suspending production and are working to identify the earliest possible date to resume production with ore that meets our standards,†the company said. “We remain committed to producing high-quality wollastonite in Willsboro.â€

The company, which has cut staff and farmed out some work in the past few years, has 59 employees. It had employed more than 100 six years ago.

It will be throwing out tons of ore and product from the past 12 months. When workers clean the plants in Willsboro they will be wearing enhanced safety gear because of expected dusty conditions.

Mark Buckley, a former administrator at the plant who served as its safety and health director, said an asbestos contamination issue arose about 16 years ago when a customer discovered the problem. At that time, the company closed for a few days of cleaning and investigation. Workers needed to be fitted for masks for protection then. The root of the asbestos was a rock formation adjoining the ore mine, he said.

The new issue surfaced amid inspections by the U.S. Mine Safety and Health Administration, which sends inspectors into the plant at least twice a year. Already, the plant has received 33 citations for violations this year, according the MSHA web site. An MSHA spokesman was unavailable.

The plant has a long history as a major employer for mining and plant processing jobs in the Adirondack hamlets of Lewis and Willsboro, though Imerys has discontinued its mining employment and contracts the work to a Vermont excavator.

The plant also received the uncommon opportunity from New York voters to swap state forest preserve land for the rights to mine wollastonite in an area of Lewis known as Lot 8. Imerys has yet to take advantage of that opportunity, granted after heavy lobbying from the former owners who said they needed Lot 8 to preserve jobs. Voters approved a trade of 200 acres in the Jay Mountain Wilderness for lands of equal or greater value.

John Brodt, a spokesman for the Imerys mining division, said Imerys intends to continue testing the ore at Lot 8. Imerys wants to capitalize on the mining opportunity extended by voters in 2013, he said.

An application, submitted late last year, is pending before the state Department of Environmental Conservation to conduct horizontal drilling from the company’s land adjacent to Lot 8, he said. The goal is to add to previously collected test data before determining the value of Lot 8.

If the company and the state arrive at a land swap deal, the Lot 8 acquisition could happen in 2022, Brodt said.

SOURCE: https://www.adirondackexplorer.org/stories/asbestos-contamination-closes-adirondack-mine