- Provides an update on its $750,000 pilot plant program on the Company’s Separation Rapids Lithium Project

- 30 tonne bulk sample of crushed ore that was shipped this summer has arrived at its destination in Germany and process work is now underway

- Pilot plant program will be completed, and concentrate available for distribution, in Q1 2016.

Toronto, Ontario–(October 8, 2015) – Avalon Rare Metals Inc. (TSX: AVL) (NYSE MKT: AVL) (“Avalon” or the “Company”) is pleased to provide an update on its $750,000 pilot plant program on the Company’s Separation Rapids Lithium Project (“Separation Rapids Project” or “the Project”) located near Kenora, Ontario, first announced in its news release of August 17, 2015.

The 30 tonne bulk sample of crushed ore that was shipped this summer has arrived at its destination in Germany and process work is now underway. The sample will be processed using the Company’s proven flow sheet to produce a high purity lithium mineral (petalite) concentrate for the following purposes:

| 1) | to deliver further product samples to potential customers in the glass-ceramics industry who have already tested and approved smaller samples; | |

| 2) | to provide initial test samples to a number of new potential customers; and | |

| 3) | to generate concentrate for additional process development work with the objective of producing high purity lithium chemical products for the lithium ion battery manufacturing business. |

The pilot plant program will be completed, and concentrate available for distribution, in Q1 2016.

Lithium chemicals process optimization work continues at the laboratories of the Saskatchewan Research Council (“SRC”) in Saskatoon, Saskatchewan. Laboratory test work performed earlier this year at SRC provided encouraging results with a battery-grade lithium carbonate (>99.5% pure) being readily produced. Progress is being made toward the production of an enhanced grade product with a target purity of 99.9%. The potential for production of high grade lithium hydroxide was also demonstrated previously and optimization of this flowsheet is currently in progress. These programs are being conducted under the direction of David Marsh, Senior Vice-President, Metallurgy and Technology Development.

Rehabilitation work on the access road to the site initiated in September has now been completed. This road will provide ready access to the deposit for large scale bulk sampling in 2016. Several hundred tonnes of petalite concentrate is expected to be produced from this bulk sample and will be used for full-scale production trials in the glass-ceramics industry and for piloting the lithium chemical production processes.

Update on Lithium Markets

Growing demand for rechargeable batteries in electric vehicles and home energy storage is expected to result in continued growth in consumption of lithium. Critical materials consulting firm Stormcrow Capital estimates that demand could reach 410,000 tonnes of lithium carbonate equivalent per year in 2025, compared to 200,000 tonnes in 2015. This translates into a compounded annual growth rate of a 7.8%. In their May 2015 Industry Report, Stormcrow further predicts that a supply deficit will emerge in the market as existing producers struggle to meet the rapidly growing demand.

This sentiment was echoed at The Battery Show in Novi, Michigan September 15-17, attended by Vice-President, Sales and Marketing, Pierre Neatby, where some 5,000 industry participants gathered to discuss the current and future state of rechargeable batteries. The consensus was that lithium ion battery demand would grow significantly over the next decade in electric and hybrid vehicles and energy storage applications.

On September 24, Avalon was one of the sponsors of the Benchmark Mineral Intelligence (“Benchmark”) Lithium Ion Battery supply chain conference in Toronto. The conference provided excellent perspective on the rechargeable battery market and its main raw material needs: lithium, graphite and cobalt. Guy Bourassa, President and CEO of Nemaska Lithium Inc., one of the most advanced lithium chemicals projects in Canada, noted that “the market will need some 100,000 tonnes of new lithium chemicals supply to come into the market to over the next 5 years to meet the growing demand”. Industry panel participants, which included Avalon President & CEO Don Bubar, agreed that this rate of demand growth will require multiple new producers in order to keep the market in balance.

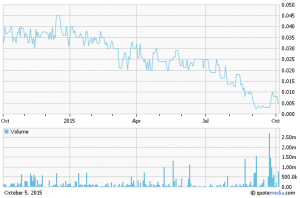

The chart below presented by Benchmark shows the increasing trend of battery grade lithium carbonate prices (US$/tonne) over the past 10 years reflecting the growing supply demand imbalance:

Lithium Carbonate Price Trend

To view an enhanced version of this image, please visit:

https://orders.newsfilecorp.com/files/3386/17578_chart-enlarged.jpg

Don Bubar, President and CEO of Avalon Rare Metals Inc. commented, “We are excited about all the new interest in the lithium sector. The rapid advance in lithium ion battery technology is creating new business opportunities for the Separation Rapids Project that were unimaginable in 1996 when Avalon first began work on the Project. Avalon is now uniquely positioned to be a long term supplier of both high purity lithium minerals to the glass ceramics market and lithium chemicals to the rapidly growing lithium ion rechargeable battery market.”

The technical information included in this news release has been reviewed and approved by the Company’s Senior Vice President Metallurgy and Technology Development, Mr. David Marsh, FAusIMM (CP), who is a Qualified Person under NI 43-101.

For questions or feedback, please email the Company at [email protected], or phone Don Bubar, President & CEO, at 416-364-4938.

Cautionary Statement

This news release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements regarding the commencement and completion of its work programs, that that the sample will be processed to produce a high purity lithium mineral, that the pilot plant program will be completed, and concentrate available for distribution, in Q1 2016, that the road will provide ready access to the deposit for large scale bulk sampling in 2016, that several hundred tonnes of petalite concentrate is expected to be produced from this bulk sample and will be used for full-scale production trials in the glass-ceramics industry and for piloting the lithium chemical production processes, that growing demand for rechargeable batteries in electric vehicles and home energy storage is expected to result in continued growth in consumption of lithium and that Avalon is now uniquely positioned to be a long term supplier of both high purity lithium minerals to the glass ceramics market and lithium chemicals to the rapidly growing lithium ion rechargeable battery market. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “potential”, “scheduled”, “anticipates”, “continues”, “expects” or “does not expect”, “is expected”, “scheduled”, “targeted”, “planned”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be” or “will not be” taken, reached or result, “will occur” or “be achieved”. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Avalon to be materially different from those expressed or implied by such forward-looking statements. Forward-looking statements are based on assumptions management believes to be reasonable at the time such statements are made. Although Avalon has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking statements include, but are not limited to market conditions, the possibility of cost overruns or unanticipated costs and expenses, and unanticipated results from the work programs, as well as those risk factors set out in the Company’s current Annual Information Form, Management’s Discussion and Analysis and other disclosure documents available under the Company’s profile at www.SEDAR.com. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Such forward-looking statements have been provided for the purpose of assisting investors in understanding the Company’s plans and objectives and may not be appropriate for other purposes. Accordingly, readers should not place undue reliance on forward-looking statements. Avalon does not undertake to update any forward-looking statements that are contained herein, except in accordance with applicable securities laws.