- Entered into a definitive long-term license agreement to develop and mine its three metallic concessions located at Ocampo, Coahuila, Mexico

- Inferred resource tonnage: 3M mt at 3.17 g/t gold and 57.3 g/t silver

- Inferred resource ounces: 306K oz gold and 5.5 M oz silver

- Open-pit mining with truck access to highway

- Most entitlements are in place including the environmental permit.

View Release / Corporate Profile / Hub On AGORACOM

———-

Santo Mining Corp to Start Producing Gold & Silver

SANTO DOMINGO, Dominican Republic, May 2, 2013 — Santo Mining Corporation (OTCQB:SANP), (the “Company”), announced that on March 13, 2012 the Company entered into a definitive long-term license agreement (the “Agreement”) with Campania Minera Los Angeles Del Desierto SA De CV (Mexico) (the”Concessionaire”)to develop and mine its three metallic concessions (the “Concessions”) located at Ocampo, Coahuila, Mexico, 45 miles south of the United States border. Pursuant to the 15 year Agreement, the Concessionaire will receive a 40% of any royalty from the Concessions and the Company will keep the remaining 60%. The Concessions total more than 7.27 square kilometers and have been assayed for Gold and Silver with impressive grades. Most entitlements are in place including the environmental permit.

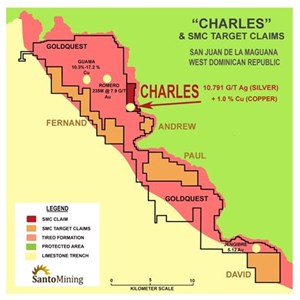

Location Map

Due Diligence Sampling

Photos accompanying this release are available at

http://www.globenewswire.com/newsroom/prs/?pkgid=18475

http://www.globenewswire.com/newsroom/prs/?pkgid=18474

The signing of the Agreement follows a year of due diligence under three consecutive standstill agreements. Under the Agreement, the Company is required to make payments during the first year to the Concessionaire totaling $210,000, and on 15 June 2013 the Company will transfer 1,000,000 shares of the Company’s common stock to the Concessionaire. $100,000 of the total initial cash payments is considered an advance on future 40% royalty payments. Preliminary assessments conducted on the first 60 hectares indicated a high probability of economic reserves that warranted entering into a definitive contract. There are indications that additional reserves are yet be discovered on the remaining 667 hectares.

QUICK FACTS:

Location: Coahuila State, North Central Mexico

Nearby Mining Operations: First Majestic Silver Corp (NYSE:AG ; TSX:FR) operates the Encantada silver mine nearby.

Area: 7.47 square kilometers of rolling desert

Inferred resource tonneage: 3M mt at 3.17 g/t gold and 57.3 g/t silver

Inferred resource ounces: 306K oz gold and 5.5 M oz silver

Secondary metals: silver & zinc

Type of mine: open-pit mining with truck access to highway

Estimated production: 2014

Estimated mine life: 2014-2030 (16 years)

Estimated employees: 66

Percent to the Company: 60%

Royalty to the Concessionaire: 40%

DUE DILLIGENCE SAMPLING:

In November 2012, a geochemical sampling survey was conducted by respected local mine engineer Juan Luis Castillo Velez under the direct supervision of Al French, the Company’s Chief Executive Officer. Surface soil and rock samples were collected at the base perimeter, sides and top of a mineralized rise and sent to Inspectorate Labs of Reno Nevada for fire assay analysis. The average results of all the samples was 3.17 g/t AU (gold) and 57.37 g/t AG (silver) which confirmed numerous certified and uncertified analyses previously commissioned by the Concessionaire. The highest results obtained were 8.581 g/t AU and 148.1 g/t AG.

RESOURCE CALCULATION & VALUATION:

The inferred mineral resource estimate is based partially on: 1) The results of the November 2012 geochemical sampling; 2) A 2007 Geological Assessment (Sketch) sponsored by the Mexican Secretary of Economy,

Coordination General de Mineria, and Fideicomso de Formento Minero; and 3) A Geological Report by Juan Jose Lopez Reyna, a Professional Geologist at the Universidad Autonoma de Coahuila. Adopting a conservative approach, the preliminary tonnage estimate inputs are limited to just 50% of the 60 hectares (600,000 square meters) study area multiplied by 5 meters of depth. The result indicates a potential of 3 million tonnes or $700 million in gold and silver in inferred resources at current prices. The Company plans to start shallow drilling, metallurgy testing, bulk sample testing in a local pilot plant, and commission a qualified geological report with the objective of augmenting the preliminary inferred resources estimates.

GEOLOGY & LOCATION:

The Concessions are located on the south periphery of the extinct volcano Cerro Minerva and consist of a numerous tertiary intrusive igneous rocks whose composition varies from granite, granodiorite, gabbro, diorite, andesite porphyries, rhyolite, and syenite as stocks, sills and dikes, and are generally rolling hills and all are accessible by truck transport. A jagged metamorphic aureole formed in the areas of contact with limestone and shale intrusive bodies generally consisting of irregular garnet skarn, marble, hornfels and recrystallized limestone. The gold-silver mineralization is largely encapsulated in silica. Because the gold and silver is so fine grained as to be invisible and largely refractory, the ore is not readily susceptible to standard cyanidation process. Santo Mining is evaluating a number of processing options to determine the most economical way to pre-treat or concentrate the refractory ore. Preliminary tests indicate a combination of conventional processes look optimistic and may provide excellent gold and silver recoveries on a cost effective basis.

PLAN OF OPERATION:

Santo Mining will establish a 100% owned local subsidiary in Mexico to administer this project. Later in 2013 and early 2014 the Company plans to systematically scale-up operations and purchase equipment and machinery with funds from a recently approved $16 million equity funding program with the Magna Group affiliate of Hanover Holdings I, LLC, of New York.

The Concessionaire is providing the three exploitation concessions and an environmental license all of which are in force. The Company will submit an application for a Forestry Permit (which typically takes 60-90 days to process) and a well permit for process water (which is expected to take 30 days to process). In Mexico Mining Concessions are typically granted for 50 years and allows for the exploration and extraction of underlying mineral deposits. Established in 2005, this modern system has attracted substantial long-term investment with 286 mining companies operating with foreign capital. In 2010, Mexico produced 79.37 tonnes of Gold, 4.41 billion tonnes of Silver (the largest in the World) and 476 tonnes of Base metals (copper, lead, Zinc, etc). According to Thomson Reuters, Mexico has lower gold production costs than most other countries. Since the implementation of NAFTA 19 years ago and its strong foreign investment protection provisions, the Mexican government has implemented a transparent and consistent mining policy, and Mexico has evolved into a friendly mining jurisdiction. Foreign mining companies and their wholly owned subsidiaries have a clear legal framework to refer to when exploring, developing and operating a project. In an effort to expand exploration, the Mexican government has created the Mexican Geological Survey which has established a detailed database of prospective exploration areas throughout the country.

Al French, CEO, Santo Mining Commented on the news: “The closing of this gold & silver mining contract is a major milestone for Santo Mining Corp as it squarely launches us into the “Junior Mining” league. The project is consistent with our vision to acquire production ready properties in Mexico and highly prospective properties (exploration concession applications) in the Dominican Republic. This, in conjunction with the recent $16 million equity funding agreement, provides Santo Mining with a credible window of opportunity for short-term exponential growth on top of the longer-term opportunities in the Dominican Republic.”

About Santo Mining:

Santo Mining Corporation is a junior minerals exploration and development company, based in the Dominican Republic. The Company is actively pursuing the acquisition and exploration of properties, which are strategically located in the prolific and highly prospective Hispaniola Gold-Copper Back-Arc area in the Dominican Republic. A detailed description of the Company’s activities is available at www.SantoMining.com.

Further information on the Company and its filings can be found at www.sec.gov.

The Santo Mining Corporation logo is available at: http://www.globenewswire.com/newsroom/prs/?pkgid=14686.

Notice Regarding Forward-Looking Statements

This current report contains “forward-looking statements,” as that term is defined in Section 27A of the United States Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements in this press release, such as the Company’s plans to acquire a number of highly prospective gold exploration properties, which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, expectations or intentions regarding the future, including but not limited to, any mineralization, development or exploration of the Company’s properties and the timing of any work program or exploration activities, and any results that may be obtained or the commencement of production.

Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, the inherent uncertainties associated with mineral exploration and difficulties associated with obtaining financing on acceptable terms. We are not in control of metals prices and these could vary to make development uneconomic. These forward-looking statements are made as of the date of this news release, and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Although we believe that the beliefs, plans, expectations and intentions contained in this press release are reasonable, there can be no assurance those beliefs, plans, expectations or intentions will prove to be accurate. Investors should consult all of the information set forth herein and should also refer to the risk factors disclosure outlined in our most recent annual report for our last fiscal year, our quarterly reports, and other periodic reports filed from time-to-time with the Securities and Exchange Commission.

Tyler Troup, B.Comm Circadian Group, Investor Relations North American: +1 (647)-930-1037 Toll Free: +1 (866) 603-3330 www.SantoMining.com Due Diligence Portal: http://circadian-group.com/santo.html