Vancouver, British Columbia–(Newsfile Corp. – October 5, 2020) – Affinity Metals Corp. (TSXV: AFF) (FSE: 34IA) (“the Corporation”) (“Affinity”) is very pleased to report that it has entered into an option agreement to earn up to a 100% interest in the Carscallen Extension property located immediately adjacent to the Melkior Resources- Kirkland Lake Gold Carscallen Project approximately 25 km west of Timmins, Ontario, Canada. Affinity’s Carscallen Extension property consists of 47 claim units covering approximately 940 hectares.

Melkior’s Carscallen property has gained considerable attention in recent months since Kirkland Lake Gold (“KL”) first entered into negotiations to join with Melkior in advancing the property. On September 30th, 2020, Melkior closed a strategic partnership with KL in an option deal worth up to $110 million. The confidence of a major producer like KL entering into an agreement of this size is very promising and shows the potential of this newly discovered gold system.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/5458/65196_00e18975549bba72_001full.jpg

The Carscallen hosts high-grade gold and has strong indications of a base metal volcanogenic massive sulphide (VMS) system. In a news release dated June 26th, 2020, Melkior reported that to date, they have delineated a potential 800m striking gold system running NW-SE through the Zam Zam and Shenkman Gold Zones that is also open in both directions. The Affinity Carscallen Extension property borders Melkior’s property to the north and is located on trend approximately 1000m NW of the presently defined gold system with similar underlying geology.

Melkior’s Carscallen property and Affinity’s Carscallen Extension property are located on the western end of the Abitibi Greenstone Belt, in the geopolitically stable and resource friendly province of Ontario. Along with the Frasier Institute deeming it the 4th most attractive mining jurisdiction in the world, the Abitibi Greenstone Belt is home to dozens of world class deposits, and has reportedly produced in excess of 170 million ounces of gold, 400 million ounces of silver, 15 billion tons of copper, and 35 billion tons of zinc.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/5458/65196_00e18975549bba72_002full.jpg

Affinity previously entered into an option agreement for the West Timmins property with the same arm’s length party that also holds the Carscallen Extension property. The West Timmins property was recently drilled by Affinity. An existing single shallow drill hole was extended to 525m in depth in an effort to accomplish two objectives: 1) to test the validity and accuracy of the Stargate Acoustic EM technology to delineate geological contacts, more specifically to define the extent of granite caps which commonly mask the underlying geology within the west Timmins region, and 2) to test the geology immediately beyond the granite cap.

The technology was able to predict the contact where the granitic cap terminated in the hole. This ability to potentially map granitic intrusions and caps at depth, where other geophysical techniques have failed, has far reaching positive implications and potentially opens up many possibilities for increasing exploration success in granitic environments within the Timmins camp and elsewhere.

The geological environment to the 525m depth drilled did not produce any significant precious metal values in the core samples that were assayed.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/5458/65196_00e18975549bba72_003full.jpg

Given the recent Melkior-KL partnership, and after considerable examination of the regional data specific to the immediate vicinity around Melkior’s Carscallen Project, it was determined that Affinity’s immediate focus and priority should shift away from the Timmins West property to the south and instead to secure the northern Carscallen Extension project and pursue a more aggressive exploration program on this property located on trend to the north and much closer to Melkior’s recent work that attracted KL to the Carscallen property.

The relationship that Affinity has developed with the owners holding both the Timmins West and Carscallen Extension properties allowed us the flexibility to have optionality between priorities and projects. The Timmins West property option has now been terminated with no cash or share payments having been made, and the Carscallen Extension project has effectively replaced the previous agreement. Affinity has the opportunity to enter into a new option agreement and return to the Timmins West property at the discretion of the optionor but Affinity may not hold both the Timmins West and Carscallen Extension properties concurrently. Affinity’s present and immediate focus is now to advance the Carscallen Extension property.

Rob Edwards, Affinity CEO & President stated: “As the Carscallen Extension property immediately adjoins the Melkior-Kirkland Lake Carscallen project to the north, and also clearly appears to be on trend with the gold system that Melkior has defined to date and believes to be open for expansion, we believe the Carscallen Extension to be the most prospective property within the immediate region associated with this exciting partnership project. We very much appreciate the flexibility afforded us by the holders of the Timmins West and Carscallen Extension properties and for their confidence in Affinity in allowing us to secure the Carscallen Extension property and to shift focus and capitalize on the recent Kirkland Lake developments and associated potential.”

The terms of the Carscallen Extension option agreement are as follows:

Granting of 70% option:

In order for Affinity to earn a 70% interest in the property, within 6 months of Exchange approval of the option agreement:

1) Affinity shall pay $1,539.63 in outstanding assay fees and shall receive assays for the bottom section of a previously drilled hole.

2) Pay the optionor $30,000 in cash.

3) Complete a minimum of 1,300 meters of drilling.

4) Grant to the optionor a 1% NSR along with an initial $25,000 advance royalty payment.

Granting of additional 10% (80% option):

In order for Affinity to earn an 80% interest in the property:

1) Within 30 days of receipt of assays from the 1,300m drilling above, issue 400,000 shares of Affinity to the optionor.

2) Complete an additional 6,000 meters of drilling on the property within 4 months of completing the 70% option.

Granting of additional 10% (90% option):

In order for Affinity to earn a 90% interest in the property:

1) Upon completing the 80% earn in and electing to proceed with the 90% earn in, issue 500,000 Affinity warrants to the optionor.

2) Complete an additional 4,000 meters of drilling on the property within 15 months of Exchange approval of the option agreement.

Granting of additional 10% (100% option):

In order for Affinity to earn a 100% interest in the property:

1) Pay $5,000,000 to the optionor.

Affinity shall pay advance royalty payments of $25,000 every 6 months to an aggregate total of $250,000 to maintain the property in good standing.

Affinity will also deliver a Preliminary Economic Assessment within 5 years of executing the option agreement or the property will revert back to the optionor.

The optionor will hold a 1% NSR on the property with no buy back provision.

All shares or warrants issued under this agreement will be subject to a statutory 4 month hold period. This agreement is subject to approval by the TSX Venture Exchange.

Qualified Person

The qualified person for the Carscallen Extension Project for the purposes of National Instrument 43-101 is Kevin Montgomery, P.Geo. He has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

About Affinity Metals

Affinity is focused on the acquisition, exploration and development of strategic metal deposits within North America. Affinity is following a hybrid approach of combining the advancement of strategic assets along with following a Project Generator model.

In addition to the recently acquired Carscallen Extension property, Affinity presently holds two properties in British Columbia as well as four additional properties located near Timmins, Ontario.

A drill program is presently underway on the Regal property located near Revelstoke, BC in the northern end of the prolific Kootenay Arc. Over 3,000m of drilling has been completed to date.

On behalf of the Board of Directors

Robert Edwards, CEO and Director of Affinity Metals Corp.

The Company can be contacted at: [email protected]

Information relating to the Company is available at: www.affinity-metals.com

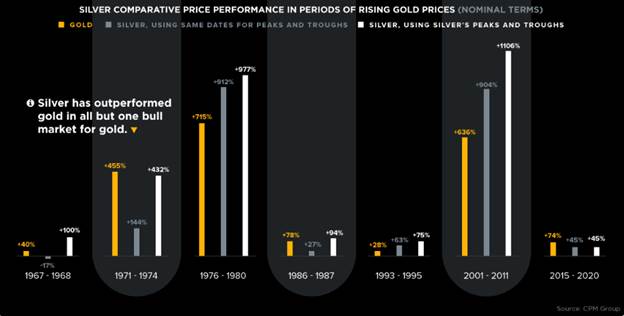

Silver Comparative Price Vs Rising Gold Prices

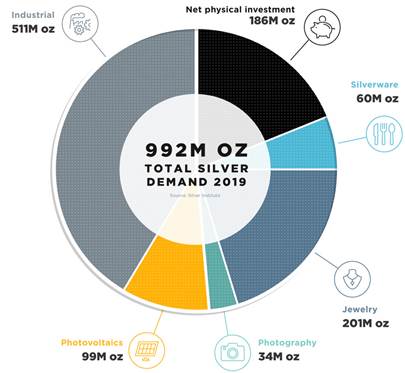

Silver Comparative Price Vs Rising Gold Prices Total Silver Demand 2019

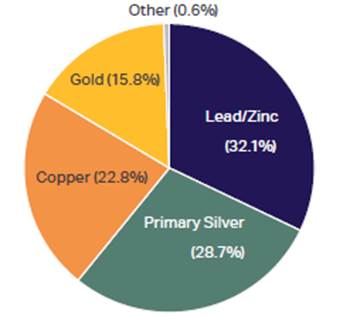

Total Silver Demand 2019 Silver Supply

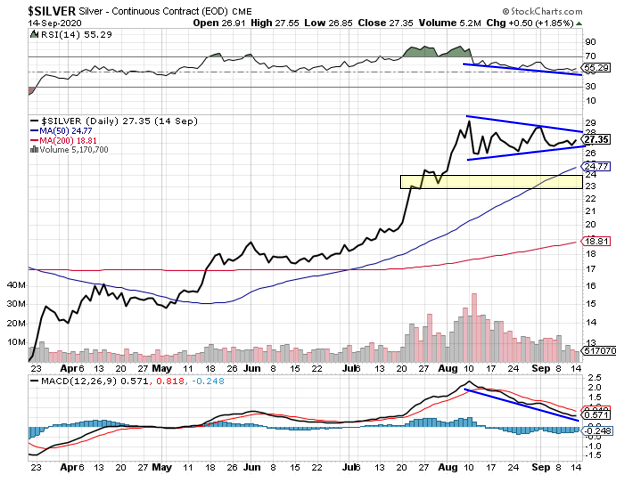

Silver Supply Silver Daily Chart

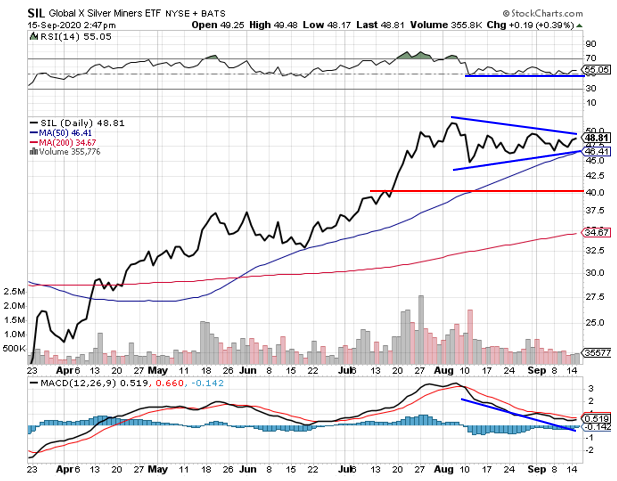

Silver Daily Chart SIL Daily

SIL Daily