- Announced the start of an exploration program focused on the detection of deep sulphide mineralization targets on the Company’s Beauce Gold project

- Approximately 80% of which is funded through governmental grants, will bring together an international world-renowned multi-disciplinary geophysical team

- Bernard Tourillon, Chairman and CEO of Uragold stated, “Our decision to participate in this government funded exploration program at this time represents the official start of the Company’s plan to spin out its’ gold assets into a separate publicly traded company…”

Montreal, Quebec, Canada /March 11 2016 – Uragold (TSX Venture: UBR) is pleased to announce the start of an exploration program focused on the detection of deep sulphide mineralization targets on the Company’s Beauce Gold project located in the Beauce region of Southern Quebec. The research program, approximately 80% of which is funded through governmental grants, will bring together an international world-renowned multi-disciplinary geophysical team oriented on studying and identifying the location of potentials hard rock sources of the Beauce Gold property.

GOLD PROJECTS TO BE SPUN OUT TO UNLOCK VALUE

Bernard Tourillon, Chairman and CEO of Uragold stated, “Our decision to participate in this government funded exploration program at this time represents the official start of the Company’s plan to spin out its’ gold assets into a separate publicly traded company, first contemplated in our press release of December 1, 2015. We believe the spin out will serve to unlock the true value of our gold assets for our shareholders, all of whom will receive shares in the new company, while allowing each company to focus on their respective core competencies. Details of the spin out, subject to shareholder and regulatory approval, will be provided in due course.”

BEAUCE GOLD PROPERTY-SEARCHING THE SOURCE OF THE LARGEST PLACER GOLD DEPOSIT IN EASTERN NORTH AMERICA

The Beauce Gold project area hosts a six (6) km long unconsolidated gold bearing sedimentary unit (a lower saprolite and an upper brown diamictite) holding the largest historical placer gold deposit in eastern North America. Uragold exploration work to date identified delicate gold in saprolite, indicating a close proximity to a bedrock source of gold providing significant potential for further exploration discoveries. (Please refer to Uragold National Instrument 43-101 report dated January 8, 2015).

Patrick Levasseur, President and COO of Uragold stated, “For the past 150 years, every 50 years has seen the occurrence of major placer gold mining operation on the property. Regardless of this, there have been few attempts made to identify the bedrock source of this prolific historical placer gold deposit.” Mr. Levasseur further stated: “Having such a team of world renowned professionals working on our project and using the latest in geophysical technology for gold exploration on our Beauce Gold property is outstanding.”

WORLD RENOWNED GEOPHYSICAL TEAM

The multi-disciplinary geophysical team is composed of members from:

- -INRS-ETE,(Eau Terre et Environnement) ;-UQAT (Universite du Quebec en Abitibi-Temiscamingue);-The Geological Survey of Canada (GSC);

-MERN (Energie et Resources Naturelles du Quebec) ;

-Paris VI – Sorbonne (Universite Pierre et Marie Curie) and

-Zonge International from Tucson Arizona (Zonge.com)

The multi-disciplinary geophysical will take magnetic and gravimetric measurements along different sections, perpendicular to the geology of the St-Simon-les-Mines gold placer area. Subsequently, they will complete an electromagnetic survey, from 0 to 2,000 m, to document the geoelectric characteristics of Bellechasse gold belt in St-Simon-les-Mines.

The Beauce Gold project has been the subject of exploration by UBR and INRS. The INRS electrical resistivity and IP survey demonstrated the presence of strong chargeability anomalies in the bedrock located below the gold placer quaternary units (News release 2013-05-23, Uragold’s Beauce survey indicates vertical anomaly).

The geophysical and petrophysical study is majority funded through a grant from the FQRNT-Mines (Fonds de recherche du Quebec – Nature et technologies) (FRQNT) with a contribution from Uragold.

Marc Richer-Lafleche PhD, P. Geo, is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this press release.

About The Beauce Gold project

The Beauce Gold Project is a unique, historically prolific gold field located in the municipality of Saint-Simon-les-Mines in the Beauce region of Southern Quebec. Comprising of a block of 37 claims 100% owned by Uragold Bay Resources, the project area hosts a six km long unconsolidated gold bearing sedimentary units (a lower saprolite and an upper brown diamictite) holding the largest placer gold deposit in eastern North America. The gold in saprolite indicates a close proximity to a bedrock source of gold providing significant potential for further exploration discoveries.

About Uragold

Uragold is also the largest holder of High Purity Quartz properties in Quebec, with over 3,500 Ha under claims. Quartz from the Roncevaux property successfully passed rigorous testing protocols of a major silicon metal producer confirming that our material is highly suited for their silicon metal production.

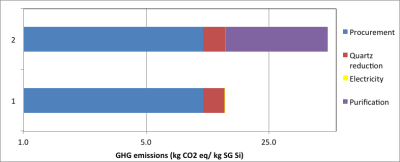

Uragold, with its worldwide exclusive usage of PyroGenesis’ PUREVAP(TM) QVR, is endeavouring to become a vertically integrated High Purity Silicon Metal (99.99% Si), Solar Grade Silicon Metal (6N Purity / 99.9999% Si) and/or Higher (9N Purity / 99.9999999% Si) producer.

The PUREVAP(TM) QVR process’s big advantage is its one step direct transformation of Quartz into High Purity Silicon Metal (99.99% Si), Solar Grade Silicon Metal (6N Purity / 99.9999% Si) and/or Higher (9N Purity / 99.9999999% Si) producer, thereby potentially allowing Uragold to manufacture high value material for the same operating cost presently being paid by traditional producers to make Metallurgical Grade Si (98.5% Si) using the traditional arc furnace approach.

This press release contains certain forward-looking statements, including, without limitation, statements containing the words “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “in the process” and other similar expressions which constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking statements reflect the Company’s current expectation and assumptions, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Company with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Company’s on-going filings with the securities regulatory authorities, which filings can be found at www.sedar.com. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact

Bernard J. Tourillon, Chairman and CEO Tel (514) 907-1011

Patrick Levasseur, President and COO Tel: (514) 262-9239

www.uragold.com