- Announced that it has closed on July 16, 2015 an additional non-brokered private placement comprised of 1,238,012 Flow-Though Units at $0.055 per Unit for gross proceeds of $68,090.66.

- Net proceeds from the Private Placement will be used to finance the implementation of the Corporation’s go forward plan for Q1/Q2 2015 and was predicated by our press release on March 2, 2015 in which we announced “Major Producer Confirms Interest in Purchasing Significant Tonnage of High Purity Quartz From Uragold Quartz Property in Quebec”

Montreal, Quebec / July 16 2015 – Uragold Bay Resources Inc. (“Uragold”) (TSX Venture: UBR) is pleased to announce that it has closed on July 16, 2015 an additional non-brokered private placement comprised of 1,238,012 Flow-Though Units (“Unit”) at $0.055 per Unit for gross proceeds of $68,090.66. The net proceeds from the Private Placement will be used to finance the implementation of the Corporation’s go forward plan for Q1/Q2 2015 and was predicated by our press release on March 2, 2015 in which we announced “Major Producer Confirms Interest in Purchasing Significant Tonnage of High Purity Quartz From Uragold Quartz Property in Quebec” and our press release on April 13, 2015 in which announced “Uragold subsidiary, Quebec Quartz, signs MOU with Dorfner Anzaplan to evaluate potential of its high purity quartz deposit.”

Each Unit is comprised of one (1) common share and a half (1/2) common share purchase warrant (“Warrant”) of the Company. Each Warrant will entitle the holder thereof to purchase one common share of the capital stock of the Company at an exercise price of $ 0.10 during a period of 24 months from the date of closing of the placement. Each share issued pursuant to the placement will have a mandatory four (4) month holding period until November 17, 2015.

The Company paid a cash finder’s fee of $6,809.06 and issued 123,801 warrants to Dundee Capital Market. Each warrants will give the right to purchase one (1) common share at 5.5 cents for 24 months.

Patrick Levasseur, President and COO of UBR stated, “We are extremely please that the developments of Quebec Quartz’s high purity quartz projects continue attracting investors interest. Our recent announcement regarding interest from a major producer in purchasing significant tonnage of our high purity quartz and our collaboration with Anzaplan are major milestones in our quartz strategy. We have started the field work required to start determining the full potential of our industry leading quartz properties.”

About UBR- Quebec Quartz

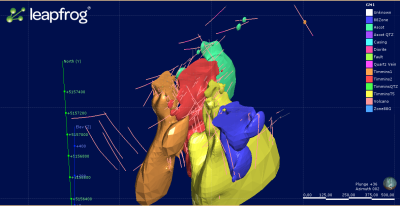

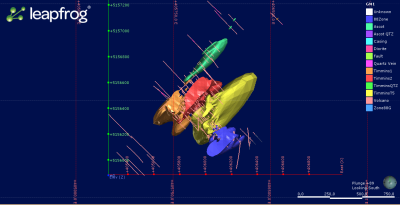

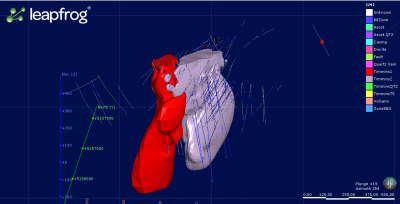

UBR- Quebec Quartz is the largest holder of distinct High Purity Quartz properties in Quebec, with over 3,500 Ha under claims. Despite the abundance of quartz, very few deposits are suitable for high purity applications. High Purity Quartz supplies are tightening, Prices are rising, Exponential growth forecasted;

Quartz from the Roncevaux property successfully passed rigorous testing protocols of a major silicon metal producer confirming that our material is highly suited for their silicon metal production.

In addition to becoming a supplier of lump quartz for silicon metal production, Quebec Quartz’s objective is to transform its High Purity Quartz into Ultra High Purity Quartz Sands to generate significantly greater profits and become a leading supplier of Ultra High Purity Quartz.

About Uragold Bay Resources Inc.

Uragold Bay Resources is a TSX-V listed Gold and High Purity Quartz exploration junior focused on generating free cash flow from mining operations. Our business model is centered on developing mining projects suited for smaller-scale start-up and that could potentially generate high yield returns. Uragold will reach these goals by developing Quebec’s first paleoplacer mine in 50 years, the Beauce Placer Project and, in partnership with Golden Hope Mines, the Bellechasse-Timmins Gold Deposit.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or the securities laws of any state of the United States and may not be offered or sold within the United States or to, or for the account or the benefit of, U.S. persons (as defined in Regulation S un der the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption from such registration requirements.

For further information contact

Bernard J. Tourillon, Chairman and CEO

Patrick Levasseur, President and COO

Tel: (514) 846-3271(514) 846-3271

(514) 846-3271

(514) 846-3271

www.uragold.com