SANP: OTCBB

THREE REASONS WHY SANTO MINING?

- Three claims next to Barrick Gold in the mineral rich Dominican Republic

- Charles claim 1 mile from Goldquest’s 2012 monster gold discovery

- Company to start producing gold and silver in Mexico

- Entered into a definitive long-term license agreement to develop and mine its three metallic concessions located at Ocampo, Coahuila, Mexico

- Inferred resource tonneage: 3M mt at 3.17 g/t gold and 57.3 g/t silver

- Inferred resource ounces: 306K oz gold and 5.5 M oz silver

- Open-pit mining with truck access to highway

- Impressive grades up to 8.581 g/t Gold and 148.1 g/t Silver

- Most entitlements are in place including the environmental permit.

DOMINICAN REPUBLIC OPERATIONS

To give a sense of the scale of the opportunity, consider the following:

- Pueblo Viejo gold-silver deposit (Barrick/ Goldcorp JV), estimated to contain 23.7 million ounces of gold. There has been documented mining activity here going back to the Spaniards in 1505. Sulphide mining operations here produce more than 450 ounces of gold and 1,800 ounces of silver every day.

- Falcondo ferronickel mine, which can produce 29,000 tons of nickel each year.

- Perilya’s Cerro de Maimón copper-gold mine, which constitutes a 6 million ton open-pit copper/gold reserve.

$16 Million Equity Enhancement Program Underway

- Program allows, but does not obligate, the Company to issue and sell up to $16 million of shares of common stock to the Investor Hanover Holdings NY from time to time over the 36-month period

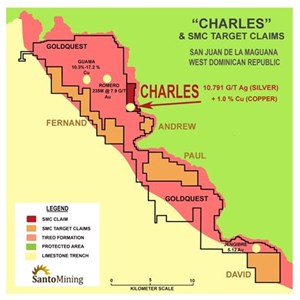

Charles Claim

This highly prospective claim is located above San Juan in western Dominican Republic and planted in the heart of the mineral rich “Tireo Formation.”

- Charles Claim borders Goldquest’s renowned La Escandalosa claim where in 2012 three bonanza drill intercepts were reported as being the largest gold discovery in the Dominican Republic in 20 years.

- The Company continues its positive growth, adding yet another quality claim to its portfolio of exploration concession applications and its focus on near-term gold production opportunities.

- Santo Mining finalizing due diligence on remaining four claims that immediately wrap around Goldquest.

- Exploration team yielded a series of results up to 10.79 g/t Silver and +1.0% Copper

Richard Claim

The company recently announced that it has signed a definite agreement to acquire 100% of the Richard gold exploration application.

- located just 200 meters southeast of Barrick gold in the mineral-rich “Los Ranchos” geological formation of the Hispaniola Gold-Copper Back-Arc.

- This definitive agreement is part of the Company’s aggressive expansion of its portfolio of precious and base metal exploration concession applications assets in its quest for near-term production opportunities.

- Shallow Diamond Core Drilling Targets to sample the underlying bed rock awaiting permitting

During the last five months Santo Mining’s field exploration team led by Elpidio Moronta conducted due diligence on the Richard Claim consisting of property wide reconnaissance surveys, including stream sediment sampling and surface soil geochemistry. Early in 2013 the exploration team sent soil, sediment and rock samples to Acme Laboratories for multi-element trace analysis. The laboratory results have potentially identified two zones of gold, silver, and copper anomalies. The principal gold zone is located in the northwest quadrant of the Richard Claim, approximately 500 meters east of Barrick Gold’s Pueblo Viejo boundary. The exploration team is currently in the field conducting a “detailed” surface soil geochemistry survey and rock sampling to better define a series of shallow drill targets.