- Barrick commenced a scout drilling program on a number of prospects in the Ngayu greenstone belt

- Scout drilling was undertaken at the Medere, Bakpau and Anguluku prospects to better understand the structural setting for the gold mineralisation

- Ground exploration has also outlined additional high priority drill targets at Mokepa and Mongaliema and where some of the most significant trench results since the start of the Barrick joint venture have been obtained

TORONTO, Nov. 23, 2020 (GLOBE NEWSWIRE) — Loncor Resources Inc. (“Loncor” or the “Company“) (TSX: “LN”; OTCQX: “LONCF”; FSE: “LO51”) is pleased to provide an update on its exploration activities within the Ngayu greenstone belt, where the Company has a joint venture with Barrick Gold (DRC) Limited (“Barrick”) as well as its own majority-owned projects.

Loncor received exploration reports from joint venture partner Barrick, who are managing and funding the joint venture that covers approximately 2,000 square kilometres of the Ngayu Archean greenstone belt. As announced previously, Barrick commenced a scout drilling program on a number of prospects in the Ngayu greenstone belt as well as continuing to delineate additional priority targets for follow-up drilling. Scout drilling was undertaken at the Medere, Bakpau and Anguluku prospects to better understand the subsurface geology including the structural setting for the gold mineralisation at these targets. Ongoing ground exploration has also outlined additional high priority drill targets at Mokepa and Mongaliema and where some of the most significant trench results since the start of the Barrick joint venture have been obtained (see Figure 1 below).

The east-west trending Medere mineralized zone is located approximately 10 kilometres south of Makapela and subparallel and 250 metres in the footwall to the south of the Makasi/Itali trend. Both these trends are located along a shear corridor between basalts and carbonaceous meta sediments coincident with a 800 metre long +100ppb gold in soil anomaly. Previous drilling along the Itali mineralized trend by Loncor intersected significant gold mineralization including 38.82 metres grading 2.66 g/t Au in core hole NIDD0001 and 14.70 metres grading 1.68 g/t and 3.95 metres grading 19.50 g/t Au in core hole NIDD0004 and where the depth of complete oxidation exceeded 130 metres. Three core holes were drilled by Barrick to obtain a better understanding of the structural setting of the mineralization at Medere and its relationship to the Itali mineralized trend with the best intersection to date of 9.05 metres grading 3.75 g/t Au from 39.82 metres in core hole ITDD0003 which is located 200 metres east of the Loncor hole NIDD0001. The Itali mineralized trend remains open to the east and further drilling is warranted on this mineralized trend.

Drilling at the Bakpau and Anguluku prospects were undertaken to test various geological concepts. At Bakpau, the favourable geological setting of a mineralized shear system hosted mainly within a coarse-grained quartz-monzonite intrusion at the contact with sheared and brecciated banded ironstone was tested. Resampling of old trenches outlined wide zones of gold mineralization including 70 metres grading 0.34 g/t Au and 33 metres grading 0.53 g/t Au. Two holes have been drilled and final assay results are awaited. At Anguluku, drilling was undertaken to test a complexly folded and thrust banded ironstone sequence below a barren overlying banded ironstone unit. Drilling results indicated that this prospect did not have the potential for hosting a Tier one deposit to meet Barrick’s filters and no further drilling is planned at this prospect.

At the Yambenda/Yasua prospect in the north of the Ngayu greenstone belt, a core rig has now been mobilised to test the prominent +9 kilometre long banded ironstone ridge associated with a number of +100 ppb gold in soil anomalies. A number of core hole sections will be drilled to fully evaluate this extensive strike length.

Ongoing exploration within the Ngayu joint venture generated new priority drill targets that have the potential to attain Barrick’s Tier 1 status at Mokepa and Mongaliema.

The Mokepa target is located on the northern margin of the major domain boundary adjacent to the interpreted F2 fold hinge in a structural setting similar to Barrick’s Kibali mine. The subsequent field mapping and trenching has defined a corridor of matrix-supported rheological contrast with complex geology composed of banded ironstone formation (BIF) and basalt interbedded with fine-grained sediments mainly with moderate to strong shearing associated with an alteration assemblage of moderate to intense silica-limonite-sericite+boxworks. Encouraging trench results have been received from trenches ADTR0004 and ADTR0005, 600 metres apart with wide zones of gold mineralization of 110 metres grading 0.50 g/t Au and 32 metres grading 0.99 g/t Au. Assay results are awaited from trench ADTR0006 which is located 1.5 kilometres southwest of trench ADTR0004 and where a 80 metre wide zone of sheared, altered and fractured BIF and basalt has been excavated (see Figure 2 below). The first core hole at Mokepa has now commenced.

Mongaliema is situated approximately 7 kilometres northwest of Loncor’s 100%-owned Makapela project where indicated mineral resources of 614,200 ounces (2.2 million tonnes grading 8.66 g/t Au) and 549,600 ounces (3.22 million tonnes grading 5.30 g/t Au) of inferred mineral resources have already been outlined by Loncor. The target area is a west northwest trending shear zone hosted within altered meta sediments with cherty units near the contact of a dolerite intrusive. During the quarter, geological mapping, auger drilling, scout-pitting and trenching was undertaken with an encouraging trench/artisanal pit assay result of 37.3 metres grading 1.48 g/t Au plus several rock samples from old artisanal workings yielding gold mineralization including 14.9 g/t, 5.23g/t, 2.9g/t and 2.43g/t Au. Pitting, trenching and augering is continuing to determine the full extent of this mineralized system.

Commenting on these latest results, Loncor’s President Peter Cowley said: “We are encouraged by the exploration results received to date from the Barrick joint venture and especially the generation by Barrick geologists of additional new, high priority drill targets such as Mokepa and look forward to receiving drilling results from this and other priority targets including Yambenda/Yasua in the north of the Ngayu belt. In terms of other drilling at Ngayu, the first hole at our 84.6%-owned Adumbi deposit has now been completed and the mineralized core section has been submitted to the independent S.G.S laboratory at Mwanza, Tanzania.”

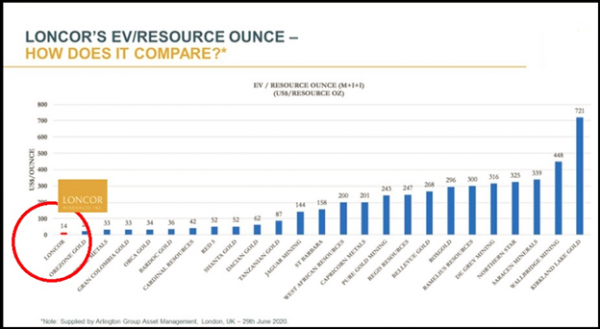

About Loncor Resources Inc.

Loncor is a Canadian gold exploration company focussed on the Ngayu Greenstone Belt in the northeast of the Democratic Republic of the Congo (the “DRC”). The Loncor team has over two decades of experience of operating in the DRC. Ngayu has numerous positive indicators based on the geology, artisanal activity, encouraging drill results and an existing gold resource base. The area is 220 kilometres southwest of the Kibali gold mine, which is operated by Barrick Gold (TSX: “ABX”; NYSE: “GOLD”). In 2019, Kibali produced record gold production of 814,000 ounces at “all-in sustaining costs” of US$693/oz. Barrick has highlighted the Ngayu Greenstone Belt as an area of particular exploration interest and is moving towards earning 65% of any discovery in approximately 2,000 km2 of Loncor ground in the Ngayu Greenstone Belt that they are exploring. As per the joint venture agreements entered between Loncor and Barrick, Barrick manages and funds exploration on the said ground until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. In a recent announcement Barrick highlighted six prospective drill targets and have commenced confirmation drilling in 2020. Subject to the DRC’s free carried interest requirements, Barrick would earn 65% of any discovery with Loncor holding the balance of 35%. Loncor will be required, from that point forward, to fund its pro-rata share in respect of the discovery in order to maintain its 35% interest or be diluted.

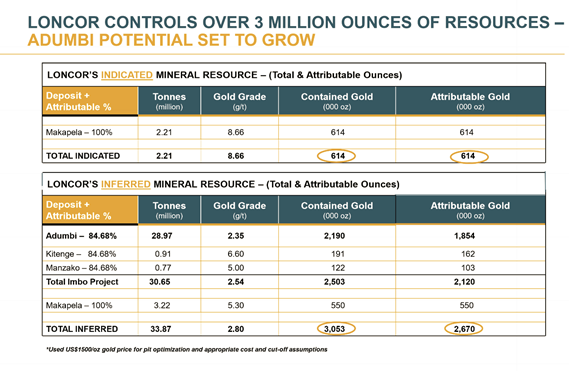

In addition to the Barrick joint ventures, certain parcels of land within the Ngayu Belt surrounding and including the Adumbi and Makapela deposits have been retained by Loncor and do not form part of any of the joint ventures with Barrick. Barrick has certain pre-emptive rights over the Makapela deposit. Adumbi and two neighbouring deposits hold an inferred mineral resource of 2.5 million ounces of gold (30.65 million tonnes grading 2.54 g/t Au), with 84.68% of this resource being attributable to Loncor via its 84.68% interest in the project. Loncor’s Makapela deposit (which is 100%-owned by Loncor) has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au).

Resolute Mining Limited (ASX/LSE: “RSG”) owns 26% of the outstanding shares of Loncor and holds a pre-emptive right to maintain its pro rata equity ownership interest in Loncor following the completion by Loncor of any proposed equity offering.

Additional information with respect to Loncor and its projects can be found on Loncor’s website at www.loncor.com