2024 has been a remarkable year for gold. The precious metal has surged to near-record highs, thanks to several economic and geopolitical factors creating a perfect storm for its value. For gold and critical mineral investors, this bullish trend signals significant opportunities. As global uncertainty continues to drive demand for safe-haven assets, companies like Lake Winn Resources, with their gold and critical mineral projects, stand to potentially benefit from the market momentum.

Here’s why gold is expected to stay bullish for the rest of 2024 and how it presents unique opportunities for investors.

Market Dynamics Driving Gold’s Bullish Run

Gold’s rise in 2024 is fueled by several key factors:

- U.S. Election Uncertainty: The upcoming U.S. presidential election is generating volatility in the financial markets. Historically, political uncertainty tends to drive demand for gold as investors look for safe-haven assets.

- Federal Reserve Rate Cuts: The U.S. Federal Reserve’s decision to cut interest rates has made gold more attractive. Lower rates reduce the opportunity cost of holding gold, a non-yielding asset, and weigh on the dollar, further boosting gold’s appeal.

- Geopolitical Tensions: Ongoing geopolitical risks, including global trade wars, continue to support gold prices, as these uncertainties push investors to seek stability in physical assets like gold.

- Central Bank Buying: Central banks across the globe have increased their gold reserves in 2024, further driving demand. As nations hedge against inflation and currency devaluation, this trend is expected to continue.

Lake Winn Resources, with its active exploration in Canada’s gold-rich regions, is strategically positioned to ride this wave. Their ongoing exploration efforts could bring significant new gold discoveries, capitalizing on the surging market.

U.S. Monetary Policy and Elections: Catalysts for Gold’s Growth

Gold’s impressive performance in 2024 can be attributed to shifts in U.S. monetary policy and political uncertainty:

- Fed Rate Cuts: The Federal Reserve’s pivot toward lower interest rates has been one of the most significant drivers of gold’s bullish performance. With further rate cuts expected, the yellow metal is likely to continue climbing. Lower rates make it less costly to hold non-yielding assets like gold, which historically outperforms in such environments.

- U.S. Election Volatility: The looming 2024 U.S. presidential election is adding an extra layer of uncertainty to global markets. A closely contested race could lead to market volatility, making gold an even more attractive asset for investors seeking protection from potential economic disruptions.

Lake Winn Resources benefits from these macroeconomic shifts. As a company focused on gold exploration, the rising value of gold enhances the potential profitability of their projects. Their gold assets offer exposure to a commodity that thrives in times of political and economic turbulence.

Gold vs. Other Safe-Haven Assets: Why Gold Still Outshines

While investors traditionally look to other safe-haven assets like U.S. bonds, the U.S. dollar, or even cryptocurrencies, gold continues to shine for several reasons:

- Historical Stability: Gold has stood the test of time as a reliable store of value, particularly in periods of inflation or economic downturn.

- Inflation Hedge: As inflation rises, gold tends to outperform other assets. Even though the U.S. dollar has strengthened, gold remains resilient.

- Low Correlation with Other Assets: Gold has a low correlation with other asset classes like stocks or bonds, making it a powerful diversification tool in any portfolio.

- Limited Supply: Unlike fiat currency, which can be printed, gold’s supply is finite. This limited supply continues to bolster its value, especially during periods of economic uncertainty.

How Investors Can Capitalize on the Bullish Gold Market

Investors looking to capitalize on the bullish gold market in 2024 have several strategies:

- Physical Gold: Gold bars and coins offer a tangible investment in the metal itself.

- Gold ETFs: Exchange-Traded Funds (ETFs) allow investors to track gold prices without physically holding the metal.

- Gold Mining Stocks: Investing in companies engaged in gold exploration and mining offers leveraged exposure to rising gold prices. This is where companies like Lake Winn Resources come into play, as they actively explore potential high-yield gold deposits.

- Junior Mining Stocks: These companies offer the potential for large returns if they discover significant gold resources.

Why Lake Winn Resources Offers Unique Opportunities

Lake Winn Resources is strategically positioned to benefit from the bullish gold market:

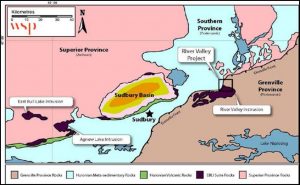

- Active Gold Exploration: Lake Winn Resources is actively exploring gold-rich areas in Canada, one of the most politically stable regions in the world. Their exploration efforts could result in significant gold discoveries, positioning the company to benefit from the rising prices.

- Diversified Portfolio: Beyond gold, Lake Winn Resources is also exploring critical minerals, which are in increasing demand due to the rise of electric vehicles and renewable energy technologies. This dual focus on gold and critical minerals provides investors with diversified exposure to two booming markets.

- Stable Jurisdiction: Canada is known for its stable mining regulations and transparent legal framework, which reduces the risks associated with political instability, making Lake Winn Resources a safer bet in a volatile global market.

Looking Forward: What to Expect in 2024 and Beyond

As 2024 progresses, gold is expected to remain a strong performer, driven by ongoing macroeconomic factors like interest rate cuts, geopolitical tensions, and central bank buying. Analysts predict that gold could reach new record highs by the end of the year, offering investors continued opportunities.

For companies like Lake Winn Resources, this market environment is incredibly favorable. With their focus on gold exploration and critical minerals, they are well-positioned to take advantage of rising demand for these essential commodities.

Conclusion

Gold is set to remain bullish for the rest of 2024, creating exciting opportunities for both gold and critical mineral investors. Companies like Lake Winn Resources, with their strategic exploration efforts and diversified portfolio, stand to potentially benefit from the continued rise in gold prices.

YOUR NEXT STEPS

Visit $LWR HUB On AGORACOM: https://agoracom.com/ir/LakeWinnResources

Visit $LWR 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/LakeWinnResources/profile

Visit $LWR Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/LakeWinnResources/forums/discussion

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients.

In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.