Introduction to the Company:

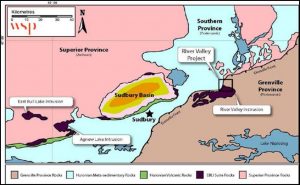

New Age Metals (NAM) stands as a prominent figure in the mining industry, with a dedicated focus on developing a diverse portfolio of platinum group metals (PGMs) and lithium. Founded with a mission to provide sustainable resources to power the transition to a low-carbon economy, NAM values innovation, environmental stewardship, and strong community partnerships. The company’s primary business revolves around the exploration and development of mineral projects in North America, with a particular emphasis on the River Valley Palladium Project in Ontario and lithium assets in Manitoba.

Established in 2001, New Age Metals has evolved significantly over the past two decades. The company began its journey with a focus on precious and base metals but pivoted towards PGMs and lithium in response to growing market demand. This strategic shift has shaped NAM’s reputation as a forward-thinking company committed to delivering high-quality, sustainable resources for the electric vehicle and clean energy sectors.

Company’s Recent Accomplishments:

In the last 12 to 24 months, New Age Metals has marked several significant milestones that underscore its growth trajectory and commitment to innovation. The company has focused heavily on advancing its River Valley Palladium Project, which is recognized as the largest undeveloped primary palladium project in North America. The project features a NI 43-101 resource estimate of 2.25 million ounces of palladium, platinum, and gold in the measured and indicated category, alongside an additional 1.59 million ounces in inferred resources.

A key highlight in NAM’s recent journey has been its partnership with Mineral Resources Ltd. (MinRes), the 5th largest lithium producer globally. This collaboration enhances NAM’s capabilities in lithium exploration and development, providing the necessary expertise and support to maximize the potential of its lithium assets. The partnership exemplifies NAM’s strategy of aligning with industry leaders to drive sustainable growth.

The company has also allocated a $7.3 million exploration budget for 2023-2024, demonstrating its commitment to advancing both its palladium and lithium projects. This investment is crucial for facilitating geological studies and exploration initiatives that will enhance resource estimation and project feasibility.

Impact on the Industry/Market:

New Age Metals’ achievements have positioned it as a leader in the critical minerals market, significantly impacting the industry landscape. The company’s emphasis on PGMs and lithium aligns with global trends favoring sustainable and environmentally friendly practices in mining and resource extraction.

In a recent statement, New Age Metals’ management emphasized their commitment to innovation and sustainability. “We are focused on creating a sustainable mining model that benefits not just our shareholders, but also the communities we operate in and the environment,” they stated. This vision reflects the company’s dedication to responsible mining practices and community engagement.

NAM’s competitive edge lies in its diversified portfolio, strong strategic partnerships, and its operations within stable jurisdictions like Canada. By capitalizing on the rising demand for critical minerals, particularly for electric vehicle batteries and renewable energy technologies, New Age Metals is well-positioned to thrive in a rapidly evolving market.

Future Outlook:

Looking ahead, New Age Metals aims to build on its recent successes by further expanding its exploration initiatives and project developments. The company plans to focus on enhancing the value of its River Valley Palladium Project while simultaneously advancing its lithium projects in Manitoba.

With the global shift towards a low-carbon economy and increasing demand for critical minerals, NAM is poised to capture significant market opportunities. The company’s strategic vision includes the potential exploration of additional projects and regions, reinforcing its commitment to resource sustainability and responsible mining.

While the company anticipates challenges such as fluctuating commodity prices and regulatory hurdles, its proactive approach and solid partnerships equip it to navigate these obstacles effectively. By fostering innovation, embracing sustainability, and maintaining strong community relationships, New Age Metals is dedicated to shaping the future of the mining industry and contributing to a greener, more sustainable world.

In summary, New Age Metals continues to exemplify the potential for growth and innovation within the mining sector, solidifying its reputation as a key player in the critical minerals market. As the company moves forward, it remains focused on its mission to provide sustainable resources while driving positive change in the industry and the communities it serves.

YOUR NEXT STEPS

Visit $NAM HUB On AGORACOM: https://agoracom.com/ir/NewAgeMetals

Visit $NAM 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/NewAgeMetals/profile

Visit $NAM Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/NewAgeMetals/forums/discussion

Watch $NAM Videos On AGORACOM YouTube Channel:

https://www.youtube.com/playlist?list=PLfL457LW0vdLbNGQy7XX-5_B8l0kYTajA

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication & dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.