SPONSOR: Labrador Gold – Two successful gold explorers lead the way in the Labrador gold rush targeting the under-explored gold potential of the province. Exploration has already outlined district scale gold on two projects, including a 40km strike length of the Florence Lake greenstone belt, one of two greenstone belts covered by the Hopedale Project. Click Here for More Info

Excerpts from Crescat Capitals November Newsletter:

Precious Metals

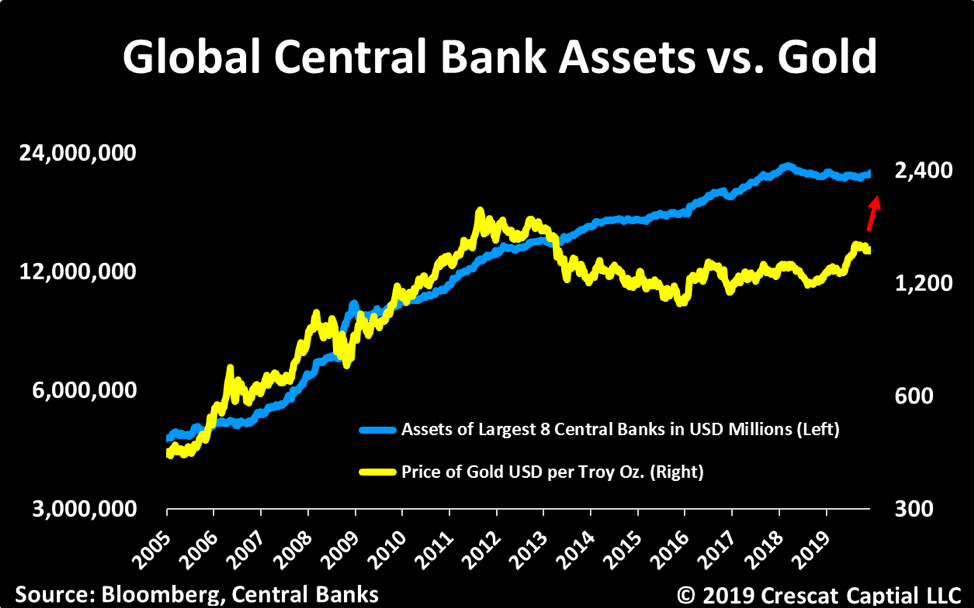

Precious metals are poised to benefit from what we consider to be the best macro set up we’ve seen in our careers. The stars are all aligning. We believe strongly that this time monetary policy will come at a cost. Look in the chart below at how the new wave of global money printing just initiated by the Fed in response to the Treasury market funding crisis is highly likely to pull depressed gold prices up with it.

The imbalance between historically depressed commodity prices relative to record overvalued US stocks remains at the core of our macro views. On the long side, we believe strongly commodities offer tremendous upside potential on many fronts. Precious metals remain our favorite. We view gold as the ultimate haven asset to likely outperform in an environment of either a downturn in the business cycle, rising global currency wars, implosion of fiat currencies backed by record indebted government, or even a full-blown inflationary set up. These scenarios are all possible. Our base case is that governments and central banks will keep their pedals to the metal to attempt to fend off credit implosion or to mop up after one has already occurred until inflation becomes a persistent problem.

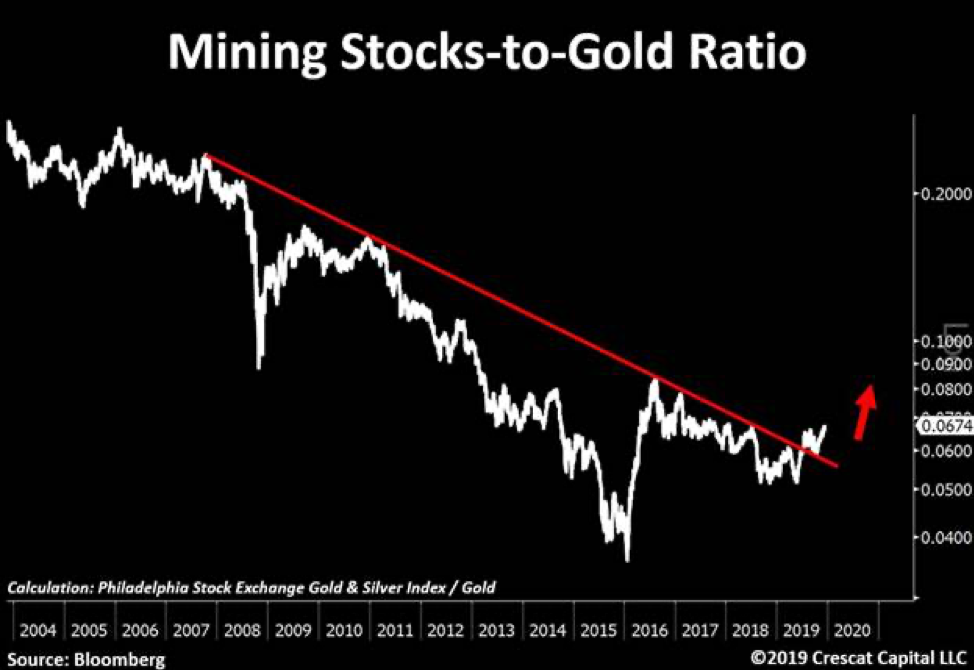

The gold and silver mining industry is precisely where we see one of the greatest ways to express this investment thesis. These stocks have been in a severe bear market from 2011 to 2015 and have been formed a strong base over the last four years. They are offer and incredibly attractive deep-value opportunity and appear to be just starting to break out this year. We have done a deep dive in this sector and met with over 40 different management teams this year. Combining that work with our proprietary equity models, we are finding some of the greatest free-cash-flow growth and value opportunities in the market today unrivaled by any other industry. We have also found undervalued high-quality exploration assets that will make excellent buyout candidates.

We recently point out this 12-year breakout in mining stocks relative to gold now looks as solid as a rock. In our view, this is just the beginning of a major bull market for this entire industry. We encourage investors to consider our new Crescat Precious Metals SMA strategy which is performing extremely well this year.

Zero Discounting for Inflation Risk Today

With historic Federal debt relative to GDP and large deficits into

the future as far as the eye can see, if the global financial markets

cannot absorb the increase in Treasury debt, the Fed will be forced to

monetize it even more. The problem is that the Fed’s panic money

printing at this point in the economic cycle may hasten the unwinding of

the imbalances it is so desperate to maintain because it has perversely

fed the last-gasp melt up of speculation in already record over-valued

and extended equity and corporate credit markets. It is reminiscent of

when the Fed injected emergency cash into the repo market at the peak of

the tech bubble at the end of 1999 to fend off a potential Y2K computer

glitch that led to that market and business cycle top.

After 40

years of declining inflation expectations in the US, there is a major

disconnect today between portfolio positioning, valuation, and economic

reality. Too much of the investment world is long the “risk parityâ€

trade to one degree or another, long stocks paired with leveraged long

bonds, a strategy that has back-tested great over the last 40 years, but

one that would be a disaster in a secular rising inflation environment.

With historic Federal debt relative to GDP and large deficits into

the future as far as the eye can see, rising long-term inflation, and

the hidden tax thereon, is the default, bi-partisan plan for the US

government’s future funding regardless of who is in the White House and

Congress after the 2020 elections. The market could start discounting

this sooner rather than later.

The Fed’s excessive money printing

may only reinforce the unraveling of financial asset imbalances today as

it leads to rising inflation expectations and thereby a sell-off in

today’s highly over-valued long duration assets including Treasury bonds

and US equities, particularly insanely overvalued growth stocks. We

believe we are in the vicinity of a major US stock market and business

cycle peak.

Source:”Running Hot”

Courtesy of Crescat Capital: https://www.crescat.net/running-hot/

Thanks to

Kevin C. Smith, CFA

Chief Investment Officer

Tavi Costa

Portfolio Manager

Tags: #Ashuanipi, #Discovery, #Drilling, #Greenstone, #Hopedale, #LAB, #Labrador, #LabradorGold, #Newfoundland, #Plethora, #ShawnRyan, 2020