Agoracom Blog Home

Archive for the ‘AGORACOM Client Feature’ Category

Online Wagering Platform for the Future of Competitive Gaming

Why VGambling Inc?

“There is no other way to say it … VGambling represents one of the best potential mega winners I’ve seen in years.” George Tsiolis, AGORACOM Founder

“The Business of eSports Is Set To Explode…. Billions of dollars will soon be wagered on eSports competitions. Brands, consultants and investors are always looking for the next great opportunity and eSports appears to be an able applicant for the role.†Forbes Magazine, October 15, 2015

The 5 Things You Need To Know:

1. eSports – Over 130 million people from around the world tune in to watch teams of video game players compete with each other.

2. eSports Wagering – Wagering on eSports is projected to hit $23 BILLION by 2020.

3. VGambling is the next generation online gambling company that is built for the purpose of facilitating as much of this wagering as possible

4. VGambling is fully licensed, compliant and authorized to legally transact in eSports wagering.

5. VGambling has assembled a team of officers and board members with significant star power in the world of eSports and online gambling

Who is VGambling Inc.?

- Company intends to o�ffer users from around the world the ability to wager on professional e-Sports events for real money in licensed and secure environment.

- Makes it possible to play in multi-player video game amateur tournaments and win cash prizes.

- Issued an Internet gambling License by the Kahnawake Gaming Commission in Canada

- Applied for a License in Antigua and Barbuda.

- Company intends to conduct real money interactive gaming activities on a global basis from our base in St. John’s, Antigua.

- Bringing users from these two huge industries together by o�ffering our users from around the world the opportunity to play, and bet on online single and multi-player, video game tournaments for real money in our secure and licensed environment.

- Utilizing VGambling Inc.’s peer-to-peer wagering system, video game fans and enthusiasts everywhere will be able to place all manner of bets on eSports professional players’ performance. Wagering will be available on a wide range of professional eSports events from around the world.

- Company also intends to o�ffer the widest selection of video games of skill, designed to be compatible for all applications including mobile and in multiple languages, to be played online for real money in small groups, tournaments and major events

The Opportunity

INTERNET GAMBLING EXPENDITURE IS INCREASING GLOBALLY

Online gambling, also known as Internet gambling and iGambling, is a general term for gambling using the Internet.

- $40B industry with +20% annual growth

- Sports betting estimated to be 41% of total online market.

- Internet gambling represents +10% of global gambling market

eSports

Electronic sports (also known as eSports, e-sports,

competitive gaming, or progamming in Korea) is a term for organized multiplayer video game competitions.

Last year Riot Games’ “League of Legends†world championship had 27 million streaming views. To provide some correlation, it was more than the average viewership of the World Series of baseball, which is the second most viewed sport in the USA. The number of professional eSports tournaments worldwide more than tripled from 430 in 2013 to 1,485 in 2014.

- eSports organizations hosting major tournaments include the Electronic Sports League in Europe, Major League Gaming in North America, and the Korean eSports Association founded by the Korean government and affliated to the Korean Olympic Committee

- China and Korea continue to dominate the global eSports market

- eSports are currently being seriously considered by the IOC as an Olympic sport

Tags: #smallcapstocks, $TSXV, CSE, esports, eSports Investing, online gambling, otcqb, sports gambling, Vgambling

Posted in AGORACOM Client Feature, All Recent Posts, eSports Investing, VGambling Inc. | Comments Off on FEATURE: VGambling (GMBL: OTCQB) Targeting Billions of Dollars Expected to be Wagered on eSports Competitions $GMBL

TSX-V: BFF, (OTC Pink: SSMLF)

Why Lithium?

- Major companies such as Sony and Panasonic got behind lithium as an anchor material in a possible successor to the lead-acid battery paradigm.

- Although it took decades, lithium-based batteries are now the industry standard.

- Lithium has limited supply and increasing demand.

- Lithium seems untouched by economic downturns.

- Climate change has lead to the frenzied search for green energy solution

- Because of its high reactivity, lithium does not occur as a pure element in nature but is contained within minerals in a range of hard rock types or in brine solutions (elements contained in salty water) in salt lakes, “salars.†Lithium’s primary driver for growth is:

Batteries and grid-scale energy storage:

- Most important use of lithium is in rechargeable lithium-ion batteries for electric vehicles, grid-scale energy storage, phones, laptops, cameras, gaming consoles and hundreds of other electronic devices.

- Lithium-ion batteries are increasingly used for bikes, power tools, forklifts, cranes and other industrial equipment. In essence, lithium powers modern technology.

Benchmark Mineral Intelligence estimates that the

“EV market will grow five-fold between 2015 and 2020 while the market for stationary storage will increase 8-fold.â€

We have already seen Tesla increase the land holding of their $5 billion under-construction lithium-ion battery factory and Faraday Future strike a deal to build a $1 billion electric car plant.

Nevada Energy Metals Acquires 100% Ownership in Clayton Valley BFF-1 Lithium Project

- Announced acquisition of 60 claims in Clayton Valley, Esmeralda County, Nevada

- 250 meters from Albemarle Corporation’s Silver Peak lithium mine and brine processing operations

- Also the location of Pure Energy Minerals’ 816,000 metric tonnes Lithium Carbonate Equivalent (LCE) Inferred Resource

- 3.5 hours away from Tesla’s Gigafactory, which has a planned annual lithium-ion battery production capacity of 35 gigawatt-hours per year by 2020

Nevada Energy Metals Expans Lithium Exploration Potential at San Emidio

Company has increased the exploration potential of the San Emidio property by adding 69 additional claims to its land position. The property now includes 155 claims (approximately 3,100 acres/1255 hectares) in the San Emidio Desert, Washoe County, Nevada, 95 km northeast of Reno.

Importantly, historical results by previous operators exploring the playa for lithium reported lithium value in sediments up to 312 ppm and up to 80 ppm lithium in brine from a depth of 1.5 meters.

Projects

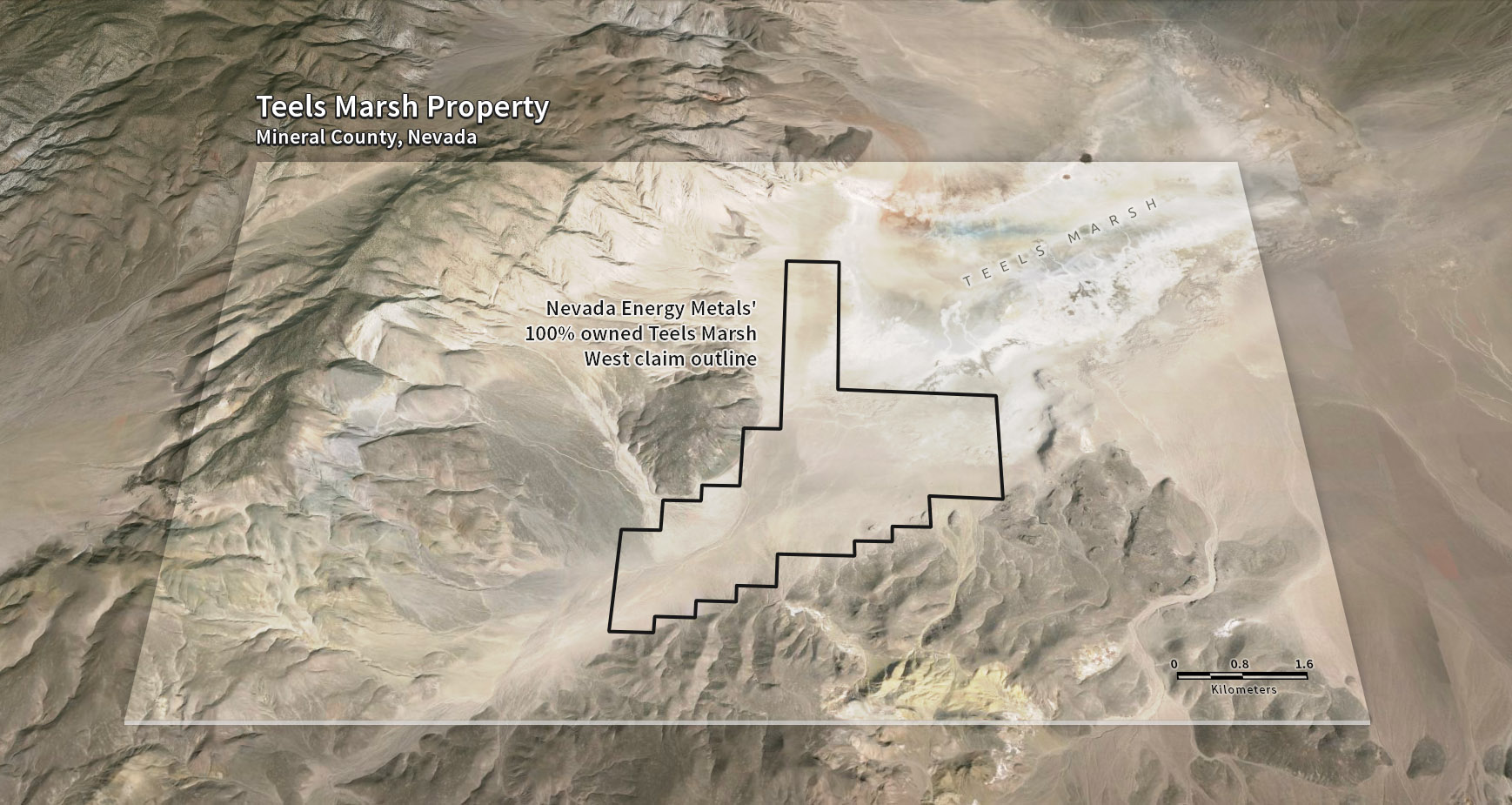

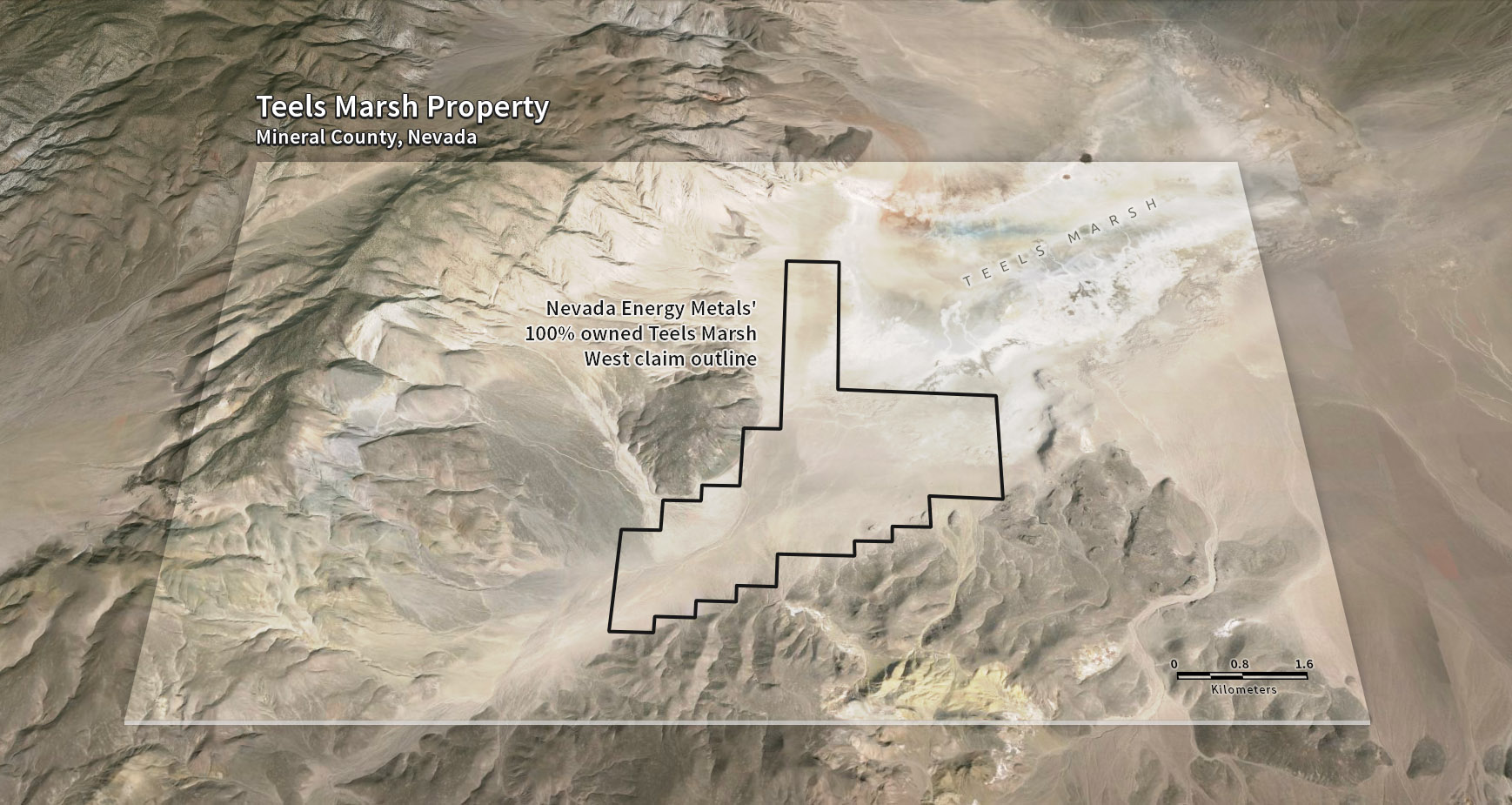

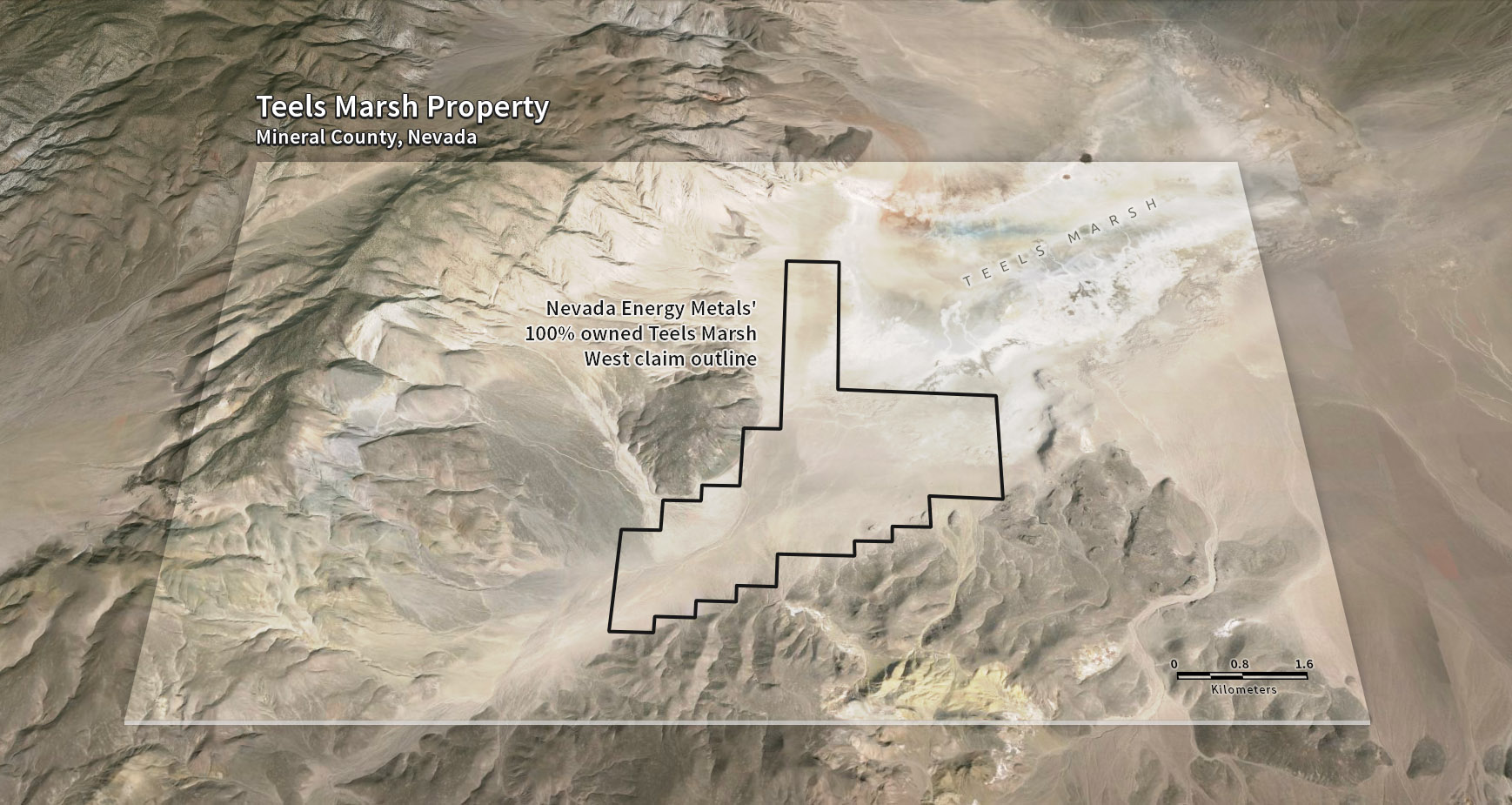

- Acquired, by staking, 100 placer claims covering 2000 acres (809 hectares) at Teels Marsh, Nevada.

- Property, called Teels Marsh West is highly prospective for Lithium brines and is located approximately 48 miles northwest of Clayton Valley and the Rockwood Lithium Mine, North America’s only producing brine based Lithium mine supporting lithium production since 1967.

- Access to Teels Marsh is via dirt road, west of Highway 95 and northwest of Highway 360.

Teels Marsh West is a highly prospective Lithium exploration project, 100% owned without any royalties, located on the western part of a large evaporation pond, or playa (also known as a salar). Structural analysis reveals that Teels Marsh is bounded by faults and is tectonically active. Tectonic activities supply additional local permeability that could be provided by the faults that bound the graben and sub-basins.

- Located 12 km (7.5 miles) northeast of Albemarle Corporation’s (formerly Rockwood Lithium),Silver Peaksolar evaporation ponds. Silver Peak is the only producing brine-based lithium facility in North America.

- 60-40 earn-in joint venture with Dajin Resources Corp.

- In addition to its proximity to Silver Peak, the property is 20 km (12.5 miles) east-northeast of Pure Energy Minerals’ Clayton Valley exploration project.

- Preliminary data from ongoing exploration activities on the property, suggest that Alkali Lake could be situated on one of the most prospective areas in the entire basin.

- Lithium assay results from sediment sampling carried out on the Alkali Lake property confirmed the presence of near-surface lithium at grades ranging from 73 ppm to 382 ppm.

- Early stage exploration property, located in the northern foothills of the Alaska Range, which contains VMS (volcanogenic massive sulfide) mineralization.

- Property is located in the east portion of the Bonnifield Mining District, central Alaska, approximately 60 mi (96 km) south of Fairbanks, Alaska (Figure 1).

- Property consists of 36 quarter-section State of Alaska mining claims (Galleon 1-36; Appendix 1) held by Anglo Alaska Gold Corporation (AAGC). Rock Star Resources Inc (RSRI) holds the rights to a 100% earn-in interest under an agreement with AAGC to pay for exploration and make required payments.

- Access to the Property currently is only by helicopter, or by trail from a nearby airstrip, however, strong potential exists for future development of a road connecting the Property with an existing mine road system to the west.

- The claims are subject to a 3% Net Production Royalty to the State of Alaska beginning 3.5 years after mine start-up. All claims comprising the Galleon Property are in good standing at the time of this writing.

Energy metal markets are booming

The age of electrification across the transportation sector, the solar panel revolution, and Tesla’s battery gigafactory are igniting a battle for the cheapest battery. That will transform lithium into a boom-time mineral and the hottest commodity on the energy investor’s radar. It has been easy to take lithium for granted. This wonder mineral is the backbone of our everyday lives, popping up in everything from the glass in our windows to our mountains of electronics.

And while investors have long appreciated the steady rise in demand for this preferred mineral, the number of new applications continues to multiply. Smart phones, tablets, laptops, and other consumer electronics demand more lithium. But the largest driver for future lithium use will be in electric vehicles and home batteries for solar panels. That has lithium on the verge a boom for which supply can no longer be taken for granted.

Mesh with Us

Tags: Cypress Development Corp. (TSX-V:CYP), Dajin Resources Corp. (TSX-V: DJI) (OTC: DJIFF), Midnight Star Ventures Corp. (CSE: STV), Nevada Sunrise (NEV.V), Pure Energy Minerals (TSX VENTURE: PE), Southern Sun Minerals (TSX-V: SSI)

Posted in AGORACOM Client Feature, All Recent Posts, Nevada Energy Metals | Comments Off on CLIENT FEATURE: Nevada Energy Metals (BFF: TSX-V) Powering Our Green Future $BFF.ca

- Rome property is located approximately 60 km north of Val d’Or Quebec.

- Contiguous to the north and south of RB Energy’s Quebec Lithium Mine with a published measured and indicated resources (at a 0.60% Li2O cutoff) of 41,556,000 tonnes at 1.09% Li2O, and an inferred resource of (at a 0.60% Li20 cutoff) of 17,766,000 million tonnes at 1.10% Li2O

- Also contiguous to Jourdan Resources Vallee Lithium property that drilled more than 4000m of core in 2011 and intersected more 100 pegmatite and aplite dikes.

- Jourdan Resources intersected values of up to 1.187% Li2O over 5.50m

——————————————————-

Recently Announced Industrial Minerals business in Spain

Â

Fully operational processing and finishing facility with 250,000 square metres of annual production capacity

- Demand has been increasing in recent years and is currently strong in Europe Asia, and North America for Granite and industrial minerals.

- FMR receiving strong interest from finance parties in Europe, U.S., and Canada to fund up to 8m euros ($12m CDN) in senior secured debt to complete the acquisition and provide the company with a large operating cash cushion.

- Newly Optioned Lithium Project Adjacent to RB Energy’s Quebec Lithium Mine (Read Release)

GRABASA

- Fully operational processing and finishing facility, the former assets of Granitos de Badajoz S.A.

- 250,000 square metres of annual production capacity

- Total acquisition cost of EUR4.275 million

- Mine licenses and processing facility will make Fairmont one of the largest granite producers in Europe

Hub On AGORACOM / Corporate Profile

Tags: #mining, #smallcapstocks, $TSXV, Jourdan Resources Inc., lithium, RB Energy Inc.

Posted in AGORACOM Client Feature, All Recent Posts, Fairmont Resources | Comments Off on FEATURE: Fairmont (FMR: TSX-V) Optioned Lithium Project Adjacent to RB Energy’s Mine $FMR.ca

(VAI: CSE), (3V3: Frankfurt)

Highlights

- 2015 Revenues $USD 7.36M, Up 53% Over Previous

- Q4 2015 Revenue $USD 2.49M, Up 101% Over Previous

- Real Customers

The Opportunity

- 44% of security leaders expect a major cloud provider to suffer a significant security breach

- 83% Of enterprises have difficulty finding the security skills they need

- 3.8 Million Average cost of a data breach in 2015(Ponemon Institute May 2015)

- #1 CIO priority in 2015 is security (Piper Jaffray CIO Survey)

- $75 Billion Projected global spend on data security in 2015 (Gartner)

- 75% of Of IT leaders planned to increase security budgets in 2015(Piper Jaffray CIO Survey)

Recent Interview

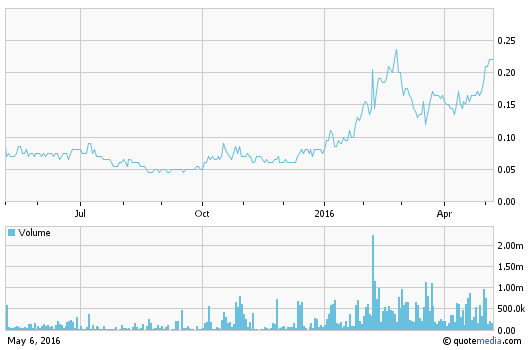

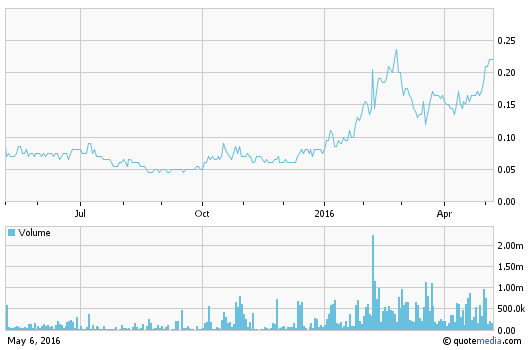

Stock Chart

Hub On AGORACOM / Corporate Profile

Tags: #smallcapstocks, $TSXV, cybersecurity, EMC Corp. (MA) (EMC: NYSE), green technology, Isilon (NASDAQ: ISLN), NetApp (NASDAQ: NTAP), Palo Alto Networks (Nasdaq: PANW), VMware Inc. (VMW: NYSE)

Posted in AGORACOM Client Feature, All Recent Posts, VirtualArmor | Comments Off on CLIENT FEATURE: VirtualArmor (VAI: CSE) With Huge Annual & Quarterly Revenue Growth $VAI.ca

Why Explor Resources?

- Flagship Property Offers The Following:

- NI 43-101 Resource – 609,000 oz Indicated / 470,000 Inferred

- Teck Resources To Spend $12 MILLION To Earn 70%

- Property Is 2.5 KM From Lake Shore Gold Mine

- Property Is 13 KM From Downtown Timmins

- 2nd Project 43-101 Open Pit Resource

- 1.4 MILLION T Indicated @ 1.38% Copper

- 2.09 MILLION T Inferred @ 1.26% Copper

ONTARIO AND NEW BRUNSWICK PROPERTIES CURRENTLY UNDER EXPLORATION

Timmins Porcupine West (TPW) (4300 ha)

- NI 43-101 Resource: 609,000 oz Indicated

470,000 oz Inferred Gold

- 13 km from downtown Timmins

- Property is 2.5 km, NE of LSG West Timmins Mine

- Model: Hollinger McIntyre Gold System: 30,000,000 oz. Au

- Discovery Hole 10-30 : 9.22g/tonne over 11.0 meters

- Optioned to Teck Resources

- Teck to spend $12,000,000 to earn 70% interest

Chester Copper & VMS Project (3500ha)

- Mineral Target: Cu, Pb, Zn, Ag, & Au

- 70 km SW of Bathurst NB

- Structural Model Complete

- 300 m wide x 2000m long mineralized Corridor identified

- Ramp to ore zone (480 meter long (3m x 4m)

- Optioned to Brunswick Resources (BRU)

- Brunswick to spend $500,000 over 3 years

- Explore to receive $40,000 and 5,000,000 shares of BRU

- Open pit resource – NI 43-101 Resource: 1,400,000 Indicated t @ 1.38% Cu

2,089,000 Inferred t @ 1.26 % Cu

Kidd Creek Project (2466 ha)

- Mineral Target: Cu-Zn Ore

- Located 1.0 km west of Kidd Creek Mine

- Kidd Mine yielded 130M tonnes of Cu-Zn Ore since 1960

- Numerous Geophysical max/min and IP Targets

- Diamond Drilling winter 2015/2016

QUEBEC PROPERTIES CURRENTLY UNDER EXPLORATION

East Bay (3203 ha):

- Mineral Target: Gold

- Lies on Porcupine Destor Fault Zone, on strike with Beattie & Donchester mine

- Historical channel samples by Lacana Mining in 1982 including: 0.81 oz/ton over 5ft; 0.16 oz/ton over 6 ft; 0.10 oz/ton over 10 ft

- Wrap around Clifton Star

Nelligan (1198 ha):

- Mineral Target: Nickel

- Located in Val d’Or mining district of Quebec

- Historical grab samples of 10% Ni and 0.6% Cu obtained by INCO

- Discovered anomalous Nickel, Copper Zones

Launay (2250 ha):

- Mineral Target: Nickel

- Mineralized zones contained in mafic volcanic rocks

- Contiguous to Royal Nickel’s Dumont property (NW end)

12 Month Stock Chart

Tags: #mining, #smallcapstocks, $TSXV, Teck Resources (tck.b: tsx), Timmins Gold Corp. (TMM.T)

Posted in AGORACOM Client Feature, All Recent Posts, Explor Resources Inc. | Comments Off on FEATURE: Explor Resources (EXS: TSX-V) 609K oz Indicated / 470K Inferred, Teck Resources To Spend $12 MILLION To Earn 70% $EXS.ca

AMK: TSX-V, ACKRF: OTC Pink

WHY AMERICAN CREEK RESOURCES?

- Mineralization in the Treaty Creek claims area lies within the same broad hydrothermal system that generated the several deposits on the Seabridge Gold KSM and the Pretivm Brucejack properties that lie immediately southwest of the Treaty Creek claims

- 20% fully carried interest

- So far over 130 million ounces of gold, 800 million ounces of silver and 20 billion pounds of copper (all categories included), representing one of the greatest concentrations of metal value on the planet, have been delineated within the geological system shared by KSM, Brucejack, and Treaty Creek.

RECENT HIGHLIGHTS

- Entered into two separate joint venture agreements with Tudor Gold Corp. (TSX VENTURE:TUD) (Read Release)

- Specimens from the structure averages 27,092 gm/tonne silver and 248 gm/tonne gold

- Results from outcrop specimens of high grade material collected on its Electrum property from the Shiny Cliff vein on the North Face Showing Read More

- TSX Venture Exchange approved the Amended and Restated Purchase Agreement regarding the Treaty Creek NSR that was previously announced April 13, 2016. Read Our Recent Blog

Exceptional Properties

Electrum Gold-Silver Property, British Columbia – 100% owned

The Electrum property has a rich history with some of the highest grade hand-mined ore mined in North America combined with excellent logistics. The property is located directly between two high-grad vein gold/silver mines; the past producing Silbak Premier mine and Pretiums high-grade Brucejack mine (production in 2017).All three lie within the Iskut mineral district (a particularly prolific part of the Canadian Cordillera) with numerous geological similarities between them.

The Electrum Property holds significant potential to attract mining companies when considering its high-grade nature combined with the exceptional logistics in place.

- Located in the prolific Golden Triangle of northwestern British Columbia, an area encompassing mineral rich belts that host more than 43 past producing mines including Eskay Creek, Silbak Premier, Granduc and Big Missouri.It is a hotbed of activity with one new mine having come online in 2015 (Imperial Mines Red Chris) and another scheduled for 2017 (Pretium Brucejack) and at least three more world-class mining projects headed toward production.

- Located in a particularly rich valley with 4 past producing commercial mines and a 5th in the adjacent valley.

- Includes the historic East Gold Mine that had intermittent small-scale production of approximately 46 tonnes of ore with grades averaging 1,661 grams of gold per tonne and 2,596 grams of silver per tone (roughly 50oz gold with 75oz silver).

- Mineralization is believed to be very similar to the silver-gold-base metal veins responsible for the precious metal mineralization found in the Silbak Premier Mine and the Big Missouri mines (located in same extended valley).

- Pretiums Brucejack Summary Report (for exploration) compares itself geologically to the Silbak Premier mine as well.

- Exceptional gold and silver assays including 440 g/t gold with 400 g/t silver over 0.52m, with numerous silver intervals of 583g/t, 501 g/t, 420 g/t, 384 g/t in core, and surface samples of 80.96 g/t gold with 80,818 g/t silver, 694 g/t gold with 550 g/t silver, 54.77 g/t gold with 14,903 g/t silver, 615 g/t gold with 616 g/t silver.

- A very successful program was run in 2015 wherein:

- A new approach focusing on high-grade was employed very successfully

- A new zone of gold / silver mineralization was discovered

- A better understanding of the property geology was obtained

- Surface samples from the structure averages 27,092 gm/tonne silver and 248 gm/tonne gold

- The program proved the Electrum Property has multiple high-grade gold-silver epithermal breccia vein systems and gave us a better understating of their sequencing.

- Excellent logistics including road access, power located 2 km away and a bulk tonnage shipping port and supportive mining town located just40 km away in a mining friendly jurisdiction.

The high-grade ELECTRUM PROPERTY recently had a program run on it. CLICK HERE for the Electrum presentation and HERE for the 2015 drill program presentation. The highly mineralized gossans on the Electrum are shown in the image at the top of this page.

2015 Drill Program Presentation

Treaty Creek Gold-Copper Property, British Columbia – 51% Joint Venture

Treaty Creek Property

Treaty Creek is located in British Columbia’s prolific Golden Triangle; one of the richest areas of mineralization in the world with one new mine having come online in 2015 (Imperial Mines Red Chris) and another scheduled for 2017 (Pretium Brucejack) and at least three more world-class mining projects headed toward production.

Mineralization in the Treaty Creek claims area lies within the same broad hydrothermal system that generated the several deposits on the Seabridge Gold KSM and the Pretivm Brucejack properties that lie immediately southwest of the Treaty Creek claims. So far over 130 million ounces of gold, 800 million ounces of silver and 20 billion pounds of copper (all categories included), representing one of the greatest concentrations of metal value on the planet, have been delineated within the geological system shared by KSM, Brucejack, and Treaty Creek.

Seabridge Gold’s KSM is the world’s largest undeveloped gold/silver project by reserves while Pretium’s Brucejack is the highest grading undeveloped large-scale gold project in the world.KSM has just past the environmental and permitting stage while the Brucejack is in construction phase.

Treaty Creek is part of the same large hydrothermal system as it’s neighbours, hosts the same bedrock geology as its neighbours, the same magneto-telluric (MT) anomalies that proved to be large deposits on the neighbours claims, the same major fault system (Sulphurets) that is responsible for KSM’s deposits, and initial exploration and drilling show similar results to initial drilling on KSM.

The Treaty Creek property is in a strategic location as it’s included in Seabridge’s plan for the KSM to go into production. Seabridge has proposed twin tunnels that would take the KSM ore through American Creek’s Treaty Creek property to a processing plant and tailings pond.

Tags: #mining, #smallcapstocks, $TSXV, gold, Seabridge Gold (SEA.T), Treaty Creek

Posted in AGORACOM Client Feature, American Creek Resources Ltd. | Comments Off on FEATURE:Treaty Creek Included In Seabridge Gold Plan To Take KSM Into Production $AMK.ca

Why Explor Resources?

- Flagship Property Offers The Following:

- NI 43-101 Resource – 609,000 oz Indicated / 470,000 Inferred

- Teck Resources To Spend $12 MILLION To Earn 70%

- Property Is 2.5 KM From Lake Shore Gold Mine

- Property Is 13 KM From Downtown Timmins

- 2nd Project 43-101 Open Pit Resource

- 1.4 MILLION T Indicated @ 1.38% Copper

- 2.09 MILLION T Inferred @ 1.26% Copper

ONTARIO AND NEW BRUNSWICK PROPERTIES CURRENTLY UNDER EXPLORATION

Timmins Porcupine West (TPW) (4300 ha)

- NI 43-101 Resource: 609,000 oz Indicated

470,000 oz Inferred Gold

- 13 km from downtown Timmins

- Property is 2.5 km, NE of LSG West Timmins Mine

- Model: Hollinger McIntyre Gold System: 30,000,000 oz. Au

- Discovery Hole 10-30 : 9.22g/tonne over 11.0 meters

- Optioned to Teck Resources

- Teck to spend $12,000,000 to earn 70% interest

Chester Copper & VMS Project (3500ha)

- Mineral Target: Cu, Pb, Zn, Ag, & Au

- 70 km SW of Bathurst NB

- Structural Model Complete

- 300 m wide x 2000m long mineralized Corridor identified

- Ramp to ore zone (480 meter long (3m x 4m)

- Optioned to Brunswick Resources (BRU)

- Brunswick to spend $500,000 over 3 years

- Explore to receive $40,000 and 5,000,000 shares of BRU

- Open pit resource – NI 43-101 Resource: 1,400,000 Indicated t @ 1.38% Cu

2,089,000 Inferred t @ 1.26 % Cu

Kidd Creek Project (2466 ha)

- Mineral Target: Cu-Zn Ore

- Located 1.0 km west of Kidd Creek Mine

- Kidd Mine yielded 130M tonnes of Cu-Zn Ore since 1960

- Numerous Geophysical max/min and IP Targets

- Diamond Drilling winter 2015/2016

QUEBEC PROPERTIES CURRENTLY UNDER EXPLORATION

East Bay (3203 ha):

- Mineral Target: Gold

- Lies on Porcupine Destor Fault Zone, on strike with Beattie & Donchester mine

- Historical channel samples by Lacana Mining in 1982 including: 0.81 oz/ton over 5ft; 0.16 oz/ton over 6 ft; 0.10 oz/ton over 10 ft

- Wrap around Clifton Star

Nelligan (1198 ha):

- Mineral Target: Nickel

- Located in Val d’Or mining district of Quebec

- Historical grab samples of 10% Ni and 0.6% Cu obtained by INCO

- Discovered anomalous Nickel, Copper Zones

Launay (2250 ha):

- Mineral Target: Nickel

- Mineralized zones contained in mafic volcanic rocks

- Contiguous to Royal Nickel’s Dumont property (NW end)

12 Month Stock Chart

Tags: #mining, #smallcapstocks, $TSXV, gold, Teck Resources (tck.b: tsx), Timmins Mining

Posted in AGORACOM Client Feature, All Recent Posts, Explor Resources Inc. | Comments Off on FEATURE: Explor Resources (EXS: TSX-V) 609K oz Indicated / 470K Inferred, Teck Resources To Spend $12 MILLION To Earn 70% $EXS.ca

AMK: TSX-V, ACKRF: OTC Pink

WHY AMERICAN CREEK RESOURCES?

- Mineralization in the Treaty Creek claims area lies within the same broad hydrothermal system that generated the several deposits on the Seabridge Gold KSM and the Pretivm Brucejack properties that lie immediately southwest of the Treaty Creek claims

- So far over 130 million ounces of gold, 800 million ounces of silver and 20 billion pounds of copper (all categories included), representing one of the greatest concentrations of metal value on the planet, have been delineated within the geological system shared by KSM, Brucejack, and Treaty Creek.

RECENT HIGHLIGHTS

- Specimens from the structure averages 27,092 gm/tonne silver and 248 gm/tonne gold

- Results from outcrop specimens of high grade material collected on its Electrum property from the Shiny Cliff vein on the North Face Showing Read More

- TSX Venture Exchange approved the Amended and Restated Purchase Agreement regarding the Treaty Creek NSR that was previously announced April 13, 2016. Read Our Recent Blog

Exceptional Properties

Electrum Gold-Silver Property, British Columbia – 100% owned

The Electrum property has a rich history with some of the highest grade hand-mined ore mined in North America combined with excellent logistics. The property is located directly between two high-grad vein gold/silver mines; the past producing Silbak Premier mine and Pretiums high-grade Brucejack mine (production in 2017).All three lie within the Iskut mineral district (a particularly prolific part of the Canadian Cordillera) with numerous geological similarities between them.

The Electrum Property holds significant potential to attract mining companies when considering its high-grade nature combined with the exceptional logistics in place.

- Located in the prolific Golden Triangle of northwestern British Columbia, an area encompassing mineral rich belts that host more than 43 past producing mines including Eskay Creek, Silbak Premier, Granduc and Big Missouri.It is a hotbed of activity with one new mine having come online in 2015 (Imperial Mines Red Chris) and another scheduled for 2017 (Pretium Brucejack) and at least three more world-class mining projects headed toward production.

- Located in a particularly rich valley with 4 past producing commercial mines and a 5th in the adjacent valley.

- Includes the historic East Gold Mine that had intermittent small-scale production of approximately 46 tonnes of ore with grades averaging 1,661 grams of gold per tonne and 2,596 grams of silver per tone (roughly 50oz gold with 75oz silver).

- Mineralization is believed to be very similar to the silver-gold-base metal veins responsible for the precious metal mineralization found in the Silbak Premier Mine and the Big Missouri mines (located in same extended valley).

- Pretiums Brucejack Summary Report (for exploration) compares itself geologically to the Silbak Premier mine as well.

- Exceptional gold and silver assays including 440 g/t gold with 400 g/t silver over 0.52m, with numerous silver intervals of 583g/t, 501 g/t, 420 g/t, 384 g/t in core, and surface samples of 80.96 g/t gold with 80,818 g/t silver, 694 g/t gold with 550 g/t silver, 54.77 g/t gold with 14,903 g/t silver, 615 g/t gold with 616 g/t silver.

- A very successful program was run in 2015 wherein:

- A new approach focusing on high-grade was employed very successfully

- A new zone of gold / silver mineralization was discovered

- A better understanding of the property geology was obtained

- Surface samples from the structure averages 27,092 gm/tonne silver and 248 gm/tonne gold

- The program proved the Electrum Property has multiple high-grade gold-silver epithermal breccia vein systems and gave us a better understating of their sequencing.

- Excellent logistics including road access, power located 2 km away and a bulk tonnage shipping port and supportive mining town located just40 km away in a mining friendly jurisdiction.

The high-grade ELECTRUM PROPERTY recently had a program run on it. CLICK HERE for the Electrum presentation and HERE for the 2015 drill program presentation. The highly mineralized gossans on the Electrum are shown in the image at the top of this page.

2015 Drill Program Presentation

Treaty Creek Gold-Copper Property, British Columbia – 51% Joint Venture

Treaty Creek Property

Treaty Creek is located in British Columbia’s prolific Golden Triangle; one of the richest areas of mineralization in the world with one new mine having come online in 2015 (Imperial Mines Red Chris) and another scheduled for 2017 (Pretium Brucejack) and at least three more world-class mining projects headed toward production.

Mineralization in the Treaty Creek claims area lies within the same broad hydrothermal system that generated the several deposits on the Seabridge Gold KSM and the Pretivm Brucejack properties that lie immediately southwest of the Treaty Creek claims. So far over 130 million ounces of gold, 800 million ounces of silver and 20 billion pounds of copper (all categories included), representing one of the greatest concentrations of metal value on the planet, have been delineated within the geological system shared by KSM, Brucejack, and Treaty Creek.

Seabridge Gold’s KSM is the world’s largest undeveloped gold/silver project by reserves while Pretium’s Brucejack is the highest grading undeveloped large-scale gold project in the world.KSM has just past the environmental and permitting stage while the Brucejack is in construction phase.

Treaty Creek is part of the same large hydrothermal system as it’s neighbours, hosts the same bedrock geology as its neighbours, the same magneto-telluric (MT) anomalies that proved to be large deposits on the neighbours claims, the same major fault system (Sulphurets) that is responsible for KSM’s deposits, and initial exploration and drilling show similar results to initial drilling on KSM.

The Treaty Creek property is in a strategic location as it’s included in Seabridge’s plan for the KSM to go into production. Seabridge has proposed twin tunnels that would take the KSM ore through American Creek’s Treaty Creek property to a processing plant and tailings pond.

Tags: #mining, #smallcapstocks, $TSXV, gold, Pretium Resources (PVG.T), Seabridge Gold (SEA.T)

Posted in AGORACOM Client Feature, All Recent Posts, American Creek Resources Ltd. | Comments Off on CLIENT FEATURE: American Creek’s Treaty Creek Included In Seabridge Gold Plan To Take KSM Into Production $AMK.ca

TSX-V: BFF, OTC Pink: SSMLF

Why Lithium?

- Major companies such as Sony and Panasonic got behind lithium as an anchor material in a possible successor to the lead-acid battery paradigm.

- Although it took decades, lithium-based batteries are now the industry standard.

- Lithium has limited supply and increasing demand.

- Lithium seems untouched by economic downturns.

- Lithium prices increased by about 20% in 2014 and by a larger percentage in 2015 when gas, coal and natural gas were down 50%

- Climate change has lead to the frenzied search for green energy solution

- Because of its high reactivity, lithium does not occur as a pure element in nature but is contained within minerals in a range of hard rock types or in brine solutions (elements contained in salty water) in salt lakes, “salars.†Lithium’s primary driver for growth is:

Batteries and grid-scale energy storage:

- Most important use of lithium is in rechargeable lithium-ion batteries for electric vehicles, grid-scale energy storage, phones, laptops, cameras, gaming consoles and hundreds of other electronic devices.

- Lithium-ion batteries are increasingly used for bikes, power tools, forklifts, cranes and other industrial equipment. In essence, lithium powers modern technology.

Benchmark Mineral Intelligence estimates that the

“EV market will grow five-fold between 2015 and 2020 while the market for stationary storage will increase 8-fold.â€

We have already seen Tesla increase the land holding of their $5 billion under-construction lithium-ion battery factory and Faraday Future strike a deal to build a $1 billion electric car plant.

Nevada Energy Metals Acquires 100% Ownership in Clayton Valley BFF-1 Lithium Project

- Announced acquisition of 60 claims in Clayton Valley, Esmeralda County, Nevada

- 250 meters from Albemarle Corporation’s Silver Peak lithium mine and brine processing operations

- Also the location of Pure Energy Minerals’ 816,000 metric tonnes Lithium Carbonate Equivalent (LCE) Inferred Resource

- 3.5 hours away from Tesla’s Gigafactory, which has a planned annual lithium-ion battery production capacity of 35 gigawatt-hours per year by 2020

Nevada Energy Metals Expans Lithium Exploration Potential at San Emidio

Company has increased the exploration potential of the San Emidio property by adding 69 additional claims to its land position. The property now includes 155 claims (approximately 3,100 acres/1255 hectares) in the San Emidio Desert, Washoe County, Nevada, 95 km northeast of Reno.

Importantly, historical results by previous operators exploring the playa for lithium reported lithium value in sediments up to 312 ppm and up to 80 ppm lithium in brine from a depth of 1.5 meters.

Projects

- Acquired, by staking, 100 placer claims covering 2000 acres (809 hectares) at Teels Marsh, Nevada.

- Property, called Teels Marsh West is highly prospective for Lithium brines and is located approximately 48 miles northwest of Clayton Valley and the Rockwood Lithium Mine, North America’s only producing brine based Lithium mine supporting lithium production since 1967.

- Access to Teels Marsh is via dirt road, west of Highway 95 and northwest of Highway 360.

Teels Marsh West is a highly prospective Lithium exploration project, 100% owned without any royalties, located on the western part of a large evaporation pond, or playa (also known as a salar). Structural analysis reveals that Teels Marsh is bounded by faults and is tectonically active. Tectonic activities supply additional local permeability that could be provided by the faults that bound the graben and sub-basins.

- Located 12 km (7.5 miles) northeast of Albemarle Corporation’s (formerly Rockwood Lithium),Silver Peaksolar evaporation ponds. Silver Peak is the only producing brine-based lithium facility in North America.

- 60-40 earn-in joint venture with Dajin Resources Corp.

- In addition to its proximity to Silver Peak, the property is 20 km (12.5 miles) east-northeast of Pure Energy Minerals’ Clayton Valley exploration project.

- Preliminary data from ongoing exploration activities on the property, suggest that Alkali Lake could be situated on one of the most prospective areas in the entire basin.

- Lithium assay results from sediment sampling carried out on the Alkali Lake property confirmed the presence of near-surface lithium at grades ranging from 73 ppm to 382 ppm.

- Early stage exploration property, located in the northern foothills of the Alaska Range, which contains VMS (volcanogenic massive sulfide) mineralization.

- Property is located in the east portion of the Bonnifield Mining District, central Alaska, approximately 60 mi (96 km) south of Fairbanks, Alaska (Figure 1).

- Property consists of 36 quarter-section State of Alaska mining claims (Galleon 1-36; Appendix 1) held by Anglo Alaska Gold Corporation (AAGC). Rock Star Resources Inc (RSRI) holds the rights to a 100% earn-in interest under an agreement with AAGC to pay for exploration and make required payments.

- Access to the Property currently is only by helicopter, or by trail from a nearby airstrip, however, strong potential exists for future development of a road connecting the Property with an existing mine road system to the west.

- The claims are subject to a 3% Net Production Royalty to the State of Alaska beginning 3.5 years after mine start-up. All claims comprising the Galleon Property are in good standing at the time of this writing.

Energy metal markets are booming

The age of electrification across the transportation sector, the solar panel revolution, and Tesla’s battery gigafactory are igniting a battle for the cheapest battery. That will transform lithium into a boom-time mineral and the hottest commodity on the energy investor’s radar. It has been easy to take lithium for granted. This wonder mineral is the backbone of our everyday lives, popping up in everything from the glass in our windows to our mountains of electronics.

And while investors have long appreciated the steady rise in demand for this preferred mineral, the number of new applications continues to multiply. Smart phones, tablets, laptops, and other consumer electronics demand more lithium. But the largest driver for future lithium use will be in electric vehicles and home batteries for solar panels. That has lithium on the verge a boom for which supply can no longer be taken for granted.

12 Month Stock Chart

Mesh with Us

Tags: #mining, #smallcapstocks, $TSXV, Cypress Development Corp. (TSX-V:CYP), Dajin Resources Corp. (TSX-V: DJI) (OTC: DJIFF), lithium, Midnight Star Ventures Corp. (CSE: STV), Nevada Sunrise Gold Corporation (TSXV: NEV), Pure Energy Minerals (TSX VENTURE: PE), Southern Sun Minerals (TSX-V: SSI)

Posted in AGORACOM Client Feature, All Recent Posts, Nevada Energy Metals | Comments Off on CLIENT FEATURE: Nevada Energy Metals (BFF: TSX-V) Powering Our Green Future $BFF

Why Explor Resources?

- Flagship Property Offers The Following:

- NI 43-101 Resource – 609,000 oz Indicated / 470,000 Inferred

- Teck Resources To Spend $12 MILLION To Earn 70%

- Property Is 2.5 KM From Lake Shore Gold Mine

- Property Is 13 KM From Downtown Timmins

- 2nd Project 43-101 Open Pit Resource

- 1.4 MILLION T Indicated @ 1.38% Copper

- 2.09 MILLION T Inferred @ 1.26% Copper

ONTARIO AND NEW BRUNSWICK PROPERTIES CURRENTLY UNDER EXPLORATION

Timmins Porcupine West (TPW) (4300 ha)

- NI 43-101 Resource: 609,000 oz Indicated

470,000 oz Inferred Gold

- 13 km from downtown Timmins

- Property is 2.5 km, NE of LSG West Timmins Mine

- Model: Hollinger McIntyre Gold System: 30,000,000 oz. Au

- Discovery Hole 10-30 : 9.22g/tonne over 11.0 meters

- Optioned to Teck Resources

- Teck to spend $12,000,000 to earn 70% interest

Chester Copper & VMS Project (3500ha)

- Mineral Target: Cu, Pb, Zn, Ag, & Au

- 70 km SW of Bathurst NB

- Structural Model Complete

- 300 m wide x 2000m long mineralized Corridor identified

- Ramp to ore zone (480 meter long (3m x 4m)

- Optioned to Brunswick Resources (BRU)

- Brunswick to spend $500,000 over 3 years

- Explore to receive $40,000 and 5,000,000 shares of BRU

- Open pit resource – NI 43-101 Resource: 1,400,000 Indicated t @ 1.38% Cu

2,089,000 Inferred t @ 1.26 % Cu

Kidd Creek Project (2466 ha)

- Mineral Target: Cu-Zn Ore

- Located 1.0 km west of Kidd Creek Mine

- Kidd Mine yielded 130M tonnes of Cu-Zn Ore since 1960

- Numerous Geophysical max/min and IP Targets

- Diamond Drilling winter 2015/2016

QUEBEC PROPERTIES CURRENTLY UNDER EXPLORATION

East Bay (3203 ha):

- Mineral Target: Gold

- Lies on Porcupine Destor Fault Zone, on strike with Beattie & Donchester mine

- Historical channel samples by Lacana Mining in 1982 including: 0.81 oz/ton over 5ft; 0.16 oz/ton over 6 ft; 0.10 oz/ton over 10 ft

- Wrap around Clifton Star

Nelligan (1198 ha):

- Mineral Target: Nickel

- Located in Val d’Or mining district of Quebec

- Historical grab samples of 10% Ni and 0.6% Cu obtained by INCO

- Discovered anomalous Nickel, Copper Zones

Launay (2250 ha):

- Mineral Target: Nickel

- Mineralized zones contained in mafic volcanic rocks

- Contiguous to Royal Nickel’s Dumont property (NW end)

12 Month Stock Chart

Tags: #mining, #smallcapstocks, $TSXV, Abitibi Greenstone Belt, Lake Shore Gold (TSX:LSG), Rogue Resources Inc. (TSX VENTURE: RRS), Teck Resources (tck.b: tsx), West Timmins Mining Inc. (TSX:WTM)

Posted in AGORACOM Client Feature, All Recent Posts, Explor Resources Inc. | Comments Off on CLIENT FEATURE: Explor Resources (EXS: TSX-V) Flagship Property Hosts NI 43-101 Resource of 609,000 oz Indicated / 470,000 Inferred Gold $EXS.ca