AGORACOM Remains Largest Small-Cap Investor Relations Site In The World

Happy New Year too all of the current officers on this list and welcome to all new officers added since our last e-mail, in which we announced hitting 300 Million Page Views In 5 Years.

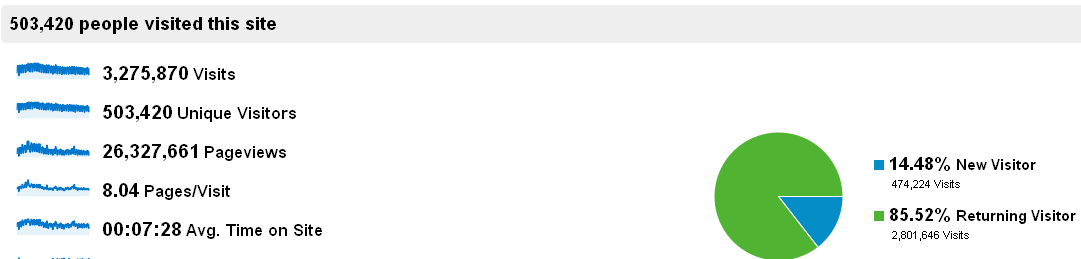

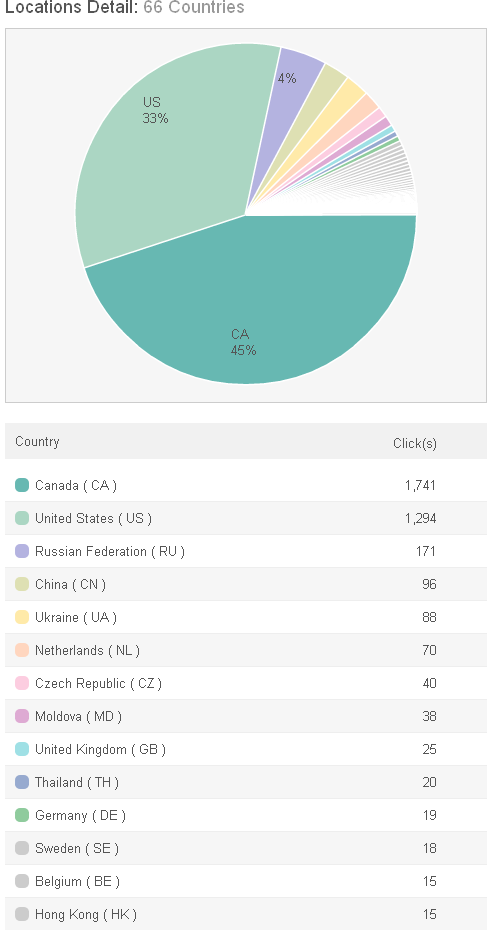

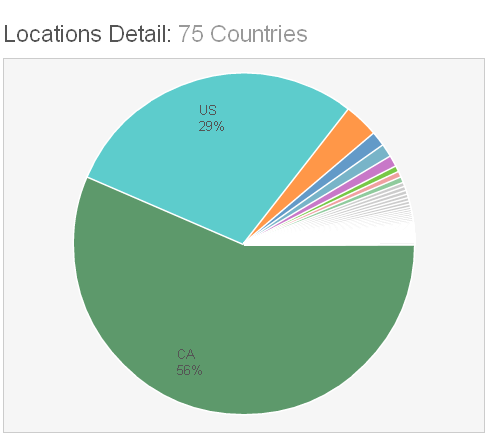

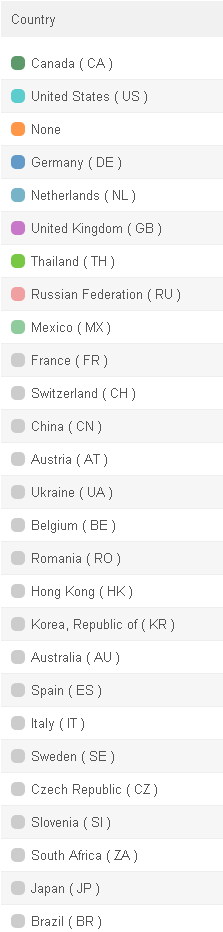

We are very pleased to announce that AGORACOM continues to hit significant traffic milestones in the small-cap space, with more than 45,000,000 (million) page views and 5,000,000 visits to AGORACOM in 2012. These traffic figures are especially pleasing given the significant difficult faced by small-caps in 2012, as they demonstrate investor desire to find their next great small cap stock

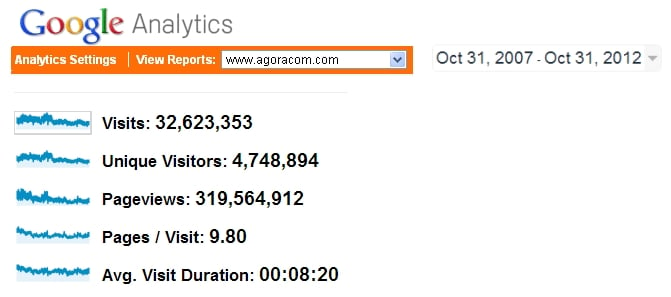

As always, here is the official Google Analytics snapshot for the full year 2012

SURPASSED 300 MILLION PAGES, 4.6 MILLION INVESTORS IN 5 YEARS

For those of you that are new to our newsletter or didn’t get a chance to review the last update, here is the official Google Analytics Snapshot surpassing 300,000,000 pages and 4,600,000 visitors.

WHY TRAFFIC DATA IS IMPORTANT FOR ONLINE INVESTOR RELATIONS

We believe data is critical in a world where anyone that can open a simple Twitter or Facebook account is holding themselves out as an online IR “experts†a.k.a. pretenders that are simply looking to capitalize on a fad … to rob you of your time and money.

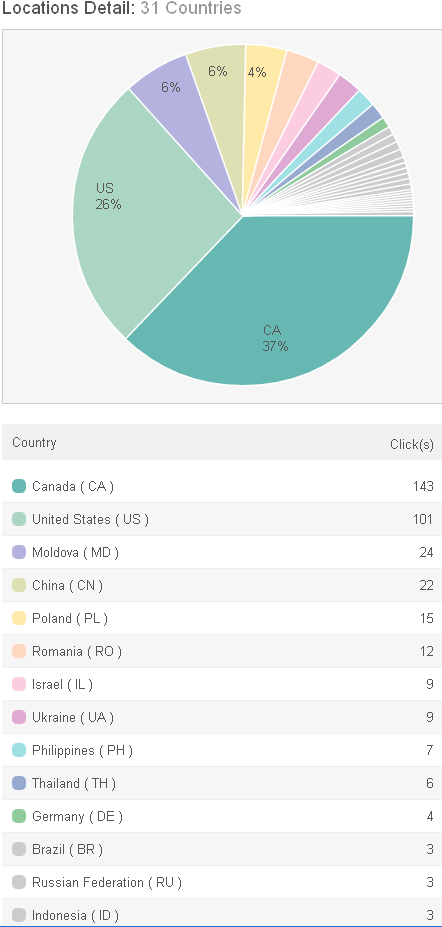

The web is a big place, we all know that. But if a provider doesn’t have both large and targeted traffic of small-cap investors, they may as well be yelling from the top of the CN Tower.

AGORACOM has the traffic.

CONTACT US TO DISCUSS YOUR ONLINE IR NEEDS AND OUR POTENTIAL SOLUTIONS

I thank-you for reading and trust you found this information to be helpful. If you’re ready to step into real and sustainable online investor relations for 2013 and beyond, please contact me below.

Best Regards,

George Tsiolis, LL.B

Founder & President

AGORACOM Investor Relations