- Keymet is a past producing Pollymetallic property

- Hole Ky-17-6 included 50M of arsenopyrite which has traditionally carried gold at Keymet

- Pollymetallic mines are the most sought after Base Metal projects due to presence of multiple ore types

Vancouver, British Columbia (FSCwire) – GREAT ATLANTIC RESOURCES CORP. (TSXV.GR) (the “Company†or “Great Atlanticâ€) is pleased to announce it has completed a diamond drilling program at its Keymet Precious – Base Metal Property, located near Bathurst, northeast New Brunswick. The Keymet property hosts multiple gold, silver, zinc, lead and / or copper occurrences and the Keymet deposit, site of the historic Keymet Mine. The drilling program (5 holes totalling 679 meters) was conducted in the northwest region of the property, northwest of the historic Keymet Mine.

“We are very encourage at this year’s drill program and are enthusiastically awaiting all the results but particularly interested in the unexpected arsenopyrite within a 50 meter core length interval in hole Ky-17-6, traditionally arsenopyrite has carried Gold on this property. As well we want to say a special thanks to Don and the guys at Orbit Garant Drilling, excellent job “Says: Christopher R Anderson CEO

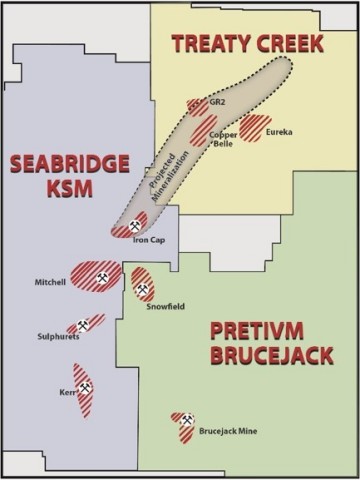

To view the graphic in its original size, please click here

The program tested the continuation of zinc, copper and silver bearing veins and a gold mineralization intersected by Great Atlantic during 2015 diamond drilling and trenching programs. All five holes intersected veins hosting base metal sulfides while three holes also intersected arsenopyrite mineralization. Gold mineralization on the property is associated with arsenopyrite. Â The Company is conducting systematic sampling of mineralized drill core from the recent program.

Gold bearing boulders (samples up to 51 grams / tonne (g/t) Au) and gold bearing bedrock in trenches and drill core have been discovered by Great Atlantic in the northwest region of the property. Great Atlantic drilled two holes in 2015 at one site in this region (Ky-15-3 and Ky-15-4), approximately 1.4 kilometers of the historic Keymet Mine, in an area referred to as the Elmtree 12 occurrence. Both 2015 holes intersected base metal and silver bearing veins (including 16.68% zinc, 1.11% copper and 152.0 g/t silver over 1.80 metre core length in Ky-15-3 and 8.68% zinc and 44.8 g/t silver Ag over 4.28 metre core length in Ky-15-4). Hole Ky-15-3 also intersected a gold bearing interval (3.28 g/t Au over 2.1 meter core length). The true width of these initial 2015 drill intersections is unknown at this time. The recent drilling tested the continuation of this base metal and precious metal mineralization.

To view the graphic in its original size, please click here

Each of the 2017 drill holes intersected veins with copper, lead and zinc sulfide mineralization. Arsenopyrite mineralization has been observed in three of these holes. Gold mineralization in boulders and bedrock in this area is associated with arsenopyrite.

Holes Ky-17-5, 6, 7 and 9 of the recent program were drilled in the same area as 2015 holes Ky-15-3 and 4. Each of these four holes intersected base metal bearing veins. Company management are interpreting the main veins to be within a steep dipping to vertical vein system to strike approximately north – south, with all Great Atlantic drill intersections to date being within an approximately 70 meter strike length and shallow (above 100 meter vertical depth). Hole Ky-17-6 intersected local arsenopyrite within an approximate 50 meter core length interval appearing to be east to northeast of the main base metal bearing vein zone. Holes Ky-17-5 and 7 also intersected local arsenopyrite.

To view the graphic in its original size, please click here

To view the graphic in its original size, please click here

Veins containing copper, zinc and lead sulfide mineralization in hole Ky-17-07

To view the graphic in its original size, please click here

Vein containing copper and zinc sulfide mineralization in hole Ky-17-05.

To view the graphic in its original size, please click here

Vein containing zinc and lead sulfide mineralization in hole Ky-17-8

Hole Ky-17-8, located approximately 80 meters southwest of holes Ky-17-5, 6 and 7, tested the down-dip extension of a gold bearing zone discovered by the Company in a 2015 trench (channel samples returning 1.1 g/t Au over 4.9 meters). The gold bearing zone in the trench is characterized by minor arsenopyrite in metasediments and increased quartz veining. A fault zone is also exposed in the trench hosting base metal and silver mineralization (2015 grab sample returned 8.99% lead, 1.76% zinc, 0.80% copper and 237 g/t silver). Arsenopyrite is not apparent in Ky-17-8 drill core. However quartz veining was intersected under the trench gold zone. The hole also intersected veins with base metal sulfides approximately vertically under the trench fault zone.

Closed-spaced 1980s diamond drill holes (Brunswick Mining and Smelting and Aurtec Inc.) in the area of holes Ky-15-3, 4, Ky-17-5, 6, 7 and 9 intersected near-surface mineralized veins (Elmtree 12 vein occurrence). A 0.88 metre core length interval from a 1981 drill hole was reported to grade 7.72% Cu, 11.36% Zn an 13.6 ounces per ton Ag. A 1.22 metre core length sample from a near-by 1989 drill hole was reported to assay 16.4% Cu, 10.11% Zn and 31.0 ounces per ton Ag. The true width of these intersections is unknown. These drill intersections are within 50 metre vertical depth. Great Atlantic personnel found loose casing in this area during 2015. It is uncertain which historic hole this represents.

Access to the property is excellent with paved roads transecting the property, including a provincial highway. The property covers an area of approximately 3,400 hectares.

To view the graphic in its original size, please click here

Readers are warned that historical records referred to in this News Release have been examined but not verified by a qualified person. Further work is required to verify that historical assays referred to in this News Release are accurate.

David Martin, P.Geo., a Qualified Person as defined by NI 43-101, is responsible for the technical information contained in this News Release.

About Great Atlantic Resources Corp.: Great Atlantic Resources Corp. is a Canadian exploration company focused on the discovery and development of mineral assets in the resource-rich and sovereign risk-free realm of Atlantic Canada, one of the number one mining regions of the world. Great Atlantic is currently surging forward building the company utilizing a Project Generation model, with a special focus on the most critical elements on the planet that are prominent in Atlantic Canada, Antimony, Tungsten and Gold.