I am pleased to announce our first ever guest blogger to the AGORACOM blog – and we couldn’t have found a better guest and situation to do it.

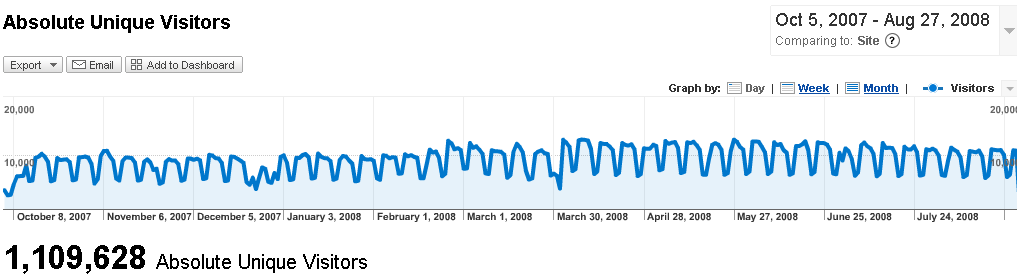

Our guest is safeharbour, an AGORACOM member that embraced our “Investor Controlled HUBS” from the outset and joined us on October 11, 2007. His contributions are so well respected by fellow members and investors on the Aurelian Resources HUB that he is now a HUB Leader with over 18,000 points and a member rating of 3.8 thanks to 114 votes from fellow members.

Our guest is safeharbour, an AGORACOM member that embraced our “Investor Controlled HUBS” from the outset and joined us on October 11, 2007. His contributions are so well respected by fellow members and investors on the Aurelian Resources HUB that he is now a HUB Leader with over 18,000 points and a member rating of 3.8 thanks to 114 votes from fellow members.

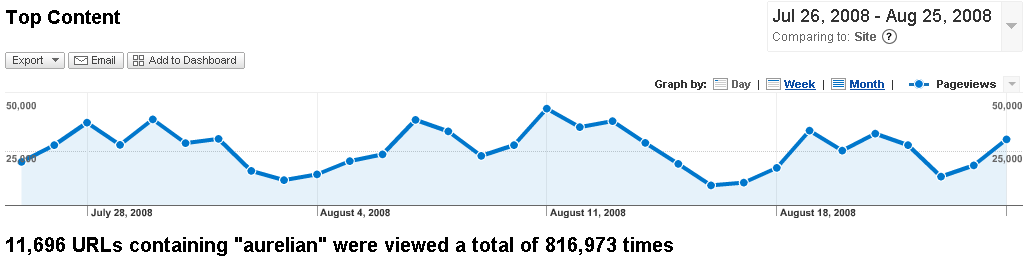

Shareholders, led by “safe” and these 6 HUB Leaders, have used the HUB to amalgamate, discuss and execute a strategy to vote down the bid, including submitting thousands of e-mail messages, telephone calls and letters to management, directors, media, analysts, bloggers, securities regulators and even other potential suitors.

The campaign has been a massive success and perhaps the best example of Web 2.0 Canadian shareholder activism with coverage from the likes of The Financial Post, Calgary Herald and Montreal Gazette.

Finally, I can tell you from personal private messages that “safe” is a conscientious investor that has the best interests of his HUB at heart.

As such, me and the entire AGORACOM team are thrilled to have safeharbour as our first guest blogger. To this end, please find enclosed his post below about this very important matter (bold emphasis is mine to provide readers with a road map):

==============

As they say, a braided rope is much stronger than a single strand, and that is how the retail shareholders on the Agoracom ARU board feel. This board has provided us with a venue where we can share information and opinions, much more than we could using other methods.

On another board prior to Agoracom, there was so much bashing that it took up much of our energy, and wasn’t worth sifting through the garbage to get to the real information. At times, each of us would be feeling pretty much ‘in the dark’. But with this board, we support, inform, and discuss Aurelian constantly. It’s just part of our day. As much as picking up a newspaper was 20 years ago, and I believe that if you want the latest on Aurelian or Ecuadorian politics, you needn’t look any further.

As far as our battle now, The Kinross deal, in my opinion, presents us with a lowball starting bid, one that is totally inadequate. The argument that it can’t go much higher because we started so low is bogus. If my neighbour went into a car lot and offered $1,000 for a $30,000 car, could I then go in the next day and say I’ll give you $1500 because he has set the value?

We have not been given all the data available by Aurelian management. They reluctantly released the last 80+ holes that were drilled but downplayed any positive effect they would have. We are not privy to results of aerotem testing that occurred prior to April 18th. While we hear that the new mining law is totally mining friendly and open to international investment, the timing of it’s release raises eyebrows.

The Aurelian website was stripped of most of it’s data, maps, and gold and copper targets. Why? Wouldn’t we want to show off all the dozens of gold and copper targets?

We ask that Micon release an updated ounce count which include all the holes to date. Instead of 13.7 million ounces, we believe that should be closer to 20 million ounces including Bonza. Our management tells us it should cost $170 an ounce to get this gold out of the ground. What are the average costs of the major producers these days?

I suggest that the updated Micon report they are sitting on could upgrade our 13.7 m oz resource to a higher grade. Most gold juniors try to maximize shareholder value, (i.e. give the best spin on the number of ounces in the ground). Instead we downplay them. Why?

You don’t have to look far to see that other juniors have sold at values in excess of $300 per ounce insitu. Yet the Kinross deal reeks at $63 an ounce, and the deal is touted at a value of $8.20 (based on 20 day averages on both stocks). Just have a look at both graphs for the 20 days prior to the deal and tell me there wasn’t manipulation going on.

“The best find in perhaps 20 years” as Mr. Anderson once said. Yet this deal is acceptable to management? This is one of the best if not the best junior gold available. Majors are looking at juniors with 1-3 mm ozs now. The large finds are just too few and far between. If you can pick up an ARU with 20 mm oz as opposed to 10 mines of 2 mm oz, you’ve just saved yourself building 9 mines and smelters….maybe 5-10 billion in savings on infrastructure. That’s a lot of money to add to the war chest to buy ARU. Then add the potential of other finds close by.

John Kaiser mentioned in his letter recently, that the general market was expecting $20 – $30. I agree. Look at the ounces we have, the going rate for insitu values, and a mining law that will reflect Ecuador as an ‘open for business-mining friendly country’. (Mining will assist the country in improving the overall standard of living) .

If this Kinross deal were to go through, it would be interesting to hear the majors explain at their next Annual General Meetings the values they are paying for much smaller juniors, and why they sat on their hands when Aurelian was up for grabs.

Gold prices have gone up from $500 to $900 and is any of that now reflected in the offer?

Recently we went out to get our side of the story heard, to the media, to the analysts, videos on you tube. This is just the start. Progress is being made but to date we aren’t very impressed. The ‘real’ story has not yet come out. Polite sound bites from the president of Aurelian do not cut it. That’s like interviewing the CEO of Phillip Morris asking if smoking is bad for your health. Soon we will get a reporter with enough ‘energy’ to actually ask the tough questions and report on the same. The OSC is involved in an investigation but frankly, given their history, we feel their report will be toothless, at least compared to the actions of the SEC.

It was a different scenario, back in April, after the Ecuadorian government put a halt to mining while they wrote the new mining laws. Mr. Anderson asked for the assistance of the Agoracom crew, in emailing the PM Steven Harper, Minister David Emerson, and the Canadian Embassy in Quito. We did, in great numbers, and in his own words, we made a difference. But that was then, and now we are on our own to defend our investments….and without a doubt, when we go to battle…we will make a difference.

All indications lead one to think another bid will surface soon. I believe it will be despite management, not because of them.

It’s tough enough picking a junior gold explorer that’s going to find you a huge motherlode, and then find one in a country that comes out with a mining friendly law….but no one expected to be sold down the river by one’s own management. That was a bit of a shocker.

We know some majors are prepared to do almost anything to get what they want. They’ll tell you how scary the politics in Ecuador are, how they wouldn’t touch ARU with a 20 foot pole, then once they buy it, they’ll tell the public what a steal ARU was, how they drooled over it, and how it’s worth many times what they paid…wait and see…all of a sudden those 13.7 million ounces become 20+ and the Micon upgrade is published.

Things aren’t always what they seem. You always have to look after your own interests, and do your own due diligence because no one else will. After three years of DD on Aurelian, we don’t give up when we are 100 feet from the finish line.

For the Agoracom crew- this is just the next battle.

“safeharbour”