SPONSOR: Lomiko Metals LMR:TSX-V – A Canadian exploration-stage company discovered high-grade graphite at its La Loutre Property in Quebec and is working toward a Pre-Economic Assessment (PEA) that will increase its current indicated resource of 4.1 Mt of 6.5% Cg to over 10 Mt of 10%+ Cg through a 21 hole program at the Refractory Zone. Click Here For More Information

The world’s biggest carmaker announced Friday that it had struck a deal with Sweden’s Northvolt to build a giant battery factory in Germany. It also confirmed production dates for two new models key to the group’s success.

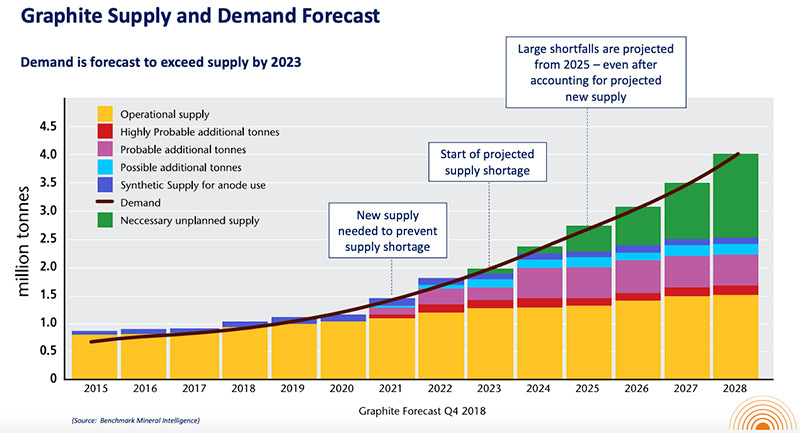

A. Paul Gill, CEO of Lomiko Metals (TSXV: LMR, OTCQB: LMRMF) noted that the graphite supply from China to Europe and North America has dropped tremendously over the past few years. This market change may be an opportunity for the Company as European and North American battery manufacturers are now looking for stable suppliers. “If we’re going to continue to expand the electric vehicle industry in Europe and  North America, we’re need a secure supply of raw materials.â€,stated Gill. “The shortage of graphite is going to be a real concern in the coming years.â€,he added.

The German company said production of lithium-ion batteries would begin in late 2023 or early 2024, a move that will be vital to Volkswagen’s (VLKAF) ability to mount what it calls “the largest electric offensive in the automotive industry worldwide.”

The group plans to launch almost 70 new electric models in the next decade, and hopes to build 22 million electric cars over this period. It is investing more than €30 billion ($33 billion) into electrifying its fleet over the next four years, prompted in part by pressure from regulators and the fallout from its diesel emissions scandal.

If successful, Volkswagen could overtake rivals such as Tesla (TSLA) and Warren-Buffet-backed BYD in China.

Battery factory big win for Europe

Lithium-ion batteries, the majority of which are currently produced in China, are a critical part of Volkswagen’s electrification strategy. Batteries account for about a third of the cost of electric cars, according to consulting firm Wood Mackenzie.

China is home to 70% of global lithium cell manufacturing capacity, with the United States in second place at 12%, said Simone Tagliapietra, a climate and energy fellow at Bruegel, the European economic think tank. Europe lags behind and hosts only about 3% of global production capacity, according to the European Commission.

The Volkswagen-Northvolt deal represents a “very significant investment for the future of European battery production,” Tagliapietra told CNN Business.

Volkswagen is investing €900 million ($993 million) into the Northvolt joint venture. Some of the money will go into the German factory, the rest will secure Volkswagen a 20% stake in Northvolt and a seat on its supervisory board.

Volkswagen also confirmed that production of the new ID.3 electric car series would begin this November, with the first models delivered to customers next year. It has already sold out a limited edition of the ID.3, which is due to make its world debut on September 9 at the Frankfurt Motor Show.

Also premiering at the show will be an electric version of the vintage Volkswagen Beetle. The conversion of the Beetle is being done by a specialist partner company, eClassics, and will use of components from the new VW e-up! city car. Porsche, one of Volkswagen’s premium brands, confirmed on Friday that it would start producing its first all-electric sports car — the Taycan — on September 9.

A New Production Plant

Alongside investing in battery production, Volkswagen is pouring €1.2 billion into overhauling its Zwickau vehicle plant, which formerly produced internal combustion engines, so that it can make electric cars. This process began in 2018 and is expected to be completed by 2020. By 2021, the plant is expected to produce 330,000 vehicles per year, making it Europe’s “largest and most efficient electric vehicle plant,” according to Volkswagen.

The ID.3 will be the first vehicle to be built on this new modular electric car production platform, or MEB. In the next three years, production of 33 models across the group’s brands is due to start on the MEB.Â