Sponsor: Loncor is a Canadian gold exploration company focused on two projects in the DRC – the Ngayu and North Kivu projects, both have historic gold production. Exploration at the Ngayu project is currently being undertaken by Loncor’s joint venture partner Barrick Gold. The Ngayu project is 200km southwest of the Kibali gold mine, operated by Barrick, which produced 800,000 ounces of gold in 2018. Barrick manages and funds exploration at the Ngayu project until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. Click Here for More Info

- Recent strong price gains are a bullish upside technical ‘breakout’ from recent trading levels, to suggest still more price gains are very likely in the coming weeks and months, or longer

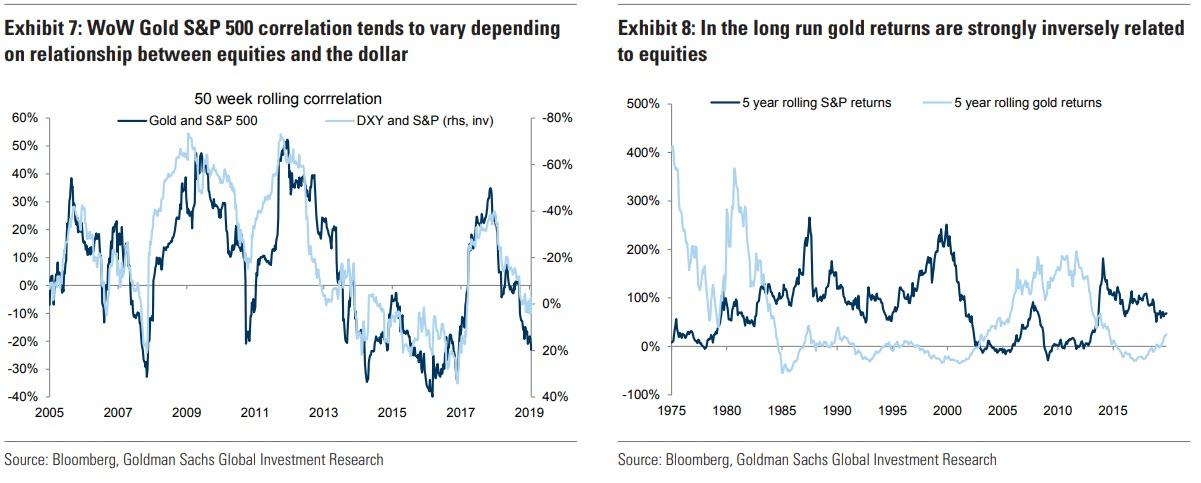

- Bullion’s price has benefited from heightened political tensions but also has enjoyed softness in the dollar,

Gold futures on Monday marked their highest settlement since April of 2013, as the killing last week of a top Iranian military commander, Qassem Soleimani, reverberated through financial markets, momentarily upending appetite for assets considered risky and boosting traditional haven assets like gold.

February gold GCG20, +0.23% on Comex added $16.40, a gain of 1.1%, to settle at $1,568.80 an ounce, after it briefly touched $1,590.90 in intraday action. The most active contract saw its highest settlement since April 9, 2013, according to FactSet data. Gold also rose for a ninth consecutive session, its longest period of straight gains since an 11-day streak that ran from December 2018 to January 2019.

March silver SIH20, +0.28% edged up by 2.8 cents, or 0.2%, to finish at $18.179 an ounce, pulling back from a high of $18.55, which was the highest intraday level since late September.

Last week, the most-active gold contract gained 2.3%, its second week of gains, while silver prices added 1.1%, also landing it higher for two consecutive weeks.

Read: Why geopolitical events are not a good reason to buy gold

“History shows that a big spike up in prices amid higher volatility tends to produce near-term market tops sooner rather than later, after that initial spike up,†said Jim Wyckoff, senior analyst at Kitco.com. “That means in the coming days the gold market could put in a ‘near-term’ top that will last for a moderate period of time.â€

“However, for the longer-term investors in gold, it’s important to note that the recent strong price gains are a bullish upside technical ‘breakout’ from recent trading levels, to suggest still more price gains are very likely in the coming weeks and months, or longer,†he said in daily commentary.

On Sunday, the Iraqi parliament passed a nonbinding resolution to expel American troops in the wake of the U.S. drone strike that killed Soleimani, leader of the foreign wing of Iran’s Islamic Revolutionary Guard Corps, on Iraqi soil.

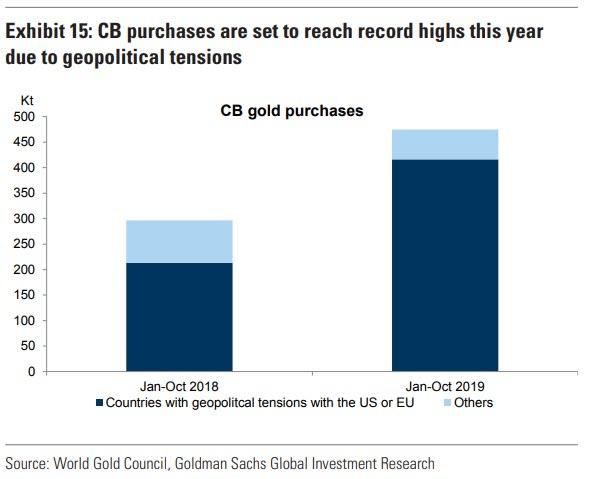

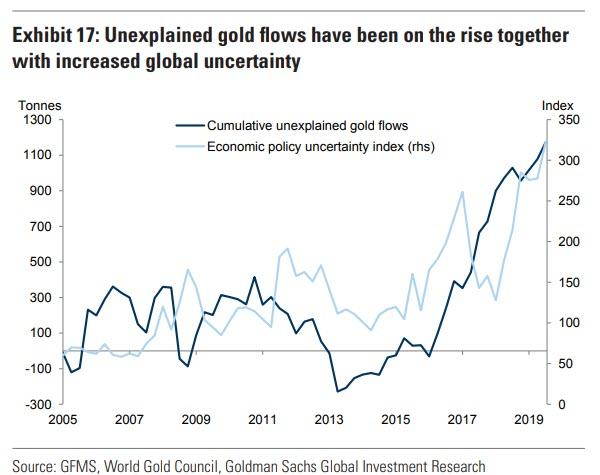

That act has intensified tensions in the Middle East, boosting the appeal of assets considered safe during global political conflicts.

Trump has threatened harsh sanctions against Iraq if it expels U.S. troops, and doubled down on earlier comments threatening to target Iranian cultural sites if Iran strikes back. Iran has said it would no longer honor the 2015 nuclear deal with a group of world powers, which the U.S. backed out of in 2018.

Oil prices climbed and the Dow Jones Industrial Average DJIA, -0.30% and S&P 500 index SPX, -0.27% opened broadly lower but turned mixed in Monday dealings.

Meanwhile, the benchmark 10-year Treasury yield TMUBMUSD10Y, +0.24% was up at 1.7917%, after tapping a four-week low on Friday after the Iranian military leader’s killing.

Bullion’s price has benefited from heightened political tensions but also has enjoyed softness in the dollar, which has occurred as investors shift to Swiss franc USDCHF, +0.3719% and Japanese yen USDJPY, +0.09% amid the potential for political turmoil.

The U.S. ICE Dollar Index DXY, +0.33%, a measure of the buck against a half-dozen currencies, was down 0.2% at 96.661 and has posted weekly declines in the last two weeks.

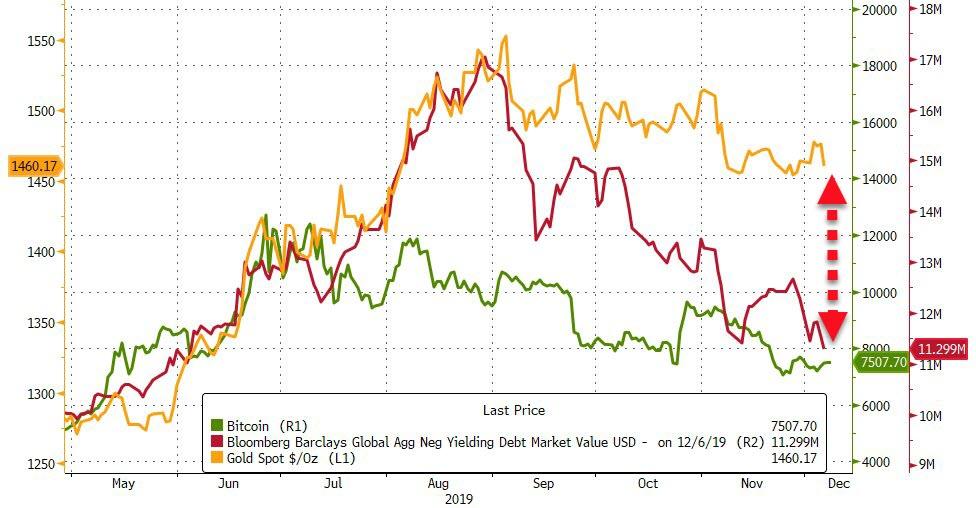

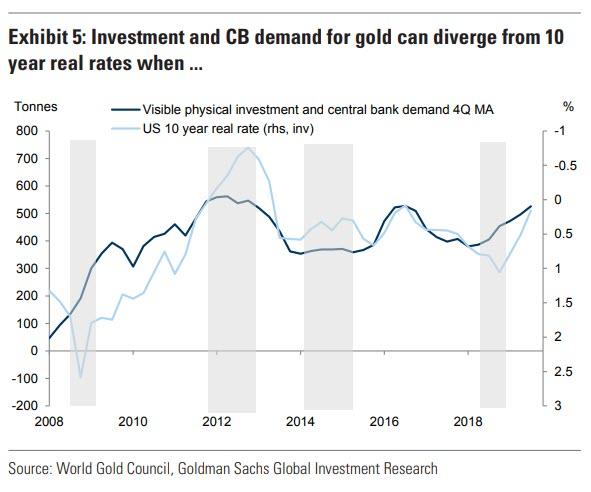

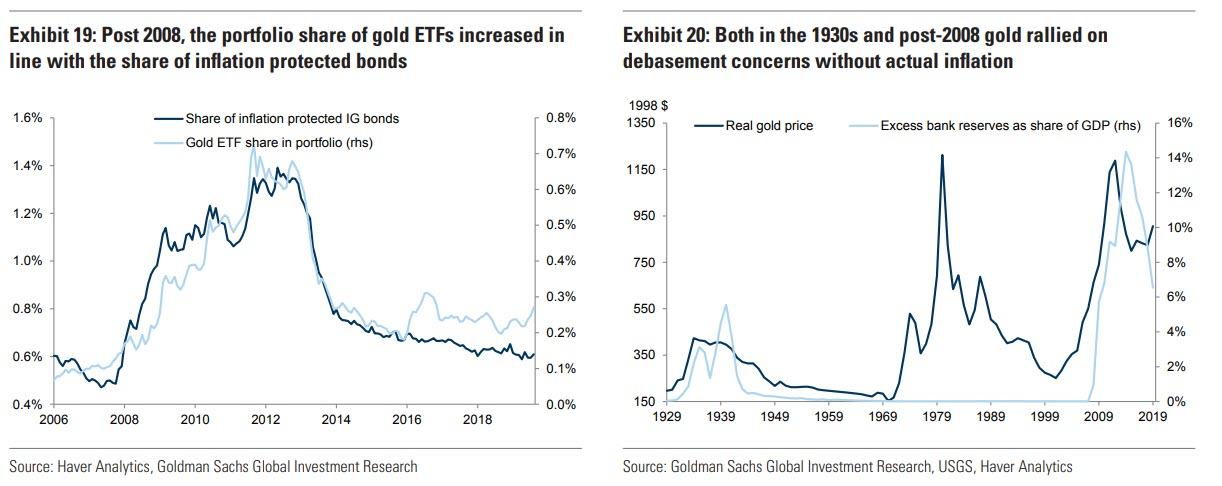

A weaker buck can make gold more attractive to buyers using other currencies, and lower bond yields can also help boost the comparative appeal of gold against government debt.

“Gold continues its breakout higher as it is now at the highest level since April 2013,†wrote Peter Boockvar, chief investment officer at Bleakley Advisory Group, in a Monday research report.

“I remain bullish but caution not to buy it on geopolitical concerns because as stated they are usually temporary. Buy it instead because the dollar continues to weaken and real yields continue to fall,†he said.

Among other metals, March copper HGH20, -0.11% added 0.1% to $2.79 a pound. April PLJ20, -0.34% shed 2.4% to $966.20 an ounce, but March palladium PAH20, +0.87% added 1.7% to $1,989.60 an ounce. Palladium futures notched a record high, as they’ve done each day so far this year and many times throughout 2019.

The platinum group markets are “not concerned that recent geopolitical events could derail the global economy and therefore demand for auto catalysts,†analysts at Zaner Metals, wrote in daily note. “Instead, it is apparent that platinum and palladium are being considered as safe haven instruments, with classic physical market fundamentals being pushed to the sidelines.”