- Exploration results have outlined a number of significant, undrilled mineralised trends at its 84.68%-owned Imbo Project.

- Situated approximately 9 km from our key deposit of Adumbi

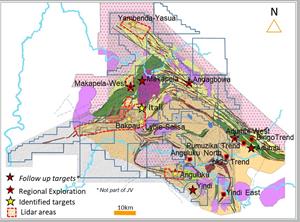

TORONTO, Sept. 21, 2020 (GLOBE NEWSWIRE) — Loncor Resources Inc. (“Loncor” or the “Company“) (TSX: “LN”; OTCQX: “LONCF”; FSE: “LO51”) is pleased to announce that the recent exploration results have outlined a number of significant, undrilled mineralised trends at its 84.68%-owned Imbo Project. The focus of exploration by Loncor during 2020 has been along trend in the southeast of the Imbo Project from the 2.5 million ounce Adumbi, Kitenge and Manzako deposits (inferred mineral resources of 30.65 million tonnes grading 2.54 g/t Au) previously delineated in the northwest of the 122 square kilometre project area.

Commenting on these results, Loncor’s President Peter Cowley said: “Situated approximately 9 kilometres from our key deposit of Adumbi, we are very encouraged by the exploration results received to date on the eastern part of our Imbo Project. Additional infill soil sampling, augering and channel sampling will be undertaken at Esio Wapi, Paradis and Museveni to better define these mineralised trends prior to outlining drill targets later in the year.”

Table 1 – Channel Sample Results on Esio Wapi, Paradis and Museveni Mineralised Trends

| Prospect | Workings | Channel_ID | Channel Width (metres) and Grade (g/t Au) | Lithology | Open/Closed |

| ESIO WAPI | Colonial | IECH033 | 19.80 m @ 1.58 g/t | Brecciated BIF | Open to northeast |

| ESIO WAPI | Colonial | IECH021 | 4.00 m @ 2.31 g/t | Metasediment | Open to southwest |

| ESIO WAPI | Colonial | IECH022 | 5.00 m @ 1.65 g/t | Brecciated BIF& Metasediment | Closed at both ends |

| ESIO WAPI | Colonial | IECH021 | 8.00 m @ 1.11 g/t | Brecciated BIF | Closed at both ends |

| PARADIS | Artisanal | IECH025 | 6.80 m @ 5.44 g/t | Metasediment with quartz vein | Open to Southwest |

| MUSEVENI | Artisanal | IECH008 | 1.40 m @ 62.10 g/t | Metasediment with quartz vein | Open to southwest & northeast |

| MUSEVENI | Artisanal | IECH006 | 6.00 m @ 4.37 g/t | Metasediment with quartz vein | Open to southwest & northeast |

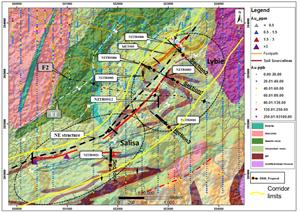

Gridding, geological mapping, soil geochemical sampling and channel sampling of old colonial trenches and artisanal workings have outlined three significant mineralised trends, Esio Wapi, Paradis and Museveni, to the east of the Imbo river and approximately 8 to 10 kilometres southeast of the Adumbi deposit (see Figure 1 below). Analytical results have been received for 21% of soil samples from the completed 5,440 metre by 2,320 metre grid and where soil samples were collected every 40 metres on lines 160 metres apart.

At Esio Wapi, soil geochemical results have outlined a number of plus 200 ppb (parts per million) gold in soil anomalies with a maximum value of 2,230 ppb Au over a 3.2 kilometre long mineralised trend (see Figure 2 below). Best channel samples from old colonial workings are tabulated in Table 1 above and include 19.80 metres grading 1.58 g/t Au (open to the northeast), 8 metres grading 1.11 g/t Au and 5.0 metres grading 1.65 g/t Au in brecciated banded ironstone (BIF) and metasediment. Individual rock sample values included 15.10 g/t and 7.88 g/t Au in quartz veins; 12.30 g/t and 6.39 g/t Au in BIF and 7.91 g/t, 4.81 g/t and 4.52g/t Au in metasediments.

On the Paradis trend, soil sample results are still awaited from the eastern part of the trend but soil anomalies (plus 200 ppb Au) in the western part of the trend occur over 800 metres of strike. Significant channel samples along the Paradis trend include 6.8 metres grading 5.44 g/t Au (open to the southwest) in metasediments with quartz veins. Individual rock sample values included 22.40 g/t, 5.84 g/t and 2.31 g/t Au in quartz veins.

At Museveni, soil samples are still to be received but artisanal workings occur over a strike of 2.7 kilometres. Channel samples from the artisanal workings include 6.0 metres grading 4.37 g/t Au and 1.40 metres grading 62.10 g/t Au and represent high grade quartz veins in metasediment. Individual rock sample values included 53.90 g/t, 32.80 g/t and 32.60 g/t Au in quartz veins and 18.10 g/t Au in metasediment.

Quality Control and Quality Assurance

Soil, channel and rock samples were put in sealed bags by Company geologists and sent to the independent SGS Laboratory in Mwanza, Tanzania. The samples were then crushed at the laboratory down to minus 2 mm and split with one-half of the sample pulverized down to 90% passing 75 microns. Gold analyses were carried out on 50g aliquots by fire assay. In addition, checks assays were also carried out by the screen fire assay method to verify high grade sample assays obtained by fire assay. Internationally recognized standards and blanks were inserted as part of the internal QA/QC analytical procedures at a frequency of four standards and two blanks per every 50 samples. Every eighth sample collected in the field was split and submitted as an unmarked duplicate for assay.

Qualified Person

Peter N. Cowley, who is President of Loncor and a “qualified person” as such term is defined in National Instrument 43-101, has reviewed and approved the technical information in this press release.

Technical Reports

Additional information with respect to the Company’s Imbo Project (which includes the Adumbi deposit) is contained in the technical report of Minecon Resources and Services Limited dated April 17, 2020 and entitled “Independent National Instrument 43-101 Technical Report on the Imbo Project, Ituri Province, Democratic Republic of the Congo”. A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Additional information with respect to the Company’s Makapela Project, and certain other properties of the Company in the Ngayu gold belt, is contained in the technical report of Venmyn Rand (Pty) Ltd dated May 29, 2012 and entitled “Updated National Instrument 43-101 Independent Technical Report on the Ngayu Gold Project, Orientale Province, Democratic Republic of the Congo”. A copy of the said report can be obtained from SEDAR at www.sedar.com and EDGAR at www.sec.gov.

About Loncor Resources Inc.

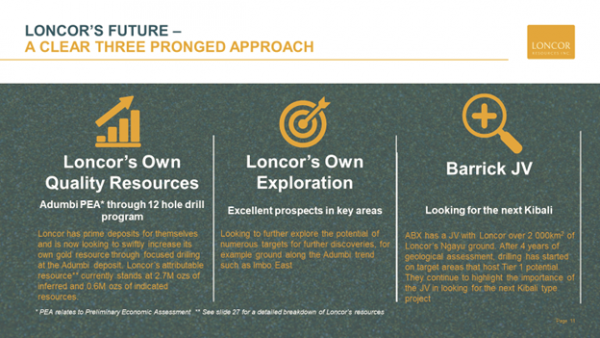

Loncor is a Canadian gold exploration company focussed on the Ngayu Greenstone Belt in the northeast of the Democratic Republic of the Congo (the “DRC”). The Loncor team has over two decades of experience of operating in the DRC. Ngayu has numerous positive indicators based on the geology, artisanal activity, encouraging drill results and an existing gold resource base. The area is 220 kilometres southwest of the Kibali gold mine, which is operated by Barrick Gold (TSX: “ABX”; NYSE: “GOLD”). In 2019, Kibali produced record gold production of 814,000 ounces at “all-in sustaining costs” of US$693/oz. Barrick has highlighted the Ngayu Greenstone Belt as an area of particular exploration interest and is moving towards earning 65% of any discovery in 1,894 km2 of Loncor ground that they are exploring. As per the joint venture agreement signed in January 2016, Barrick manages and funds exploration on the said ground until the completion of a pre-feasibility study on any gold discovery meeting the investment criteria of Barrick. In a recent announcement Barrick highlighted six prospective drill targets and have commenced confirmation drilling in 2020. Subject to the DRC’s free carried interest requirements, Barrick would earn 65% of any discovery with Loncor holding the balance of 35%. Loncor will be required, from that point forward, to fund its pro-rata share in respect of the discovery in order to maintain its 35% interest or be diluted.

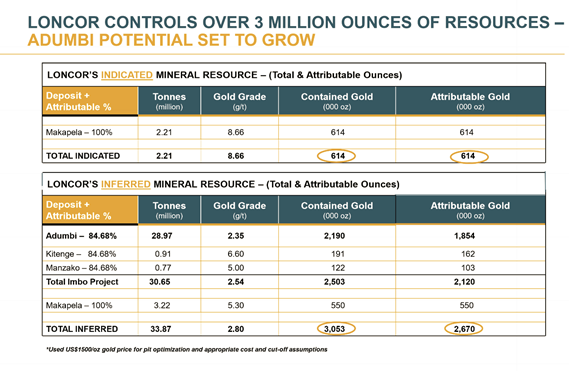

In addition to the Barrick JV, certain parcels of land within the Ngayu Belt surrounding and including the Adumbi and Makapela deposits have been retained by Loncor and do not form part of the joint venture with Barrick. Barrick has certain pre-emptive rights over the Makapela deposit. Adumbi and two neighbouring deposits hold an inferred mineral resource of 2.5 million ounces of gold (30.65 million tonnes grading 2.54 g/t Au), with 84.68% of this resource being attributable to Loncor via its 84.68% interest in the project. Loncor’s Makapela deposit (which is 100%-owned by Loncor) has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au).

Resolute Mining Limited (ASX/LSE: “RSG”) owns 26% of the outstanding shares of Loncor and holds a pre-emptive right to maintain its pro rata equity ownership interest in Loncor following the completion by Loncor of any proposed equity offering.

Additional information with respect to Loncor and its projects can be found on Loncor’s website at www.loncor.com.

Figure 1: Imbo Project Simplified Geology

Figure 2: Imbo East Soil and Channel Sampling (on Aeromagnetic grey scale Background)