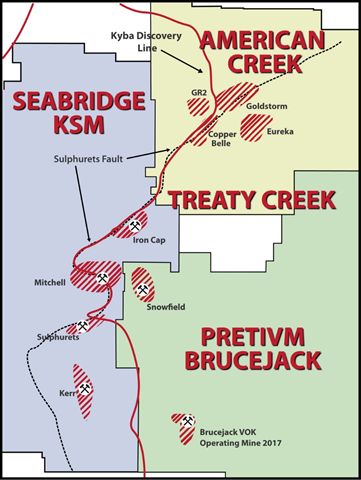

Pretium helped define the Golden Triangle with the discovery of high grade gold at Brucejack. Drilling success at American Creek’s Treaty Creek property just north of Pretium is demonstrating the opportunity for a second chance for those that missed out on Brucejack. Aiming to become a peer through sheer force of tonnage, American Creeks JV partner Tudor Gold is returning intercepts that are close to a mile in length, with 0.589 g/t Au over 1081.5m, including an upper interval of 0.828 g/t Au over 301.5m and a lower interval of 0.930 g/t Au over 207m that also demonstrated copper values before exceeding the length of the drill capabilities. Other holes include 0.725 g/t gold over 838.5m, 0.683g/t gold over 780m, and 0.98 g/t gold over 563m.

An equal measure of thanks should also be directed toward Ken Konklin, who made the discovery at at Brucejack, and is now Exploration Manager at Treaty Creek. He came out of retirement after putting the $3 billion Brucejack mine into place because he believes that Treaty Creek holds more potential than what’s he’s already accomplished. He has said that developing the Brucejack mine was a huge achievement but Treaty Creek is going to be his legacy: †The Goldstorm System shows no signs of weakening to the northeast and several more drill holes will be needed to find the length and depth of this huge gold system. Not only does the Goldstorm Zone remain open at depth and along strike, we are now seeing base-metal associations possibly as part of a zonation within the metal system.â€

Treaty Creek:

- Part of the same Sulphurets Hydrothermal System that contains a mind boggling 188M oz gold, 1.2B oz silver and 55B lbs of copper (all categories) to date ( P&P reserves of 47M oz Au, 214M oz Ag, and 10B lbs Cu)

- Same trend – deposits occur about every 2-3 km going north with gold grades increasing as the system extends northward – The Goldstorm zone on Treaty Creek is the most northerly deposit to date

- Huge logistical advantages by being on the right side of the mountain with direct access to power and highway

- Potential open pit design requiring a fraction of the capital cost with a shorter payback period.

- At the discovery stage of the mining life-cycle where biggest gains are typically made

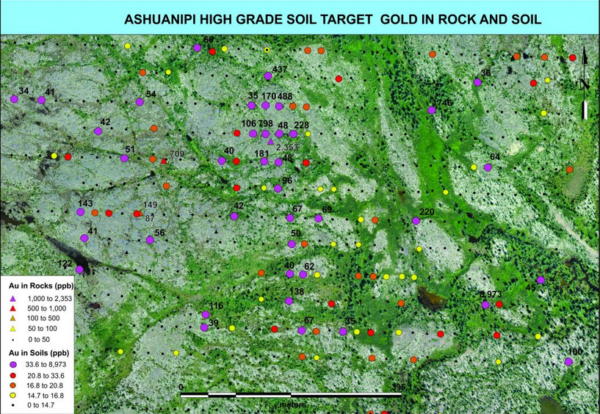

Large deposits are found near the red “discovery line†and the Sulphurets fault

Treaty Creek Project Summary Click Here: Treaty Creek Summary

Has already increased over 300% since spring and yet only the 2 sets of assays have been released. Based on the geology, geophysics, extended strike length and seemingly endless depth, it looks as though things have just started for American Creek. A major drill program is presently being conducted at Treaty Creek by JV partner and operator Tudor Gold. There are now two drills working on the Goldstorm zone. The Treaty Creek Project is a Joint Venture with Tudor Gold owning 60% and acting as operator, with American Creek holding a 20% interest in the project. American Creek is fully carried until such time as a Production Notice is issued. Until such time, Tudor is required to fund all exploration and development costs while American Creek has a “free rideâ€.

For further information please contact Kelvin Burton at: Phone: 403 752-4040 or Email: [email protected]. Information relating to the Corporation is available on its website at www.americancreek.com

FULL DISCLOSURE: American Creek is an advertising client of AGORA Internet Relations Corp.