- 2018 drilling program a total success, expanding the size of the McKenzie Break deposit and confirming its high-grade potential.

- Visible gold found in 17 of the 61 holes, including hole MK-18-196, which intersected 265.00 g/t Au over 0.6 metres, and hole MK-18-216 with 93.80 g/t Au over 0.5 metres

- Highlights of the third and last set of results for the 13,945-metre 2018 diamond drilling program:

- Hole MK-18-236: 12.60 g/t Au over 1.35 metres, incl. 55.90 g/t Au over 0.3 metres, and 13.40 g/t Au over 2.0 metres, incl. 26.40 g/t Au over 1.0 metre

- Hole MK-18-231: 15.74 g/t Au over 1.5 metres

- Hole MK-18-222: 13.95 g/t Au over 1.0 metre

- Hole MK-18-232: 6.84 g/t Au over 2.0 metres, incl. 13.65 g/t Au over 1.0 metre

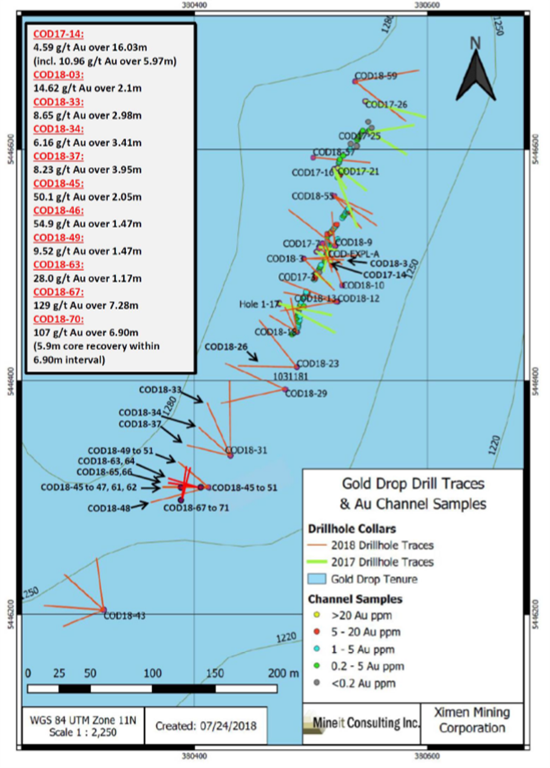

MONTREAL, March 20, 2019 – MONARCH GOLD CORPORATION (“Monarch” or the “Corporation”) (TSX: MQR) (OTCMKTS: MRQRF) (FRANKFURT: MR7) is pleased to report the third and last set of assay results from the 2018 diamond drilling program at its wholly owned McKenzie Break gold project 25 kilometres north of Val-d’Or, near its Camflo and Beacon mills. The program started in September 2018 and ended in December 2018, with a total of 13,945 metres drilled in 61 holes. The purpose of the program was to explore below the known lenses and on the periphery of the multi-vein Green and Orange zones. Assays have been received for the last 20 holes totalling 5,052 metres of core (see table below and press releases dated February 28, 2019  and March 13, 2019 for a compilation of the 2018 assay results).

“With the solid high-grade results obtained from our 2018 drilling program, we have upgraded the status of McKenzie Break as one of our prime advanced exploration projects,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch. “The program delivered beyond our expectations, enabling us to establish that the deposit remains open to the west, east, north and at depth and continues to hold excellent high-grade gold potential (see plan view and longitudinal). In fact, the next resource estimate has the potential to expand the underground deposit by 250 metres to the east, 100 metres to the north and 50 metres to the west. There is still a lot of exploration work to be done to fully assess the size and magnitude of this deposit, which remains largely underexplored. We are presently analyzing the results of the 2018 drilling and planning the follow-up program for 2019.”

Hole MK-18-236 returned 12.60 g/t Au over 1.35 metres, including 55.90 g/t Au over 0.3 metre at 80 metres below surface. This interval is 65 metres southeast of hole MK-18-210, which returned a grade of 12.50 g/t Au over half a metre from the same horizon as hole MK-18-236, thereby extending the lens to the east and showing that it is still open. Hole MK-18-236 also intersected another lens, at a depth of 145 metres from surface, with values of 13.40 g/t Au over 2.0 metres, including 26.40 g/t Au over 1.0 metre, and 75 metres north, on the same horizon, hole MK-18-232 returned values of 6.84 g/t Au over 2.0 metres, including 13.65 g/t Au over 1.0 metre. These two intersections are connected by hole MK-18-211, 100 metres northwest of hole MK-18-236. The combination of these three holes on the same horizon will increase the underground resource in this sector.

Hole MK-18-231, which returned a grade of 15.74 g/t Au over 1.5 metres, is to the north of the planned Green Zone open pit, in the middle of a triangle of three holes drilled by Monarch in 2018. These four holes are interpreted as being connected and are on the same horizon, creating a new lens. The three other holes are an average of 65 metres from hole MK-18-231 and grade an average of 5.42 g/t Au. The lens lies 200 metres below surface.

Hole MK-18-222 returned a grade of 13.95 g/t Au over 1.0 metre from 68 metres below surface. This intersection is 70 metres northwest of the Green Zone open pit and will help to increase the underground resource.

Third set of drill results for the McKenzie Break property:

| Hole | Length | From | To | Width* | Grade Au |

| number | (m) | (m) | (m) | (m) | (g/t) |

| MK-18-222 | 177 | 64.1 | 65.0 | 0.9 | 5.14 |

| 68.0 | 69.0 | 1.0 | 13.95 | ||

| 102.0 | 103.0 | 1.0 | 4.68 | ||

| 141.0 | 142.5 | 1.5 | 5.40 | ||

| Including | 141.0 | 141.5 | 0.5 | 14.00 | |

| MK-18-223 | 150 | 20.7 | 22.6 | 1.9 | 6.18 |

| Including | 21.6 | 22.1 | 0.5 | 8.99 | |

| 65.4 | 66.3 | 0.9 | 2.03 | ||

| 69.6 | 70.6 | 1.0 | 3.69 | ||

| 100.5 | 105.1 | 4.6 | 2.18 | ||

| Including | 102.8 | 103.9 | 1.1 | 3.95 | |

| 122.8 | 125.3 | 2.5 | 2.19 | ||

| Including | 124.0 | 125.3 | 1.3 | 3.17 | |

| MK-18-224 | 210 | 174.0 | 178.0 | 4.0 | 2.75 |

| Including | 177.0 | 178.0 | 1.0 | 6.11 | |

| MK-18-225 | 210 | 68.0 | 68.5 | 0.5 | 8.11 |

| 175.0 | 176.3 | 1.3 | 2.42 | ||

| MK-18-226 | 276 | 244.55 | 246.5 | 1.95 | 3.09 |

| Including | 246.0 | 246.5 | 0.5 | 9.58 | |

| 274.1 | 275.0 | 0.9 | 2.70 | ||

| MK-18-227 | 228 | 101.0 | 101.5 | 0.5 | 3.86 |

| 168.7 | 171.8 | 3.1 | 0.89 | ||

| Including | 170.5 | 171.1 | 0.6 | 2.74 | |

| MK-18-228 | 216 | 34.0 | 37.0 | 3.0 | 2.42 |

| 88.0 | 89.0 | 1.0 | 9.37 | ||

| MK-18-229 | 243 | 103.0 | 104.0 | 1.0 | 2.79 |

| 196.0 | 198.0 | 2.0 | 1.61 | ||

| Including | 197.0 | 198.0 | 1.0 | 2.39 | |

| MK-18-230 | 270 | 152.0 | 153.0 | 1.0 | 3.54 |

| 175.5 | 176.2 | 0.7 | 2.59 | ||

| 198.0 | 200.0 | 2.0 | 3.84 | ||

| Including | 199.0 | 200.0 | 1.0 | 6.20 | |

| MK-18-231 | 258 | 197.0 | 198.5 | 1.5 | 17.45 |

| 197.0 | 211.0 | 14.0 | 2.38 | ||

| MK-18-232 | 252 | 158.0 | 160.0 | 2.0 | 6.84 |

| Including | 159.0 | 160.0 | 1.0 | 13.65 | |

| 188.0 | 189.0 | 1.0 | 3.25 | ||

| MK-18-233 | 247 | 137.75 | 138.5 | 0.75 | 1.36 |

| MK-18-234 | 276 | 234.0 | 235.8 | 1.8 | 7.80 |

| Including | 235.0 | 235.8 | 0.8 | 17.30 | |

| MK-18-235 | 269 | 138.0 | 139.0 | 1.0 | 2.19 |

| 244.65 | 248.0 | 3.35 | 3.83 | ||

| Including | 244.65 | 245.4 | 0.75 | 10.60 | |

| MK-18-236 | 288 | 77.65 | 79.0 | 1.35 | 12.6 |

| Including | 77.65 | 77.95 | 0.3 | 55.9 | |

| 143.0 | 145.0 | 2.0 | 13.40 | ||

| Including | 143.0 | 144.0 | 1.0 | 26.40 | |

| 236.0 | 236.55 | 0.55 | 3.10 | ||

| 277.0 | 279.0 | 2.0 | 2.36 | ||

| 281.0 | 282.0 | 1.0 | 2.05 | ||

| MK-18-237 | 300 | 249.7 | 250.7 | 1.0 | 2.42 |

| 261.7 | 262.25 | 0.55 | 2.67 | ||

| MK-18-238 | 300 | 172.6 | 173.3 | 0.7 | 2.26 |

| 228.0 | 228.5 | 0.5 | 2.19 | ||

| 259.8 | 261.0 | 1.2 | 2.72 | ||

| MK-18-239 | 306 | 199.0 | 200.0 | 1.0 | 3.57 |

| 204.4 | 205.5 | 1.1 | 2.10 | ||

| MK-18-240 | 324 | 176.8 | 178.3 | 1.5 | 5.90 |

| Including | 176.8 | 177.3 | 0.5 | 17.5 | |

| 182.8 | 183.7 | 0.9 | 4.09 | ||

| MK-18-245 | 252 | 123.4 | 125.3 | 1.9 | 1.07 |

| *The width shown is the core length. True width is estimated to be 90-100% of the core length. |

McKenzie Break is a high-grade, multiple-narrow-vein gold deposit hosted in the dioritic Pascalis batholith and underlain by porphyritic diorite and mafic and felsic volcanic rocks. On June 14, 2018, the Corporation reported an NI 43-101 pit-constrained resource of 48,133 ounces in the Indicated category and 14,897 ounces in the Inferred category on the property, as well as an underground resource of 53,448 ounces in the Indicated category and 49,130 ounces in the Inferred category, for a total of 165,608 ounces of gold (Source: NI 43-101 Technical Report on the McKenzie Break Project, April 17, 2018, Alain-Jean Beauregard, P.Geo., and Daniel Gaudreault, Eng., of Geologica Groupe-Conseil Inc., and Christian D’Amours, P.Geo., of GeoPointCom Inc.).

Sampling normally consists of sawing the core into equal halves along its main axis and shipping one of the halves to the ALS Minerals laboratory in Val-d’Or, Quebec for assaying. The samples are crushed, pulverized and assayed by fire assay, with atomic absorption finish. Results exceeding 3.0 g/t Au are re-assayed using the gravity method, and samples containing visible gold grains are assayed using the metallic sieve method. Monarch uses a comprehensive QA/QC protocol, including the insertion of standards, blanks and duplicates.

The technical and scientific content of this press release has been reviewed and approved by Ronald G. Leber, P.Geo., the Corporation’s qualified person under National Instrument 43-101.

ABOUT MONARCH GOLD CORPORATION

Monarch Gold Corporation (TSX: MQR) is an emerging gold mining company focused on pursuing growth through its large portfolio of high-quality projects in the Abitibi mining camp in Quebec, Canada. The Corporation currently owns close to 300 km² of gold properties (see map), including the Wasamac deposit (measured and indicated resource of 2.6 million ounces of gold), the Beaufor Mine, the Croinor Gold (see video), McKenzie Break and Swanson advanced projects and the Camflo and Beacon mills, as well as other promising exploration projects. It also offers custom milling services out of its 1,600 tonne-per-day Camflo mill.

Forward-Looking Statements

The forward-looking

statements in this press release involve known and unknown risks,

uncertainties and other factors that may cause Monarch’s actual results,

performance and achievements to be materially different from the

results, performance or achievements expressed or implied therein.

Neither TSX nor its Regulation Services Provider (as that term is

defined in the policies of the TSX accepts responsibility for the

adequacy or accuracy of this press release.

View original content to download multimedia:http://www.prnewswire.com/news-releases/monarch-gold-intersects-12-60-gt-au-over-1-35-metres-including-55-90-gt-au-over-0-3-metres-at-its-mckenzie-break-gold-project-300815159.html

SOURCE Monarch Gold Corporation

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2019/20/c8817.html

Jean-Marc Lacoste, 1-888-994-4465, President and Chief Executive Officer, [email protected]; Mathieu S̩guin, 1-888-994-4465, Vice President, Corporate Development, [email protected]; Elisabeth Tremblay, 1-888-994-4465, Senior Geologist РCommunications Specialist, [email protected]; www.monarquesgold.comCopyright CNW Group 2019