SPONSOR: Lomiko Metals LMR:TSX-V – A Canadian exploration-stage company discovered high-grade graphite at its La Loutre Property in Quebec and is working toward a Pre-Economic Assessment (PEA) that will increase its current indicated resource of 4.1 Mt of 6.5% Cg to over 10 Mt of 10%+ Cg through a 21 hole program at the Refractory Zone. Click Here For More Information

Last April, Elon Musk promised that Tesla would soon be able to power its electric cars for more than 1 million miles over the course of its lifespan. At the time, the claim seemed a bit much. That’s more than double the mileage current Tesla owners can expect to get out of their car’s battery packs, which are already well beyond the operational range of most other EV batteries. It just didn’t seem real—except now it appears that it is.Â

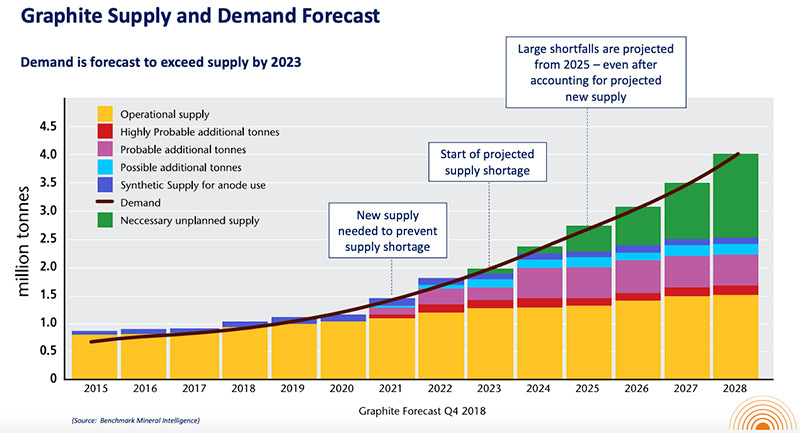

A. Paul Gill, CEO of Lomiko Metals (TSXV: LMR, OTCQB: LMRMF) stated “If we’re going to continue to expand the electric vehicle industry in Europe and  North America, we need a secure supply of raw materials.â€,stated Gill. “The shortage of graphite is going to be a real concern in the coming years.â€,he added.  Â

Earlier this month, a group of battery researchers at Dalhousie University, which has an exclusive agreement with Tesla, published a paper in The Journal of the Electrochemical Society describing a lithium-ion battery that “should be able to power an electric vehicle for over 1 million miles†while losing less than 10 percent of its energy capacity during its lifetime.

Led by physicist Jeff Dahn, one of the world’s foremost lithium-ion researchers, the Dalhousie group showed that its battery significantly outperforms any similar lithium-ion battery previously reported. They noted their battery could be especially useful for self-driving robotaxis and long-haul electric trucks, two products Tesla is developing.

What’s interesting, though, is that the authors don’t herald the results as a breakthrough. Rather, they present it as a benchmark for other battery researchers. And they don’t skimp on the specifics.

“Full details of these cells including electrode compositions, electrode loadings, electrolyte compositions, additives used, etc. have been provided,†Dahn and his colleagues wrote in the paper. “This has been done so that others can recreate these cells and use them as benchmarks for their own R+D efforts.â€

Within the EV industry, battery chemistries are a closely guarded secret. So why would Dahn’s research group, which signed its exclusive partnership with Tesla in 2016, give away the recipe for such a seemingly singular battery? According to a former member of Dahn’s team, the likely answer is that Tesla already has at least one proprietary battery chemistry that outperforms what’s described in the benchmark paper. Indeed, shortly after the paper came out, Tesla received a patent for a lithium-ion battery that is remarkably similar to the one described in the benchmarking paper. Dahn, who declined to comment for this article, is listed as one of its inventors.

The lithium-ion batteries described in the benchmark paper use lithium nickel manganese cobalt oxide, or NMC, for the battery’s positive electrode (cathode) and artificial graphite for its negative electrode (anode). The electrolyte, which ferries lithium ions between the electrode terminals, consists of a lithium salt blended with other compounds.

NMC/graphite chemistries have long been known to increase the energy density and lifespan of lithium-ion batteries. (Almost all electric car batteries, including the Nissan Leaf and Chevy Bolt, use NMC chemistries, but notably not Tesla.) The blend of electrolyte and additives is what ends up being the subject of trade secrets. But even those materials, as described in the paper, were well known in the industry. In other words, says Matt Lacey, a lithium-ion battery expert at the Scania Group who was not involved in the research, “there is nothing in the secret sauce that was secret!â€

Instead, Dahn’s team achieved its huge performance boosts through lots and lots of optimizing of those familiar ingredients, and tweaking the nanostructure of the battery’s cathode. Instead of using many smaller NMC crystals as the cathode, this battery relies on larger crystals. Lin Ma, a former PhD student in Dahn’s lab who was instrumental in developing the cathode design, says this “single-crystal†nanostructure is less likely to develop cracks when a battery is charging. Cracks in the cathode material cause a decrease in the lifetime and performance of the battery.

Through its partnership with Tesla, Dahn’s team was tasked with creating lithium-ion batteries that can store more energy and have a longer lifetime than commercially available batteries. In electric cars, these metrics translate to how far you can drive your car on a single charge and how many charges you can get out of the battery before it stops working. Generally speaking, there’s a trade-off between energy density and battery lifetime—if you want more of one, you get less of the other. Dahn’s group was responsible for the seemingly impossible task of overcoming this tradeoff. The energy density of a lithium ion battery is one of the most important qualities in consumer electric cars like Tesla’s Model 3. Customers want to be able to drive long distances in a single charge. Tesla’s newer cars can get up to 370 miles per charge, which is well beyond the range of electric vehicles from other companies. In fact, based on the average American commute, Dahn estimates that most EV owners only use about a quarter of a charge per day. But to make a fleet of robotaxis or an empire of long haul electric trucks, Tesla will need a battery that can handle full discharge cycles every day. The problem is that fully discharging and recharging everyday puts greater stress on the battery and degrades its components more rapidly. But simply maintaining the current lifespan of a Tesla battery pack— about 300,000 to 500,000 miles—isn’t enough either. Long haul electric trucks and robotaxis will be packing in way more daily miles than your average commuter, which is why Musk wants a battery that can last for one million miles. Musk asked and Dahn delivered. As Dahn and his team detailed in their benchmarking paper, “one does not need to make a tradeoff between energy density and lifetime anymore.†The team’s results show that their batteries could be charged and depleted over 4,000 times and only lose about 10 percent of their energy capacity. For the sake of comparison, a paper from 2014 showed that similar lithium-ion batteries lost half their capacity after only 1,000 cycles

“4,000 cycles is really impressive,†says Greg Less, the technical director at the University of Michigan’s Energy Institute battery lab. “A million mile range is easily doable with 4,000 cycles.†Just days after the publication of the benchmarking paper, Tesla and Dahn were awarded a patent that described a single-crystal lithium-ion battery almost identical to the batteries described in the benchmarking paper. The patented battery includes an electrolyte additive called ODTO that the patent claims can “enhance performance and lifetime of Li-ion batteries, while reducing costs.â€

It’s not certain that the battery described in the patent is the million-mile battery that Musk said would enter production next year, and neither Tesla nor Dahn are talking. But it’s a safe bet that Tesla’s proprietary battery performs even better.

Shirley Meng, who runs the Laboratory for Energy Storage and Conversion at the University of California, San Diego, says many electric vehicle companies are pursuing batteries with higher nickel content than what Dahn’s paper and patent describe. That approach can boost the energy density of a battery. Meng says the next step is to merge those higher-density designs with some high-performing mix of electrolytes and additives. Whether it’s the formula Dahn’s group perfected is an open question.

“I believe the ultimate goal of Jeff’s team is to demonstrate ultralong life in a high-nickel-content cathode, but perhaps they need a completely different mixture of the electrolyte additive cocktail,†Meng says. “I don’t think the same formula will work, and that’s why they released all the formulations.â€

Whatever design ends up making it into production at Tesla’s massive Gigafactory, the signs are clear: A million-mile battery will be here soon.