- New Age Metals has an Option/Joint-Venture agreement with partner Azincourt Energy Corp (AAZ) on its eight pegmatite hosted Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba- Exploration in southeast Manitoba is focused on Lithium-bearing pegmatites and other rare metals.- Rubidium Oxide is a highly insoluble thermally stable Rubidium source suitable for glass, optic and ceramic applications. Rubidium is recovered commercially from Lepidolite as a by-product of lithium extraction.

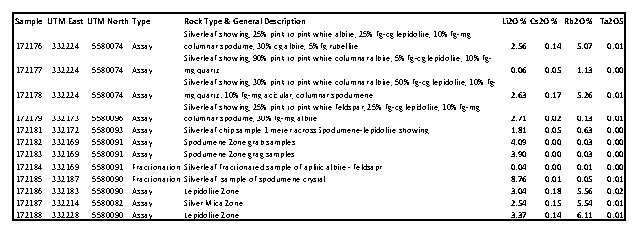

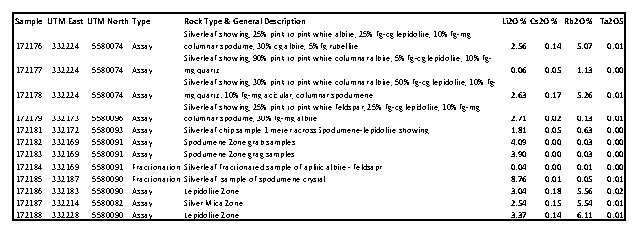

- Mapping and sampling at the Silverleaf Pegmatite on the Lithium One Project returned numerous samples of strong lithium mineralization with assays up to 4.1% Li2O and Rubidium up to 6.1% Rb2O on the Silverleaf Pegmatite.

- Drill permits have been applied for on the Lithium Two and Lithium One Projects and the company is awaiting approval from the province

- The company recently signed an Exploration Agreement with the Sagkeeng First Nation, see news release dated October 25, 2018.

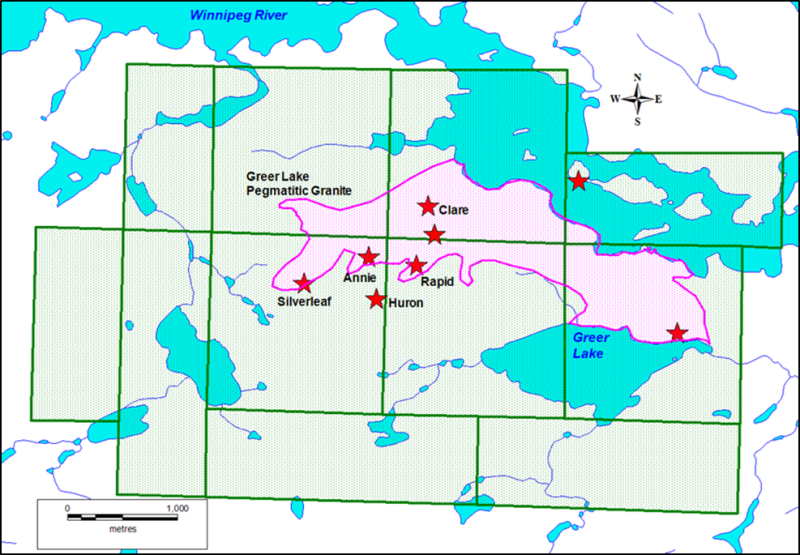

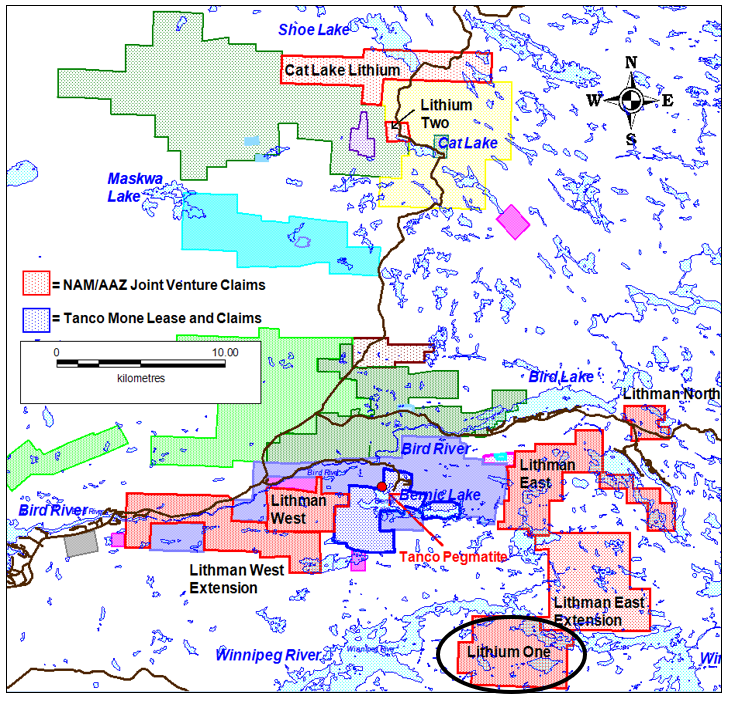

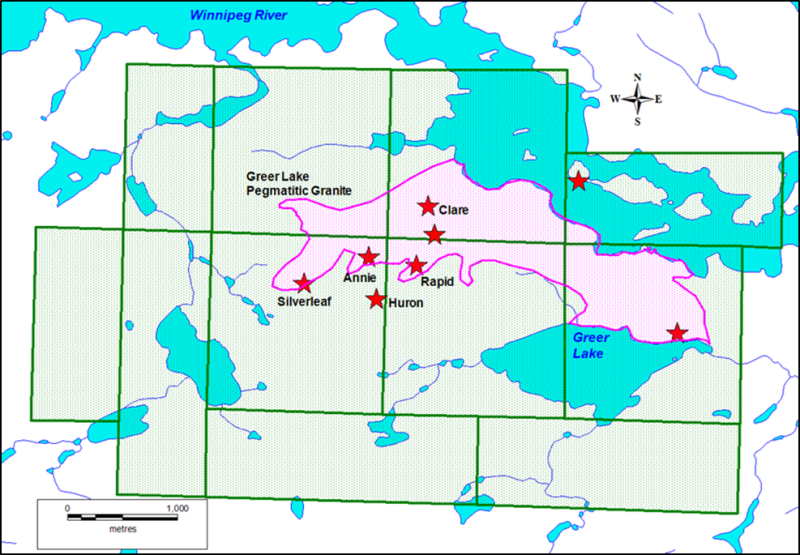

November 13th, 2018 / Rockport, Canada – New Age Metals Inc. (NAM) (TSX.V: NAM; OTCQB: NMTLF; FSE: P7J.F) New Age Metals is pleased to provide an update on the current surface exploration program on the company’s Lithium One Project. The company’s Lithium Division, Lithium Canada Development, has an aggressive exploration program for 2018. The Joint Venture with New Age Metals and Azincourt Energy, has eight Lithium Projects in the Winnipeg River Pegmatite Field, located in SE Manitoba (Figure 1).

Lithium One Project

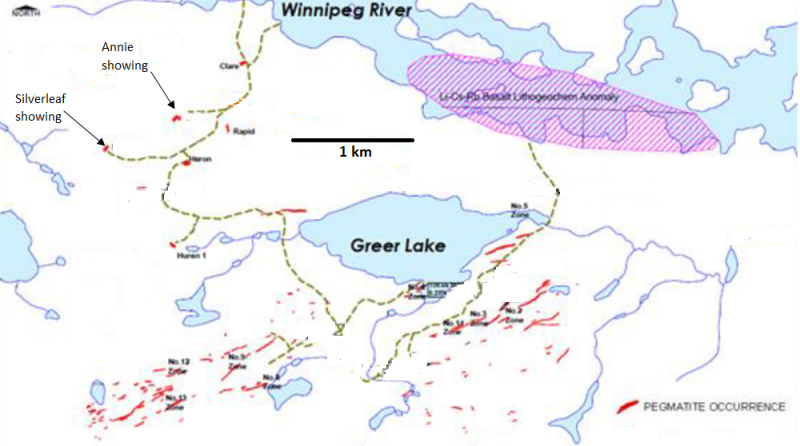

A field crew was active in the late summer and early fall exploring on the Lithium One Project. The reported results are from the Silverleaf Pegmatite (Figure 2). The Annie and other pegmatites from the Lithium One Project have been assayed and assay results are pending.

The Lithium One Project is located 125 kilometres northeast of Winnipeg, Manitoba and is geologically characterized as being a part of the Cat Lake-Winnipeg River Pegmatite Field.

Click Image To View Full Size

Figure 1: Claim Map of the Bird River Area Showing the Joint Venture Project Locations

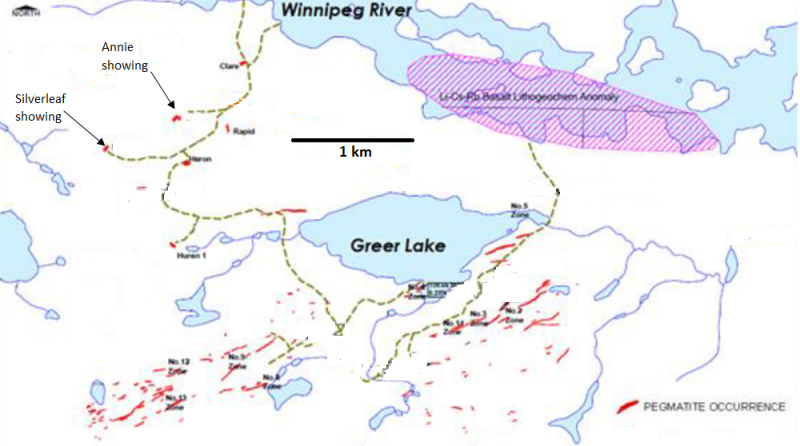

This Pegmatite Field is host to the world-class Tanco Pegmatite, which has been mined since 1969 for Tantalum, Cesium, and Spodumene (a Lithium bearing ore). Historically the Lithium One Project area is known for the presence of numerous surface Pegmatites of various dimensions and compositions (see Figure 3).

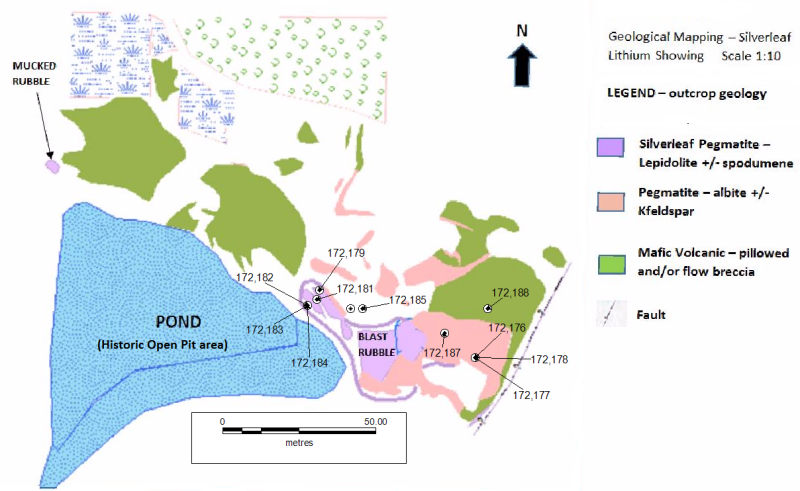

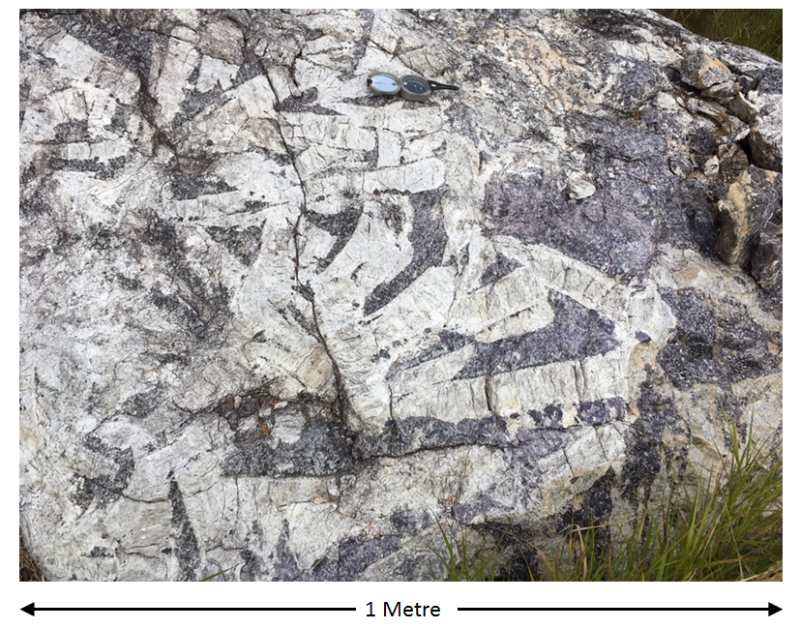

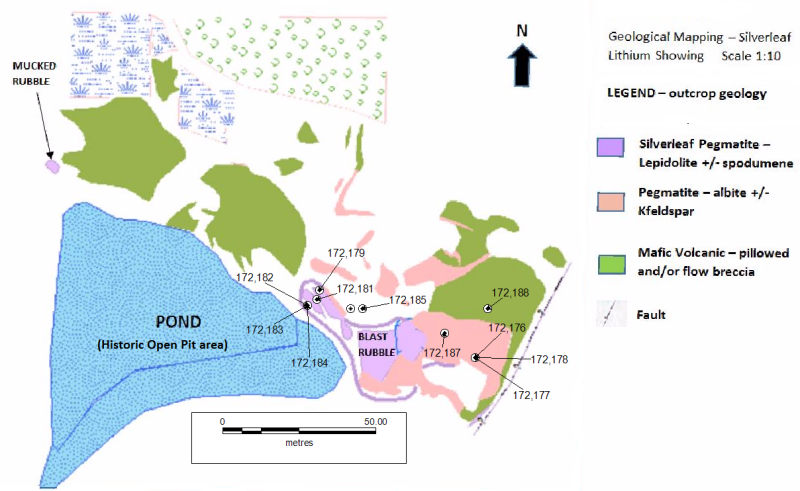

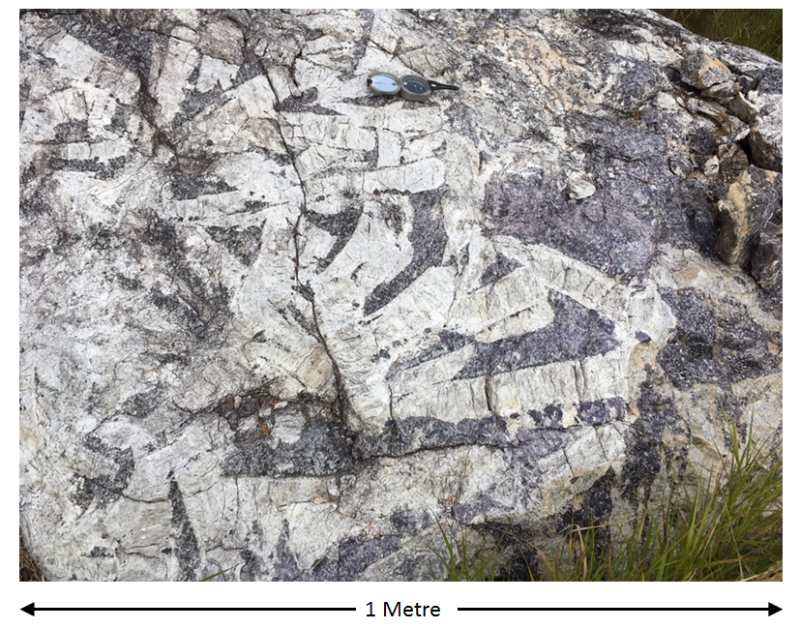

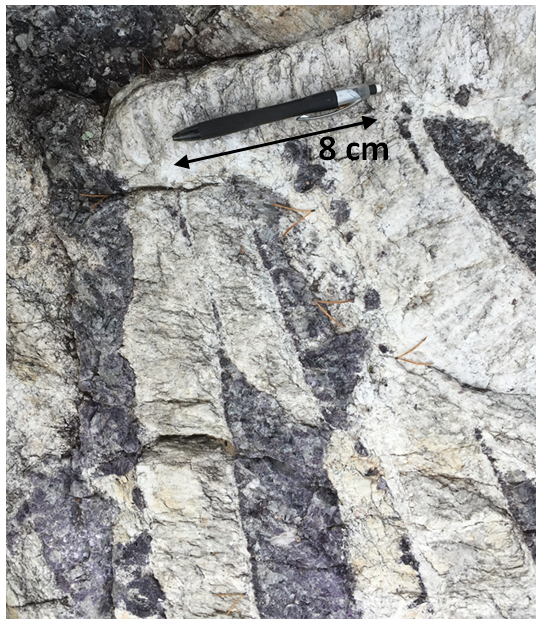

The Silverleaf Pegmatite (Figure 4) is a zoned complex Lithium-bearing Pegmatite with a surface exposure of approximately 80 metres x 45 metres. The Pegmatite is exposed in the northeast and strikes under cover to the southwest. Samples taken from the Lepidolite-Spodumene Zone yielded assays from 1.81% to 4.09% Li2O and 0.63% to 6.11% Rb2O.

.

Click Image To View Full Size

Figure 2: Historical Pegmatite Location Map – Northern Portion, Lithium One Project

This zone is approximately 50 metres x 20 metres in size and extends into a historic excavated open pit. The historic open pit area originates from the late 1920s, when a bulk sample of Spodumene was mined from the southwest side of the Silverleaf Pegmatite. Large scale mining operations were not undertaken at that time. The area has seen sporadic exploration activity with focus on base metals and tantalum with minor exploration for Lithium.

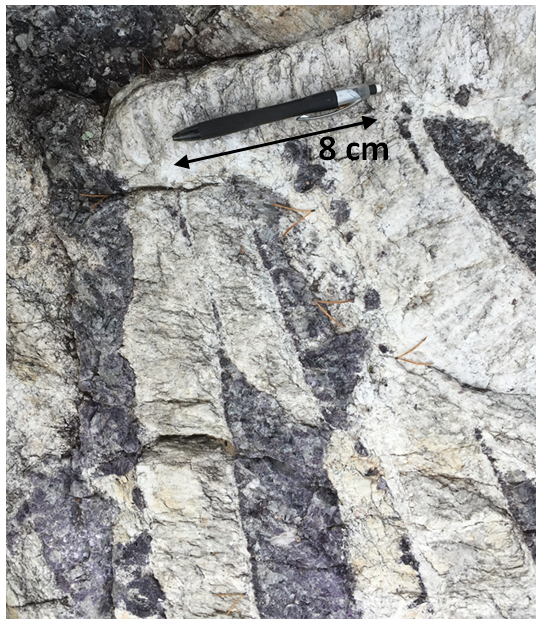

In an effort to check the purity of the Spodumene, a sample of Spodumene blades was sampled from the Silverleaf Pegmatite. This sample yielded an assay of 8.76 % Li2O. A review of Spodumene mineral data at the Webmineral website indicates that Spodumene crystal can

(https://webmineral.com/data/Spodumene.shtml#.W-ShltVKipo) have a Lithium content from 3.73 to 8.03% Li2O. This would tend to indicate that the Spodumene crystals present at the Silverleaf Pegmatite are of a very high Lithium content.

The Spodumene blades at the surface of the Silverleaf Pegmatite can reach a length of up to 40 centimeters and a width of 10 centimeters (see Figure 5 and 6). The Spodumene blades are surrounded by Lithium bearing purple micas (Lepidolite).

Click Image To View Full Size

Figure 3: Pegmatite map of the Lithium One Project

Table 1: 2018 Samples from the Silverleaf Pegmatite

Click Image To View Full Size

Click Image To View Full Size

Figure 4: Geological mapping of the Silverleaf Pegmatite, Lithium One Project

In geological terms, the Silverleaf Pegmatites encountered on the Lithium One Project is a LCT Type (Lithium-Cesium-Tantalum) Pegmatites

QA/QC Protocol

All samples were analyzed at the Activation Laboratories facility, in Ancaster, Ontario. Samples were prepared, using the lab’s Code RX1 procedure. Samples are crushed, up to 95% passing through a 10 mesh, riffle split, and then pulverized, with mild steel, to 95%, passing 105 ?m. Analyses were completed, using the lab’s Ultratrace 7 Package; a Sodium Peroxide Fusion which allows for total metal recovery and is effective for analysis of Sulphides and refractory minerals. Assay analyses are carried out, using ICP-OES and ICP-MS instrumentation. New Age Metals implemented a QA/QC field program with insertion of blanks at regular intervals. Activation Laboratories has their own internal QA/QC procedures that it carries out for all sample batches.

Click Image To View Full Size

Figure 5: Spodumene – Lepidolite Zone, Silverleaf Pegmatite, Lithium One Project

Click Image To View Full Size

Figure 6: Spodumene Blades – Lithium One Project – Silverleaf Pegmatite

Option/Joint Venture Agreement

In January of 2018, NAM announced a signed final agreement with Azincourt Energy Corp. (TSX.V: AAZ) for the Manitoba Lithium Projects. (News Release: January 15th, 2018) This Pegmatite Field hosts the world class Tanco Pegmatite that has been mined for Tantalum, Cesium and Spodumene (one of the primary Lithium ore minerals) in varying capacities, since 1969. NAM’s Lithium Projects are strategically situated in this prolific Pegmatite Field. Presently, NAM, under its subsidiary Lithium Canada Developments, is one of the largest mineral claim holders in the Winnipeg River Pegmatite Field for Lithium. Azincourt Energy Corp. as our option/joint venture is financed for and has committed to a minimum of $600,000 to be expended on exploration in Manitoba for 2018. See news release dated Janurary 15, 2018.

OPT-IN LIST

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news.

ABOUT NAM’S PGM DIVISION

NAM’s flagship project is its 100% owned River Valley PGM Project (NAM Website – River Valley Project) in the Sudbury Mining District of Northern Ontario (100 km east of Sudbury, Ontario). See results from the most recent NI 43-101 resource update below in Table 1. NAM management and consultants are currently designing a complete drill program to be executed in 2019 for the River Valley Project. This plan will consider previously proposed drill parameters and will be based on the most recent geophysical assessment and consultant expertise. The projects first economic study, a Preliminary Economic Assessment (PEA) is underway and is being overseen by Mr. Michael Neumann, P.Eng., a veteran mining engineer and one of NAM’s directors. See the most recent press releases for the River Valley Project PEA which detail the appointment of P&E Mining Consultants and DRA Americas to jointly conduct the study, dated July 25, 2018 and August 1, 2018 respectively. Our new Fall Chairman’s message can be accessed at our website (www.newagemetals.com) .

On April 4th, 2018, NAM signed an agreement with one of Alaska’s top geological consulting companies. The companies stated objective is to acquire additional PGM and Rare Metal projects in Alaska. On April 18th, 2018, NAM announced the right to purchase 100% of the Genesis PGM Project, NAM’s first Alaskan PGM acquisition related to the April 4th agreement. The Genesis PGM Project is a road accessible, under explored, highly prospective, multi-prospect drill ready Palladium (Pd)- Platinum (Pt)- Nickel (Ni)- Copper (Cu) property. A comprehensive report on previous exploration and future phases of work was completed by Avalon Development of Fairbanks Alaska in August 2018 on Genesis. A full sampling program will be conducted to continue to outline additional mineralization along the 800-meter by 40-meter mineralized zone

On August 29, the Avalon report was submitted to NAM, management is actively seeking an option/joint-venture partner for this road accessible PGM and Multiple Element Project using the Prospector Generator business model.

The results of the updated Mineral Resource Estimate for NAM’s flagship River Valley PGM Project are tabulated in Table 1 below (0.4 g/t PdEq cut-off).

| Class |

Tonnes

‘,000 |

Pd (g/t) |

Pt (g/t) |

Rh (g/t) |

Au (g/t) |

Cu (%) |

Ni (%) |

Co (%) |

PdEq (g/t) |

| Measured |

62,877.5 |

0.49 |

0.19 |

0.02 |

0.03 |

0.05 |

0.01 |

0.002 |

0.99 |

| Indicated |

97,855.2 |

0.40 |

0.16 |

0.02 |

0.03 |

0.05 |

0.01 |

0.002 |

0.83 |

| Meas +Ind |

160,732.7 |

0.44 |

0.17 |

0.02 |

0.03 |

0.05 |

0.01 |

0.002 |

0.90 |

| Inferred |

127,662.0 |

0.27 |

0.12 |

0.01 |

0.02 |

0.05 |

0.02 |

0.002 |

0.66 |

| Class |

PGM + Au (oz) |

PdEq (oz) |

PtEq (oz) |

AuEq (oz) |

| Measured |

1,440,200 |

1,999,600 |

1,999,600 |

1,136,900 |

| Indicated |

1,856,900 |

2,626,700 |

2,626,700 |

1,463,800 |

| Meas +Ind |

3,297,200 |

4,626,300 |

4,626,300 |

2,600,700 |

| Inferred |

1,578,400 |

2,713,900 |

2,713,900 |

1,323,800 |

Notes:

- A.CIM definition standards were followed for the resource estimation.

- B.The 2018 Mineral Resource models used Ordinary Kriging grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids.

- C.A base cut-off grade of 0.4 g/t PdEq was used for reporting Mineral Resources.

- D.Palladium Equivalent (PdEq) calculated using (US$): $1,000/oz Pd, $1,000/oz Pt, $1,350/oz Au, $1750/oz Rh, $3.20/lb Cu, $5.50/lb Ni, $36/lb Co.

- E.Numbers may not add exactly due to rounding.

- F.Mineral Resources that are not Mineral Reserves do not have economic viability.

- G. The Inferred Mineral Resource in this estimate has a lower level of confidence that that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

QUALIFIED PERSON

The contents contained herein that relate to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Carey Galeschuk, a consulting geoscientist for New Age Metals. Mr. Galeschuk is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.

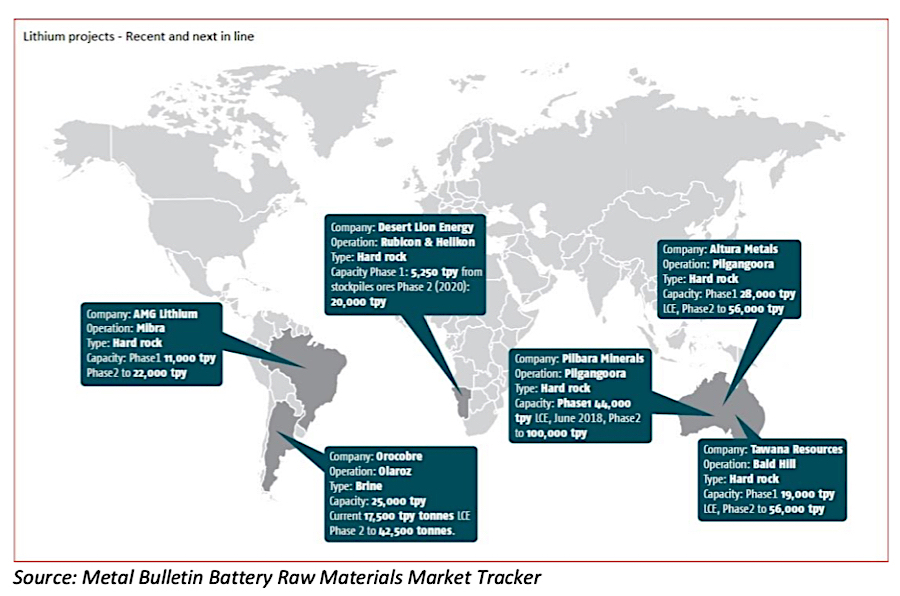

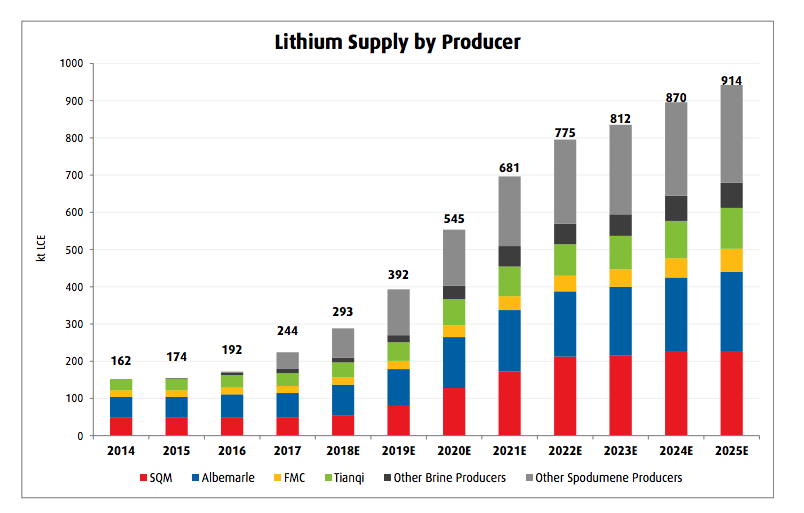

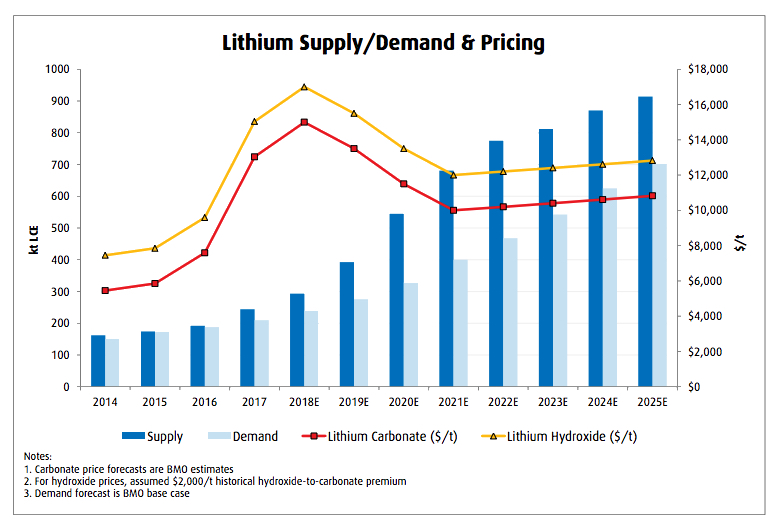

Wave of much-needed spodumene based supply coming online. (Source:

Wave of much-needed spodumene based supply coming online. (Source:  Source:

Source: