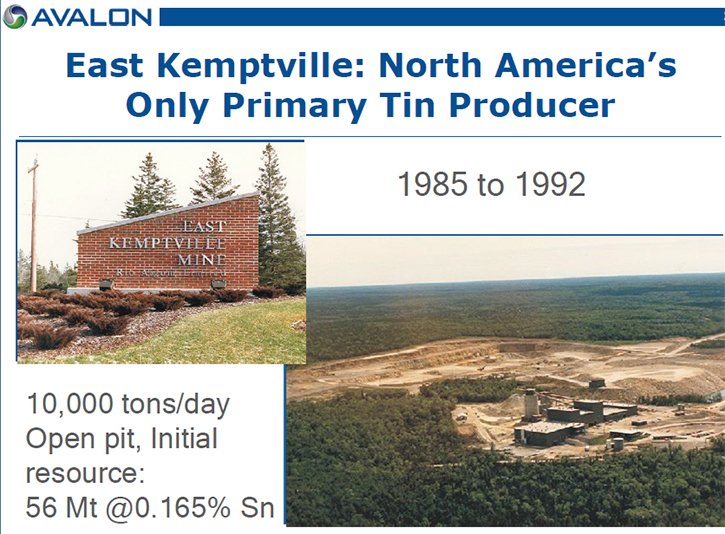

TORONTO, Feb. 25, 2015 — Avalon Rare Metals Inc. (TSX:AVL) (NYSE MKT:AVL) (“Avalon” or the “Company”) is pleased to announce the completion of a Conceptual Redevelopment Study, including preliminary economics (the “Study”) on the East Kemptville Tin Deposit (the “Deposit”). The Study was prepared by Hains Engineering Company Limited (“Hains”) and is the first economic study of the Deposit since the original East Kemptville mine closed in 1992. The purpose of the study was to confirm the business case for re-development of the Deposit before securing the necessary approvals to proceed with physical work at the site. The results of the Study indicate that there is potential for attractive economics under the development model proposed by Hains. The Study is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the preliminary economics indicated in the Study will be realized.

The proposed development model assumes conventional open pit mining at a production rate of 10,000 tonnes per day, similar to the original mine at the site with conventional truck and shovel operation. Hains recommends that a new operation take advantage of recent innovation in metallurgical recovery technology for tin ores that can achieve improved recoveries for tin as well as by-product copper and zinc. In addition, Hains recommends building a tin refinery at the site that will process the tin mineral concentrate, to produce tin ingots as a final saleable tin product. This strategy offers the potential benefits of creating value-added in Nova Scotia, reducing the risks associated with using third party processors and enhancing the overall economics of the operation. Hains estimates that the operation would create approximately 187 new full-time jobs.

Hains estimates that the proposed mining, milling and refining development model at a designed mill throughput rate of 10,000 tonnes per day would require a capital investment in the order of CDN$200 million. Operating costs (including tin refining) were estimated at CDN$15/tonne of ore mined or CDN$53 million on an annual basis. Using long term metal price assumptions of US$23,500 per tonne for tin, US$1.00/lb for zinc and US$3.00/lb for copper, average annual revenues in the order of CDN$107 million are estimated (assuming an exchange rate of CDN$1=US$0.85). Approximately 85% of the revenues in the model are derived from tin ingot sales totaling 3,350 tonnes per annum, representing just 1% of the global market. Although indium is known to occur in the deposit in association with the zinc mineralization, no credits for indium were applied in the model due to insufficient indium analytical data in the resource model. Copper concentrate sales include credits for minor contained silver and gold based on comparable assays on historic production.

Don Bubar, President and CEO stated, “We are pleased to have confirmed from this Conceptual Redevelopment Study that there is a strong business case to be made for re-developing the East Kemptville mine site. The opportunity is made more attractive by the excellent infrastructure present in southwestern Nova Scotia including year round road access, deep water port within 60 kilometres, existing power line to the site, nearby communities with available skilled labour and government supportive of new investment in mineral development. With the Study in hand we see an opportunity for Nova Scotia to re-emerge as the Tin Capital of North America.”

The development model developed for this conceptual study is based on the initial National Instrument 43-101 mineral resource estimate produced by Hains in October, 2014 and disclosed in the Company’s news release dated October 31, 2014. A Whittle Pit optimization analysis was completed for this Study based on the current resource estimate and net smelter return values estimated by Hains. The Whittle Pit optimization indicated the optimum pit contained 49.3 million tonnes of mineral resources (which includes resources classified both as Indicated and Inferred) within the pit at average diluted grades of 0.113% tin. 0.131% zinc and 0.053% copper, including 5.87 million tonnes of low grade stockpile material. Total waste rock was estimated as 43.4 million tonnes, for a Life-of-Mine stripping ratio of 0.88.

Based on the results of the Whittle analysis, a preliminary pit schedule was developed, which calls for mining 3.5 million tonnes mill feed per year, or 10,000 tonnes per day, yielding a 14 year mine life with an overall mining extraction of 95% and 5% mining dilution. Note that no work has yet been undertaken to optimize production parameters in the context of the current tin market. Further, the Whittle block model contains mineral resources classified both as indicated mineral resources and inferred mineral resources under CIM mineral resource reporting standards. Further definition drilling will be required before these mineral resources can be incorporated into a mining reserve and relied upon in an economic analysis for feasibility study purposes. Metal recoveries, based on very preliminary test work, are estimated at 87% for tin, 85% for zinc and 75% for copper.

Mineral Tenure Status

The Company holds mineral rights at East Kemptville through a “Special Licence”, a form of mineral tenure granted by the Province of Nova Scotia in circumstances where there is a history of previous industrial land use activity (such as mining) in the area of interest. It does not immediately convey surface land rights and, accordingly, access must be arranged with the permission of surface rights holders which was done in 2014. Ultimately, with completion of a feasibility study and related environmental assessment work, a form of mining lease is obtainable from the government to secure the requisite surface land rights.

The Company first acquired a Special Licence at East Kemptville in 2005 and it has been subsequently renewed multiple times while the Company negotiated access to the site. In September 2014, the Company submitted an application for a new Special Licence reflecting the entire original mine site. This application is presently being processed by the Government of Nova Scotia. Like the previous Special Licences obtained by the Company, the new Special Licence requires approval by an Order in Council of Government of Nova Scotia, which typically takes several months to receive. Final approval of the current application is still pending, following which surface work at the site will resume.

In addition to the Special Licence, the Company holds 183 mineral claims totalling 2,962 hectares to the northeast and southwest of the East Kemptville property, covering over 10 kilometres of strike length along the geological trend of the East Kemptville tin deposit. Since 2005, the Company has incurred over CDN$2.1 million in exploration expenditures on these claims and the Special Licences.

Future Plans

Once the new Special Licence is in place, the Company plans to proceed with an initial CDN$1.2 million work program utilizing funding secured in the Company’s private placement completed in December, 2014. This work will include:

1. Preliminary metallurgical process testwork on the flowsheet proposed by Hains to confirm recoveries and costs to at least the level of confidence required for a preliminary economic assessment.

2. Diamond drilling to better define known resources and delineate additional resources to depth and on other known tin occurrences in the area.

3. Environmental studies to examine the nature of the waste rock generated in any proposed mine, as well as the conditions required for bringing the existing operation into readiness for future production.

The Company is planning an extensive in-fill drilling program with the objective of moving inferred mineral resources into the indicated and measured categories. Requests for bids from drilling contractors have been sent out to conduct a minimum 2,000 metre drilling program this spring.

Bench scale metallurgical testing, using sample material collected during the 2014 drill program, is presently being initiated in order to verify metallurgical recoveries, concentrate grades and evaluate ore variability. This will lead eventually to larger scale pilot plant testing using representative bulk samples collected from future drilling and existing ore stockpiles at the site.

Environmental studies planned will also include more work on future closure requirements and baseline studies such as species at risk surveys and studies on effluent chemistry requirements.

Qualified Persons

The Study was prepared by Don Hains, P. Geo, with contributions from the following independent consultants and “Qualified Persons” for the purposes of National Instrument 43-101, who have reviewed and approved this release.

| Qualified Person |

Consulting Firm |

Contribution |

| Don Hains, P. Geo |

Hains Engineering |

Mining and Mineral Reserves, Process, Infrastructure, Capital & Operating Costs |

| Bruce Brady, P. Eng. |

Associate of Hains Engineering |

Mine Capital & Operating Costs |

| Ross MacFarlane, P. Eng |

Associate of Hains Engineering |

Metallurgical analysis, Process Capital and Operating costs |

The information contained in this document relating to the proposed work program has been reviewed and approved by Donald Bubar, P. Geo. (ONT), CEO and President of Avalon, a qualified person for the purposes of National Instrument 43-101.

Results of 2015 Annual General Meeting

At the Annual General Meeting of shareholders held in Toronto, Ontario on February 24, 2015 (the “Meeting”), all director nominees listed in the Company’s management information circular dated January 12, 2015 were elected as directors of the Company. The detailed results of the vote are as follows:

| Director |

|

Number of Votes Cast |

Percentage of Votes Cast |

|

|

|

|

| Donald S. Bubar |

In Favour: |

21,699,297 |

96.95% |

|

Withheld: |

682,498 |

3.05% |

|

|

|

|

| Alan Ferry |

In Favour: |

21,293,109 |

95.14% |

|

Withheld: |

1,088,686 |

4.86% |

|

|

|

|

| Phil Fontaine |

In Favour: |

21,694,255 |

96,93% |

|

Withheld: |

687,540 |

3.07% |

|

|

|

|

| Brian D. MacEachen |

In Favour: |

21,685,072 |

96.89% |

|

Withheld: |

696.723 |

3.11% |

|

|

|

|

| Peter McCarter |

In Favour: |

21,693,567 |

96,93% |

|

Withheld: |

688,228 |

3.07% |

|

|

|

|

| Kenneth G. Thomas |

In Favour: |

21,704,747 |

96.98% |

|

Withheld: |

677,048 |

3.02% |

In addition, at the Meeting shareholders appointed Deloitte LLP as auditors of the Company, and approved all unallocated options under the Company’s stock option plan. The formal report on voting results with respect to all matters voted upon at the Meeting will be filed on SEDAR at www.sedar.com.

About Avalon Rare Metals Inc.

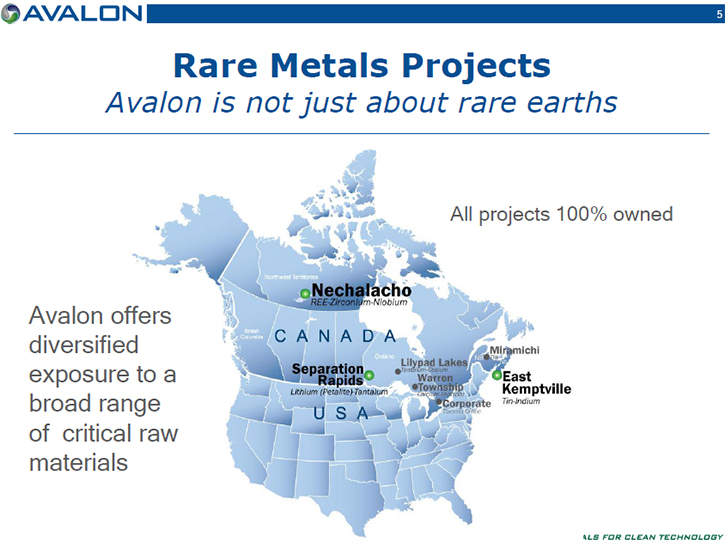

Avalon Rare Metals Inc. is a mineral development company focused on rare metal deposits in Canada, with three advanced stage projects. Its 100%-owned Nechalacho Deposit, Thor Lake, NWT is exceptional in its large size and enrichment in the scarce “heavy” rare earth elements, key to enabling advances in clean technology and other growing high-tech applications. Avalon is also advancing its Separation Rapids Lithium Minerals Project, Kenora, ON and its East Kemptville Tin-Indium Project, Yarmouth, NS. Social responsibility and environmental stewardship are corporate cornerstones.

For questions and feedback, please e-mail the Company at [email protected], or phone Don Bubar, President & CEO at 416-364-4938.

This news release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, the potential for re-development of the East Kemptville Tin deposit, the potential for attractive economics under the development model proposed by Hains, the key measures and economics reported in the Study, the strategy of a tin refinery offers the potential benefits of creating value-added in Nova Scotia, reducing the risks associated with using third party processors and enhancing the overall economics of the operation, that surface work at the site will resume once a new Special Licence is received, that the Company plans to proceed with an initial $1.2 million work program, that the Company is planning an extensive in-fill drilling program with the objective of bringing inferred mineral resources into the indicated and measured resource categories, that bench scale metallurgical testing will lead eventually to larger scale pilot plant testing using representative bulk samples collected from future drilling and existing ore stockpiles at the site, that environmental studies planned will also include more work on future closure requirements and baseline studies such as species at risk surveys and studies on effluent chemistry requirements. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “potential”, “scheduled”, “anticipates”, “continues”, “expects” or “does not expect”, “is expected”, “scheduled”, “targeted”, “planned”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be” or “will not be” taken, reached or result, “will occur” or “be achieved”. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Avalon to be materially different from those expressed or implied by such forward-looking statements. Forward-looking statements are based on assumptions management believes to be reasonable at the time such statements are made. Although Avalon has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking statements include, but are not limited to market conditions, Avalon’s ability to secure sufficient financing to advance and complete the project, uncertainties associated with securing the necessary approvals and permits in a timely manner, assumptions used in the Study proving to be inaccurate, uncertainties associated with Avalon’s resource and reserve estimates, uncertainties regarding global supply and demand for tin and market and sales prices, and uncertainties with respect to social, community and environmental impacts as well as those risk factors set out in the Company’s current Annual Information Form, Management’s Discussion and Analysis and other disclosure documents available under the Company’s profile at www.SEDAR.com. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Such forward-looking statements have been provided for the purpose of assisting investors in understanding the Company’s plans and objectives and may not be appropriate for other purposes. Accordingly, readers should not place undue reliance on forward-looking statements. Avalon does not undertake to update any forward-looking statements that are contained herein, except in accordance with applicable securities laws.

Cautionary Note to United States Investors Concerning Reserve and Resource Estimates

The reserve and resource estimates in this news release have been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Unless otherwise indicated, all reserve and resource estimates included in this news release have been prepared in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and reserve and resource information contained in this news release may not be comparable to similar information disclosed by United States companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve”. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by United States standards in documents filed with the SEC. United States investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” exists, is economically or legally mineable, or will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Disclosure of the amount of minerals contained in a resource estimate is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by Avalon in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with United States standards.