Sponsor: Affinity Metals (TSX-V: AFF) a Canadian mineral exploration

company building a strong portfolio of mineral projects in North

America. The Corporation’s flagship property is the Drill ready Regal

Property near Revelstoke, BC. Recent sampling encountered bonanza grade

silver, zinc, and lead with many samples reaching assay over-limits.

Further assaying of over-limits has been initiated, results will be

reported once received. Click Here for More Info

By: Frank E. Holmes, Chairman/CEO/CIO of U.S. Global Investors, Inc.,

— Published: Tuesday, 14 January 2020 |

Near

the start of every year, I share our ever-popular Periodic Table of

Commodity Returns, now updated to reflect the final results of 2019. To

view the interactive table and download a copy of your own, click here.

- Having

broken above $2,000 an ounce last week, palladium in now forecast by

Citi analysts to hit $2,500 by the middle of this year.

Commodities

as a whole had a mostly positive 2019, returning 16.53 percent as

measured by the S&P GSCI. This far surpasses commodities’ five-year

average return of about negative 11.52 percent, between 2014 and 2018.

Precious

metals were responsible for much of the growth. For the third straight

year, and for the fourth time in six years, palladium was the

top-performing commodity. The metal, used widely in the production of

catalytic converters, increased an incredible 54.21 percent to end 2019

at $1,912 an ounce, a slightly higher price than gold’s all-time high

set in September 2011.

As

was the case in past years, palladium benefited from mounting global

demand to curb emissions from gasoline-burning engines. It’s also among

the world’s scarcest precious metals, mined primarily in Russia and

South Africa, which means supply will potentially remain in deficit for

years to come.

Having

broken above $2,000 an ounce last week, palladium in now forecast by

Citi analysts to hit $2,500 by the middle of this year.

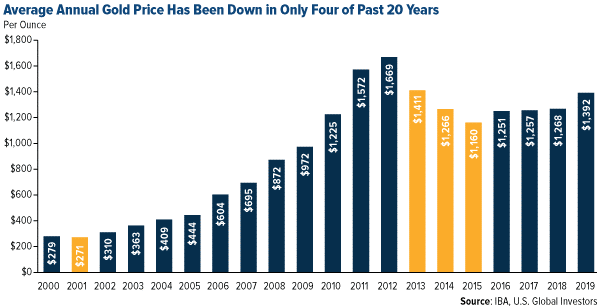

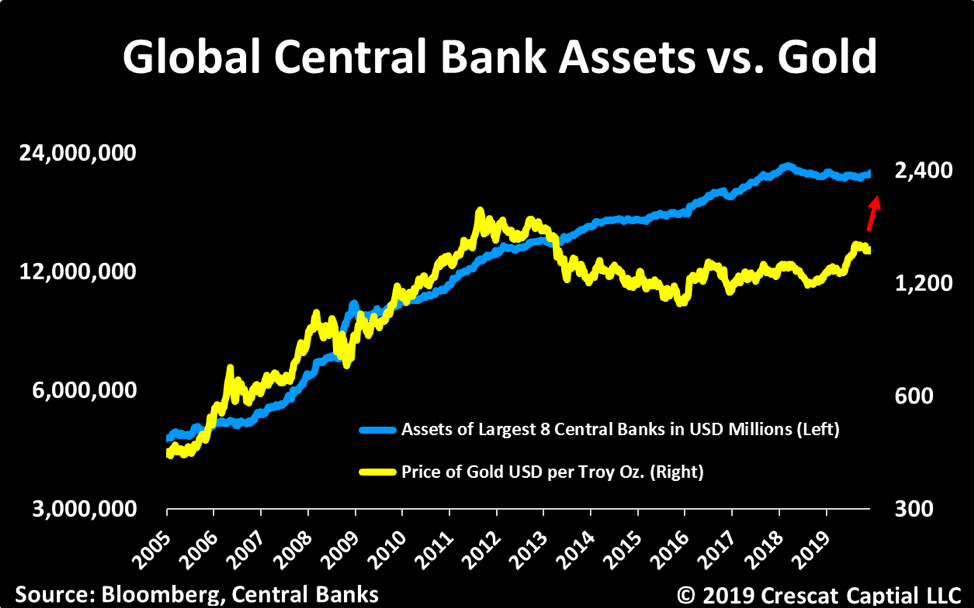

Gold Price Up in Four out of Every Five Years

Gold,

meanwhile, had its best year since 2010, climbing as much as 18.31

percent. The yellow metal’s role as an exceptional store of value shined

brightly in the second half of the year when the pool of negative-yielding debt

around the world began to skyrocket, eventually topping out at around

$17 trillion in August. On the news last week that Iran launched a

counterstrike against U.S.-occupied military bases in Iraq, the safe

haven briefly broke above $1,600 an ounce for the first time since April

2013.

In

the past two decades, gold has helped investors limit market volatility

and portfolio losses. Between 2000 and 2019, the precious metal’s

average annual price was down in only four years. Put another way, gold

was up on average in four out of every five years—a remarkable track

record.

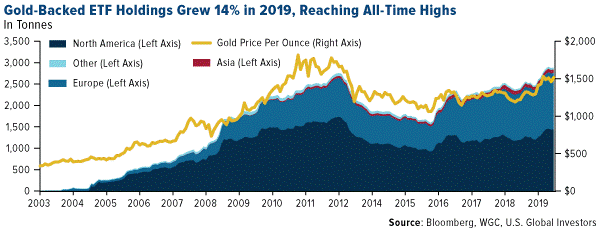

Safe

haven-seeking investors around the world piled into gold-backed ETFs in

2019, making it the best year on record for gold holdings. Assets under

management (AUM) in gold bullion ETFs expanded 37 percent from the

previous year, adding $19.2 billion, or 400 tonnes, according to the World Gold Council (WGC).

During the fourth quarter, total holdings hit a jaw-dropping 2,900

tonnes, the equivalent of 102 million ounces, which is the most on

record.

As

of the end of last week, gold looked slightly overbought on a relative

strength basis, meaning a correction wouldn’t be such a bad thing and in

fact expected.

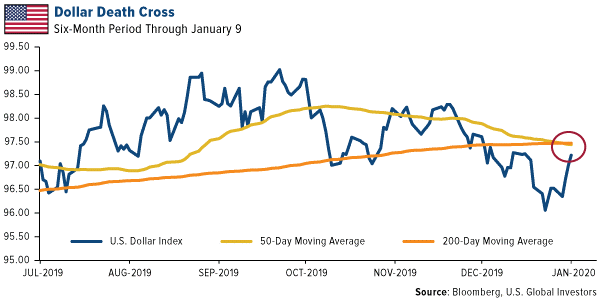

Has the Greenback Peaked?

Short

of escalating tensions in the Middle East or a pullback in stocks, the

catalyst for higher gold prices—and, indeed, commodity prices in

general—may very well be a substantial weakening of the U.S. dollar. On

Tuesday, the U.S. Dollar Index experienced a “death cross,†a bearish

signal that takes places when an asset’s 50-day moving average crosses

below its 200-day moving average. We haven’t seen this from the

greenback since May 2017.

Other

firms and analysts have recently made the case that the dollar is ready

to decline in 2020, which would give gold and other hard assets the

room to gain momentum. Below are just three such forecasts from the past

couple of weeks:

“Our

view is that the dollar is ready to decline in 2020 and will be

encouraged to do so as negative interest rates abroad turn less negative

while the Fed holds pat (or cuts)… In the event of an unlikely

recession in 2020, U.S. fiscal and monetary policy will turn sharply

expansionary, the dollar will decline further, and gold will do well.â€

~Murenbeeld & Co., January 3

“We

expect that U.S. dollar weakness will likely characterize global

financial markets throughout 2020… A weaker dollar is always good news

for commodity prices. We are particularly bullish gold at this point.

Gold is a direct play on a weaker dollar and could also benefit from any

major flare-up in geopolitical tensions.â€

~Alpine Macro, January 6

“Starting

2020, the key setup from a macro perspective is the confirmed top in

the U.S. Dollar Index as well as the U.S. Trade-Weighted Broad Dollar

Index… The U.S. Dollar Index (DXY) has broken below the 97 support to

trigger the bearish implication of the June-December topping pattern

(head-and-shoulders top) and the U.S. Trade-Weighted Broad Dollar Index

has broken below the early-November 2019 low as well as the 200-day

moving average to confirm a similar topping pattern to the DXY.â€

~CLSA, January 7

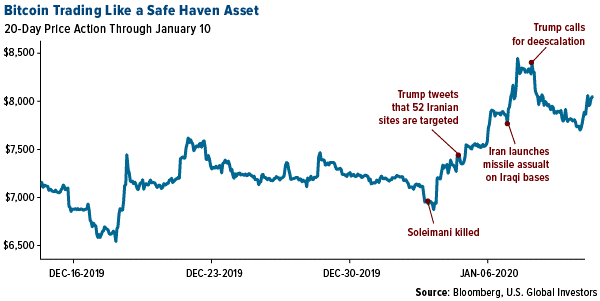

Bitcoin as a Safe Haven Asset

Gold

isn’t the only asset that responded positively to geopolitical

uncertainty involving Iran. The price of bitcoin, the world’s largest

cryptocurrency by market cap, surged on the news that President Donald

Trump had ordered a strike on Iranian general Qasem Soleimani, before

commenting that the U.S. was targeting as many as 52 sites in Iran.

From

January 2, the day before the strike, to January 8, when Trump

announced that Iran appeared to be “standing down,†bitcoin traded up as

much as 21 percent to its highest level in six weeks. In addition,

there were reports that local bitcoin sellers in Iran were charging three times the market rate in response to the threat of war with the U.S.

Google searches for “bitcoin†were also up. Cointelegraph reports that the search term “bitcoin Iran†exploded more than 4,450 percent in the seven days through January 8.

All

of this tells me that bitcoin continues to mature as an asset, and that

investors and savers increasingly trust it as a store of value in times

of uncertainty.

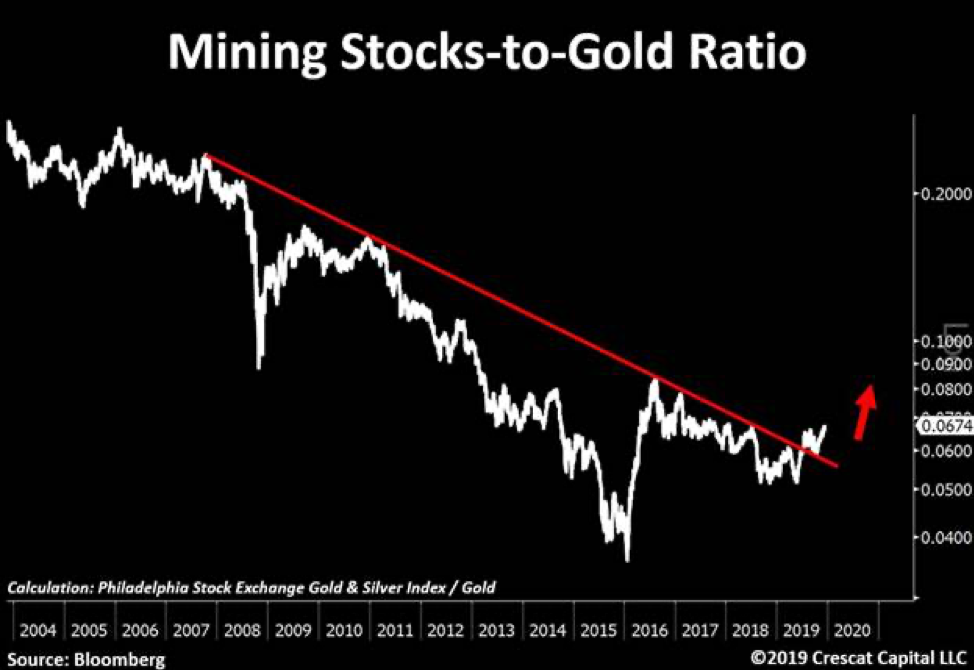

Looking for the inside scoop on mining companies? Click here

to read U.S. Global Investors portfolio manager Ralph Aldis’ interview

with MoneyShow and get his favorite mining picks for 2020!

Source: http://news.goldseek.com/USFunds/1579015085.php