Vancouver, British Columbia (FSCwire) – GREAT ATLANTIC RESOURCES CORP. (TSXV.GR) (the “Company†or “Great Atlanticâ€) is pleased to announce it has received a diamond drilling permit (up to 15 holes) and a $40,000 exploration grant from the New Brunswick government for its Keymet Precious – Base Metal Property, located near Bathurst, northeast New Brunswick. The Company is planning diamond drilling beginning in July 2018 in the northwest region of the Property to define polymetallic veins (zinc, lead, copper and silver bearing) and a explore a gold bearing zone discovered during 2017 drilling. Great Atlantic’s 2017 drilling highlights from this region included 37.32% zinc equivalent over 1.27 meters core length (new vein discovery) and 7.76% zinc equivalent over 12.05 meter core length at the Elmtree 12 vein system (using metal prices at June 14, 2018) plus 0.64 g/t gold over 19.96 meter core length (new gold discovery). Drilling will focus in the Elmtree 12 vein system to provide additional data for a planned maiden resource estimate.

To view the graphic in its original size, please click here

The upcoming diamond drilling program will be conducted in the northwest region of the property in the area of the polymetallic Elmtree 12 vein system and an adjacent polymetallic vein which was discovered in 2017. These polymetallic veins contain significant levels of zinc, copper, lead and silver. The 2018 program will test these polymetallic veins along strike and depth. The Company has drilled five holes in the Elmtree 12 veins system since 2015. The 2018 drill program will provide additional data for a planned maiden resource estimate on the Elmtree 12 vein system. The Company also discovered a new gold bearing zone adjacent to the Elmtree 12 vein system during 2017 drilling, being hosted in arsenopyrite bearing meta-sedimentary rocks. Drilling is also planned to test this zone. The drilling program will be partly funded through a $40,000 grant received from the New Brunswick government under the Junior Mining Assistance Program. Highlights of previous drilling by the Company in this area include the following (as reported in News Releases of October 29, 2015, February 23, 2016, December 20, 2017 and March 2, 2018 with up-dated zinc equivalent based on metal prices at June 14, 2018:

- Hole Ky-15-3 (Elmtree 12): Â Â Â 16.68% Zn, 1.11% Cu, 0.44% Pb & 152 g/t Ag / 1.80 meter core length (22.06% Zn Equiv. / 1.80 meter core length)

- Hole Ky-15-4 (Elmtree 12): Â Â Â Â 8.68% Zn, 0.29% Cu, 0.20% Pb & 44.8 g/t Ag / 4.28 meter core length (10.23% Zn Equiv. / 4.28 meter core length)

- Â Hole Ky-17-6 (Elmtree 12): Â Â Â 3.54% Zn, 0.92% Cu, 0.28% Pb & 115 g/t Ag / 12.05 meter core length (7.76 % Zn Equiv. / 12.05 meter core length) & 0.64 g/t Au over 19.96 meter core length (new gold discovery).

- Hole Ky-17-8 (2017 discovery): Â 18.80% Zn, 3.55% Cu, 1.16% Pb & 576 g/t Ag / 1.27 meter core length (37.32% Zn Equiv. / 1.27 meter core length)

Elmtree 12 Vein System: Polymetallic Vein in Ky-17-6

To view the graphic in its original size, please click here

Keymet Northwest Region: 2015 and 2017 Diamond Drilling Plan

To view the graphic in its original size, please click here

To view the graphic in its original size, please click here

To view the graphic in its original size, please click here

The Company’s focus since acquiring the Keymet Property has been the northwest region of the property in the area of reported polymetallic veins with most work in the area of the Elmtree 12 copper-lead-zinc-silver bearing vein system. At least seven vein occurrences with lead, zinc and +/- copper, silver and gold are reported in this region of the property in addition to the polymetallic veins reported at the historic Keymet Mine (source: New Brunswick Dept. of Energy and Resource Development Mineral Occurrence Database). The Keymet Mine operated during the mid-1950s, producing copper, lead, zinc and silver. Production at this mine was terminated due to a fire at the site.

Significant precious metal – base metals deposits are reported within 4 km of the Keymet Property. The Elmtree gold deposits are located within 3 km west-southwest of the Keymet Property. The historic Nigadoo River Mine is located approximately 4 km south of the Keymet Property. Polymetallic massive sulfide veins were mined at the Nigadoo River Mine during the 1960s and 1970s with copper, lead, zinc and silver being produced. The N.B Dept. of Energy and Resource Development Mineral Occurrence Database reports shaft depth and production totals at this historic mine. Production during 1967 – 1971 is reported as 1.126 million tonnes at 2.2% Pb, 2.1% Zn, 0.24% Cu and 92.57 g/t Ag. Production during 1973 – 1977 (after a 2 year closure) is reported to be 0.733 million tonnes (only partial metal grades reported). The shaft is reported to at least 470 meter deep.

To view the graphic in its original size, please click here

Historic Keymet Mine (1950s)

Readers are warned that mineralization at the Elmtree gold deposits and historic Nigadoo River Mine is not necessarily indicative of mineralization on the Keymet Property.

Access to the Keymet Property is excellent with paved roads transecting the property, including a provincial highway. The property covers an area of approximately 3,400 hectares and is 100% owned by the company.

Readers are warned that historical records referred to in this News Release have been examined but not verified by a Qualified Person. Further work is required to verify that historical records referred to in this News Release are accurate.

David Martin, P.Geo., a Qualified Person as defined by NI 43-101 and VP Exploration for Great Atlantic, is responsible for the technical information contained in this News Release.

A Qualified Person has verified the 2015 and 2017 exploration data for Great Atlantic. The Qualified Person managed the 2015 and 2017 exploration programs for Great Atlantic at the Keymet Property. True thickness of these intersections is unknown at this time.

Zinc equivalent (% Zn Equiv.) values for drill hole intersections are based on the following metal prices (as of June 14, 2018): Zinc US$3,227 / tonne (US$1.4638 / lb.), Lead US$2,459 / tonne (US$1.1154 / lb.), Copper US$7,201 / tonne (US$3.2664 / lb.) and Silver US$16.95 per troy ounce. Metal recoveries of 100% were applied in the zinc equivalent calculations. The zinc equivalent calculation is as follows: Zn Eq. = 100 x ((Ag Price in grams x Ag Grade) + (Pb Price x 2204.6 x Pb Grade (%) / 100) + (Cu Price x 2204.6 x Cu Grade (%) / 100) + (Zn Price x 2204.6 x Zn Grade (%) / 100)) / Zn Price x 2204.6.

On Behalf of the board of directors

“Christopher R Andersonâ€

Mr. Christopher R Anderson ” Always be positive, strive for solutions, and never give up ”

President CEO Director

604-488-3900 – Dir

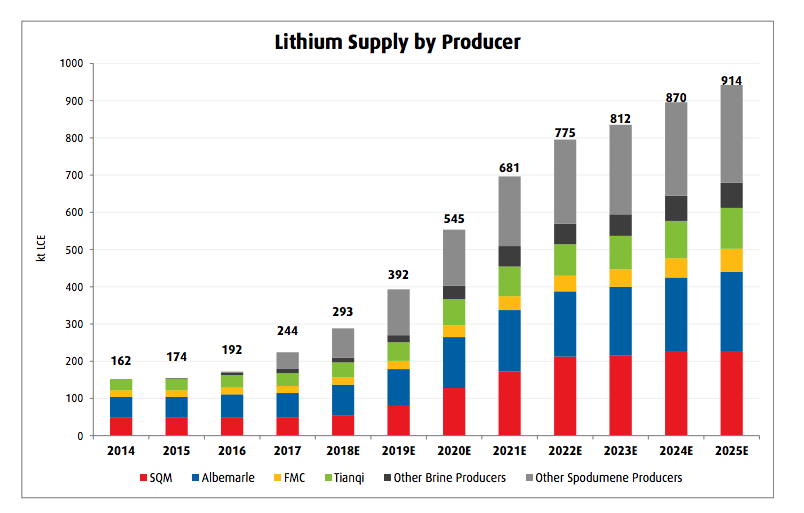

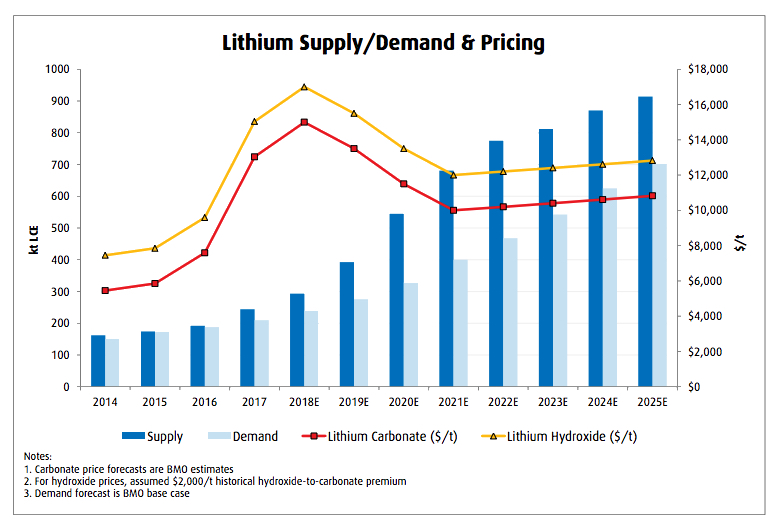

Wave of much-needed spodumene based supply coming online. (Source:

Wave of much-needed spodumene based supply coming online. (Source:  Source:

Source:

View original content with multimedia: http://www.newswire.ca/en/releases/archive/June2018/20/c8059.html

View original content with multimedia: http://www.newswire.ca/en/releases/archive/June2018/20/c8059.html