MONTREAL, March 08, 2018 – PyroGenesis Canada Inc. (http://pyrogenesis.com) (TSX-V:PYR), (the “Company”, the “Corporation†or “PyroGenesis”) a Company that designs, develops and manufactures plasma waste-to-energy systems and plasma torch systems, is pleased to provide herein a general update on its PUREVAP™ Project with HPQ Silicon Resources Inc (“HPQâ€).

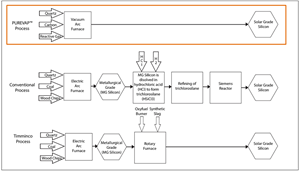

Comparison of PUREVAP™ vs. Conventional and Timminco Process.

Mr. P. Peter Pascali, President and CEO of PyroGenesis, provides this update on PUREVAP™ in the following Q&A format. The questions, for the most part, are derived from inquiries received from investors, and analysts:

Q. For those that are new to the story, could you please describe to us what the PUREVAP™ technology is and some of its many advantages?

A. Most certainly. HPQ is the owner of quartz properties. Quartz can be processed, through multiple steps, into a high purity silicon metal which is an important element in solar panels. It helps convert solar energy into useful electricity. Many in the solar panel industry consider the cost of converting Quartz into solar grade silicon metal to be a limiting factor in the growth of the solar panel industry.

PyroGenesis was first engaged by HPQ to demonstrate, on a laboratory scale, that its one-step proprietary PUREVAPTM process could produce high purity silicon metal from quartz in just one step.

PyroGenesis was taken by the prospect of using a plasma-based process to convert Quartz into solar grade silicon metal as there seemed to be a strong market need for such. A number of years ago, a company by the name of Timminco saw its stock soar from 20 cents to over $30 and its market cap increased to over 3 billion of dollars when it was perceived that they had found a way to reduce the number of steps, not eliminate all steps, just reduce the number of steps, in the processing of quartz into solar grade silicon metal1. That is not to say that this is what we expect here, but it did give us confidence that there was a significant need for a cheaper way to make solar grade silicon metal and, on paper, at the time, it looked like plasma might be able to address issues where other processes failed (Figure 1).

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/616c51e5-4644-46e2-b77d-2de4e8d362e7

To date, we are very pleased with the results and, in fact, believe we have already demonstrated better results than the Timminco process had in its day.

Q. That is quite impressive and quick. Tell me…the project has been described in several phases; Gen 1, Gen 2, and now the Pilot Plant. Could you please explain what the targets were in each generation, what was accomplished, and what the targets are now?Â

A.  Sure.

It goes without saying that, from a 30,000 ft level, it all has to do with purity and production rates. GEN-1’s goal was simply to prove the concept on a bench test scale and, if possible, identify parameters that could affect purity and production rates. GEN-2’s goal was to test the observations in GEN-1 at scale more representative of the pilot unit and was also geared towards optimizing the final pilot scale design.

GEN-1 was limited in that it was a batch system. This means that the feedstock, quartz, was fed into the system in batches…i.e. there was not a continuous feed of material. This limited the running time to batch runs of only a few hours. GEN-1’s primary goal of proving out that the PUREVAP™ technology could convert quartz into pure silicon metal in only one step was successful. From tests with GEN-1, we were also able to estimate the impurity removal efficiency of the PUREVAP™ process which turned out to be higher than expected from bench tests.

Some of the most interesting developments with GEN-1 were the observations relating to production yield. GEN-1’s thermal efficiency was very low due to certain characteristics inherent with GEN-1 (excessive cooling rate and long ramp ups for example). To make a long story short, PyroGenesis was able to conclude, by the end of GEN-1, that operating under a batch process with low thermal efficiency, lowered production yield (i.e. % conversion of silicon in quartz to elemental silicon) and in turn production rate. In other words, we concluded that by increasing production yield, we would not only generate larger amounts of output (higher production rate), but that output, by all accounts, should be at higher yields of wanted end-product. This was later proven out in GEN-2 and remains an important parameter in the final purity of silicon metal.

Another significant observation with GEN-1 spoke to the efficiency of the PUREVAPTM process. During testing with the GEN-1, we used lower quality quartz to see how the system would handle impurities. Low and behold, we managed to produce high purity silicon metal. Not the high purity metal demanded by solar panels, but high enough to be suitable for other commercial applications. We found this to be extremely significant as it opened up other markets for the PUREVAPTM process which were not identified at the outset. Remember, the original goal was to convert high purity quartz to high purity silicon metal for solar panels…now we can add to that equation the conversion of low purity quartz to high purity silicon for other applications (such as casting and chemical industries).

In short, GEN-1 accomplished the following:

- Proof of concept: converting quartz to high purity silicon using PUREVAPTM,

- Production rates and yields move in step,

- Use of lower quality quartz for the production of high purity silicon: PUREVAP™ has a very high impurity removal efficiency which enables the use of lower quality quartz for silicon production.

GEN-2 was designed and fabricated to operate semi-continuously in order to test the observations made in GEN-1. We also wanted to operate at higher temperatures and confirm the impact of thermal efficiency on production yield and ergo, purity (i.e. the more heat that goes towards the process rather than being lost to various system components should allow for a higher rate of silicon production and as such higher product purity).

GEN-2 was also made at a scale more representative of the operating mode of the pilot unit and as such was also geared towards optimizing the final pilot scale design.

GEN-2 demonstrated the following:

- PUREVAP™ can operate semi-continuously,

- A higher thermal efficiency was obtained resulting in a higher operating temperature,

- A higher production yield was achieved.

The challenges going forward relate to typical scale up issues, as well continually improving the process and focusing on removing individual impurities towards achieving solar grade silicon metal. Given the accomplishments to date and that, in many aspects, the GEN-2 is similar to the pilot plant, we are confident that at the end of the day we will have a commercial success. However, we don’t know what we don’t know, right? That is what development is all about. I am confident that any challenges will be met head on, as they have in the past, by arguably the best team around to do that. Together with Apollon Solar, which have signed an agreement with HPQ to provide valuable input into the process, we are well positioned to successfully complete the design and testing of the next phase.

Q. Interesting. In your press release dated January 15th, 2018, you announced that your GEN-2 process is now operating “semi-continuously under vacuumâ€. What does that mean exactly, “under vacuumâ€? And what difference does it make?

A.  This is a huge development.  Essentially it means that rather than operate at normal pressure, the PUREVAP™ process can operate at very low pressure when converting quartz into high grade silicon metal. Lowering the operating pressure favors something called volatilization of impurities. Without getting too technical, this volatilization of impurities essentially improves the purity of the end product by forcing the impurities out of the reacting system thus leaving behind a purer silicon metal. It effectively enhances the removal efficiency of impurities. Bottom line: the main advantage of being under vacuum is the fact that impurities don’t accumulate in the silicon phase. This is a huge development on our road to success. To our knowledge, there is no other process that produces silicon metal directly from quartz under vacuum. Don’t get me wrong, vacuum refining does exist in the market to remove certain impurities from silicon that has already been produced (i.e., silicon is produced, re-melted, then it goes under vacuum), but it is a total different animal altogether. It requires a post-treatment process which is limited and thereby adds additional costs. As far as we know, we are the only players to operate under vacuum in the production of silicon metal. As I said, this is huge, and the impact of which has not really been fully understood by the market.

Q. How transferable are the results obtained from GEN-2 to the pilot plant?

A.  We believe they are very transferable. In fact, we expect the results to be even better at larger scale. By increasing the scale, we are increasing the production rate. Theoretically, this will give us a better conversion yield according to our results so far.

As you can imagine, we are already extremely excited about the results we have had with GEN-2, and we can only imagine what the results will be with the pilot plant. As mentioned, at a larger scale, the production rate is automatically higher which, we have proven with GEN-2, should lead to a higher conversion yield and better purity.

Q. Tapping tapping tapping… Everyone is asking for tapping. Why hasn’t it occurred and when will it occur?

A.  It is an interesting question because it reflects a belief that there is a connection between tapping and success to date. The accomplishments noted above with GEN-1 and GEN-2, in my opinion, are more reflective of success than tapping.

Tapping will come naturally. When liquid accumulates enough, tapping can occur. The purity of silicon in liquid form is expected to be very high. Tapping was not part of the GEN-2 objectives and, as such, we never operated with the goal of creating the conditions to tap.  At this point, we spent our time and money on testing that had a direct impact on production, purity, and design. Tapping, as nice as it would be to see, and possibly a nice press release, has more value to our knowledge and progress in the pilot phase. As such, rest assured, that at the pilot plant phase tapping will be demonstrated as production and conversion yields should be higher.

Q. An often-asked question is, how comfortable are you with the patent application?

A. The short answer is: very comfortable. PyroGenesis has never failed in obtaining a patent when we have applied for one, and we have extensive experience over many years doing so. Â

It is understandable that a person unfamiliar with our history, patents in general and the patent process specifically, may get hung up or side tracked by this question.

I answered this type of question once before, in another forum, by describing the players and the process.  It basically works something like this: when one applies for a patent it behooves one to try and describe in as much detail what the patent can uniquely do and, at the same time, get the best coverage surrounding the patent claims.  That is the role of one who applies for a patent.   The examiners role, on the other hand, is to challenge the patent and/or limit the claims.  That is their role. Of note is that the examiner cannot be expected to be an expert in every field so oftentimes, the challenges are more of a “please explain why…†type of a challenge.  We have faced on numerous occasions extremely negative comments from the examiner at the PCT level. This is quite common, and it has never prevented us from obtaining patents at the end of the day.

As I said, we feel very comfortable with the patent application and, without getting into specifics, we have a very well thought out and articulated patent and IP strategy regarding the PUREVAP™ technology. Just remember, this is a costly and time-consuming process and we don’t have either to waste. Rest assured, if we did not think we would succeed we wouldn’t waste our time or money.  It’s not more complicated than that.

Q. Some investors/shareholders are skeptical about the whole process. Do you have any comments?

A. …and so they should be. Seriously, we are talking about a process that potentially could be game changing beyond description. Who wouldn’t be skeptical? You would have to be a fool not to be. Adding to this is the fact that the results to date are beyond our expectations which, in a weird way, fuels the skepticism, no? It’s almost too good to be true…makes one think that a little bit of bad news might put people at ease. Just joking, but you get my drift.

On the other hand, how many chances do you get to invest into such potential, at 10 cents a share and market cap of under CAD$20 million? I am talking about HPQ here. Anyways, just food for thought.

Q. PyroGenesis is a shareholder of HPQ, isn’t it?

A.  Yes, we are. We currently hold over 5 million common shares and over 3 million warrants which are reflected on our balance sheet.

Q. Would you invest more into HPQ?

A. Yes, we would consider it if it made sense, but let me be very very clear on this point. PyroGenesis is investing each and every day into HPQ. I have said this before and I will say it again, PyroGenesis does not have time or money to waste on projects that do not have future potential. Each and every day PyroGenesis has to decide where to allocate its resources, the most important of which is its time. Plasma expertise, such as ours, does not grow on trees and we must be very discerning as to where we dedicate this valuable resource. Do we dedicate it to Additive Manufacturing (powders for 3D printers), DrosriteTM, other development projects…or HPQ? The profit from the HPQ contract does not in and of itself justify dedicating such scarce resources to the project, the royalty from the success of the project, does.

Q. And that is a good segue into our last question. Some investors of HPQ have accused them of paying PyroGenesis for a project that has no risk to PyroGenesis. How would you respond to them?

A.  Besides my answer above, where I describe the opportunity cost of the HPQ contract and the risk associated with that, I would have to add that PyroGenesis is not a charity and we are in the business of making money. Our expertise is unique and arguably, it is that exact expertise that has given this project, and HPQ, a life and a future. In short, you get what you pay for and we would not have done it for less…in fact, we wanted more and were negotiated to the current arrangement.

My final comment to any detractor of HPQ and HPQ management is: wake up. Wake up to the unique management you have, a management that was not only able to identify this opportunity, but also the players required to carry out the project. In fact, it took a lot of convincing by HPQ management to get PyroGenesis’ interest as HPQ did not fit our client/risk profile at all. All this to say that, take it from experience, encouraging management and getting behind it goes a long way to getting management up in the morning…to do it again and again …which, can do nothing but help the stock…. then bashing them with perverted 20/20 hindsight. Just a thought.

Q. Conclusion?

A. We believe the PUREVAP™ process to be game changing and has the potential to revolutionize the solar panel industry. We don’t know of any other process or technology that is able to do what we have done to date.

Not only have we progressed along the path to processing high purity quartz to solar grade silicon metal, but we have demonstrated the ability to convert low purity quartz to quality silicon metal suitable for other industries which was not contemplated when the project was initiated.

In short, PyroGenesis is happy with the progress to date and stand firmly behind the project. We are more convinced than ever before that we will be successful in having a commercially viable process at the end of the day.

About PyroGenesis Canada Inc.

PyroGenesis Canada Inc. is the world leader in the design, development, manufacture and commercialization of advanced plasma processes. We provide engineering and manufacturing expertise, cutting-edge contract research, as well as turnkey process equipment packages to the defense, metallurgical, mining, advanced materials (including 3D printing), oil & gas, and environmental industries. With a team of experienced engineers, scientists and technicians working out of our Montreal office and our 3,800 m2 manufacturing facility, PyroGenesis maintains its competitive advantage by remaining at the forefront of technology development and commercialization. Our core competencies allow PyroGenesis to lead the way in providing innovative plasma torches, plasma waste processes, high-temperature metallurgical processes, and engineering services to the global marketplace. Our operations are ISO 9001:2008 certified, and have been since 1997. PyroGenesis is a publicly-traded Canadian Corporation on the TSX Venture Exchange (Ticker Symbol: PYR) and on the OTCQB Marketplace. For more information, please visit www.pyrogenesis.com

This press release contains certain forward-looking statements, including, without limitation, statements containing the words “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “in the process” and other similar expressions which constitute “forward- looking information” within the meaning of applicable securities laws. Forward-looking statements reflect the Corporation’s current expectation and assumptions, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Corporation with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Corporation’s ongoing filings with the securities regulatory authorities, which filings can be found at www.sedar.com, or at www.otcmarkets.com. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Corporation undertakes no obligation to publicly update or revise any forward- looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange, its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) nor the OTCQB accepts responsibility for the adequacy or accuracy of this press release.

SOURCE PyroGenesis Canada Inc.

For further information please contact: Rodayna Kafal, VP, Investor Relations and Strategic Business Development, Phone: (514) 937-0002, E-mail: [email protected]Â

To view the graphic in its original size, please click here

To view the graphic in its original size, please click here Polymetallic vein in Ky-15-4 (8.68% Zn, 0.29% Cu & 44.8 g/t Ag over 4.28 meter core length)

Polymetallic vein in Ky-15-4 (8.68% Zn, 0.29% Cu & 44.8 g/t Ag over 4.28 meter core length) To view the graphic in its original size, please click here

To view the graphic in its original size, please click here Copper, Zinc & Silver bearing vein in 2015 Trench (Elmtree 12 Vein System)

Copper, Zinc & Silver bearing vein in 2015 Trench (Elmtree 12 Vein System)