TSX-V: BFF, (OTC Pink: SSMLF)

Why Lithium?

- Major companies such as Sony and Panasonic got behind lithium as an anchor material in a possible successor to the lead-acid battery paradigm.

- Although it took decades, lithium-based batteries are now the industry standard.

- Lithium has limited supply and increasing demand.

- Lithium seems untouched by economic downturns.

- Lithium prices increased by about 20% in 2014 and by a larger percentage in 2015 when gas, coal and natural gas were down 50%

- Climate change has lead to the frenzied search for green energy solution

- Because of its high reactivity, lithium does not occur as a pure element in nature but is contained within minerals in a range of hard rock types or in brine solutions (elements contained in salty water) in salt lakes, “salars.†Lithium’s primary driver for growth is:

Batteries and grid-scale energy storage:

- Most important use of lithium is in rechargeable lithium-ion batteries for electric vehicles, grid-scale energy storage, phones, laptops, cameras, gaming consoles and hundreds of other electronic devices.

- Lithium-ion batteries are increasingly used for bikes, power tools, forklifts, cranes and other industrial equipment. In essence, lithium powers modern technology.

Benchmark Mineral Intelligence estimates that the

“EV market will grow five-fold between 2015 and 2020 while the market for stationary storage will increase 8-fold.â€

We have already seen Tesla increase the land holding of their $5 billion under-construction lithium-ion battery factory and Faraday Future strike a deal to build a $1 billion electric car plant.

Nevada Energy Metals Acquires 100% Ownership in Clayton Valley BFF-1 Lithium Project

- Announced acquisition of 60 claims in Clayton Valley, Esmeralda County, Nevada

- 250 meters from Albemarle Corporation’s Silver Peak lithium mine and brine processing operations

- Also the location of Pure Energy Minerals’ 816,000 metric tonnes Lithium Carbonate Equivalent (LCE) Inferred Resource

- 3.5 hours away from Tesla’s Gigafactory, which has a planned annual lithium-ion battery production capacity of 35 gigawatt-hours per year by 2020

- Aannounced that it has agreed to grant 1074654 Nevada Ltd an Option to acquire a seventy (70%) percent interest in the BFF-1 Clayton Valley Property

Nevada Energy Metals Expans Lithium Exploration Potential at San Emidio

Company has increased the exploration potential of the San Emidio property by adding 69 additional claims to its land position. The property now includes 155 claims (approximately 3,100 acres/1255 hectares) in the San Emidio Desert, Washoe County, Nevada, 95 km northeast of Reno.

Importantly, historical results by previous operators exploring the playa for lithium reported lithium value in sediments up to 312 ppm and up to 80 ppm lithium in brine from a depth of 1.5 meters.

Company acquired 160 placer claims, with an area of 3,200 acres/1,295 hectares, located in northern Big Smokey Valley, Township 13N., Range 43E, Nye County, Nevada.

BSV Property:

Big Smokey Valley is situated in central Nevada. It begins at a point 12 miles east of the town of Austin and extends approximately 100 miles in a southwesterly direction to reach a southern terminus near Clayton Valley to the west of Tonopah. Hydrologically and topographically the valley is divided into northern and southern sections by a physiographic high near the mining community of Round Mountain. The northern section, where the claims area is located contains three geothermal resources; the Darrough, the McLeod and the Spencer hot springs.

Projects

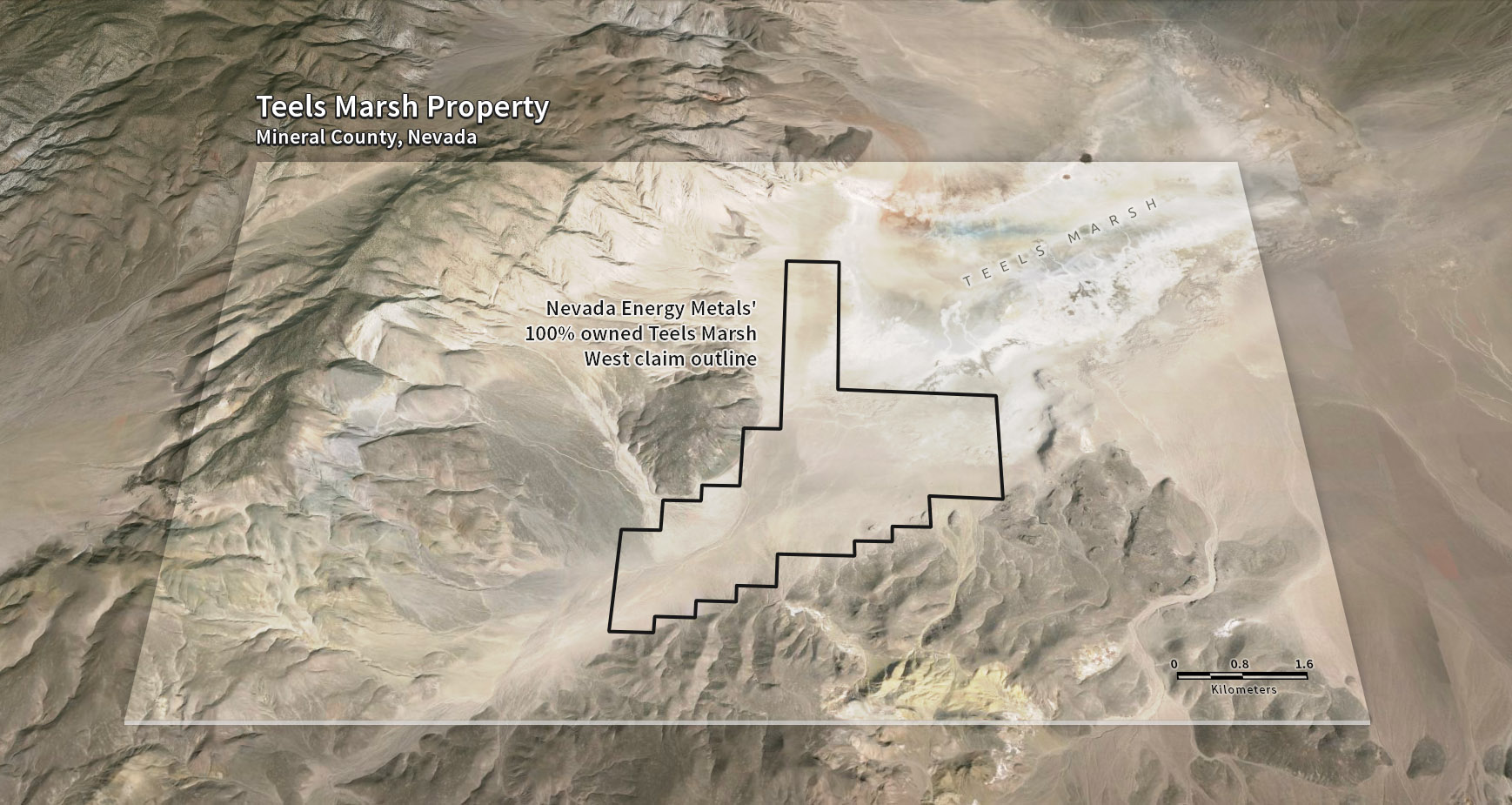

- Acquired, by staking, 100 placer claims covering 2000 acres (809 hectares) at Teels Marsh, Nevada.

- Property, called Teels Marsh West is highly prospective for Lithium brines and is located approximately 48 miles northwest of Clayton Valley and the Rockwood Lithium Mine, North America’s only producing brine based Lithium mine supporting lithium production since 1967.

- Access to Teels Marsh is via dirt road, west of Highway 95 and northwest of Highway 360.

- Completed an orientation survey

- Collected twenty-seven shallow auger sediment samples

- Lithium values ranged from 8.9 to 104.5 ppm. The two best results (93.2 and 104.5) were obtained downstream of thermal springs on the western part of the property

Teels Marsh West is a highly prospective Lithium exploration project, 100% owned without any royalties, located on the western part of a large evaporation pond, or playa (also known as a salar). Structural analysis reveals that Teels Marsh is bounded by faults and is tectonically active. Tectonic activities supply additional local permeability that could be provided by the faults that bound the graben and sub-basins.

- Located 12 km (7.5 miles) northeast of Albemarle Corporation’s (formerly Rockwood Lithium),Silver Peaksolar evaporation ponds. Silver Peak is the only producing brine-based lithium facility in North America.

- 60-40 earn-in joint venture with Dajin Resources Corp.

- In addition to its proximity to Silver Peak, the property is 20 km (12.5 miles) east-northeast of Pure Energy Minerals’ Clayton Valley exploration project.

- Preliminary data from ongoing exploration activities on the property, suggest that Alkali Lake could be situated on one of the most prospective areas in the entire basin.

- Lithium assay results from sediment sampling carried out on the Alkali Lake property confirmed the presence of near-surface lithium at grades ranging from 73 ppm to 382 ppm.

- Early stage exploration property, located in the northern foothills of the Alaska Range, which contains VMS (volcanogenic massive sulfide) mineralization.

- Property is located in the east portion of the Bonnifield Mining District, central Alaska, approximately 60 mi (96 km) south of Fairbanks, Alaska (Figure 1).

- Property consists of 36 quarter-section State of Alaska mining claims (Galleon 1-36; Appendix 1) held by Anglo Alaska Gold Corporation (AAGC). Rock Star Resources Inc (RSRI) holds the rights to a 100% earn-in interest under an agreement with AAGC to pay for exploration and make required payments.

- Access to the Property currently is only by helicopter, or by trail from a nearby airstrip, however, strong potential exists for future development of a road connecting the Property with an existing mine road system to the west.

- The claims are subject to a 3% Net Production Royalty to the State of Alaska beginning 3.5 years after mine start-up. All claims comprising the Galleon Property are in good standing at the time of this writing.

Energy metal markets are booming

The age of electrification across the transportation sector, the solar panel revolution, and Tesla’s battery gigafactory are igniting a battle for the cheapest battery. That will transform lithium into a boom-time mineral and the hottest commodity on the energy investor’s radar. It has been easy to take lithium for granted. This wonder mineral is the backbone of our everyday lives, popping up in everything from the glass in our windows to our mountains of electronics.

And while investors have long appreciated the steady rise in demand for this preferred mineral, the number of new applications continues to multiply. Smart phones, tablets, laptops, and other consumer electronics demand more lithium. But the largest driver for future lithium use will be in electric vehicles and home batteries for solar panels. That has lithium on the verge a boom for which supply can no longer be taken for granted.