SPONSOR: Tartisan Nickel (TN:CSE) Kenbridge Property has a measured and indicated resource of 7.14 million tonnes at 0.62% nickel, 0.33% copper. Tartisan also has interests in Peru, including a 20 percent equity stake in Eloro Resources and 2 percent NSR in their La Victoria property. Click her for more information

Fact Sheet

—————————-

EV’s will make nickel a once-in-a-generation investment opportunity, says BHP

- More EVs and more nickel in each of them will drive nickel demand through the roof, says the head of BHP’s Nickel West arm.

- His forecast is great news for those juniors with large nickel deposits awaiting development, such as the Jaguar project just acquired by Centaurus from Brazilian giant Vale.

By: Barry FitzGerald

The display of oomph at last week’s Diggers & Dealers conference in Kalgoorlie was not restricted to the gold stocks.

The nickel stocks made sure of that, with none other than BHP leading the charge in a presentation by its Nickel West president, Eddy Haegel.

Nickel West is the formerly unloved BHP unit that has come into its own in response to what Haegel described as a once-in-a-generation opportunity presented by the gathering nickel-rich battery boom.

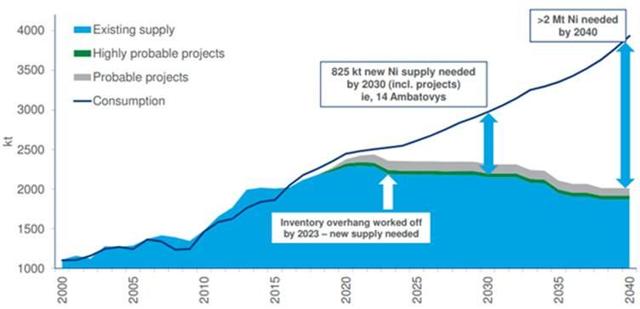

Haegel said that in addition to the rapid growth in electric vehicles sales, BHP expects nickel-in-vehicle demand to surge, driven by three factors.

The first is batteries are becoming bigger to improve vehicle range and performance. Next, nickel-based cathodes are taking market share from non-nickel cathodes because they’re “simply betterâ€.

And finally, increasing nickel in battery chemistries increases energy density, delivering better performance and lower costs.

“It is important to understand that a 60kwh NMC811 battery needs 9kg of cobalt, 11kg of lithium and a massive 70kg of nickel,†Haegel said.

While stainless steel still accounts for about 70% of nickel consumption, batteries is the fast growing subset, to the point where EV’s alone could account for all of the current production in the late 2020s.

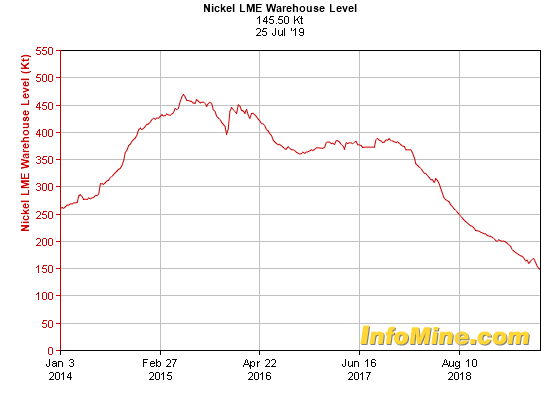

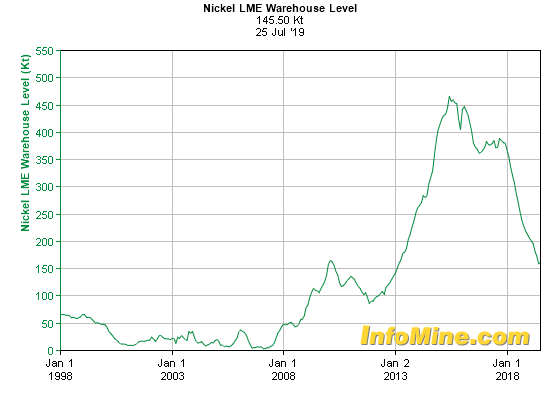

Haegel sounded a note of caution about the here and now. While BHP thinks there is going to be a significant increase in global nickel demand, it is a case of not just yet.

“We do not expect to see a meaningful impact on the nickel market from batteries until the mid – late 2020s. Only then, do we expect to see serious industry investment by Class 1 nickel producers,’’ Haegel said.

“However, we will not rest waiting for that day to arrive. We are actively developing options to position ourselves for this once-in-a-generation opportunity.’’

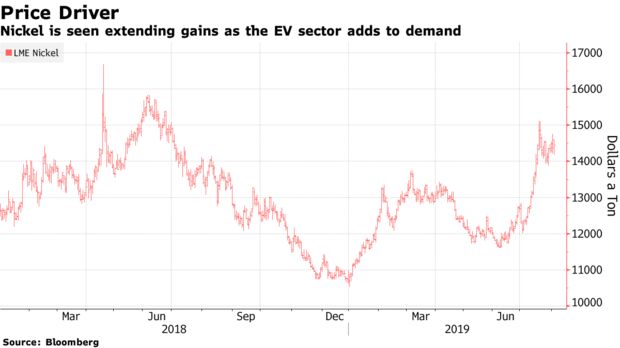

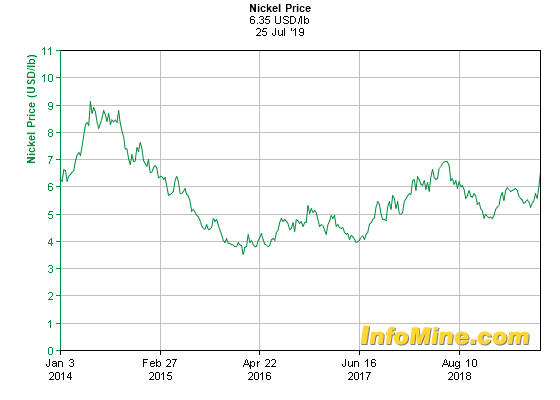

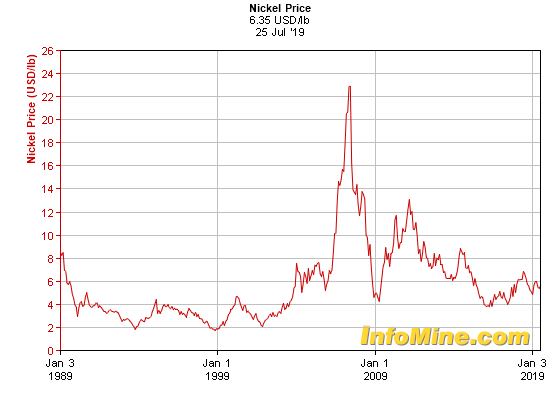

It is against that backdrop that the nickel price has been a strong performer of late. The current price of $US7.17/lb compares with the 2018 (calendar) average of $US5.95/lb, and the 2017 average $US4.72/lb.

CENTAURUS METALS:

Talking about once-in-a-generation opportunities, Centaurus Metals (CTM, trading at 0.9c for a market cap of $24m) has just seized one which gives it a ticket to the battery-led nickel party discussed above.

In what was probably the most significant announcement by a junior at D&D, Centaurus made everyone sit up and take notice when it revealed it had struck an option deal to acquire the Jaguar nickel sulphide project in Brazil from Vale, no less.

Jaguar comes with a foreign resource estimate of a near-surface 40.4mt grading 0.78% nickel for a total of 315,000t of contained metal across a cluster of deposits, with lots of exploration upside to boot.

It is a lot of nickel for a company with a $24m market, particularly, as was mentioned here on May 31 when Centaurus was trading at 0.8c, its market value is pretty much covered by its Jambreiro iron ore project in Minas Gerais state.

Assume long-term-term iron ore prices of $US60-$80/t, Jambreiro could be good for $A20-$A25m in pre-tax operating cashflow. But it is not in production and it has to be said its importance to Centaurus has been overwhelmed by Jaguar.

Jaguar sits in the western portion of the Carajas mineral province and covers 30sqkm of land containing the known foreign resource estimate (based on 55km of diamond drilling by Vale) and at least four exploration targets.

To complete the acquisition, Centaurus is up for a $US250,000 upfront cash payment, the transfer of its Salobo West copper-gold exploration tenements to Vale, two deferred payments totalling $US6.75m and a production royalty of 0.75%.

Vale will have offtake rights (its Onca-Puma nickel mine is in the region) and importantly, preliminary metallurgical testwork by Vale has indicated a high-grade and quality nickel concentrate can be produced from Jaguar’s sulphide mineralisation.

It is not a deal that would have been available to others as it reflects both Centaurus’ long-term commitment to Brazil and Vale’s interest in Salobo West, which is near its Salobo mine, its biggest copper operation.

Centaurus hits the Eastern States next week to promote the Jaguar deal and assuming a good reception, raising some funds to get cracking on Jaguar’s near-term potential as an open-cut producer from higher grade sections of its resource base will a key talking point.

VENTUREX:

Venturex boss AJ Saverimutto had a good reason to be wearing a sharp suit at an investor lunch at the Palace Hotel on the opening day of the D & D conference.

AJ had just announced Venturex (VXR, trading at 18c for a market cap of $54m) had locked away a $100m senior debt funding package with commodities trader Trafigura for its Sulphur Springs copper-zinc project in the Pilbara, 145km south of Port Hedland.

The debt deal means that Sulphur Springs is pretty much on its way – once the equity component of the $169m capex project is locked away – to becoming Australia’s next base metals producer in an ASX market where leveraged investment opportunities for copper in particular are thin on the ground.

As much as nickel is needed for batteries in the electric vehicle and the storage of renewable energy revolution, copper is even more so. About 80kg of the red metal is required for an EV alone, a fact that underwrites expectations that the world will be short about 4mpta of copper come 2025.

Sulphur Springs’ high-grades – it nets out at about 3.3% copper equivalent – from five years of open cut mining, followed by five years of underground mining as the starting point, makes it a development for the times.

Based on realistic metal price assumptions, the 1.2mtpa operation (easily expandable to 2mtpa on the conversion of exploration upside to additional resources/reserves) will generate revenue of about $209/t and a before-tax margin of $65/t.

Multiply that out and Sulphur Springs is good for about $80m in average annual free cashflow, or $800m over the initial 10 year mine life. That’s why Venturex has been able to lock away the $100m in debt funding in a market where debt funding for projects held by juniors is virtually non-existent.

Northern Star has been a supporter of the story since 2012 and is Venturex’s biggest shareholder with a 19.8% stake.

AJ said a number of equity options would be looked at to complete the financing, including the possible introduction of a strategic partner who would be happy with Trafigura’s 100% offtake for the first 11 years, 50% thereafter.

Broker valuations of the stock which pre-date the debt component of Sulphur Springs, a major de-risking event if there ever was one, were multiples of the current price.

Source: https://www.livewiremarkets.com/wires/ev-s-will-make-nickel-a-once-in-a-generation-investment-opportunity-says-bhp