As the world shifts towards a more sustainable future, electric vehicles (EVs) have become a key player in reducing carbon emissions and fossil fuel dependency. Central to this transition is the nickel used in lithium-ion batteries, the power source for EVs. In this context, Power Nickel Inc., a Canadian junior exploration company, has positioned itself as a leader in the exploration and development of high-grade nickel projects. With the company’s recent acquisition of an additional 30% stake in the Nisk Project, Power Nickel has solidified its role in the rapidly growing EV battery manufacturing industry.

Industry Outlook and Power Nickel’s Trajectory

The demand for nickel in EV battery manufacturing is on a steep upward trajectory. According to industry projections, the global demand for nickel is expected to increase six-fold by 2030, driven by the rapid growth of electric vehicle production worldwide. This surge in demand underscores the critical role that nickel plays in the journey towards a greener future.

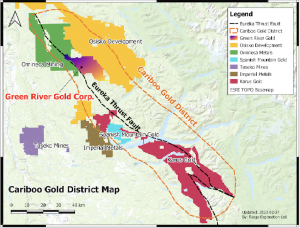

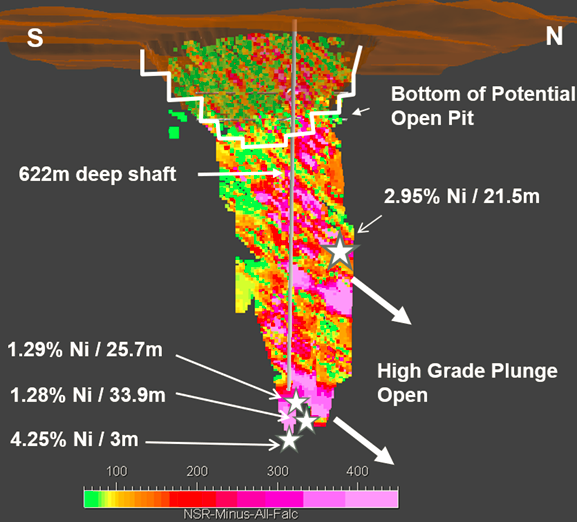

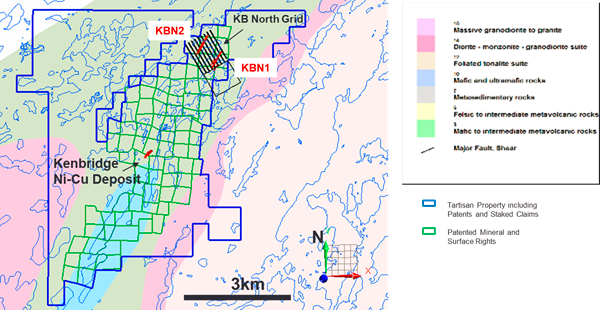

Power Nickel’s focus on developing high-grade nickel-copper platinum group elements (PGE) mineralization is perfectly aligned with this industry trend. The company’s flagship project, the Nisk Project, encompasses 20 kilometers of strike length with numerous high-grade intercepts, positioning Power Nickel to meet the industry’s growing demand for nickel.

Voices of Authority

Industry leaders and experts are emphasizing the importance of nickel in the transition to electric vehicles and a sustainable future. Terry Lynch, CEO of Power Nickel, commented on the recent acquisition, stating, “We look forward to ramping up our efforts throughout 2024 and 2025 as we seek to bring these targets to a production decision.” This sentiment reflects the optimism within the industry and Power Nickel’s commitment to contributing to a carbon-neutral future.

Kenneth Williamson, Power Nickel’s VP of Exploration, added that the company’s drilling program has yielded significant results, providing a strong foundation for future exploration. “With 15 successful holes at the Lion Discovery zone and additional assays on the way, we’re excited about the potential of the Nisk Project,” he noted.

Power Nickel’s FLASH Highlights

The latest resource estimate for Power Nickel’s Nisk Project presents a promising outlook with significant indications of nickel and associated minerals. The assessment reveals a considerable amount of both indicated and inferred resources, indicating the high potential of the project’s nickel sulfide deposits.

Here are the key details from the resource estimate:

- Indicated Resources:

-

- The Nisk Project has over 5.4 million tonnes of indicated resources, grading an average of 1.05% Nickel Equivalent (NiEq). This category reflects mineralized material with a higher level of geological confidence, derived from drilling results and other studies.

- Inferred Resources:

- In addition to the indicated resources, there are 1.8 million tonnes of inferred resources, grading at 1.35% NiEq. While this category has lower geological certainty compared to indicated resources, it shows the considerable potential for further exploration and resource expansion.

In addition, Power Nickel has achieved several key milestones that underscore its strategic position in the industry. The company’s acquisition of an additional 30% stake in the Nisk Project, increasing its ownership to 80%, is a significant step towards its goal of developing Canada’s first carbon-neutral nickel mine. Additionally, Power Nickel’s Winter 2024 drill program revealed high-grade assay results, further validating the project’s potential.

These achievements not only demonstrate Power Nickel’s commitment to exploration and development but also highlight its capacity to contribute to the broader EV battery manufacturing industry.

Real-world Relevance

Power Nickel’s work has a direct impact on the EV industry and, by extension, on our everyday lives. The nickel sourced from projects like Nisk is a key component in lithium-ion batteries, which power electric vehicles and a wide range of portable electronic devices. This connection between nickel mining and green technology is a tangible example of how companies like Power Nickel are driving positive change in the world.

Moreover, the company’s commitment to carbon neutrality aligns with the broader sustainability goals that many industries are striving to achieve. As electric vehicles become more prevalent, the need for sustainable nickel sourcing will only grow, reinforcing Power Nickel’s relevance in this evolving landscape.

Looking Ahead with Power Nickel

Power Nickel’s forward-looking goals are closely tied to the optimistic industry forecast for the nickel sector. The company’s ongoing exploration and development efforts are set to continue throughout 2024 and 2025, with plans to bring the Nisk Project to a production decision. This ambitious approach reflects Power Nickel’s confidence in the project’s potential and its dedication to contributing to the growth of the nickel industry.

With the demand for nickel in EV battery manufacturing expected to soar, Power Nickel is well-positioned to capitalize on this trend. As the company moves forward, its focus on high-grade mineralization, sustainability, and exploration will play a crucial role in shaping its future success.

Conclusion

Power Nickel’s recent achievements and strategic trajectory make it a compelling participant in the nickel industry’s growth narrative. With the increasing demand for nickel in EV battery manufacturing, the company’s focus on high-grade projects and sustainable practices positions it as a key player in this dynamic industry. Power Nickel’s journey towards becoming a leading provider of nickel and multi-element mineralization is a story worth watching.

YOUR NEXT STEPS

Visit $PNPN HUB On AGORACOM: https://agoracom.com/ir/PowerNickel

Visit $PNPN 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/PowerNickel/profile

Visit $PNPN Official Verified Discussion Forum On AGORACOM:

https://agoracom.com/ir/PowerNickel/forums/discussion

Watch $PNPN Videos On AGORACOM YouTube Channel:

https://youtube.com/playlist?list=PLfL457LW0vdLJgdyN9gnd7VKr4xMKBpQ7&si=DumfF-sMw_Uat7Ce

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.

From time to time, reference may be made in our marketing materials to prior Records we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

NO INVESTMENT ADVICE

This record, and any record we publish by or on behalf of our clients, should not be construed as an offer or solicitation to buy or sell products or securities.

You understand and agree that no content in this record or published by AGORACOM constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person and that no such content is tailored to any specific person’s needs. We will never advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

Neither the writer of this record nor AGORACOM is an investment advisor. Both are neither licensed to provide nor are making any buy or sell recommendations. For more information about this or any other company, please review their public documents to conduct your own due diligence.

If you have any questions, please direct them to [email protected]

For our full website disclaimer, please visit https://agoracom.com/terms-and-conditions