Summary

- At $1.34/share the stock is trading for just less than 12% of the company’s net current assets.

- Investors have good justification for being pessimistic toward Omagine’s future profitability.

- The question is not whether investor sentiment should be low, but whether it is too low.

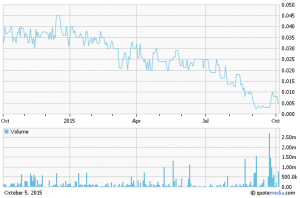

Omagine, Inc. (OTCQB:OMAG), a Delaware-based holding company, is a stock the market has apparently left for dead. In fact, investors are currently declaring that the company is worth more dead than alive. At $1.34/share the stock is trading for just less than 12% of the company’s net current assets. This means that not only does the market value the firm’s Property, Plant & Equipment at zero, but it is also discounting the net liquid assets by nearly 90%.

Benjamin Graham famously classified stocks such as Omagine as Net Current Asset Value (NCAV) stocks. NCAV is a stock-selection strategy which Graham developed and implemented. The strategy finds stocks trading for less than the difference between current assets minus total liabilities. There is no regard given to the company’s long-term assets or future profits. Warren Buffett nicknamed it the “cigar-butt approach” because:

Investors have good justification for being pessimistic toward Omagine’s future profitability. The company has consistently posted negative earnings and free cash flow in each year for the last decade. The question is not whether investor sentiment should be low, but whether it is too low. The company has reported free cash flow per share of negative $0.064 on average for each of the last five years. If this losing trend continues, it would take 160 years for the company’s net current assets to fall to what they are valued at today.

Without attempting to make any predictions on Omagine’s future prospects, the fundamentals below clearly show that a significant margin of safety is built into the stock price.

- Current Assets: $490.85 Million

- Total Liabilities: $288.92 Million

- Diluted Weighted Average Shares: 17.42 Million

- Net Current Asset Value/Share: $11.59

- Current Price: $1.34 (intraday on 2/18/16)

- Price/NCAV: 11.6%

Individual investors who buy a diversified group of NCAV stocks such as Omagine, can be confident in the long-term results they will achieve by patiently implementing the strategy. Benjamin Graham acknowledged that this approach is “ridiculously simple” but argued for its undeniable success.

Late in his life, he estimated this strategy earned him an average of 20% per year. He said, “I consider it a fool-proof method of systematic investment – not on the basis of individual results but in terms of the expectable group outcome.”

Graham warned that the approach only works “if you can find enough of them to make a diversified group, and you don’t lose patience if they fail to advance soon after you buy them.” For a deep margin of safety, Graham always made an effort to pay no more than two-thirds the NCAV.

At the time of this writing, Omagine is displaying as stock with the lowest price to NCAV on TheStockMarketBlueprint.com.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.