TUCSON, Ariz., Feb 18, 2015 — Liberty Star Uranium & Metals Corp. (“Liberty Star” or the “Company”) (OTCQB: LBSR), which holds 100% interests in the Company’s premier exploration property for porphyry copper, gold and associated commercial metals, The Hay Mountain Project (southeast Arizona – Cochise County), is pleased to announce a shareholder update and comments from the CEO. Additionally, new travel arrangements have been set: Mr. Briscoe and Director Brett Gross depart for Manila, Philippines, February 26th to meet a group of mining professionals introduced to the Company by a long-time Liberty Star shareholder, mining engineer and investor, in an all-day meeting on Monday, March 2, 2015. The pair plan to make multiple in-depth presentations to an audience of potential investors that have signed binding non-compete/non-disclosure agreements. The naseba roadshow announced in NR 193 has been postponed.

James A. Briscoe, Chairman, CEO and Chief Geologist, offers the following update and comments:

“At this time I feel it is important to reaffirm our goals for the Hay Mountain Project and the company at large. The financing of our yearlong Phase 1 drilling program at our Hay Mountain Project remains priority one. I plan to travel to Manila, Philippines, to meet sophisticated potential investors with this goal in mind. We were scheduled to travel to the Middle East for a roadshow sponsored by naseba/Naru Capital, but events there and ensuing turmoil have intervened and I and the board of directors have decided that I should not travel to the area until security issues have been resolved. I have arranged with Naru/naseba to undertake teleconference meetings with appropriate candidates from the Middle East area for now. While Hong Kong was on the agenda and is a good venue, we will have to put it off until more contacts have been made.

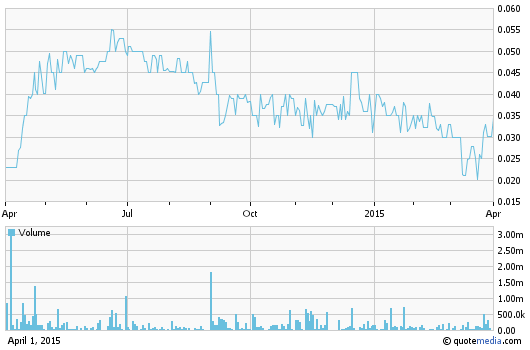

“Let me go over some of the financial realities we are operating under right now that have impacted the Company. Natural resource prices have hit multiyear lows which have turned investment not only away from our efforts, but the industry at large. I invite you to look at the stock trading charts of any exploration or mining company and you will see red ink everywhere. I believe this will not last long term and that copper and gold prices must go up: if not immediately, the trend must return to conform to the global demand for resources that is widely acknowledged. While I am in no position to take responsibility for this mega-trend knowledge, I do intend to capitalize on it for shareholders when negotiating with potential investors in Hay Mountain. Right now the cost of exploration is depressed: it will be a sage partner who will enter the market at its very lowest and understands the adage ‘buy low, sell high’ and understands the supercycle for metal prices, especially copper (see Don’t Get Hung Up on Short-term Copper Prices: Lawrence Roulston, Jan 22, 2015).

“I also want to address questions that have come to my attention:

“Question 1: Is a reverse split under consideration? I am not considering this option at this time. Even if I did decide to reverse split because of a new regulatory requirement or other unforeseen reason, I would first seek approval of the shareholders to increase the authorized capital, and there would be prior notice through our filings with the SEC. When we progress to the drilling stage and as the copper price rises, as it always does and will again, I believe our fortunes will rise as well, and a rollback will have seemed inconsequential.

“Question 2: Am I considering changing the Phase 1 drilling program to drilling a couple of mother holes soon, using Liberty’s funds, rather than waiting for a JV? No, I think that is not a good idea for the Company and its shareholders. My thinking stems from my experience and the history of exploration in the area. I’ve been involved in porphyry copper exploration and mining for 50 years. It was my good fortune to have worked directly for two of the world’s great ore finders and lifelong business partners, ASARCO geologists Kenyon Richard, and James Harold Courtright, respectively VP Exploration and Chief Geologist. I’ve spent many hours and days with these two mentors, who took time to review the exploration histories of the discovery of Silverbell, the Mission Mine (both in Pima County, Arizona), and many others in Arizona, Nevada, Canada, southern Peru, Mexico, the Mother Lode gold belt, California and the Mesquite and Cargo Muchacho gold mines in southeast California. I spent two intensive years working in the Silverbell mine under them where I extended and expanded the seven-year-long drill program which had about ‘six weeks’ to go on my arrival to an additional 4 years with additional drill rigs. I found with this intimate contact with a classic operating open pit porphyry copper mine that even a porphyry copper can have dead spots in it. In a study I personally set up, I determined that if Silverbell had been completely covered and had only an IP (induced polarization study and anomaly: the primary geophysical tool at the time) it would have required 21 holes spaced on a 1,000 foot grid, to be sure that one intersected ore grade material.

“To hope that ‘a hole or two’ would intersect ore is a sure road to a ‘gambler’s ruin’ and would never have been allowed under the Richard and Courtright team management. Note it took them 27 holes into the Mission target before ore grade material was cut by the diamond drills, resulting in the massive Mission Mine that has now been operating 50 years with at least 30 years left. Liberty Star will continue to pursue our careful plan that will result in a thorough and professional test of the world-class anomaly at the Hay Mountain Target 1. Remember, the Hay Mountain target is projected to be a mega multiyear exploration, development and mining project. The dimension of the geochemical and geophysical response is 4 miles long by 2 miles wide, a permissible size to contain a ‘World Class’ very large mineral deposit. The only way to determine where the hot spots are is to drill diamond drill holes to test for mineralization while confirming and honing our geophysics, geology, and geochemistry knowledge. Rather than making Phase 1 small and desperate, careful analysis sees the project expanding the possible number of viable targets and the funding requirements. One of the key attributes of Phase 1 is its economic practicality: that would be completely destroyed if a drilling rig was employed to only drill two holes because the drill and all of its men and equipment is expensive to mobilize and demobilize. Also ore grade mineralization might be missed entirely.

“Raising money is very hard in the current economic circumstances, but given recent interest the Hay Mountain Project has generated, certainly possible.

“We have serious interest from experienced mining professionals that also possess the financial means to invest in Hay Mountain and will also participate in the conceptualizing of operations there. The invitation to present in Manila came from Mr. Tomas Malihan, CEO & President of Oremet Corp., Mr. Angelito Doria, VP Civic Corp., and Mr. Alfonso Doria, Philippine mining engineer and longtime supporter and major Liberty Star shareholder. Mr. Alfonso Doria completed a 3 day trip with me to southeast Arizona copper mines surrounding Hay Mountain and then Hay Mountain, examining surface outcrops, and technical documents concerning the Hay Mountain Project. He was duly impressed with the thoroughness of the approach and indications of the presence of a large but covered metal source resulting in geochemical, alteration and geophysical indications. His report of his evaluation resulted in the above-mentioned invitation to present in Manila. In an all-day meeting at a major hotel in downtown Manila between 10 and 20 mining professionals, including mining representatives from the Philippines, China, and India, will listen to me and Mr. Brett Gross, Mining Engineer, Attorney and Liberty Star Director. I will speak extensively about the geology, geochemistry and geophysics of Hay Mountain and why they indicate a mineral body at depth. Mr. Gross will present an innovative and financially attractive proposal to them for funding Hay Mountain, Phase 1 and beyond. There will be time for detailed information transfer as well a question and answer session.

“Multiple copper and precious metal mines are underway in southern Arizona, primarily funded by Canadian junior to intermediate companies. We have now been contacted, regarding interest in Hay Mountain, by three major international mining companies that are among the world’s largest. This is indicative of the perceived quality of the Hay Mountain Project. We hope these expressions of interest generate visits to the Hay Mountain area, continued due diligence by multiple parties and the eventual signing of a joint venture agreement. This is not a quick process to undertake a large project, but it is a beginning. We are optimistic that even during this period of low metal prices we are generating genuine interest and feel optimistic that a deal or deals will be struck on Hay Mountain.”

“James A. Briscoe” James A. Briscoe, Professional Geologist, AZ CA CEO/Chief Geologist Liberty Star Uranium & Metals Corp.

Forward-Looking Statements

Statements in this news release that are not historical are forward-looking statements. Forward-looking statements in this news release include our entire planned drilling program; that mineral prices will rebound; and our planned route to access partners or funding sources. Factors which may delay or prevent these forward-looking statements from being realized include: the failure of our proposals to be accepted; we may not attract any partners or funding sources; we may not be able to raise sufficient funds to complete our intended exploration, keep our properties or carry on operations; mineral prices may not rebound in time for us to keep our properties; and we may encounter an inability to continue exploration due to weather, logistical problems, labor or equipment problems or hazards even if funds are available. Even if we find a partner, we may not be able to reach agreement or carry out the development program as contemplated. Despite encouraging data there may be no commercially exploitable mineralization on our properties. Readers should refer to the risk disclosures in the Company’s recent 10-K and the Company’s other periodic reports filed from time to time with the Securities and Exchange Commission.

http://cts.businesswire.com/ct/CT?id=bwnews&sty=20150218005211r1&sid=cmtx6&distro=nx&lang=en

SOURCE: Liberty Star Uranium & Metals Corp.

CONTACT:

Agoracom Investor Relations [email protected] http://agoracom.com/ir/libertystar or Liberty Star Uranium & Metals Corp. Tracy Myers, 520-425-1433 Investor Relations [email protected] Follow Liberty Star Uranium & Metals Corp. on Facebook, LinkedIn & Twitter@LibertyStarLBSR