Montreal, Quebec / October 8 2014 / Uragold Bay Resources Inc. (“Uragold”) (TSX Venture: UBR) is pleased to announce that it has signed a definitive written Agreement with Fancamp Exploration Ltd. (“Fancamp”) (TSX Venture: FNC) regarding the acquisition of 32 claims encircling Uragold’s Beauce Placer Gold Project located in the municipality of Saint-Simon-les-Mines in the Beauce region of southern Quebec.

Uragold’s original Beauce paleoplacer project, 5 claims situated between the Rang Chaussegros and the Rang Gustave, covered only twenty-six percent (26%) of the length of the paleo-placer gold channel. When the transaction closes, Uragold’s claim block will cover the full 6.5 km long paleo-placer gold channel.

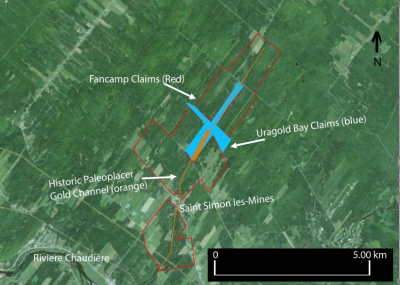

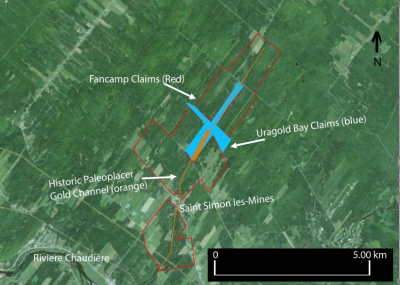

Click Image To View Full SizeFigure 1. This figure shows the paleo-placer identified by Beauce Place Company in 1959 (Orange);

Uragold’s original Beauce Claims (Blue); mineralized zones where

Uragold delineated an Inferred Resource in March 2014 (Thick Orange); and the Fancamp Claims subject to the Letter of intent (Red).

The Beauce Placer Project Overview:

The property is located southeast of Beauceville and 3 km northeast of Saint-Simon-les-Mines, in the Gilbert River Valley (in the Appalachians of southern Quebec) where the discovery of an egg-sized gold nugget in the river sands was made in 1846. News of this find attracted hundreds of prospectors who panned just about every stream, brook and river in the area. Two of the largest recorded gold nuggets found in Canada came from the Gilbert River, in areas now covered by Uragold. In 1866 J. Kilgour found a nugget weighing 52 oz. on the north branch of the Gilbert River; and in 1867 Mr. MacDonald found a nugget weighing 45 oz. in the same general area.

By 1880, the profitable properties were taken over by larger mining companies, and gold was mined intermittently in various tributaries of the Chaudiere River (into which the Gilbert River flows). Unfortunately, legal challenges between the old Seigneurial rights owners, landowners and the Mining Companies created such a hindrance to the development of gold projects in the region that almost all work stop by 1900. The result was that prospectors and the mining Companies moved their attention elsewhere in Quebec and in Canada.

In 1957, Mr. M. J. Boylen formed the Beauce Placer Mining Company. The Company drilled the area to estimate the volume and gold content of the buried placers. By 1959, they had defined a drilled historical resource of 168,952 Au oz (12,978,710 m3 @ 0.405 g/m3) (June, 1959 – GM08785) on a paleo-channel striking from the Rang St-Charles through to Rang Delery, Rang Chaussegros, Rang St-Gustave all the way to Rang 6. Parts of the paleo-channel were mined from 1959 to 1964 using dragline and dredging operations. Some of this mining was conducted, on the western part of the Original Uragold Property. Despite a significant production of 56,000 oz. gold, the operations ceased somewhere in 1963/4 because of technical problem.

On the section of the deposit previously mined by The Beauce Placer Mining Company, the unpublished gold production data for the dredging and drag line operation from 1959 to the early 1960s and their 1958-59 exploration reports mentioned that:

This infers that the actual gold grade recovered during dredging was roughly six times (x6) the suggested grade derived from the Beauce Placer Mining Company drilling programme.

This point was emphasised by Rose (1959) who in relation to the proposed dredging by the Beauce Placer Company at the time stated: –

“…Gold obtained in the drill samples has been coarse and in a number of holes small nuggets were found. In estimating volumes and values these nuggets have been included. When the gold is coarse it usually follows that actual dredging recoveries are higher than the drill estimates.”

In March 2014, the Uragold technical team concluded, after having reviewed all the technical data available derived from 30 boreholes (7 recently drilled sonic boreholes and 23 historical boreholes from work done in the 80’s) located only on Uragold original claim blocks, that there was enough recent and historical information to disclose an Inferred Polygonal Resource on the Claims block controlled by Uragold.

Following the signature of the letter of intent with Fancamp, the Uragold technical team reviewed all the technical data available derived from 90 boreholes now located on the new Uragold claim blocks (7 recently drilled sonic boreholes and 83 historical boreholes from work done in the 80’s). From this recent and historical information, a new historical Polygonal Resource was calculated, and a new resource potential was estimated for the Beauce Placer.

It must be emphasised that any grade/ tonnage calculation at the Beauce Project will be fraught with difficulty. Key amongst the problems with the Beauce (and many other gold projects) is ore grade variability. The grade can and will change from almost nothing to a value of several grams per cubic metre within a very short distance.

Due to the nugget effect and the clear disparity between drilled and mined gold grades at the Beauce, the Uragold technical team believes that gold volumes contained in the deposit will be larger than indicated by the historical drilling. However, until the completion of additional drilling that can validate the historical data, the only way to quantify and divulge the historical information, while taking into consideration the nugget effect, is to look at the historical Polygonal Resource as a guideline for a new potential exploration* target range.

Making the assumption that recovered gold could be up to six times (x6) the historical Polygonal Resource figure (as per the data derived from the historical mining figures) suggests that the gold potential for the entire deposit now controlled by Uragold could range between 61,000 ounces (2,200,000 m3 @ 0.87 g Au/m3) and 366,000 ounces** (2,200,000 m3 @ 5.22 g Au/m3) using the x6 multiplier.

*Potential quantity and grade are conceptual in nature, there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will results in the discovery of a mineral resource.

All information such as resources estimates and grades herewith presented is historical in nature and while relevant, the information was obtained before the implementation of National Instrument 43-101 and as such does not meet National Instrument 43-101 reporting standards. The historical estimate should not be relied upon until the Company can confirm them.

While the presence of significance quantities of visible (placer) gold in the region is a fact, the source/s of these gold showings has not yet been identified. Studies by Uragold of the auriferous basal till and the underlying saprolite suggest a close proximity source of gold, and since the acquired claims cover an extensive area of the Gilbert river valley this increases the chances that the unknown Bellechasse / Timmins type deposit mentioned in our March 27, 2014 press release will be found on Uragold claims.

Subject to regulatory approval, the Uragold and Fancamp definitive agreement transaction contains the following salient points:

- 1.Uragold will acquire the 32 claim block contained in the Appalachian Properties that surrounded the Uragold Beauce Property (herein, collectively the “Claims”) (“The Acquisition”) through:

- a.As consideration for the transfer and the sale of the Claims and related assets to Uragold, Uragold will issue, at the closing an amount equal to 8,000,000 Uragold Units. Each Unit will be comprised of 1 common share and 1 common share purchase warrant (the Warrant”) of Uragold.

- b.Each full Warrant will entitle Fancamp to purchase one common share of the capital stock during a period of 60 months from the date of the issuance of the Units. Each Warrant shall entitle Fancamp to purchase one (1) additional common share of Uragold at a price of C$0.20 per share during the first 24 months from the date of issuance of the units, at a price of C$0.30 from the start of the 25th month until the end of the 48th month, and at a price of C$0.40 per share at the start of the 49th month until the end of the 60th month.

- 2.Contemporaneously with the signing of the definitive Agreement:

- a.Uragold will make cash payment of C$25,000 to Fancamp within six (6) months of the Signing of the definitive Agreement.

- b.Uragold will finance C$400,000 worth of exploration work on the Claims over the next 4 years, under the following schedule, Year 1: C$50,000, Year 2: C$75,000, year 3: C$100,000 and year 4: C$175,000.

- c.Uragold has granted Fancamp a three and one half percent (3.5 %) Gross Metal Royalty on any gold production extracted from the 32 Claim block acquired by Uragold.

- 3.Fancamp and Uragold have signed a Covenant regarding the sale of Uragold shares held by Fancamp.

- a.Included in the Covenant is a Standstill agreement whereby Fancamp agrees not to sell any of its Uragold shares (“Standstill”) during a twelve (12) month period (“Standstill Period”) starting on the day of the issuance of the Uragold Units to Fancamp.

- b.The Covenant also includes a Change of Control Clause whereby in the event that a Change of Control event occurs at either Parties, then either the Fancamp Standstill Period will be automatically increased by thirty-six (36) months or a new thirty-six (36) months Standstill Period will start, or in the case that the change of control occurs at Uragold, then the standstill agreement will lapse.

- c.So long as Fancamp owns at least ten percent (10%) of the issued and outstanding Uragold Shares, Fancamp can have one nominee elected as a director to the Uragold board of directors.

- 4.Fancamp intends to nominate Mr. Peter H Smith to the Uragold Board.

Peter H. Smith PhD, P.Eng. is a Director and founder of Fancamp Exploration Ltd. and is presently Chairman of the Board and interim President. He has been a Director of Fancamp Exploration Ltd. and its predecessor company, Fancamp Resources Ltd, since January 1986. He is presently a Director of Lamelee Iron Ore Ltd., since May of 2014 and served as a Director of Argex Titanium Inc. from October 2009 to May 2013. He has served as a Director of Litewave Corp. and St. Georges Platinum Base Metals Ltd. since January 2010, leaving the latter company in October 2010. He was a Director of Golden Hope Mines Ltd from May 1997 to August 2009. He is a member of the Ontario Order of Professional Engineers and is a former Director of the Prospectors and Developers Association of Canada.

- 5.Once Gold Mining operations have begun on the Claims purchased, Uragold will make a one-off cash payment of C$500,000 to Fancamp.

- 6.Pursuant to an agreement entered into between Fancamp and a private vendor as of December 12, 2005, the Vendor currently holds a one point five percent (1.5 %) net smelter return royalty affecting the Claims, of which one percent (1%) may be purchased at the sole discretion of Fancamp, or of Uragold as of the date hereof, for a payment of one million dollars ($1,000,000), (the “NSR Royalty”).

The transaction is also subject to the approval of the TSX Venture Exchange, approval that requires the filing of an updated NI43-101 compliant technical report on the Beauce Property.

Mr. Vivian Stuart-Williams, SACNASPS, working under Special Authorization #290 of the Quebec Order of Geologist, is an Independent Qualified Person as defined by National Instrument 43-101 that supervised the preparation of the information in this news release.

Patrick Levasseur, President and COO of Uragold stated that: “This signature of a final agreement is another significant step being undertaken by Uragold. This acquisition is changing the whole dynamics of the Beauce Paleo-placer Gold project, as it significantly increase the size and scope of our project.” Mr. Levasseur went on to add: “We are extremely pleased to have been able to conclude such a transaction with Fancamp Exploration Ltd., a Canadian junior mineral exploration company that is evolving into a holder of shares in partner companies and royalties on near-term producing mines. Lastly, the addition of Peter Smith to the board of Uragold, an experience project developer, is another very positive development for the Corporation.”

About Uragold Bay Resources Inc.

Uragold Bay Resources is a TSX-V listed Gold and High Purity Quartz exploration junior focused on generating free cash flow from mining operations. Our business model is centered on developing mining projects suited for smaller-scale start-up, (Capex < C$10M), that will generate high yield returns (IRR > 50%). Uragold will reach these goals by developing Quebec’s first placer mine in 50 years, the Beauce Placer Project developing and, in partnership with Golden Hope Mines, the Bellechasse-Timmins Gold Deposit.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact

Bernard J. Tourillon, Chairman and CEO

Patrick Levasseur, President and COO

Tel: (514) 846-3271

www.uragold.com