The Metals Report: Simon, the Chinese government says it is no longer willing to sacrifice the environment to mine and export commodities. You recently visited several graphite mining operations in China. Is this for real or just paying lip service?

Simon Moores: When you visit these mines and see how dated and wasteful some of their mining practices are, the environmental issues are apparent. But while this stance is partially to benefit the environment, it’s also about China wanting to retain raw materials and use them to manufacture higher-value products. China does have some leading graphite producers that are now investing in not only improving their products as well as their mining practices. This is something non-Chinese companies will have to keep track of.

TMR: If China is “going green,” what are the ripple effects that graphite investors in the West will feel?

SM: China’s “going green” is twofold. Green from the mining side means becoming more efficient with graphite mining and using less hazardous materials for processing the material. This will result in less material being available for export. Buyers outside of China have no choice but to eventually find supplies elsewhere.

From the market side, going green undoubtedly means expanding the electric vehicle market. The growth for batteries, especially lithium-ion batteries, could be explosive. This could transform demand for key raw materials, especially flake graphite.

TMR: What were the biggest takeaways from your visit to China?

SM: The biggest one was China’s willingness to control the industry. Its amorphous graphite industry has been consolidated. In Hunan province, the government consolidated close to 230 small-time mines into one company that now controls 50–60% of the production in that area. Another takeaway is that flake graphite is on China’s radar. Although it was the amorphous graphite mines that were consolidated, flake graphite, which is the bigger business, was being discussed.

The Black Dragon graphite Mine in China. Photo credit: Laura SyrettTMR: Some people have speculated that the consolidation strategy in flake graphite could ultimately lead China to flood the market with graphite, much like it did in the mid-’90s, forcing some graphite miners out of business. You disagree. Tell us why.

SM: Today is a completely different situation from the mid-’90s. A generation ago, China was on its way up. It was getting its primary industries underway, growing as quickly as possible, taking in as much revenue as possible. Back then, China could mine cheaply, export cheaply, undercut everybody and get quick money. There was no competition. Now, China needs to move its economy to the next level, to the value-added level. It wants to compete with South Korea, Japan, Europe and the U.S. Cheap exports are not the way to do that.

Its challenge is to appease the mining companies through things like tax breaks on higher-value products to push these companies to develop value-added products such as battery-grade graphite and even the batteries themselves. The car industry is a perfect example. Ten years ago, China didn’t have one; now I expect to see Chinese cars on European and North American roads in the next three years.

TMR: China also has a source of flake graphite in North Korea. What is going on there?

SM: China has exported flake graphite from North Korea for the last decade from a mine that once was a joint venture between North and South Korea. It exported about 1,000 tonnes in 2012. The graphite goes to China, where it is blended with other products. This is a captive source for China that has historically been used internally.

TMR: Why is this Korean source being talked about more now?

SM: I am not sure. Our research indicates that China is not getting as much flake graphite from North Korea as previously thought. The problem is that bad information gets around really quickly, especially when it is free. Everyone thought North Korea was sending 30,000 tonnes per year (tpa) of flake graphite to China. We think it was actually less than 1,000 tonnes in 2012. North Korea was considered the fourth-largest producer in the world. If the data are wrong, that could indicate there is a lot less flake graphite in the market than people realized.

The same problem exists with India. The Indian production figures that are freely available for flake graphite indicated production of 140,000 tpa when, according to our research, in the last 12 months it was actually 35,000 tpa. If that is the case, the rest of world production could be well overestimated.

TMR: The price of flake graphite has been dropping since May 2012, mostly owing to softer demand from steel refractories and lubricant markets.How is this affecting the economics of flake graphite projects?

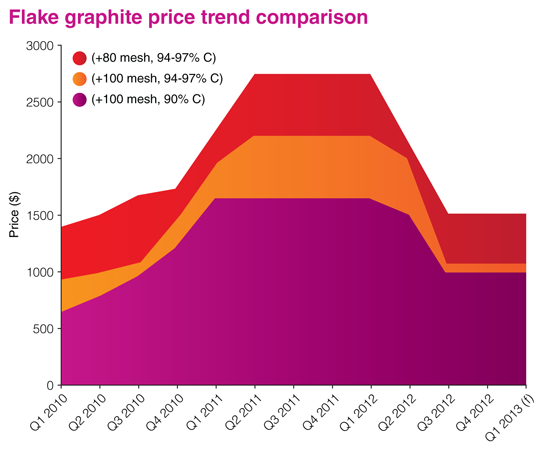

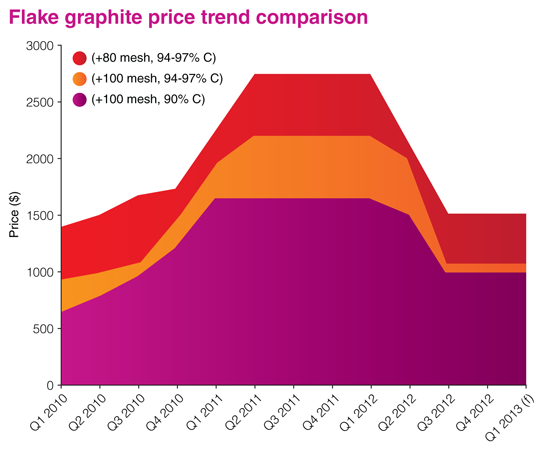

SM: Obviously, lower prices would have a negative effect on projects whose economics were done 12–18 months ago using the very high prices we saw then. Prices have come down about 50% on average from the 2011-2012 peak. On that basis, some companies are already reevaluating.

“Graphite buyers need supply security; the price volatility of the past five years has not been good for business.”

TMR: Does that invalidate their preliminary economic assessments and other economic studies?

SM: “Invalidate” is probably too strong a word, but the more responsible graphite juniors are revaluating their economics based on lower prices. Typically, these companies use price averages for their analyses. Predicting the future price of graphite price is always guesswork. Whether they take a 12-, 18- or 24-month average, it will be an average, and there will always be problems with that.

But understandably, miners have to use a price and this is where we come in, as the only independents pricing natural graphite.

Source: Industrial Minerals Data

TMR: What is the current price of flake graphite?

SM: Using our most commonly quoted grade, the +80 mesh, 94–97% carbon, the price is now $1,400/tonne. It has dropped about 50% since the highs of 2011 and 2012.

TMR: What price do you predict through 2015?

SM: I think the industry has seen the bottom of graphite prices and should expect a rise from here or in Q3/13. Flake graphite prices have settled higher than expected. They remain 60% higher than pre-recession levels in 2008-2009. Other commodities, especially fluorspar, have crashed and hit all-time lows. Graphite has not done that.

TMR: What is the path forward for companies developing graphite projects?

SM: It depends on the company, whether it is coming from an industry perspective or, like most of the juniors, from a stock market perspective. From an industry perspective, the hope is to move away from dependency on China. Graphite buyers need supply security; the price volatility of the past five years has not been good for business. For a company producing refractories, raw materials are by far the biggest input cost, and price volatility does not allow for long-term business planning. For long-term supply security, companies are looking away from China.

TMR: Does that make graphite a go-long play?

SM: Yes, because the fundamentals will not change any time soon.

TMR: The other great debate in this sector is whether graphene is worth talking about as part of an economic thesis.

SM: I do not think graphene will ever be a volume business for any graphite producers. The value for graphite companies going into graphene, which only a handful are doing, is the research and development (R&D) and new technology that will allow them to produce graphene from natural graphite. This technology will be a game changer for materials science, and the graphite industry will be pretty irrelevant in terms of global impact.

Some companies are experimenting with carbon sciences, merging carbon materials into their applications. Companies will never make money from selling large volumes of graphite to make graphene.

TMR: Realistically, how far away are we from producing graphene from mined graphite?

SM: A few companies are pioneering that technology. Grafoid Inc. has an R&D agreement with Focus Graphite Inc. (FMS:TSX.V) to investigate and develop a graphene-based composite for electrochemical energy storage for the automotive and/or portable electronics sectors. They have just launched the world’s first trademarked graphene product—MesoGraf. But this material is still in the R&D phase.

The value of these companies is their research into the best methods to produce graphene and finding applications for it. No one really knows how to use it—the graphene pioneers have to build an industry and convince people to use it. Everyone now knows the theory, but the reality—the real world application—is something that will take time.

“There have not been any new mines opened in a generation. When you have this kind of growth potential, matched with underinvestment on the supply side, it doesn’t take a genius to work out that something has to change.”

I went to a graphene event last month, and it struck me that people are not worried about how to produce it, they are more focused on developing the market, on getting end-users to try to make products that include graphene.

TMR: What will be the next graphite project to reach production?

SM: If the press releases are anything to go by, I would say Ontario Graphite Ltd. (private). But it is hard for us to analyze because it is a private company that does not put out much information. We look less at the tonnages in the ground and more at the flake distribution of the deposit. Ultimately, these companies will need to sell material. Flake fines, or smaller-flake graphite, is the hardest to sell, while large flake the easiest.

TMR: Suppose, just for the sake of argument, that Ontario Graphite did add the 20,000 tonnes it says it will to the market. With TIMCAL (a member of Imerys [NK:PA]) already operating at a roughly similar production rate, could both operations continue at a profit?

SM: No, I do not think those two mines could both operate at that rate for very long—not in today’s market conditions. The good news is that the production rate at TIMCAL’s Lac des Iles mine has always been falling, while costs have been rising for a while now. TIMCAL has been looking at other options and other mines, at other graphite juniors. You can pretty much assume that Lac des Iles is on its last legs, which is good news for graphite juniors.

TMR: What does that news from TIMCAL mean for a company like Northern Graphite Corporation (NGC:TSX.V; NGPHF:OTCQX), which also has an advanced-stage graphite project in Ontario?

SM: It is great news for companies like Northern Graphite. The TIMCAL mine is a generation old. Northern Graphite has been around for ages under a different name prior, but I think that will pay off because of the amount of information the company has on that deposit. I think everything it’s been working toward will pay off.

TMR: As a graphite deposit, what does Bissett Creek have going for it?

SM: The large flake size is the key attraction. The grade is very low, but that’s not much of a problem with graphite mining if you can economically extract it. Northern Graphite has a much higher distribution of large-flake material, which is what the industry wants.

TMR: What are the next steps for Northern Graphite?

SM: The next step is to redo the economics. The company released more drill information and increased its confirmed resource data. From there, it is a matter of riding out the storm until the market cycle comes around again. When that happens, it will be one of the strongest junior graphite companies.

TMR: In our last interview you talked about Energizer Resources Inc. (EGZ:TSX.V; ENZR:OTCBB) and its Green Giant project in Madagascar. Can you give us an update?

SM: Energizer Resources is doing something very similar to Northern Graphite. It has its asset, its project and a lot of information gathered already. Energizer has to get the word out and go to the market to get funding. I think management is focusing on that, because there is only so much drilling and reporting public companies can do. In other news, Energizer is planning on making an agreement with the nearby Sakoa Coal Field project that would allow Energizer to purchase “over-the-fence” power and share infrastructure, reducing its operating costs.

Logistics is a major factor, particularly in somewhere like Madagascar. If the company can team up with a much larger operation, then it will be a compelling project.

TMR: Can you share a couple of other graphite stories that have compelling narratives?

SM: Talga Resources Ltd. (ASX: TLG) has been working on a JORC-confirmed (Joint Ore Resources Committee) graphite resource in Sweden. In terms of volume, it is smaller than deposits in Canada or Africa, but in terms of quality it is up there. I would look out for it.

Syrah Resources Ltd. (ASX: SYR) is the leading graphite junior in Australia. It also is developing the Balama graphite project in Mozambique. Syrah had a great 12 months when everybody else struggled.

Zenyatta Ventures Ltd. (ZEN: TSX.V) has made a lot of headlines in recent months and enjoyed a high share price when everyone else has suffered. The company has a unique project with very high carbon purities. Zenyatta has been coy about allowing others to test this so far. The data it has released is very impressive on the carbon purities front, but because it’s so unique, the question is whether or not it can be used in the same markets as flake or synthetic graphite. Only time will tell.

TMR: What thoughts would you leave investors with for the rest of 2013?

SM: Look at the long-term basics in the graphite industry. Look at where graphite is used. Traditional volume markets include refractories, which is the steel industry. High-tech uses include electric vehicle batteries and portable electronics. Very few raw materials have this balance.

Look at the supply situation. China continues to dominate, and there have not been any new mines opened in a generation. When you have this kind of growth potential, matched with underinvestment on the supply side, it should not take a genius to work out that something has to change.

TMR: Simon, thank you for your time and your insights

Simon Moores is manager of Industrial Minerals Data, a business that sets prices for natural graphite and fluorspar industries from offices in London and Shanghai. He has been reporting on, researching and analyzing the non-metallic minerals sector since 2006, when he joined London-based publishing and research house Industrial Minerals. He has specialist knowledge in critical and strategic minerals including graphite, lithium, rare earths and titanium. He led the research and publication of the market study, “The Natural Graphite Report 2012: data, analysis and forecast for the next five years.” He has chaired conferences and given keynote presentations around the world. He has also been interviewed by international press including London’s Times regarding Chinese control on world graphite production, and The New York Times with regard to rare earths after breaking the story that China blocked exports to Japan in 2009.

Want to read more Metals Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Brian Sylvester conducted this interview for The Metals Report and provides services to The Metals Report as an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Metals Report: Energizer Resources Inc. and Northern Graphite Corporation. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Simon Moores: I or my family own shares of the following companies mentioned in this interview: None. I personally or my family am paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

( Companies Mentioned: EGZ:TSX.V; ENZR:OTCBB,

FMS:TSX.V,

NK:PA,

NGC:TSX.V; NGPHF:OTCQX,

ASX: SYR,

ASX: “TLG”,

ZEN: TSX.V,)