The technology space has never been more exciting for investors. From biotech to blockchain, investing in the tech sector is like being the proverbial “kid in a candy storeâ€.

Many of these applications involve pioneering new technology. However, there are also a lot of companies taking technology that has already reached the marketplace, and then customizing these platforms in order to reach new markets and demographics. This is the strategy of Kuuhubb Inc. (TSX: V.KUU, OTCQB: BCDMF, Forum).

The space in which KUU is operating could be generally termed digital entertainment. But that label won’t convey a lot to readers. More specifically, the Company is targeting online gaming, “lifestyle†sites, and esports.

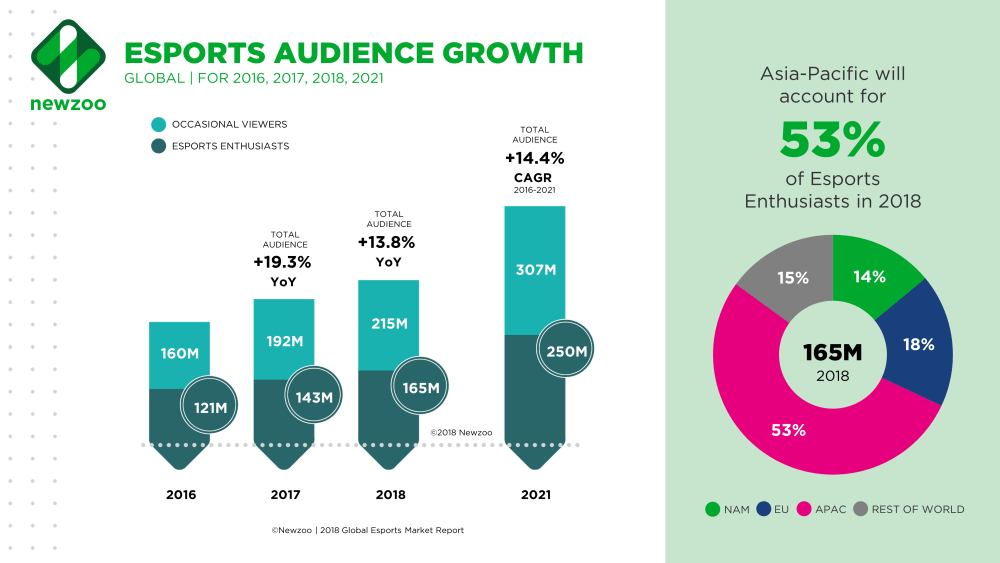

Few readers will not already be familiar with online gaming. Esports is a more recent evolution: taking this digital, online gaming and (literally) elevating it to a level on par with professional sports. Indeed, esports may become a medal event for the Paris Olympics (2024).

But what are lifestyle sites?

Perhaps a more illuminating term for investors would be hobby sites. Young or old, rich or poor, male or female; everyone has hobbies. In past generations, these hobbies tended to be physical activities of some kind, set in “the real worldâ€. People engaged in cooking or gardening or even knitting, as a low-tech means to relax, unwind, or simply play.

In the 21st century, however, real-world hobbies have given way to virtual hobbies. Digital technology can now create simulations or virtual representations of almost anything. Kuuhubb’s mission is to take our love of hobbies and recreation, channel this demand into high-traffic lifestyle/recreation sites, and then optimize the revenue streams from these operations.

This somewhat daunting task has been streamlined through a series of internal strategic decisions. In simple terms, it is a strategy all about untapped markets. Specifically, the Company is focusing on:

- The least-developed segment of the gaming/lifestyles space.

- A large, under-served demographic.

- Additional, huge markets with (as yet) minimal penetration.

With respect to the online gaming and lifestyles market, what is the least-developed segment? That question can be answered with one word: mobile.

KUU wasn’t interested in getting in line behind a long list of companies that are already developing and commercializing online games for (primarily) a desktop user base. The Company saw that far less energy had been devoted toward templates created expressly for mobile users.

In the Western world, mobile internet traffic passed desktop traffic about 18 months ago. In Asia, this trend emerged even sooner – roughly two years ago. The largest percentage of internet users are not (yet) receiving an appropriate level of attention from software developers and their website platforms.

This was the first competitive advantage that Kuuhubb sought to gain as it built its mobile online gaming/lifestyles business. Then, within this now-dominant mobile market, the Company is targeting an under-served demographic: women.

image: http://www.stockhouse.com/getattachment/767cbb4f-bb36-4b4f-984e-a8c1cdb579a1/KuuHubb_overview-(2).jpg?width=450&height=124

(click to enlarge image)

Female users actually comprise a slightly larger share of the overall mobile user base than males. Along with this, women have a somewhat greater propensity to try out new/different mobile apps. Yet the vast majority of the gaming industry has had a distinct male focus, perhaps reflecting the fact that the majority of game developers are also males. Whatever the reason, females are an under-served mobile demographic, and Kuuhubb intends to capitalize on this opportunity.

Lastly, the Company has chosen to target huge but relatively vacant markets for expansion: Asian markets (starting with India). Then within these Asian markets, the focus is also on a female demographic.

KUU has an acquisitions-based business model and the Company has already acquired several key assets. These operations provide Kuuhubb with a strong foundation from which to increase revenues and build up market share.

- 30+ million total downloads

- 7+ million monthly active users (MAU’s)

- U.S $6.3 million quarterly revenue as of most recent quarter

- 117% Q/Q revenue growth as of the most recent quarter

Existing online operations are presently almost entirely based on an iOS user base, with over 90% of revenues derived from iOS. However, overall, more than 80% of all smartphones use an Android platform. By simply making its existing apps Android-friendly, this can/should drive 5 – 10 times as much traffic to its sites, just by boosting user demographics to the industry standard.

The current online centerpiece for Kuuhubb is Recolor. This is a “colouring†app aimed at women, where female users colour-in artistic illustrations. Essentially, it is a virtual colouring book for women.

A colouring site, for adults? Some investors may view this as a rather trivial activity. However, many readers would say the same thing about adults who spend much of their leisure time tending to flowers. Yet in the U.S. alone, “home gardening†is a $275 billion per year industry.

Likewise, the numbers for Recolor speak for themselves. While this is still a relatively new internet lifestyle activity, this one app is already registering 6 million MAU’s. For readers still skeptical about the appeal of such an activity, there are actually a dozen “colouring†websites, aimed at primarily an adult (female) user base.

This leads to an issue that may be a concern for some investors: barriers to entry. Generally speaking, game development and hobby sites are seen as having low barriers to entry. Producing a new game/activity doesn’t require a large capital investment, meaning that (potential) competitors can easily enter the space.

Kuuhubb’s management recognized this concern and has worked to address it – by creating barriers to entry. The Company’s strategy here is multi-faceted. It starts with premium quality.

Anyone can design a game/activity site. However, produce a template of superior quality and you immediately create a barrier to entry: users will gravitate toward the product with the best quality. In selecting Recolor as its initial acquisition, the Company was intent on acquiring the best adult colouring site. With higher-quality illustrations and a larger selection of images, Recolor provides a superior user experience versus its competitors.

However, this is only the starting point in looking to lock-up market share. The next element to this strategy are communities. As with any other hobbyists, the users of these game/lifestyle sites like to interact with each other. Recolor already has a highly evolved community for its user base.

To further enhance the Company’s existing user base, KUU is currently executing several high-profile marketing campaigns. Its partners include household names like Kelloggs, Samsung, and Lionsgate Films.

Lastly there is branding. Companies that are able to establish marquee branding (i.e. celebrities, professional sports, etc.) with their products/sites will distinguish themselves from peers in a manner that will be difficult to duplicate. Kuuhubb is already very active on this front as well.

Currently, these lifestyle sites are primarily Western-oriented: created in the West for Western audiences. The Company’s existing revenue base is almost entirely generated in the West. Given that KUU has already devised a better strategy for market penetration in this space and can dramatically increase its North American market simply through adding Android users, why seek to target Asia for its future growth?

image: http://www.stockhouse.com/getattachment/692613b7-a1b8-4e66-8f25-6ee4d1b5263d/KuuHubb_revenues-(1).jpg

Again, it’s all in the numbers.

On the demand side, India in particular looms as a prime target. With cable internet access still not widely available, India’s internet user base is (by far) a mobile user base. At the same time, as an under-served internet market, user acquisition costs (for paid users) are much lower in India.

The Company’s research indicates current user acquisition costs in India between US$0.07 and $0.12. This compares with several dollars per user to add paid users in the West. Even China can’t compare with India.

image: http://www.stockhouse.com/getattachment/77c6f67d-db5e-45ea-a349-6039b2e74614/KuuHubb_IndianGaming.jpg?width=450&height=266

(click to enlarge)

User acquisition costs in China have recently soared to above US$1. From management’s perspective, India today looks like the Chinese marketplace of 6 – 8 years ago. Once again, KUU’s strategy is to target a relatively vacant market, rather than try to elbow its way into a more crowded space.

India may be a vacant market, but does this mean that investors should automatically expect Kuuhubb to be successful in penetrating this giant market? Here the Company is relying upon the experience and knowledge base of their global team led by CEO Jouni Keränen and Chief Investment Officer, Christian Kolster. Keränen was a resident of India for several years.

India is the single most exciting mobile market growth story in the planet right now. Thanks to the introduction of affordable unlimited 4G data plans and the subsequent growth in the last 15 months, there is no doubt in my mind that India will become one of the top global mobile markets within the next 3 years. Utilising my extensive network of connections from the time I lived in India in early 2000’s, Kuuhubb is executing a unique market entry strategy that will provide rapid growth with limited investment and hopefully enable Kuuhubb to become one of the leading players in the Indian mobile market.

KUU is particularly eager to roll out Recolor in India with a premier branding agreement already in place. It has a partnership with Kwan Media, India’s leading talent agency. In a conference call with Stockhouse Editorial, Kuuhubb’s management team were rather tight-lipped about a marquee branding deal that the Company expects to execute imminently.

What they were willing to reveal was that the branding agreement currently being negotiated centers around:

- An “A†list (female) Indian celebrity

- She is regarded as a fashion icon by Indian women

- She already has her own fashion line

Investors don’t require a lot of imagination to see how such branding could be worked into a colouring site for adult Indian women.

What’s left? Advertising. This is the key factor that KUU expects will transform their successful recreational products into a successful investment for shareholders.

The reality of these gaming/lifestyle sites is that the bulk of user revenues actually come from a small sliver of users. This means that even sites with massive MAU’s may have difficulty generating much free cash flow. On the other hand, the users of these sites typically engage in frequent sessions and/or extended sessions. This creates the instant potential for significant exposure to onsite advertising.

Revenue streams from advertising can be generated in various ways. CEO Jouni Keränen outlined one strategy to Stockhouse that KUU has already identified as being (potentially) extremely lucrative.

The Company loads game-based videos onto their gaming platform, with prominently inserted advertising. Users are offered a game-based, non-monetary “reward†if they view the clip to conclusion. The reward costs Kuuhubb nothing. Their captive audience for advertisers represents a consistent revenue stream.

The Company has already acquired two more online sites to compliment this specific strategy, Neybers (virtual interior design) and My Hospital (build/develop your own virtual hospital). These sites also target primarily a female user base. [details in Appendix below]

More recently, Kuuhubb has added new dimensions to this business model. On January 31, 2018; KUU announced a double-pronged acquisition: Valiance UG, a Germany-based developer of mobile esports that is already working to incorporate blockchain technology into its gaming platform. Further, Valiance’s young, dynamic, and female Co-Founder will be an important asset in designing products/sites with greater appeal to women.

Investors who are interested in KUU’s plans for the esports space should tune-in to an upcoming Stockhouse feature that will center around this new division of operations (hint: think “Community + Blockchainâ€). Blockchain is technology that is a natural fit for the Company’s current operations which emphasize creating communities.

One feature that most of these game/lifestyle sites share in common is that they already have their own “internal token systemsâ€. Essentially, this is (non-monetary) internal “moneyâ€, that users employ to purchase premium features or add-ons. Blockchain is just as functional with respect to internal accounting/payment systems as it is with external payment systems (like cryptocurrencies).

Internet hobbies for adults? This may sound like a simple concept. However, as illustrated by Kuuhubb Inc., transforming these popular products into a money-making opportunity for investors requires a sophisticated strategy and disciplined execution.

Appendix: other Kuuhubb lifestyle/gaming platforms

image: http://www.stockhouse.com/getattachment/fda6eecb-ed63-4421-a280-fe2387fb8f4c/KuuHubb_MyHospital.jpg?width=200&height=107

image: http://www.stockhouse.com/getattachment/e963abc7-f026-4fde-a229-0a7995cf85a2/KuuHubb_Neybers-(1).jpg?width=200&height=107

image: http://www.stockhouse.com/getattachment/e963abc7-f026-4fde-a229-0a7995cf85a2/KuuHubb_Neybers-(1).jpg?width=200&height=107

(click to enlarge images)