Posts Tagged ‘#Survey’

VIDEO – Allan Barry Discusses The #Gamestop $GME Short Squeeze, Its Implications For #Gold & #Silver, Plus Advanced Gold $AAX.ca

VIDEO – Advance Gold $AAX.ca discusses recent high-grade hit of 2 metres of 664 g/t silver at AAX project in Mexico

Advance Gold $AAX.ca – 50-Year High In Central Bank Gold Purchases $FA.ca $ANG.jo $ABX.ca $NGT.ca $MGG.ca $TECK.ca

SPONSOR: Advance Gold AAX.v – Advance Gold controls 100% interest in the Tabasquena Silver Mine in Zacatecas, Mexico. A cluster of 30 Epithermal veins have been discovered, with recent emphasis on exploring a large anomaly to drill. Advance also owns 13.5% of the Kakamega JV attached to Barrick Takeover Offer for Acacia Mining. Click Here For More Info

Opportunities

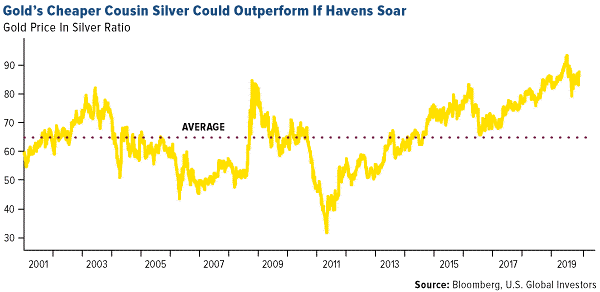

- 2019 is on track to be a 50-year high in central banks’ net gold purchases. Bloomberg Intelligence reports that central banks have been absorbing about 20 percent of global gold mine supply. Based on the gold-to-silver ratio, it looks like silver might have more upside if demand for safe haven assets rises. Bloomberg’s Eddie van der Walt writes that the gold-silver ratio has dropped to 86 from 93 in July and that means silver has outperformed on the back of gold’s gains. UBS analyst Giovanni Staunovo is bullish on palladium and platinum. Staunovo wrote in a December 5 report that palladium will likely enter its ninth straight year of market deficit in 2020 and could climb above $2,000 an ounce. Even as platinum is set to enter a surplus, its price could be driven by gold. “As platinum is highly correlated to gold, our bullish view for gold should mean higher platinum prices, which we expect to trade at around $1,000 an ounce next year.â€

- Zijin Mining Group Co. has agreed to buy Continental Gold in a rare all-cash deal worth C$1.37 billion – the second big takeover in a few weeks of a junior Canadian gold miner. Bloomberg reports the offer reflects a 29 percent premium to the Continental Gold share price from the past 20 days and that major shareholder Newmont Goldcorp was supportive of the deal. In hostile M&A news, Centamin Plc rejected Endeavour Mining Corp.’s $1.9 billion takeover offer saying that it undervalues its assets, reports Bloomberg News. Centamin has been a takeover candidate since the size of its Egyptian mine was discovered at the start of the decade, though the company has faced many operational setbacks.

- Kinross Gold has been busy raising cash. Kinross announced this week that it has agreed to sell its remaining shares of Lundin Gold for C$150 million to Newcrest Mining and the Lundin Family Trust. Kinross earlier announced that it has sold its royalty portfolio to Maverix Metals for $74 million.

Threats

- ABN Amro strategist Georgette Boele says they see gold weakening in the coming weeks and months with a price average of $1,400 an ounce. However, they do expect prices to increase to $1,600 by December of 2020. Before this happens, extreme net-long positioning would clear u p because “these positions currently hang over the market and prevent prices from moving substantially higher.â€

- Another sign of a weakening economy was released last week. The ISM manufacturing PMI unexpectedly declined to 48.1 in November, below the median forecast of 49.2. The reading remains below the 50 level that indicates activity is shrinking.

Bloomberg’s Enda Curran writes that cheap borrowing costs have sent global debt to another record – $250 trillion of government, corporate and household debt. This level is almost three times global economic output and policymakers are now grappling with how to keep economies afloat – with more debt? According to Cornerstone Macro’s head of technical analysis Carter Worth, his S&P 500 chart signals a 5 to 8 percent decline in the coming months. Bloomberg reports that the S&P 500 fell 1.4 percent on Tuesday, pushing it below an upward trend line established in October.

SOURCE: https://www.gold-eagle.com/article/50-year-high-central-bank-gold-purchases

Advance Gold $AAX.ca – Gold Discovery Rates Continue To Slide $SIL.ca $FA.ca $ANG.jo $ABX.ca $NGT.ca $MGG.ca $TECK.ca

SPONSOR: Advance Gold AAX.v – Advance Gold controls 100% interest in the Tabasquena Silver Mine in Zacatecas, Mexico. A cluster of 30 Epithermal veins have been discovered, with recent emphasis on exploring a large anomaly to drill. Advance also owns 13.5% of the Kakamega JV attached to Barrick Takeover Offer for Acacia Mining. Click Here For More Info

- Just 215.5 million ounces has been discovered in 41 discoveries over the past decade, compared with 1.72 billion ounces in 222 discoveries in the preceding 18-year period.

S&P Global Market Intelligence’s annual Gold Discoveries report found that gold exploration budgets peaked in 2012, but remain at historically high levels.

Explorers have allocated US$54.3 billion to gold exploration over the past decade, 60% higher than the $32.2 billion spent over the preceding 18 years.

Despite the effort, just 215.5 million ounces has been discovered in 41 discoveries over the past decade, compared with 1.72 billion ounces in 222 discoveries in the preceding 18-year period.

Over half of that amount is contained in just 10 discoveries, with Zhaojin Mining Industry Co’s 16.4Moz Haiyu deposit in China the largest.

Other deposits in the top 10 including Barrick Gold’s Goldrush, White Rivers Exploration/Harmony Gold’s JV, SolGold’s Cascabel and Cardinal Gold’s Namdini.

S&P says that even after adjusting for more recently identified deposits that might eventually surpass its threshold for a major discovery, and for major discoveries with potential to expand, it forecasts that the gold in major discoveries might only increase to about 363Moz over the next decade.

S&P Metals & Mining senior research analyst Kevin Murphy said previous research into gold lead times showed that it took about 20 years for an asset to advance from early exploration to production.

“This timeline implies that the reduced discovery rates of the last decade will limit the pool of projects that could come online in 15 to 20 years,” he said.

“Unless discovery rates begin an upswing in the near future, there could be a lack of quality assets available for development in the longer term.

“The declining discovery rate shows the importance of continuing exploration and funding companies responsible for exploration to maintain a healthy future pipeline of assets available for development.”

Majors Barrick and Newcrest Mining reported declines in reserves this year.

Barrick’s reserves dropped to 64.4Moz from 86Moz, mainly due to divestments and reclassification, while Newcrest’s dropped by 3Moz to 62Moz.

Newmont Mining’s remained unchanged at 68.5Moz, though the average grade fell by 5%.

Newmont has increased its 2018 exploration budget to US$350-400 million from $200 million last year, Barrick is boosting its spend to $185-225 million from $149 million, and Newcrest is spending $70-90 million in FY18, up from $58 million.

SOURCE: https://www.mining-journal.com/research/news/1337480/gold-discovery-rates-continue-to-slide

Advance Gold $AAX.ca – Starts Drilling Large 1000 x 500 Metres Continuous Chargeability Anomaly $SIL.ca $FA.ca $ANG.jo $ABX.ca $NGT.ca $MGG.ca $TECK.ca

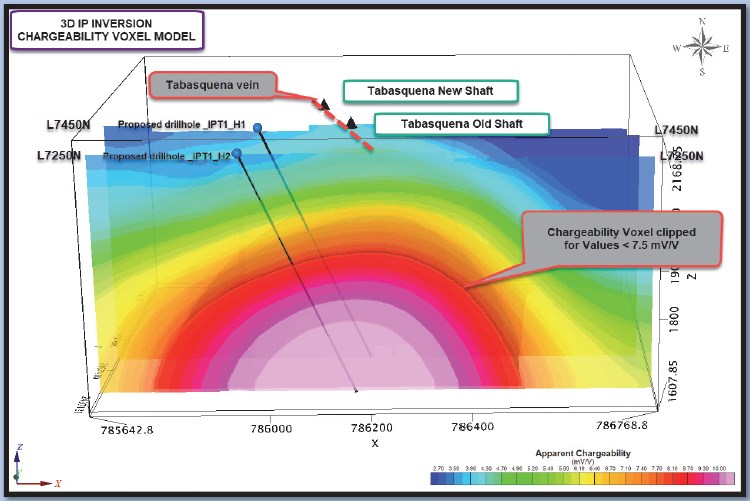

Kamloops, British Columbia–(Newsfile Corp. – November 27, 2019) – Advance Gold Corp. (TSXV: AAX) (“Advance Gold” or “the Company”) is pleased to announce drilling has started to test the large chargeability anomaly identified in recent 3D Induced Polarization (IP) geophysical surveys on its Tabasquena project in Zacatecas, Mexico. Two phases of IP surveys identified a 1000 metres by 500 metres continuous chargeability anomaly. The anomaly remains open to the north and to the south and at depth.

Allan Barry Laboucan, President and CEO of Advance Gold Corp. commented: “We are very excited to drill this large chargeability anomaly as these kinds of targets are not easily found, especially in regions well known for big mines. What makes it particularly stand out is that the high chargeability is consistent from east to west on each survey line, and from line to line over the entire grid. One always has to be aware of possible false positives, such as the possibility of disseminated magnetite causing the chargeability anomaly. However, in this case there has been no magnetite found in the area and an historical magnetic geophysical survey by the Geological Survey of Mexico showed no magnetic anomaly. There are a few potential explanations for the anomaly of this size from mines in Zacatecas. At the Real de Angeles mine and the mine at Fresnillo there were large stockwork vein systems. Previous drilling at Tabasquena has found a near surface network of epithermal veins with widespread gold and silver mineralization, although the IP survey did not pick up that network of drilled veins. Another possibility is a porphyry intrusion that are known to be below epithermal vein systems. Finally, volcanogenic massive sulphide deposits (VMS) are known to occur in clusters, so far, there is only one found in the area, Teck’s San Nicolas VMS deposit. The San Nicolas discovery was found with the first drill hole into a large IP chargeability anomaly. For a small company like Advance Gold to have such a significant anomaly, in a prolific region for mines is exceptional, now we are drilling to better understand what we have at the Tabasquena project.”

The

first drill hole to test the chargeability anomaly will be

approximately in the middle of the anomaly. It will be drilled at a 65

degree angle, from west to east. The first image below shows the collar

location and direction of the hole. In the north part of the image, you

can see the Tabasquena shaft area, where historical mining was done in

the oxide zone of the Tabasquena vein, and just off the image to the

south is the Tesorito shaft also used historically to mine the

Tabasquena vein in the oxides.

Drill Hole 1

To view an enhanced version of Drill Hole 1, please visit:

https://orders.newsfilecorp.com/files/5492/50185_7f3793d874883847_001full.jpg

The image below is a plan view, with past drill holes outside the purple area which is the projected chargeability anomaly to surface. Those drill holes intersected a series of veins, with widespread gold and silver mineralization. None of the holes reached the chargeability anomaly.

Plan view showing previous drill holes

To view an enhanced version of the plan view, please visit:

https://orders.newsfilecorp.com/files/5492/50185_7f3793d874883847_002full.jpg

The final image below, is a cross section of the new drill hole, which has been designed to cover approximately 100 metres from west to east, plus go down to 500 metres and hit the middle of the chargeability anomaly. The anomaly remains open at depth beyond the planned 500 metres and a decision will be made during drilling to extend it.

Cross section of new drill hole

To view an enhanced version of the cross section, please visit:

https://orders.newsfilecorp.com/files/5492/50185_7f3793d874883847_003full.jpg

Julio Pinto Linares is a QP, Doctor in Geological Sciences with specialty in Economic Geology and Qualified Professional No. 01365 by MMSA., and QP for Advance Gold and is the qualified person as defined by National Instrument 43-101 and he has read and approved the accuracy of technical information contained in this news release.

About Advance Gold Corp. (TSXV: AAX)

Advance Gold is a TSX-V listed junior exploration company focused on acquiring and exploring mineral properties containing precious metals. The Company acquired a 100% interest in the Tabasquena Silver Mine in Zacatecas, Mexico in 2017, and the Venaditas project, also in Zacatecas state, in April, 2018.

The Tabasquena project is located near the Milagros silver mine near the city of Ojocaliente, Mexico. Benefits at Tabasquena include road access to the claims, power to the claims, a 100-metre underground shaft and underground workings, plus it is a fully permitted mine.

Venaditas is well located adjacent to Teck’s San Nicolas mine, a VMS deposit, and it is approximately 11km to the east of the Tabasquena project, along a paved road.

In addition, Advance Gold holds a 13.23% interest on strategic claims in the Liranda Corridor in Kenya, East Africa. The remaining 86.77% of the Kakamega project is held by Barrick Gold Corporation.

For further information, please contact:

Allan Barry Laboucan,

President and CEO

Phone: (604) 505-4753

Email: [email protected]Reply

Advance Gold $AAX.ca – Five Reasons Why Gold Stocks Make Sense $SIL.ca $FA.ca $ANG.jo $ABX.ca $NGT.ca $MGG.ca $TECK.ca

SPONSOR: Advance Gold AAX.v – Advance Gold controls 100% interest in the Tabasquena Silver Mine in Zacatecas, Mexico. A cluster of 30 Epithermal veins have been discovered, with recent emphasis on exploring a large anomaly to drill. Advance also owns 13.5% of the Kakamega JV attached to Barrick Takeover Offer for Acacia Mining. Click Here For More Info

Gold mining stocks have soared approximately 30% so far in 2019, based on the performance of the NYSE Arca Gold Miners Index (GDM) as of November 15.1 Over the last 12 months, the sector is up nearly 50%. Some investors may assume that gold stocks have run their course. On the contrary, we think that the gold mining equities still have a great deal of upside to offer.

In brief, we think we’re in the early stages of a prolonged bull market for gold. While the relationship between the prices for gold bullion and gold stocks isn’t a linear one, rising demand for the yellow metal commodity has historically driven stock performance. Moreover, despite the recent rally, gold mining stocks have yet to recover from the beating they suffered starting in 2011. Still, recent outperformance — coupled with improving fundamentals — creates momentum, a key factor in many quantitative strategies.

Gold has been a store of value since the beginning of civilization, and yet the nuances of investing in gold — be it the metal or miners — is still a source of confusion. As we see it, that also means opportunity.

Here are five reasons to consider investing in gold equities now.

REASON #1. Rising Gold Prices Drive Demand

Figure 1. Gold Bull Market is Just Getting Started

Source: Bloomberg as of 11/15/19. Gold was $1,514 on 11/1/19, and $1,468 as of 11/15/19.

Gold recently broke past $1,500 an ounce for the first time since 2013 (Figure 1), as global political and macroeconomic trends are driving demand for the yellow metal. Along with other strategists, we think gold bullion could surpass its all-time high of $1,900 within the next couple of years. Key factors driving long-term demand for gold as a store of value and defensive asset, especially among central banks and institutions, include low-to-negative interest rates, rising debt levels, trade tensions and intensifying geopolitical risk.

Price movements for physical gold and gold-mining stocks aren’t perfectly in sync, but the relationship between them is strong and persistent, across economic cycles.

Historically, rising (and falling) gold prices have a three-times multiplier effect on gold stocks: If the value of gold bullion increases by 10%, mining stocks tend to increase by 30%, and vice versa. The reason: Miners have significant fixed operating costs and high operating leverage, meaning big swings in physical gold prices have a larger impact on miners’ profitability.

This relationship cuts both ways, as we saw after physical gold prices peaked in late 2011. As the value of gold subsequently declined (Figure 2), the value of gold stocks plummeted even more. Between 2011 and 2018, the sector posted negative returns in six out of eight calendar years. Even with recent gains, gold mining stocks have yet to recover relative to historical valuations. Since the sector peak in April 2011, gold mining equities are still off by more than 60%.

Figure 2. Gold Mining Equities are Very Undervalued

Source: Bloomberg as of 11/12/19.

Figure 3. Gold Demand Has Rebounded: Purchases by Central Banks

Central banks have been net buyers of gold over the past 10 years. Gold plays an important part in central banks’ reserves management, and they are significant holders of gold. According to the World Gold Council: “Today, central banks own almost 34,000 tonnes (t) of gold, making it the third-largest reserve asset in the world. The increase in central bank demand for gold reflects current geopolitical, political and economic conditions, as well as structural changes in the global economy. Gold is both a liquid, counter-cyclical asset and a long-term store of value. As such, it can help central banks meet their core objectives of safety, liquidity and return.â€

Source: Metals Focus, Refinitiv GFMS, World Gold Council. As of June 30, 2019.

REASON #2. Gold Stocks are Severely Undervalued

Given the amplified volatility of gold stocks relative to gold, investors need to go in with their eyes wide open. Nevertheless, multi-year declines may now set the stage for significant upside.

While miners as a group still trade below their net asset values, the discounts of smaller, “junior†miners are especially extreme, as much of the recent rally has been driven by the largest, “senior†gold miners. In fact, the valuation gap between North American junior and senior gold miners is the widest it’s ever been.

Figure 4. The Valuation Gap Between Senior and Juniors is at Historic Extremes

Source: BMO Capital Markets, FactSet. North American senior vs. junior gold miners. As of 7/19/19.

Reason #3. Supplies are Limited

Most investors grasp the importance of investing in companies whose business models are protected by “competitive moats.†Gold miners have this in spades, as it can take 15 years from discovery of a new gold mine to successful ore production. The barriers to entry are enormous for newcomers in this sector, given the need for expensive and specialized equipment, environmental regulations and political considerations.

Meanwhile, the supply of gold is finite and there have been increasingly fewer gold discoveries in recent years. This dynamic — combined with depressed valuations of junior gold miners — is driving consolidation in the industry. It is far cheaper for senior miners to buy new gold production than to “build†capacity themselves. In fact, based on an analysis of recent transactions, there is a 35% discount for buying ounces in the market via acquisitions versus discovering new ounces (according to Scotiabank).

Figure 5. Major Gold Discoveries have Declined Significantly

Source: © Copyright by SNL Metals & Mining 2016. All rights reserved.

REASON #4. Momentum May Turn Positive

Investors love momentum — following positive trends in prices, earnings and other factors — and the rise of quantitative strategies has made this market phenomenon even more pervasive. For the last eight years, momentum has largely worked against the gold mining sector, but now there are signs the wind is shifting, and that momentum could soon work in its favor.

Analysts covering the sector have understandably been conservative in their estimates and may soon be playing catch up, given higher gold prices and a leveling off of mining costs. Any improvements in earnings outlooks could potentially accelerate positive momentum for the sector. As my colleague Paul Wong wrote earlier this month in The Sweet Spot for Gold Equities: â€At this stage in the gold cycle, we are in the sweet spot for gold mining company earnings. A starting low gold price base will result in earnings changes with a high percentage increase when measured quarter-over-quarter or year-over-year.â€

In Figure 6, we highlight the progression of 2020E EPS (estimates of earnings-per-share) revisions for the top-10 gold mining companies in SGDM2 versus the average 2020E EPS for the top-20 companies in the S&P 500 Index.3 Since January 2019, the average 2020E EPS for the top-10 gold mining companies had increased from $0.65 to $0.98 by the end of October, representing a 50% jump, compared to a decline of 9% for the S&P 500. After the Q3 reporting season, we would expect that 2020E EPS for gold miners will be revised even higher.

Figure 6. Sweet Spot for Gold Mining Company Earnings

Source: Bloomberg as of 10/31/19.

REASON #5. Gold Stocks Play a Different Role than Bullion

As with any investment, it’s important to think about the role of gold stocks in the context of a broader portfolio. One common misconception is that gold stocks and physical gold are two sides of the same coin. While their fates are certainly correlated, as asset classes they could not be more different.

Physical gold, whether it’s in the form of coin, bar or a trust (for example, Sprott Physical Gold Trust, NYSE Arca: PHYS), should be viewed as a stable store of value. It’s counter-cyclical and has proven over millennia to be an effective hedge against market turbulence and volatility.

As such, we recommend that investors allocate between 5% to 10% of their assets to physical gold and precious metals.

Gold stocks, conversely, should be viewed in the context of an investor’s overall equity portfolio; the size of the allocation will depend on many factors, including risk tolerance. Strategists advocate owning gold stocks continuously, in part because they have low correlations to the broader market. However, most investors view gold stocks as tactical investments. When valuations are severely depressed, as they are now, gold stocks may have the potential to outperform.

At Sprott, we believe that it may be time to consider investing in gold stocks, in addition to physical gold.

BY Ed Coyne

SOURCE: https://www.sprott.com/insights/five-reasons-why-gold-stocks-make-sense/

CLIENT FEATURE: Advance Gold $AAX.ca – IP Survey Demonstrates Potential for Large System Beneath Tabasquena Mine Prior to Drill Program $SIL.ca $FA.ca $ANG.jo $ABX.ca $NGT.ca $MGG.ca $TECK.ca $FNLPF $PAAS.ca

- A 3D Induced Polarization (IP) geophysical survey on its Tabasquena project in Zacatecas, Mexico has outlined a significant continuous chargeability anomaly.

- This anomaly now has an east-west width of approximately 400 to 500 metres and an apparent strike length of over 1000 metres.

- The anomaly remains open to the north and to the south and at depth.

- Drilling to commence once the IP survey has been completed.

The IP data also clearly shows that the large polarisable body/target is apparently quickly deepening northward and getting closer to surface southward. The IP anomaly starts at around 100 metres below the past drill hole intersections that contained widespread gold and silver mineralization in epithermal veins.

Tabasquena

- Previous drilling found a network of veins with widespread gold and silver mineralization.

- The first phase geophysical survey revealed a large chargeability anomaly right below these veins and is getting nearer to the surface as it trends south.

- Geophysical advisor described the anomaly as ‘quite remarkable in its size and continuity.

- Advance is in a region with very large mines, including the El Coronel open pit, 12 miles to the south of Tabasquena.

FULL DISCLOSURE: Advance Gold is an advertising client of AGORA Internet Relations Corp.

Advance Gold’s $AAX.ca – Follow Up Geophysical Survey Identifies Large 1000 by 500 Metres Continuous Chargeability Anomaly $SIL.ca $FA.ca $ANG.jo $ABX.ca $NGT.ca $MGG.ca $TECK.ca

Kamloops, British Columbia–(Newsfile Corp. – November 6, 2019) – Advance Gold Corp. (TSXV: AAX) (“Advance Gold” or “the Company”) is pleased to announce that the recently completed second phase of 3D Induced Polarization (IP) geophysical survey on its Tabasquena project in Zacatecas, Mexico, has significantly increased the size of its continuous chargeability anomaly. This anomaly now has an east-west width of approximately 400 to 500 metres and an apparent strike length of over 1000 metres. The anomaly remains open to the north and to the south and at depth.

Images below are east-west cross sections representing key portions of the overall anomaly where upcoming drilling will test this continuous chargeability anomaly.

Line 7350N

To view an enhanced version of Line 7350N, please visit:

https://orders.newsfilecorp.com/files/5492/49483_ee273a13f4482b50_001full.jpg

Line 7150N

To view an enhanced version of Line 7150N, please visit:

https://orders.newsfilecorp.com/files/5492/49483_ee273a13f4482b50_002full.jpg

Allan Barry Laboucan, President and CEO of Advance Gold Corp. commented: “After our first phase of geophysics, we identified a large chargeability anomaly with the highest chargeability at the southern end of the grid and still wide open. In that southerly direction we have elevation relief and it was also where the anomaly appeared to be closest to surface. Prior to drilling this anomaly, we decided to carry out a second phase of geophysics to see if the anomaly continued to the south. The second phase of geophysics has revealed that the anomaly actually has a much longer strike length and appears to be somewhat wider. This chargeability anomaly is now at least 1000 metres from north to south and approximately 400 to 500 metres from east to west. It sits below a network of veins with widespread gold and silver mineralization that ranges from anomalous to high-grade gold. There are three shafts on the property that go down around 100 metres that were used in the historical mining of the oxide zone of the Tabasquena vein. The geophysical anomaly is primarily right below those shafts, starting at approximately 200 metres below the underground workings. It is fair to say that we have identified a major target. Our next step will be to drill this target, we expect to start this shortly and will put out a news release once it has started.”

Gennen McDowall, Geophysical Advisor to Advance Gold Corp. commented: “This southerly extension to the original IP grid has shown that the large chargeability anomaly first detected in August is actually much bigger than originally thought and appears to strike right across the claim group and shows little evidence of ending either to the north or to the south and its depth extent is as of yet unknown. The chargeability anomaly is visible on every east-west IP line. The observed near surface mineralisation may be an expression of a much larger mineralised body underlying the entire Tabasquena project.”

Details of Geophysical Survey

The first 3D Induced Polarization survey was carried out by GEOFISICA TMC SA de CV, between August 3rd and August 14th, 2019. Approximately 9.6 kms of IP data was collected over the central portion of the company’s claims. This was followed up by a second phase of geophysics consisting of 5 east-west lines. The southerly extent of the second survey reached just beyond the Tesorito shaft. An off-set pole dipole array was used.

Data processing and inversion of the data was carried out using RES3DINV software. The inversion model was extended to approximately 550 metres below surface. 3D Voxel images together with a series of depth slices were generated (all available on the company’s website).

The main purpose of the IP survey was to map, laterally and at depth the evolution of the known gold and silver veins and to identify any new mineralised structures. The survey was designed in such a way to allow approximately 500 to 550 metres of vertical depth investigation.

The IP survey area encompassed the historic and new shafts that are located to the east of the Tabasquena and Nina veins that define a mineralised system that outcrops at surface for 2.0 km. From past exploration work, the Tabasquena vein was recognized over approximately 70 m along strike near the shafts but only at shallow depth (< 100 m).

The fourteen (14) vertical sections that were extracted from the 3D IP inversion voxels suggest the presence of (4) four main stratigraphic horizons (lithological units) mainly characterized by their resistivity signatures.

The IP data also clearly shows that the large polarisable body/target is apparently quickly deepening northward and getting closer to surface southward. The IP anomaly starts at around 100 metres below the past drill hole intersections that contained widespread gold and silver mineralization in epithermal veins.

Chargeability and resistivity anomalies are indicated on the IP sections (see report on company’s website) and are graded as per their relative strength. Those chargeability anomalies that are deemed to be caused by the same anomalous target are grouped together in what is called a polarisable axis. Only one main axis was delineated following the review of the IP data, which was labelled IPT-1 (Map C351-3 & Figure 11, report on company website). This axis is a single large amplitude continuous chargeability anomaly running north-south, coincident with the two shafts at Tabasquena, the Tesorito shaft and the surface projection of the mineralised veins. This anomaly has been categorized as having a high chargeability and is conductive. The anomaly has an average depth of approximately 250 to 300 meters. It should also be mentioned that this anomaly is visible on every line, albeit less intense on the most northerly line, as the target is becoming deeper to the north.

In conclusion

This geophysical work has now identified a large consistent chargeability anomaly that can be seen on all lines, implying a strike extent of at least 1000 metres and an apparent width of 400 to 500 metres. This observed IP anomaly could define a much wider mineralised system at depth.

The main recommendation of the original geophysical report was that prior to drilling the anomaly the 3D IP survey should be extended to the southeast for at least 1 km in the direction of the Tesorito shaft. This has now been completed and this new work has established that the main anomaly does in fact continue past the Tesorito shaft and is somewhat wider. A number of boreholes are now planned to intersect this anomaly.

Julio Pinto Linares is a QP, Doctor in Geological Sciences with specialty in Economic Geology and Qualified Professional No. 01365 by MMSA., and QP for Advance Gold and is the qualified person as defined by National Instrument 43-101 and he has read and approved the accuracy of technical information contained in this news release.

About Advance Gold Corp. (TSXV: AAX)

Advance Gold is a TSX-V listed junior exploration company focused on acquiring and exploring mineral properties containing precious metals. The Company acquired a 100% interest in the Tabasquena Silver Mine in Zacatecas, Mexico in 2017, and the Venaditas project, also in Zacatecas state, in April, 2018.

The Tabasquena project is located near the Milagros silver mine near the city of Ojocaliente, Mexico. Benefits at Tabasquena include road access to the claims, power to the claims, a 100-metre underground shaft and underground workings, plus it is a fully permitted mine.

Venaditas is well located adjacent to Teck’s San Nicolas mine, a VMS deposit, and it is approximately 11km to the east of the Tabasquena project, along a paved road.

In addition, Advance Gold holds a 13.23% interest on strategic claims in the Liranda Corridor in Kenya, East Africa. The remaining 86.77% of the Kakamega project is held by Barrick Gold Corporation.

For further information, please contact:

Allan Barry Laboucan,

President and CEO

Phone: (604) 505-4753

Email: [email protected]

Advance Gold $AAX.ca – Largest Gold ETF Inflows in Three Years Boosted Demand for Yellow Metal in the Third Quarter

SPONSOR: Advance Gold AAX.v – Advance Gold controls 100% interest in the Tabasquena Silver Mine in Zacatecas, Mexico. A cluster of 30 Epithermal veins have been discovered, with recent emphasis on exploring a large anomaly to drill. Advance also owns 15% of the Kakamega JV attached to Barrick Takeover Offer for Acacia Mining. Click Here For More Info

A surge in speculation led to an increase in gold demand in the third quarter, according to a World Gold Council report released Tuesday.

Exchange-traded fund inflows shot higher by the largest amount since the first quarter of 2016, in what the council attributed to accommodative monetary policies, safe-haven and momentum buying. During the third quarter, the Federal Reserve cut interest rates twice, and the European Central Bank cut interest rates in a package of easing measures.

Leading gold ETFs include the SPDR Gold Trust GLD, +0.01%, iShares Gold Trust IAU, +0.07% and the Aberdeen Standard Physical Swiss Gold Shares ETF SGOL, -1.51%.

Overall gold demand rose just 3% during the quarter, as jewelry demand shrank by 16% as the yellow metal’s prices rose.

Gold futures GC00, -1.67% were holding above the $1,500 an ounce level on Tuesday and have climbed by 19% over the last 12 months.

Central-bank buying fell by 38%, as the third quarter of 2018 featured the highest amount of buying on record. Bar and coin demand dropped by half.

The gold supply rose by 4%, helped by a 10% increase in recycling.

SOURCE: https://www.marketwatch.com/story/largest-etf-inflows-in-three-years-drove-gold-demand-higher-in-the-third-quarter-2019-11-05

Advance Gold $AAX.ca – Gold Eyes Further Gains as Rock-Bottom Rates Tempt Investors $SIL.ca $FA.ca $ANG.jo $ABX.ca $NGT.ca $MGG.ca $TECK.ca

SPONSOR: Advance Gold AAX.v – Advance Gold controls 100% interest in the Tabasquena Silver Mine in Zacatecas, Mexico. A cluster of 30 Epithermal veins have been discovered, with recent emphasis on exploring a large anomaly to drill. Advance also owns 15% of the Kakamega JV attached to Barrick Takeover Offer for Acacia Mining. Click Here For More Info

BENGALURU — Fragile global growth and the prospect of interest rates staying lower for longer, boosting gold’s appeal for nervous investors, are behind upward revisions to price forecasts for the yellow metal, a Reuters survey showed.

Spot gold will average $1,402 an ounce in 2019 and $1,537 an ounce next year, according to the median forecasts returned by the poll of 40 analysts and traders in mid-October.

Those numbers are sharply higher than predictions of $1,351 for 2019 and $1,433 for 2020 returned by a similar poll conducted three months ago. Gold has averaged around $1,375 an ounce so far this year.

Gold – traditionally seen as a safe place to invest in uncertain times – hit a more than six-year high of $1,557 in September and with gains of about 17% so far is set for its biggest yearly gain since 2010.

“Rate cuts by major central banks, a deteriorating global economic outlook and elevated geopolitical tensions are the key tailwinds for gold prices,†ANZ analyst Daniel Hynes said.

A U.S.-China trade war has sent a shiver through the global economy.

The U.S. Federal Reserve has meanwhile cut interest rates twice this year to stimulate growth, and other major central banks have followed suit.

Lower rates reduce the opportunity cost of holding non-yielding bullion, making it more attractive to investors.

Central banks have also steadily increased their gold reserves and private cash has flooded into gold-backed exchange traded funds (ETFs), boosting physical demand.

“If central banks and exchange-traded funds keep on buying and the Fed continues with lowering interest rates, we will talk about prices of $1,600 in the near future,†said LBBW analyst Frank Schallenberger.

For silver, poll respondents forecast average prices of $16.24 an ounce this year and $18.13 in 2020, up from predictions of $15.50 and $16.85 three months ago. In the year to date it has averaged $15.97 an ounce.

Silver will remain cheap relative to gold, with the gold/silver ratio averaging 86 in 2019 and 85 in 2020, not far from a more than two-decade high just above 93 reached in July.

Silver in September breached the $19 mark for the first time since 2016. It tends to move with gold, but around half of consumption comes from industry, and weaker economic growth would drag on demand and, potentially, prices.

Gold and silver prices have dipped in recent weeks as signs of progress in trade talks revived appetite for riskier assets. If reached, a trade deal could boost economic growth and hurt gold and silver, said ETF Securities analyst Nitesh Shah.

Speculative bets on price rises for gold on the COMEX exchange have eased slightly from record highs in September, while those for silver have also dipped from a near two-year peak in July. .

High prices have also dampened demand in Asia, the biggest gold-consuming region.

“The main negative factors (for gold) are the speculative overhang in the futures market and the lackluster demand from physical buyers in India, to some extent in China and amongst Western coin and bar purchasers,†said Ross Norman, an independent analyst.

“Gold is due a period of consolidation and perhaps even a temporary correction,†he said.

Source: Reporting by Brijesh Patel in Bengaluru; editing by Arpan Varghese, Peter Hobson and)