- Phase One Exploration Program to begin Summer 2016

- Program of Pegmatite Sampling, Prospecting and Mapping planned for the Lithium One, Lithman North and Lithman East Project

- Numerous historical Pegmatites to be tested for Lithium mineralization

- Summer Surface Exploration; objective to outline future Drill Programs

- Utilizing the Prospector Generator Model, the Company is currently seeking participation by interested Option/Joint Venture Partners for its Lithium Projects (see About the Company’s Business Model – Page 2)

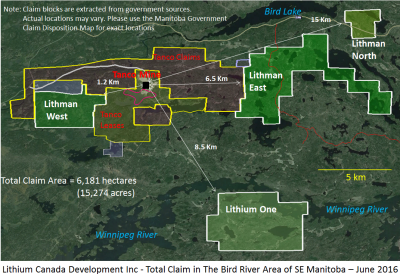

Vancouver, BC / July 21, 2016 – Pacific North West Capital Corp. (“PFN”, the “Company”) (TSX-V: PFN; Frankfurt: P7J; OTCQB: PAWEF announces that its 100% owned subsidiary, Lithium Canada Developments will be conducting a Phase One Exploration Program, during the summer of 2016, on three Lithium Projects in southeast Manitoba.

A surface Phase One Exploration Program, consisting of Mapping, Prospecting and Sampling of known Pegmatites, on three of the company’s Lithium Projects, will begin during the summer of 2016. Presently, work permits have been submitted with the government and once granted, the field work will begin. The exploration program planned will lay the groundwork for future Exploration Plans and Drill Programs. Historic records in the region have indicated Lithium mineralization and mineralogy to be present in several Pegmatites, but at the time, exploration was being conducted for other commodities.

The three projects that are being explored this summer will be the Lithium One, Lithman North and Lithman East Projects. All three have previously mapped Pegmatites and are situated in the Winnipeg River Pegmatite Field. This Pegmatite Field hosts the world class Tanco Pegmatite, which has been mined from an underground operation, at the Tanco Mine Site in various capacities, since 1969. It once was one of the primary producers of Spodumene (a primary Lithium ore) in North America.

The Tanco Pegmatite is not exposed at surface, except for under Bernic Lake. It is an extremely fractionated, rare-metal, complex type-Petalite subgroup, LCT (Lithium-Cesium-Tantalum) Pegmatite, hosted in a late-stage, subvolcanic Gabbro. Current NI43-101 compliant resource calculations are not available for the Tanco Pegmatite. Academic publications have estimated the size of the deposit to be up to approximately 57 million tonnes. The last published mineral reserves (end of 1992) were 1.075 million tonnes of 0.12% Ta2O5, 3.5 million tonnes of 2.7% LiO2, and 315,000 tonnes of 23.3% Cs2O.

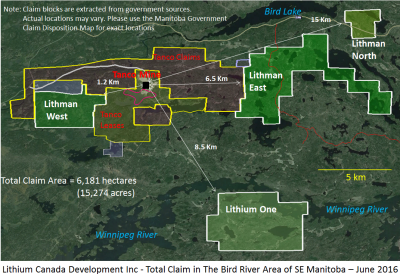

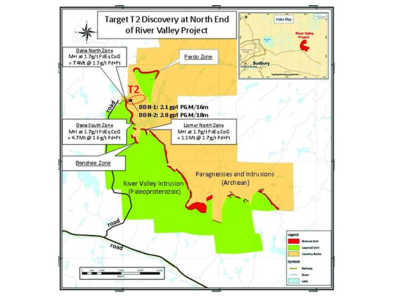

Click Image To View Full Size

Lithium Canada Development Inc. (100% wholly owned Subsidiary of Pacific North West Capital); total land holding in SE Manitoba, as of July 2016: 6,181 hectares (15,274 acres).

Further announcements regarding potential Joint Ventures and other exploration initiatives, on the company’s Lithium Projects, in southeast Manitoba will be forthcoming.

About the Company’s Business Model

“Utilizing the Prospector Generator Model and an aggressive project Acquisition Program, management plans to provide our shareholders with the opportunity to explore and develop a number of Concurrent Exploration Projects. After an initial phase of exploration on our projects, our team plans to partner via Option/Joint Venture Agreements with Major and well-funded Junior companies that want exposure to the Lithium industry.

The Prospector Generator Model reduces risk, share dilution and increases Discovery Potential.”

About The Company’s Lithium Division

The company’s new Lithium Division will focus on the Discovery, Acquisition, Exploration and Development of Lithium Projects in Canada. In the United States, the company will use its wholly owned U.S.A subsidiary to Acquire and Develop projects, in active mining camp, in Nevada, Arizona and California.

Management believes that these New Age Metals, Lithium, PGMs and Rare Earths, have robust macro trends, with surging demands and limited supply. Going forward, this new Division will explore for the minerals needed, to fuel the demand for energy storage and other core 21st Century Technologies.

The company has a growing portfolio of Lithium Projects. The Clayton Valley Forks Li Project in Nevada is a recent Lithium Brine Project, acquired by the company (PFN News Releases: April 25th, 2016 and May 9th, 2016.) The company also has Hard Rock Lithium projects in Canada (PFN News Releases: April 21st, 2016, May 24th, 2016 and July 5th, 2016), located in the Winnipeg River Pegmatite Field of southeast Manitoba.

Lithium and Platinum Group Metal prices have improved dramatically in recent months. Lithium supplies remain in deficit, relative to their demand. Both metals groups are used for the expanding worldwide automobile industry (conventional and electric). In the case of PGMs, demand is increasing for Autocatalysts, a key component for reducing toxic emissions for automotive, gasoline and diesel engines. Regarding Lithium, there is an ever increasing demand for batteries, in cellphones, laptops, electric cars, solar storage, wireless charging and renewable energy products.

About the Company’s Platinum Group Metals Division

Achievements to date and future plans for River Valley are outlined below as follows:

- 1.PFN currently has 100% ownership in the River Valley Project, subject to a 3% NSR, with options to buy down;

- 2.Completed Exploration and Development Programs, on the River Valley property, include more than 600 holes drilled since year 2000 and several mineral resource estimates and metallurgical studies;

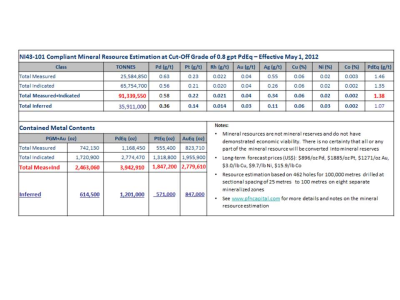

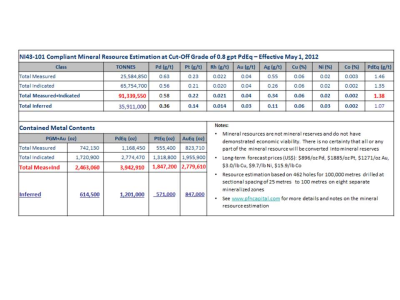

- 3.Results for the current (2012) mineral resource estimate are below;

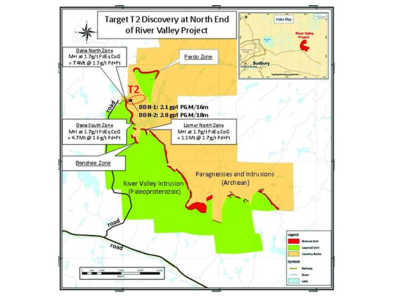

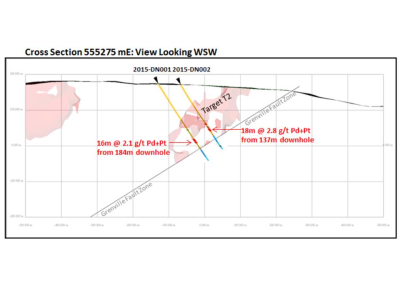

- 4.2015 Drill Program confirms New High Grade T2 Discovery

- 5.Exploration and Development Plans outlined for 2016

- 6.Exploration and Development Plans outlined for 2016

- 7.Exploration and Development Plans outlined for 2016

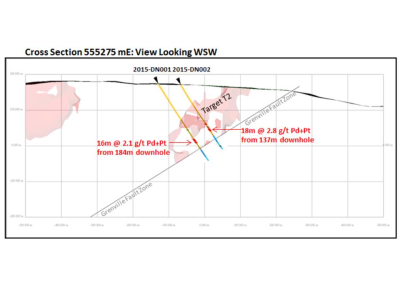

Click Image To View Full Size

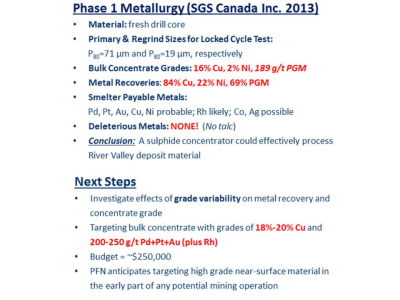

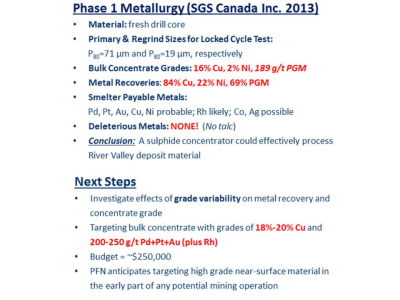

- 8.Results for the most recent Metallurgical Testwork Study are summarized below:

– Prepared by Tetra Tech (Wardrop)

– High Confidence: Measured plus Indicated = 72% of total

– Reported on PdEq basis: Pd=40% & Pt=20% of the payable metals

– Pd to Pt ratio = 2.5:1; Cu to Ni ratio = 3:1

– High Grade potential, particularly in the north part of the River Valley deposit

– Resources under evaluation for development potential, as open pit mining operation

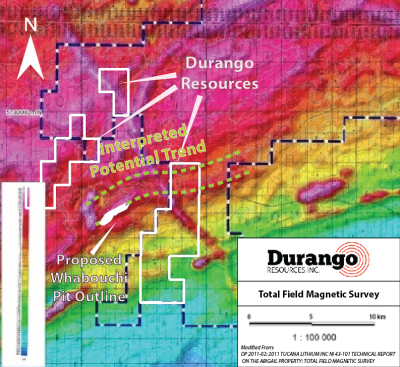

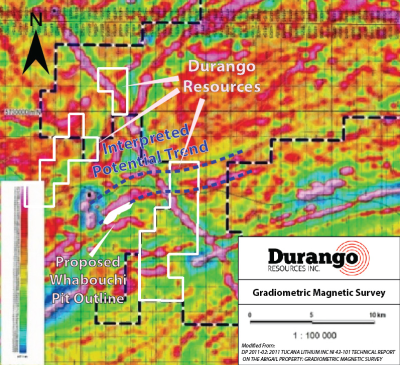

Click Image To View Full Size

Click Image To View Full Size

- 9.Results for the 2015 Discovery Drill Program, on the T2 Target are as follows:

– Drill hole intercepts much higher than the average grade of current mineral resource estimate

– Possible new mineralized zone at the north end of the River Valley deposit

– Show potential to take the River Valley PGM Project in a new direction

-More drilling required

Click Image To View Full Size

Exploration and Development Plans for 2016:

-Mineral Prospecting and Geological Mapping on surface

-Drill Programs targeted to add more higher grade

-Geological interpretation and 2D/3D modeling of all drill and surface results

-Application to the OPA’s Junior Exploration Assistance Program (JEAP) for 33% refund

of all exploration expenditures up to $300,000.

-Ongoing Strategic Partner Search for River Valley

QUALIFIED PERSON

The contents contained herein that relates to Exploration Results or Mineral Resources is based on information compiled, reviewed or prepared by Dr. Bill Stone, Principal Consulting Geoscientist for Pacific Northwest Capital. Dr. Stone is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content.

On behalf of the Board of Directors

” Harry Barr ”

Harry Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements. This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.