Introduction:

The global AdTech market is on the brink of a significant transformation, with the latest projections showing the market is set to hit USD 3.249 billion by 2032, driven by a compound annual growth rate (CAGR) of 14.7%. This rapid growth reflects the increasing demand for more sophisticated, targeted, and data-driven advertising solutions across digital platforms. As one of the key players in child-safe digital advertising, Kidoz Inc. is poised to capitalize on this booming sector, leveraging its strong market position and innovative platform to drive further success.

AdTech Market: A Snapshot of Booming Growth

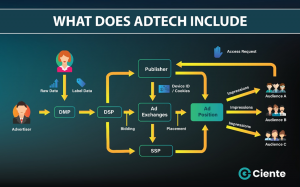

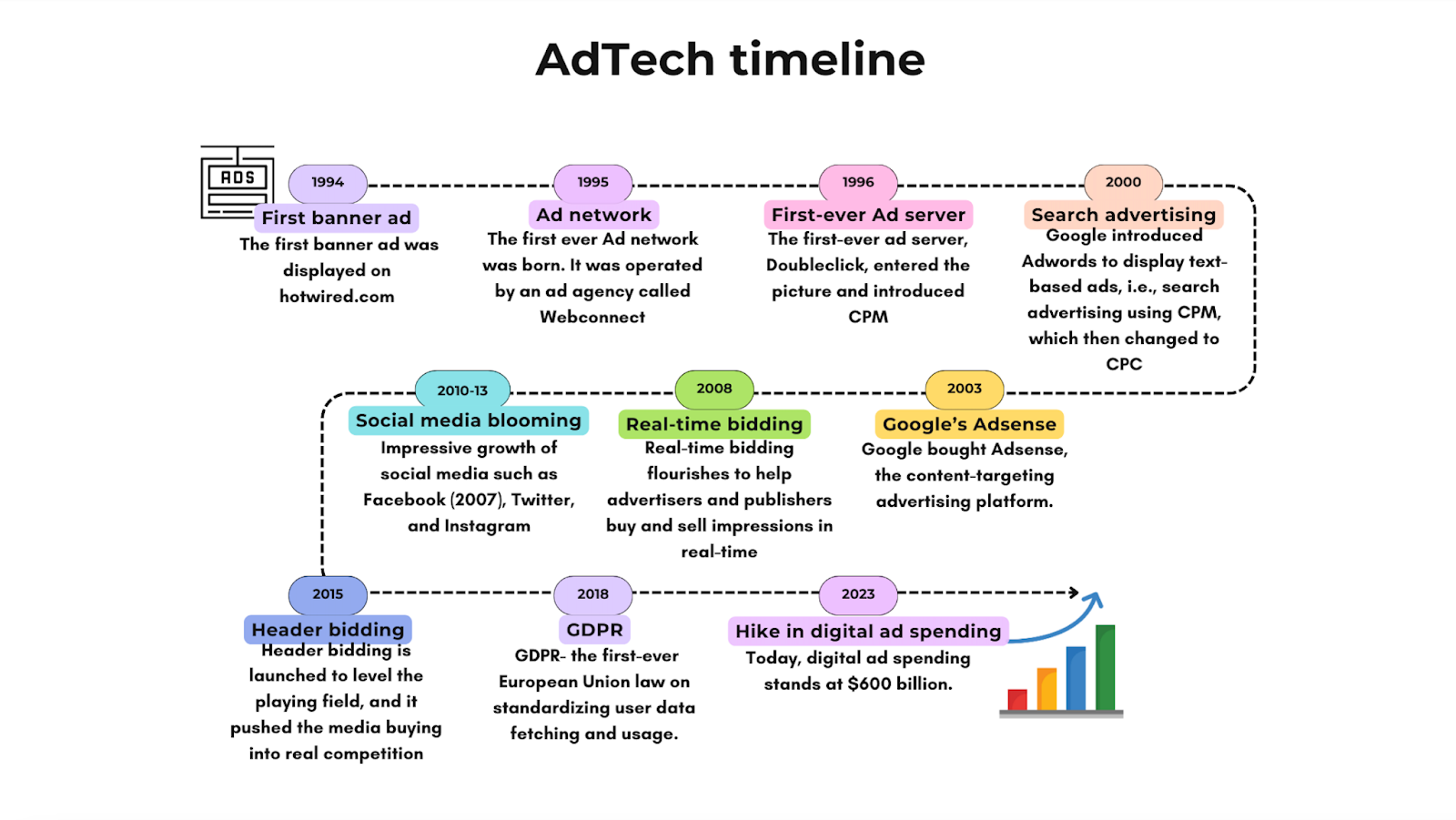

According to recent reports, the AdTech market is experiencing unprecedented growth, as companies across industries recognize the value of targeted, personalized advertising powered by advanced technologies. The sector is being driven by increased consumer engagement on mobile devices, the rise of programmatic advertising, and the growing adoption of artificial intelligence (AI) and machine learning (ML) tools. These technologies are transforming how advertisers reach their audiences, enabling more effective campaigns that deliver higher returns on investment.

As the AdTech market expands, brands are increasingly seeking platforms that offer high levels of accuracy, transparency, and safety—particularly when it comes to advertising to sensitive demographics, such as children and young audiences. This is where Kidoz, with its commitment to compliance and child-safe advertising, stands out as a leader in the industry.

Kidoz: A Leader in Child-Safe AdTech

Kidoz has carved out a niche in the AdTech industry by specializing in safe, compliant advertising for children and families. The company’s platform is designed to meet the stringent privacy regulations surrounding child-directed advertising, including the Children’s Online Privacy Protection Act (COPPA) and General Data Protection Regulation (GDPR). These standards ensure that Kidoz’s clients can reach younger audiences without compromising on data security or privacy.

Kidoz’s ad network spans more than 5,000 apps and reaches over 400 million children, teens, and families globally. By focusing on creating a secure, engaging environment for advertisers and users alike, Kidoz has positioned itself as the go-to platform for brands seeking to connect with younger demographics. The company’s innovative platform not only meets the regulatory requirements but also enhances the effectiveness of digital ad campaigns, making it a key player in the fast-growing AdTech space.

Programmatic Advertising and Kidoz’s Competitive Edge

A significant driver of the AdTech market’s growth is the rise of programmatic advertising, which uses automated systems to buy and sell ads in real-time. This approach allows advertisers to target specific audiences more efficiently and at scale. Kidoz’s platform is fully integrated with programmatic technology, allowing brands to serve ads in-app, where children and families spend much of their digital time.

By integrating programmatic advertising with a focus on child-safe environments, Kidoz offers a unique value proposition. Brands can leverage Kidoz’s extensive reach and targeting capabilities while ensuring they are adhering to all necessary safety protocols. This combination of automation, safety, and reach makes Kidoz a standout in the competitive AdTech market, particularly as demand for programmatic solutions continues to rise.

Data-Driven Insights: The Future of Advertising with Kidoz

Another key trend driving the growth of the AdTech market is the increasing reliance on data-driven advertising strategies. Brands are moving away from broad, untargeted campaigns and are instead focusing on highly personalized content that resonates with specific audiences. Kidoz’s platform excels in this area, providing brands with the ability to serve relevant ads based on user behavior, preferences, and engagement patterns, all while maintaining compliance with privacy regulations.

Kidoz’s AI-driven technology ensures that ads are not only served in a compliant and safe manner but are also optimized for performance. The platform’s robust data analytics tools allow advertisers to track the effectiveness of their campaigns in real-time, providing insights that help brands refine their strategies and improve outcomes. This data-centric approach is becoming increasingly important as advertisers seek to maximize the return on their digital ad spend, making Kidoz a valuable partner for brands navigating the complexities of the AdTech landscape.

Kidoz’s Role in the Future of AdTech

As the AdTech market continues to grow and evolve, Kidoz is well-positioned to remain at the forefront of the industry. The company’s commitment to safety, privacy, and innovation aligns with the broader trends shaping the future of digital advertising. With its extensive reach, programmatic capabilities, and focus on data-driven insights, Kidoz is poised to capture a significant share of the booming AdTech market.

Furthermore, as regulations surrounding digital privacy become stricter, Kidoz’s expertise in compliant advertising will only become more valuable to brands. The company’s ability to navigate the complexities of child-directed advertising gives it a unique competitive advantage in a market that is becoming increasingly focused on data protection and user safety.

Conclusion: A Strong Future Ahead for Kidoz

The AdTech market is undergoing a period of rapid growth, and Kidoz is uniquely positioned to capitalize on the opportunities this presents. With its innovative platform, commitment to compliance, and focus on child-safe advertising, Kidoz is a key player in the evolving digital advertising landscape. As the market continues to expand, Kidoz’s proven ability to deliver effective, safe, and data-driven advertising solutions will ensure its continued success in the years to come.

Source: https://www.openpr.com/news/3668283/adtech-market-size-to-hit-usd-3-249-billion-with-booming-cagr

YOUR NEXT STEPS

Visit $KIDZ HUB On AGORACOM: https://agoracom.com/ir/Kidoz

Visit $KIDZ 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/Kidoz/profile

Visit $KIDZ Official Verified Discussion Forum On AGORACOM: https://agoracom.com/ir/Kidoz/forums/discussion

Watch $KIDZ Videos On AGORACOM YouTube Channel:

https://www.youtube.com/feed/library

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.

From time to time, reference may be made in our marketing materials to prior Records we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

NO INVESTMENT ADVICE

This record, and any record we publish by or on behalf of our clients, should not be construed as an offer or solicitation to buy or sell products or securities.

You understand and agree that no content in this record or published by AGORACOM constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person and that no such content is tailored to any specific person’s needs. We will never advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

Neither the writer of this record nor AGORACOM is an investment advisor. Both are neither licensed to provide nor are making any buy or sell recommendations. For more information about this or any other company, please review their public documents to conduct your own due diligence.

If you have any questions, please direct them to [email protected]

For our full website disclaimer, please visit https://agoracom.com/terms-and-conditions