By Nathan Pearson and Rachel Harrison

ResourcexInvestor.com

With the graphite space exploding like a supernova, junior exploration companies are snapping up prime real estate to sink their eager drills into across Canada and beyond. It’s an exciting time for investors and investees alike as we find ourselves in the eye of a perfect storm in which insufficient supply is beginning to clash with ever-increasing demand. From rapid industrial advancements in developing nations to a host of burgeoning green technologies, graphite seems to be at the center of it all.

Why Graphite Matters

Graphite is one of three types of carbon, alongside amorphous—such as coal and charcoal—and diamonds. Graphite also exists in amorphous form, as well as crystalline flake and lump/vein and is classed by grade, mesh and moisture content. Not only found within pencils, graphite is used extensively in steel manufacturing as well as applications such as brake linings and clutches, lubricants, crucibles and plastics. But that’s only half the story. Newly emerging and green technologies are sending the demand skyward as lithium-ion batteries, fuel cells, solar panels, pebble bed nuclear reactors and graphene become technologies of today rather than tomorrow.

What is it about graphite that makes it so suitable for a wide variety of applications? The reasons are numerous: it’s an excellent conductor of heat and electricity, is extremely resistant to strong acids as well as thermal shock, is a phenomenal lubricant, is highly refractive and has the highest natural strength and stiffness of any known material.

And then there’s graphene. These one-atom-thick sheets of graphite make up the thinnest and strongest material ever developed: two hundred times stronger than steel and several times tougher than a diamond. Because it conducts both electricity and heat better than copper, it has vast potential in applications such as LCD touch-screen technology, transistors, solar cells and data and energy storage units.

A Perfect Storm:

Supply and Demand Graphite demand has been rising at a steady rate of five percent per year for the last decade, due largely to the rapid industrialization of developing nations such as China and India. Another factor is the lithium-ion battery, needed to satisfy the First World’s thirst for consumer goods such as laptops, cameras, cell phones and mp3 players, as well as electric and hybrid vehicles, which can require up to seventy kilograms of graphite per vehicle. Surprisingly, the lithium-ion battery takes twenty to thirty times more graphite than lithium to produce. These factors have a Canaccord research report stating that, “Annual flake graphite production will have to increase by a factor of six by 2020 to meet incremental lithium carbonate requirements for batteriesâ€.

Seventy percent of the world’s graphite is currently exported from China. The problem lies in a combination of depleted reserves, a need to fuel their own growing steel and automotive industries and a steep twenty percent export duty and seventeen percent VAT. This has contributed to the price of graphite doubling since 2010 and nearly tripling since 2008. Prices for graphite are determined by flake size and purity—with premium product being large flake, high carbon graphite—and currently commands up to $3000 per tonne.

The remaining thirty percent of graphite production takes place in countries such as India, Brazil, North Korea, Madagascar, Sri Lanka and Canada, but not nearly enough sources exist to meet the burgeoning demand. It is estimated that up to twenty-five more mines worth of new production could be needed. It is for this reason that the British Geological Survey has declared graphite a critical material and the European commission included graphite among the fourteen materials it considers high in economic importance and supply risk.

Junior Companies On the Scene

So, what should investors look for when researching players in the graphite space? In terms of a company’s resource, investors will want to focus on projects with near-surface, high-grade, large-flake deposits that are in politically and economically safe areas with sound infrastructure. Investors in the know will have already heard about players such as Northern Graphite and Focus Metals, but who else has taken to the stage?

Graphite One Resources Inc. Delving right in, Graphite One (TSX-V: GPH) has a market cap is $27 million and shares are going for $0.35 as of April 2.

As well as Graphite One’s Kelly Creek gold property, they also own 100% interest of their Graphite Creek property, acquired in February and located on privately owned land on the Seward Peninsula of Alaska within a pro-mining jurisdiction. The property is 65 km north of Nome, 3 km from an airstrip, and 20 km from the nearest road systems.

This scalable deposit contains the potential for over 200 million tonnes of graphite-bearing rocks, with large-flake, high purity graphite exposed at the surface, creating favourable conditions for an open-pit mining configuration. Graphite One estimates the potential grades at the site to fall between 5.0% – 10% Cg and plans to be NI 43-101 compliant by next year. Their exploration campaign of geologic mapping, surface sampling, conductivity survey and diamond drilling are set to be carried out in Q2 and Q3 of this year.

Graphite One’s management team combines over twenty years experience in mineral exploration, development and production. They have managed major high-budget exploration programs and collectively financed over $250 million for various resource companies. Acting as CEO, Chairman and Director is Charles Chebry B.Sc. CMA. His list of achievements is lengthy and includes positions as CEO, Chairman and Director of Altiplano Minerals Ltd., Director of Argonaut Exploration Inc., Happy Creek Minerals Ltd. and North Country Gold Corp., former Director of CBR Gold Corp, President and founder of Arta Enterprises Inc., past CFO of Kaminak Gold Corp. and Kivalliq Energy Corp., Anthony Huston B.Comm., as President and and Director; Mr. Huston has a background in management and finance having served as a Managing Partner with both public and private companies where he recently played an integral role in raising over $20M. Mr. Huston acted as lead financial advisor on a range of finance and acquisition transactions in many industry sectors including technology, bio-tech, and most recently the resource sector. He holds a Bachelor of Commerce degree from the University of British Columbia. Past CFO, Vice President of Finance and Director of Olympia Trust Company and Olympia Financial Group Inc., where Mr. Chebry remains a Director. Joining Mr. Chebry in his efforts at Graphite One is Dean Besserer P.Geo, VP Exploration; Dale Hansen CMA, CFO; John Williamson P.Geo, Director; Sean Mager B.Comm, Director; Peter Kleespies P.Geo, Director; and John Robins P.Geo, Advisory Board.

Lomiko Metals

Lomiko Metals (TSX-V: LMR) (US: LMRMF) (FSE: DH8B) is a Vancouver-based company focused on electric minerals with three properties, one each in the lithium, gold and graphite spaces. As of April 2 their market capitalization is $8.88 million and shares can be purchased for $0.16.

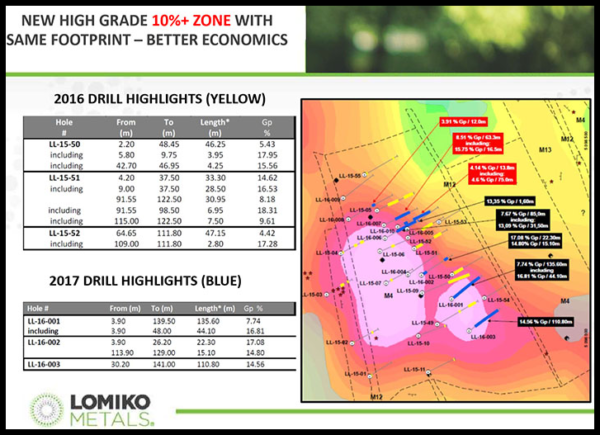

Lomiko holds 100%-interest in its Quatre Milles Graphite Project located approximately 175 km northwest of Montreal and 17 km north of Sainte- Veronique, Quebec. The 1,600-hectare property consists of 28 contiguous claims and was previously explored by Graphicor Resources Inc. beginning in 1989. Although the historical assays conducted at Quatre Milles at the time predate the introduction of NI 43-101, the results should not be ignored. Three surface samples were collected and analyzed returning results of 14.16% Cgf, 18.06% Cgf and 20.35% Cgf. Twenty-three of the initial twenty-six drill holes intersected graphite concentrations ranging from 4.69% to a highlight of 8.07% Cgf over 28.60 metres. The highest individual assay reported was 15.48% Cgf over 0.50 metres.

The current focus for Lomiko is the commencement of an aggressive exploration campaign, including surface mapping, prospecting, diamond drilling and of course, if positive, completing an initial NI 43-101 compliant resource estimate.

In a recent interview with Streetwise Reports, Siddharth Rajeev of Fundamental Research Corporation commented on Lomiko Metals Inc. Rajeev finds his top investment prospects by zeroing in on a specific material and tracking its growth drivers and believes that critical metals used in viable new technologies will see increasing demand. In this exclusive interview with The Critical Metals Report, he explains how lithium-ion battery development and the forthcoming WTO ruling affect his outlook for graphite and niobium.

“Lomiko Metals Inc. is an early-stage project. It just acquired a project in Quebec. Some historic work has been done on the property. As for near-term catalysts, it is working on an NI 43-101 technical report, and it is going to commence an exploration program on the property. . .our last report on Lomiko’s graphite came out a few months ago. The stock had doubled since the initial report. It’s dropped since then. As long as the graphite market stays in its current space, where I expect it to stay for a while, and if Lomiko’s exploration program produces positive results, that should reflect in the stock price.â€

The management team at Lomiko brings a wealth of skill and knowledge to each of its projects. CEO Paul Gill has extensive experience in resource exploration, having previously served as Officer, Director and Vice President of Business Development of Norsemont Mining from 2003 to 2006, CEO of Grenville Gold Corp. and President and CEO of Epic Mining, located in Peru. In the case of Norsemont Mining, in the short time he was with the company Mr. Gill helped it grow from a worth of $1 million to $50 million. Also on the team is Jacqueline Michael, CFO; Mark Nesbitt LLB P.Geo, Director; and Julius Galik, Director.

First Graphite Corp.

Targeting strategic metal deposits in Canada is Vancouver-based First Graphite (TSX-V: FGR). As of April 2 First Graphite’s market cap sits at $10 million with a share price of $0.58.

First Graphite owns a rare earth metals property in the Northwest Territories at Blachford and the Mont Pellier graphite property in the Grenville Province in western Quebec, which it acquired in February. The project sits approximately 172 km northwest of Montreal, is close in proximity to the Timcal Canada graphite mine and is road accessible.

Geologically, the Grenville Province can be divided into the Central Gneiss Belt (CGB) and the Central Metasedimentry Belt (CMB), with the Montpellier property residing in the CMB. Graphite grades in the CMB typically vary between less-than 1% to 20% Cg. Grab samples at Montpellier revealed grades of 0.82% – 14.4% Cg.

In March, management signed an option on the Mt Heimdahl graphite project, once again capitalizing on the “close-ology†of one of Canada’s few producing graphite projects, in this case, Eagle Graphite’s Black Crystal mine. The Mt. Heimdahl Property, totaling approximately 1045 hectares is located in the Valhalla Ranges, in high-grade metamorphic rocks of the Valhalla Complex, within the Omineca Crystalline Belt. Infrastructure is well developed in the Mt. Heimdahl Property area, as the property is approximately 35 kms south west of Nelson BC.

First Graphite management has been clear that they are aggressively evaluating further acquisitions and intend to commence exploration early in Q2 of this year. First Graphite’s management blends experience in accounting, capital markets, public company administration, consultancy for junior mining companies, and mineral exploration. At the helm is President Andrew Mugridge, President of Progressive IR Consultants Corporation since 2007, former CEO of Venture Media Group Inc. and Officer and Advisor to numerous publicly traded companies. His team members are Peter Posnikoff, CFO and Corporate Secretary; Benjamin Curry, Director; Brian Morrison, Director; Kyle Stevenson, Director; and Martin Bajic, Director.

Flinders Resources Flinders Resources (TSX-V: FDR) is another Vancouver-based company, though their Kringel graphite mine, of which they hold 100% interest, is located in Sweden. They hold four mining licenses: Kringel, containing 11.3% Cg; Gropabo, 6.9% Cg; Mattsmyra, 8.8% Cg; and Mansberg, 9.4% Cg. Flinder’s market cap is $90 million and shares can be purchased for $3.02 as of April 2.

Flinders has the unique advantage of having acquired a previously producing mine with an infrastructure of roads, power, water, tailings dam, dumps and pit already in place, as well as a fully permitted beneficiation plant rated to 13,000 tonnes per year of graphite production, which could easily be expanded. It is located in central Sweden where the climate is mild, in a first class mining jurisdiction and is 15 km from rail and 75 km from the harbour.

Kringel has a solid history dating back to 1993 when Kringel Graphite formed to develop the deposits. By 1995 development of its mining and beneficiation operation, as well commercial production of flake graphite products was well underway. Adverse market conditions in 2001 caused production to halt, and the site lay dormant until the acquisition of Kringelgruvan AB in 2012 by Flinders Resources Ltd.

While in production, Kringel produced high-value, high-quality, large flake graphite. Historic resources at the mine achieved 8.8% Cg, and production yielded a purity of 85% – 94%. Current improvements to graphite production will allow for an end purity of greater than 94%.

Estimated resource at the site is 6.9 million tonnes containing 8.8% graphite in four separate deposits. At full capacity Kringel could potentially supply up to 15% of Europe’s flake graphite requirements. This is great news for Flinders because Europe depends on imported graphite for 95% of its needs, most currently imported from China.

This year will see Flinders reprocessing and selling its stockpiled graphite, while later in the year and into 2013 drilling, the development of a mine plan, a mill refurbishment, environmental improvements, production optimization and expansion evaluation are slated to occur. Already underway are an environmental study, resource drilling and an upgrade of resources to NI 43-101 compliancy.

Martin McFarlane B.Eng (Chem) B.Bus (Mktg) heads up this ambitious company as President and CEO. He brings twenty-five years of resource industry experience, having been President of Minerals and Metals Group, General Manager of Investor and Community Relations for Zinifex Ltd. and having held various positions in sales and marketing and zinc smelter operations at CRA and Pasminco Ltd. He is backed by Michael Robert Hudson B.Sc. (Hons) GDipAppFin FAusIMM MSEG MAIG, Director; Nick DeMare CA, Director; Mark Saxon B.Sc. (Hons) GDipAppFin MAusIMM MAIG, Director; and Robert Atkinson, Director.

Zimtu Capital Corp. Giving a helping hand to ambitious young juniors finding their footing is Zimtu Capital Corp. (TSX-V: ZC) (FSE: ZCT1). Zimtu achieves this by offering new resource companies early-stage risk capital and management, as well as finance and marketing guidance. For investors, this means access to pre-IPO companies not normally accessible to them. In addition to helping companies to solidify their foundations, Zimtu locates and acquires new mineral properties to match up with public resource companies then establishes strategic partners, capitalizes the company and helps execute the business plan. To date, Zimtu has received more than 7 million shares as compensation for selling seven graphite projects to up and coming public companies. As of April 2 shares for Zimtu cost $1.40 and their market cap is $13.28 million.

Some of the project transactions that Zimtu has played a role in have been the Deep Bay East and Simon Lake properties for Strike Graphite Corp., the Griffith and Brougham properties in southern Ontario for Big North Capital Inc., as well as properties for Lomiko Metals, Standard Graphite, and a portfolio of graphite projects in Australia for Pinestar Gold Inc. The graphite space is proving to be fertile ground for Zimtu, and in Zimtu’s most recent newsletter, Ryan Fletcher, one of Zimtu’s Directors, says he thinks the best deposits have yet to be found.

Management for this skilled group is led by David Hodge, President and Director. He has twenty years experience as a resource executive, has been President of Commerce Resources Corp. since 2001 and is Director of Western Potash Corp. He is joined by Sven Olsson, Director; Patrick Power, Director; Ryan Fletcher, Director, and Sean Charland, Director.

It’s clear that some great value can potentially be found in a number of junior exploration companies residing in our own back yard. Canada will play a major role in moving the graphite supply out of the red zone, but don’t wait until that happens before you invest or you may miss out on a golden opportunity.

Follow the exciting emerging graphite story at http://www.resourcexinvestor.com