SPONSOR: Labrador Gold – Two successful gold explorers lead the way in the Labrador gold rush targeting the under-explored gold potential of the province. Exploration has already outlined district scale gold on two projects, including a 40km strike length of the Florence Lake greenstone belt, one of two greenstone belts covered by the Hopedale Project. Click Here for More Info

At first glance gold looks like it may be about to advance out of a bull Flag, but there are a number of factors in play that we will examine which suggest that any near-term advance won’t get far before it turns and drops again, and that a longer period of consolidation and perhaps reaction is necessary before it makes significant further progress.

On the 6-month chart we can see how gold stabbed into a zone of strong resistance on the Iran crisis around the time Iran’s General was murdered, but after a couple of bearish looking candles with high upper shadows formed, it backed off into what many are taking to be a bull Flag.

The 10-year chart makes it plain why gold is vulnerable here to

reacting back over the short to medium-term, because it has advanced

deep into “enemy territory†– the broad band of heavy resistance

approaching the 2011 highs, with a zone of particularly strong

resistance right where it is now. It would be healthier and increase

gold’s chances of breaking out to new highs if it now backed off into a

trading range for a while to moderate what now looks like excessive

bullishness.

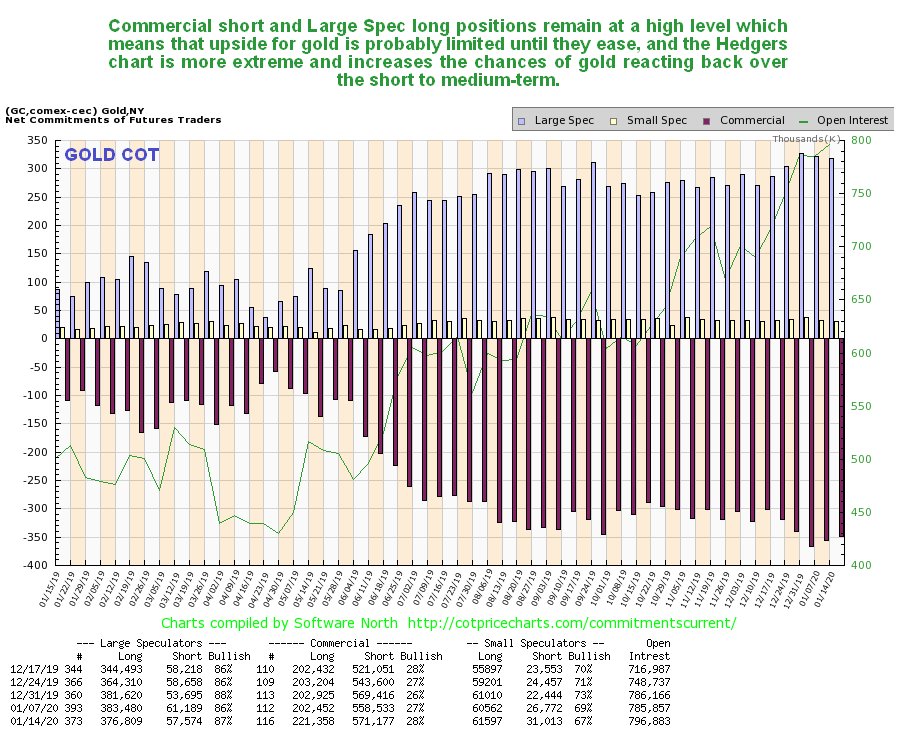

Thus it remains a cause for concern (or it should be for gold

bulls) to see gold’s latest COTs continuing to show high Commercial

short and Large Spec long positions. Is it “going to be different this

time� – the latest Hedgers charts that we are now going to look at

suggest not.

Click on chart to popup a larger, clearer version.

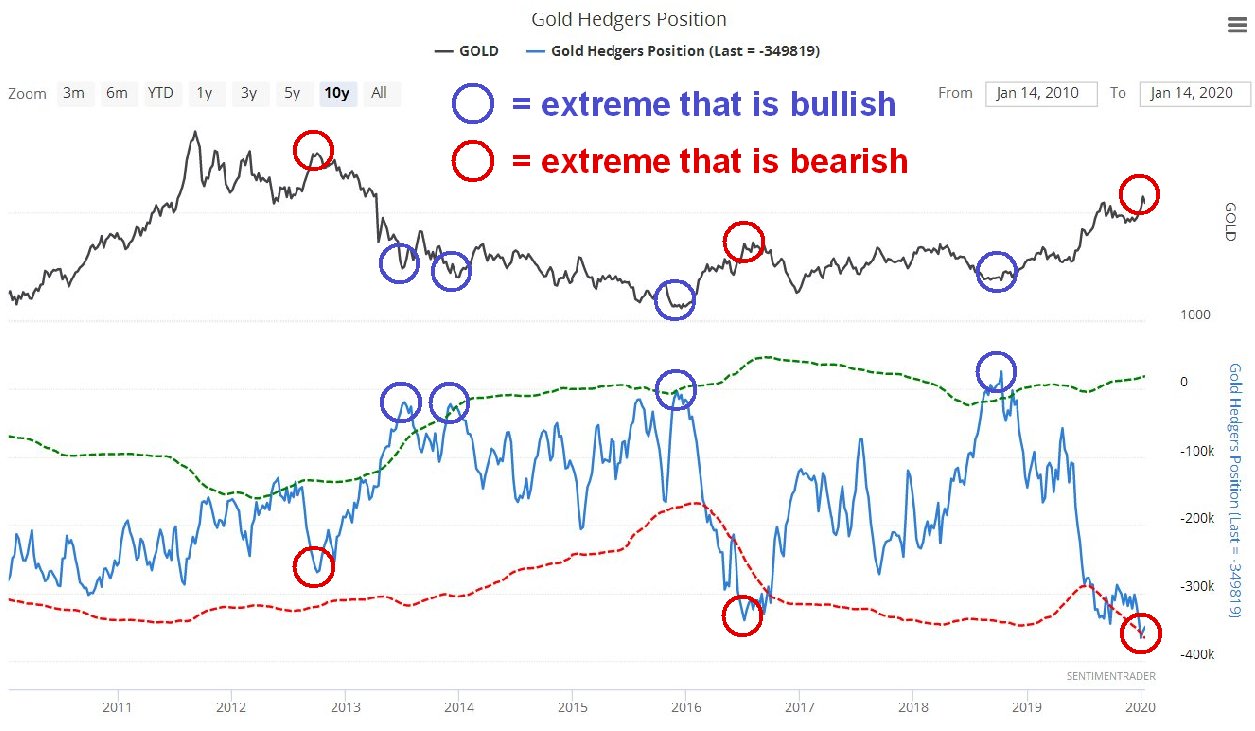

The COT chart only goes back a year. The Hedgers charts shown

below, which are a form of COT chart, go back many years, and frankly,

they look pretty scary.

We’ll start by looking at the Hedger’s chart that goes back to before the 2011 sector peak. On it we see that current Hedgers positions are at extremes that way exceed even those at the peak of the 2012 sucker rally, which was followed by the bulk of the decline in the bearmarket that followed. Does this mean that we are going to see another bearmarket like that – no it doesn’t, but it does mean that these positions will probably need to moderate before we see significant further gains.

Click on chart to popup a larger, clearer version.

Chart courtesy of sentimentrader.com

Looking at the Hedgers chart going way back to before the year

2000, we see that the current readings are record readings by a

significant margin and obviously increase the risks of a sizeable

reaction. We can speculate about what the reasons for a decline might

be, one possibility being the sector getting dragged down by a

stockmarket crash after its blowoff top, which may be imminent, as

happened in 2008, since it remains to be seen whether investors will

rush into the sector as a safe haven in the event of a market crash.

Click on chart to popup a larger, clearer version.

Chart courtesy of sentimentrader.com

Turning now to Precious Metals stocks, we see on its latest

10-year chart that GDX still looks like it is completing a giant

Head-and-Shoulders bottom pattern. However, it is currently dithering

just beneath resistance at the top of this base pattern, which means

that it is vulnerable to backing off.

So, how then does gold stock sentiment look right now? As we can

see on the 5-year chart for the Gold Miners’ Bullish Percent Index,

bullishness towards the sector is now at a very high level, 84.6%, which

makes it more likely that stocks will drop soon rather than rally, and

what they could do of course is rally some to increase this level of

bullishness still further, and then drop.

Does all this mean that investors in the sector should suddenly

rush for the exits? No, it doesn’t, especially as the charts for many

individual stocks across the sector look very bullish, and it may be

that all that is needed is a cooling period of consolidation. However it

does make sense to use Hedges at extremes, such as leveraged inverse

ETFs and better still options as insurance, which have the advantage of

providing protection for a very small capital outlay, a fine example

being GLD Puts which are liquid with narrow spreads. We did this just ahead of the recent peak

when Iran lobbed a volley of missiles at Iraq. We will not be selling

our strongest gold and silver stocks, but instead look to buy more on

dips.

SOURCE: https://www.clivemaund.com/gmu.php?art_id=68&date=2020-01-19

Tags: #Ashuanipi, #Discovery, #Drilling, #Greenstone, #Hopedale, #LAB, #Labrador, #LabradorGold, #Newfoundland, #Plethora, #ShawnRyan, 2020, gold